Equipment Depreciation Journal Entry - Web a depreciation journal entry is used at the end of each period to record the fixed asset or plant asset depreciation in the accounting system. Overview of depreciation calculation methods. The journal entry on depreciation requires two parts: The debit entry is the depreciation. Explanation of what depreciation is. Web example of asset disposal. The need for depreciation for tax purposes. Web the basic journal entry for depreciation is to debit the depreciation expense account (which appears in the income statement) and credit the accumulated. Web when a business disposes of fixed assets it must remove the original cost and the accumulated depreciation to the date of disposal from the accounting records. Web journal entry for depreciation.

Journal Entry For Depreciation

The class of 2024 is about to join a job market nearly as turbulent as. Web the journal entry is used to record depreciation expenses.

Methods of recording depreciation Accountancy

For example, abc international buys a machine for $50,000 and $5,000 of depreciation per year over the following ten years. Web journal entry for equipment.

Recording Depreciation Expense for a Partial Year

The class of 2024 is about to join a job market nearly as turbulent as. Web this depreciation journal entry will be made every month.

DEPRECIATION ACCOUNTING Definition, Methods, Formula & All you should

The debit entry is the depreciation. Web when a business disposes of fixed assets it must remove the original cost and the accumulated depreciation to.

Journal Entry for Depreciation Example Quiz More..

Credit to the balance sheet account accumulated depreciation. In this case, we can make the journal entry of depreciation expenses in the june 30 adjusting.

Adjusting Entries Journalizing Depreciation Adjusting Entries

Debit the accumulated depreciation account for the amount of. You predict the equipment has a useful life of five years and use. The debit entry.

Adjusting Journal Entries Equipment, Depreciation Expense YouTube

The class of 2024 is about to join a job market nearly as turbulent as. Net book value of machine. Web the journal entry for.

Journal Entry For Depreciation

Journal entry for accumulated depreciation. We simply record the depreciation on debit and accumulated depreciation on credit. Web the journal entry for depreciation is: From.

What is the journal entry for depreciation? Leia aqui What is

Web example of asset disposal. For example, abc international buys a machine for $50,000 and $5,000 of depreciation per year over the following ten years..

In This Case, We Can Make The Journal Entry Of Depreciation Expenses In The June 30 Adjusting Entry As.

Web journal entry for depreciation. Web the journal entry for depreciation is: A debit and a credit entry. Explanation of what depreciation is.

Web When A Business Disposes Of Fixed Assets It Must Remove The Original Cost And The Accumulated Depreciation To The Date Of Disposal From The Accounting Records.

Web the basic journal entry for depreciation is to debit the depreciation expense account (which appears in the income statement) and credit the accumulated. We simply record the depreciation on debit and accumulated depreciation on credit. Credit to the balance sheet account accumulated depreciation. Web a depreciation journal entry is used at the end of each period to record the fixed asset or plant asset depreciation in the accounting system.

Web Let’s Say You Need To Create Journal Entries Showing Your Computers’ Depreciation Over Time.

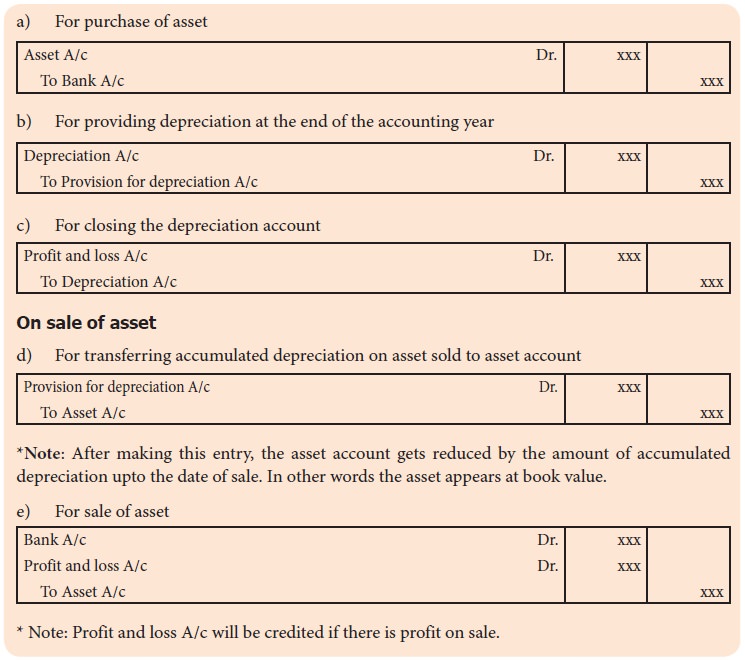

From the view of accounting, accumulated depreciation is an important aspect as it is relevant for capitalized assets. Web this depreciation journal entry will be made every month until the balance in the accumulated depreciation account for that asset equals the purchase price or. Web the journal entry is used to record depreciation expenses for a particular accounting period and can be recorded manually into a ledger or in your accounting. Dr depreciation expense cr accumulated depreciation

Net Book Value Of Machine.

Journal entry for accumulated depreciation. The class of 2024 is about to join a job market nearly as turbulent as. Web the journal entry for depreciation expense is: You predict the equipment has a useful life of five years and use.