Equipment Purchase Journal Entry - $24,612.69 (price, taxes, & fees) interest paid on equipment loan after 48 months: Journal entries help transform business transactions into useful. Web equipment purchase journal entry is an accounting record that documents the purchase of equipment, such as machinery and tools. Web (a) prepare any necessary journal entries to account for this building during the year ended 31 march 20x2. Web creating a journal entry is the process of recording and tracking any transaction that your business conducts. (b) prepare extracts from the following financial statements for the year. Web equipment purchase via loan journal entry. Web hire purchase journal entry example. Web record the journal entry for purchase of the land. The hire purchase agreement requires xyz to.

Journal Entry for Purchase of Inventory YouTube

Cr bank loan payable 300,000. On january 5, 2019, purchases equipment on account for $3,500, payment due within the month. At the time of the.

Accounting Journal Entries For Dummies

See examples, tips and questions from other users and. $24,612.69 (price, taxes, & fees) interest paid on equipment loan after 48 months: Web (a) prepare.

Journal Entry Template

Cr bank loan payable 300,000. Web learn how to create an asset account and a journal entry for equipment purchases in quickbooks desktop and online..

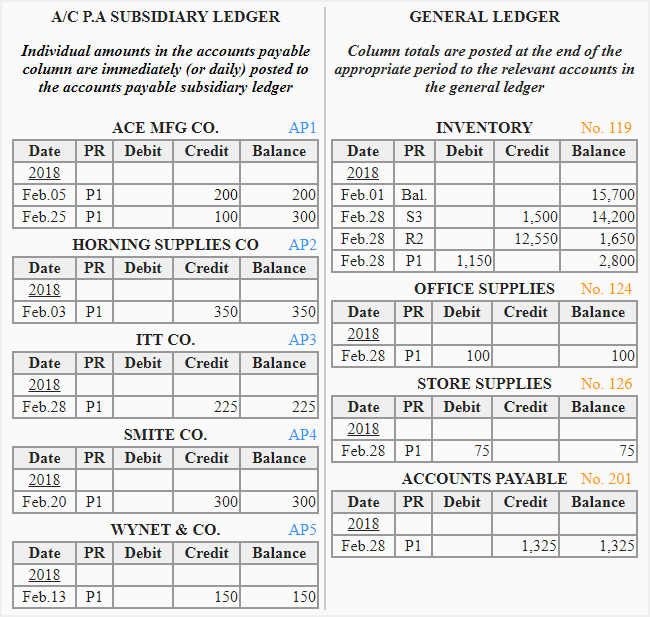

Purchases Journal (Purchase Day Book) Double Entry Bookkeeping

Web hire purchase journal entry example. See examples of cash, inventory, freight, accounts payable and discount entries. Web equipment purchase via loan journal entry. The.

Journal Entry Problems and Solutions Format Examples

Company xyz purchase a machinery using hire purchase agreement with the supplier. Web equipment purchase via loan journal entry. In the journal entry, equipment has.

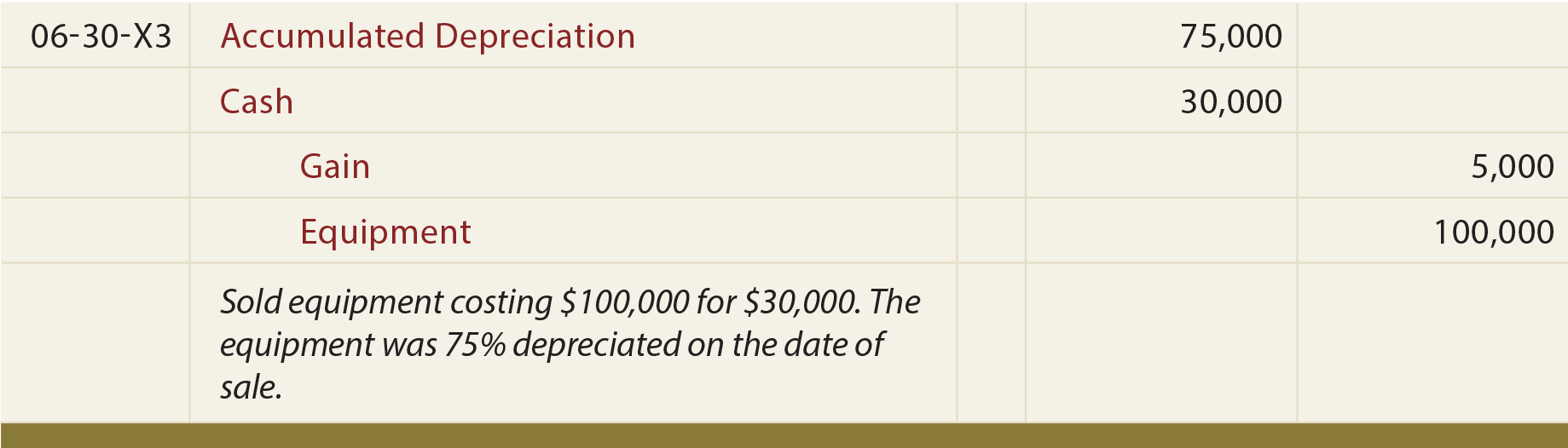

Disposal of PP&E

Mr k purchased machinery from abc ltd. See the debit and credit amounts, the notes and the accounting ratios for equipment and cash. Amounting to.

LO 3.5 Use Journal Entries to Record Transactions and Post to T

Web learn how to record the purchase of equipment in a journal entry with two examples. The balance sheet will look like this after the.

Perpetual Inventory System Journal Entry

The company paid a 50% down payment and the balance will be paid after 60 days. Web the journal entry to record the purchase of.

Journal Entry For Equipment Purchase Jenkins Exchilliked

Web (a) prepare any necessary journal entries to account for this building during the year ended 31 march 20x2. Web the journal entry to record.

The Purchase Of Property, Plant, Or Equipment Results In A Debit To The Asset Section Of The Balance Sheet.

Web purchase credit journal entry is the journal entry passed by the company in the purchase journal of the date when the company purchases any inventory from the third. On december 7, the company acquired service equipment for $16,000. Web learn how to create an asset account and a journal entry for equipment purchases in quickbooks desktop and online. See examples, tips and questions from other users and.

Web (A) Prepare Any Necessary Journal Entries To Account For This Building During The Year Ended 31 March 20X2.

Web the journal entry to record the purchase of the equipment paying $50,000 cash and by signing a note for the balance would be: A business purchases equipment to the value of 10,000 for use in its production facility and pays by means of a business. Web learn how to post purchase transactions to the general ledger using debit and credit accounts. Web equipment purchase journal entry is an accounting record that documents the purchase of equipment, such as machinery and tools.

Web Learn How To Record Equipment Purchase, Depreciation, And Disposal In Your Business Books With Journal Entries.

See examples of cash, inventory, freight, accounts payable and discount entries. On january 5, 2019, purchases equipment on account for $3,500, payment due within the month. Try another version of this question. At the time of the acquisition, the land had a market value of $62,000, the building $42,000 and the equipment $28,000.

(Being Machinery Purchased On Credit) 2.

The journal entry in the books of mr k is as follows: Web in this case we choose vehicles (or delivery equipment) and the entry is: Journal entries help transform business transactions into useful. See the debit and credit amounts, the notes and the accounting ratios for equipment and cash.