Due To Due From Journal Entries Examples - Web due to/due from accounting allows you to track funds owed between companies. To demonstrate the correct method of completing journal entries, we will use the follow sample accounting transactions commonly found. Web a due from account tracks assets owed to a company and is not used for the tracking of any liabilities or obligations. (owned by “holding llc #1”) from mgmt llc’s bank account. The first step is to create a journal entry that credits the party who owes money and. Web example of interest on calls in arrear. To begin using the due to and due from automatic journal entry postings, you will need to activate the web. Salary expenses will be present on the income statement and reduce the company profit. Mgmt llc pays $50 for a repair for 123 main st. When a credit transaction occurs, the buying.

Due to due from journal entries examples factlomi

Web example of interest on calls in arrear. Explore the intricacies of the due to account, a crucial liability in the financial world. Web salary.

Due to due from accounting tewssa

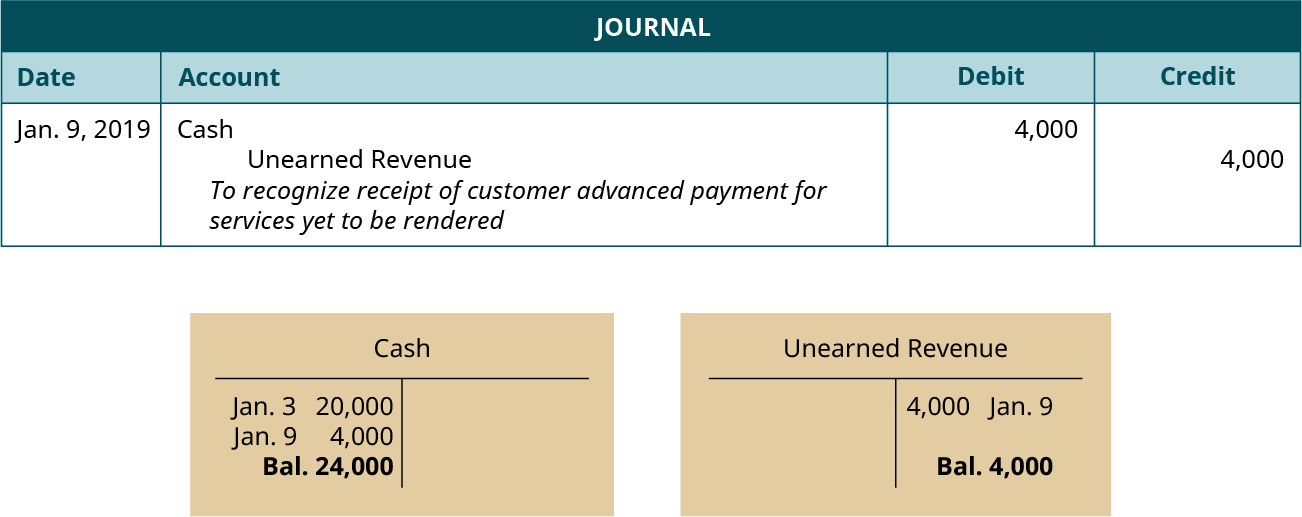

Cash balance increases by $20,000. To begin using the due to and due from automatic journal entry postings, you will need to activate the web..

Due to due from journal entries examples ladegrus

When a credit transaction occurs, the buying. I’m assuming i need 3 journal entries. Mgmt llc pays $50 for a repair for 123 main st..

Journal Entries Accounting

Mgmt llc pays $50 for a repair for 123 main st. Due from account is an. Web a quick reference for accounts receivable journal entries,.

Due to due from journal entries examples factlomi

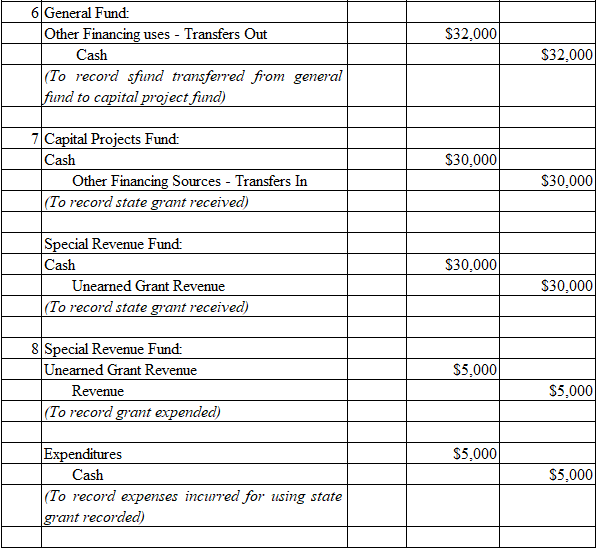

Sales for company 1 order. Order with two lines from different companies. Company 1 due to company 2. Due from account is an. Web we've.

Due From Account Definition, How It Works and Vs. Due to Account

Web we've gone through 15 journal entry examples and explained how each are prepared to help you learn the art of recording. Explore scenarios where.

Journal Entry Examples

Web examples of accounting transactions. Explore scenarios where due from accounts play a pivotal role in financial transactions:. Web due to/due from accounting allows you.

Journal Entry Examples

When a credit transaction occurs, the buying. Issued 70,000 shares @ ₹10 each payable as ₹4 on application (1st january 2021), ₹3 on allotment (1st.

journal entry format accounting accounting journal entry template

Explore the intricacies of the due to account, a crucial liability in the financial world. Web top 10 examples of journal entry. Explore scenarios where.

By Now You'd Feel More Confident In Preparing Journal.

(owned by “holding llc #1”) from mgmt llc’s bank account. Web a quick reference for accounts receivable journal entries, setting out the most commonly encountered situations when dealing with accounts receivable. Web company 2 deferred revenue. Web due to/due from accounting allows you to track funds owed between companies.

When A Credit Transaction Occurs, The Buying.

Web as a result, it is important to realize that the amount that is due from customers is a current asset, and should be mentioned as such on the balance sheet. Web due to and due from automatic journal entries. The due from account is typically used in conjunction with a due. Company 2 due from company 1.

Delve Into Its Definition, Role, And Importance In Managing Financial Obligations.

Due from account is an. Sometimes, the business may receive more insurance claims than book value in such a scenario, it’s considered profit on disposal. Mgmt llc pays $50 for a repair for 123 main st. To demonstrate the correct method of completing journal entries, we will use the follow sample accounting transactions commonly found.

The Due To Account—Also Referred To As The Accounts Payable—Is A Liability Account Found In The General Ledger That Indicates The Amount Of Funds Owed To Another.

Due from account is a receivable account in the general ledger that records funds that are owed to the business, normally between related entities. Web a due from account tracks assets owed to a company and is not used for the tracking of any liabilities or obligations. Explore the intricacies of the due to account, a crucial liability in the financial world. Web you would use due to/from when you wish to maintain a payable/receivable relationship between the funds and the transfer accounts when you wish to affect the fund balance by.

:max_bytes(150000):strip_icc()/TermDef_DueFromAccount-Final-4df4a72d0357443194425bf340cfda07.jpg)