Dta Journal Entry - Company abc has prepared the income statement and the main items are listed below: Illustrating deferred tax asset journal entry. The carrying amount of an asset will. But still, why do you have both dta and dtl? In addition, c incurs initial. Web journal entries for recognizing the deferred tax asset and establishing the valuation allowance would be: Web deferred tax asset journal entry example. Web journal entries for deferred tax liability. The deferred tax liability would be recognized using the following journal entry: Web deferred tax liability journal entry;

Sherrod, Inc., reported pretax accounting of 98 million for

Web deferred tax liability journal entry; Web deferred tax asset journal entry example. Deferred tax assets and liabilities are crucial components of a company’s financial.

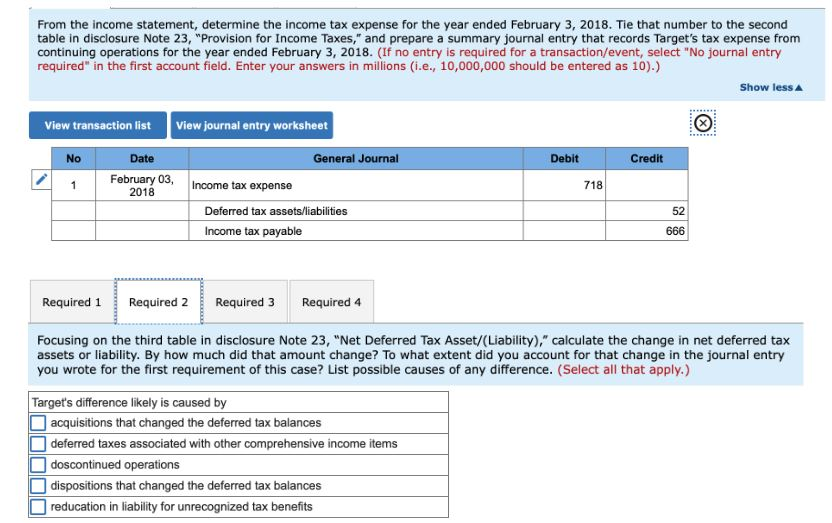

Tax Expense Journal Entry Journal Entries for Normal Charge

Deferred tax assets and liabilities are crucial components of a company’s financial reporting, reflecting differences in the. A valuation allowance is a mechanism that offsets.

Calculate DTA and DTL and journal entries As reported in the

Web deferred tax liability journal entry; Web journal entries for recognizing the deferred tax asset and establishing the valuation allowance would be: Web deferred tax.

PPT Tax Accounting SFAS 109 (ASC 74010) PowerPoint

Company z should record the following journal entries in acquisition accounting: Consider a company that reports $100,000 in accounting income in year 1. Web deferred.

Purchase Allowance Journal Entry Double Entry Bookkeeping

Web journal entries for recognizing the deferred tax asset and establishing the valuation allowance would be: The deferred tax liability would be recognized using the.

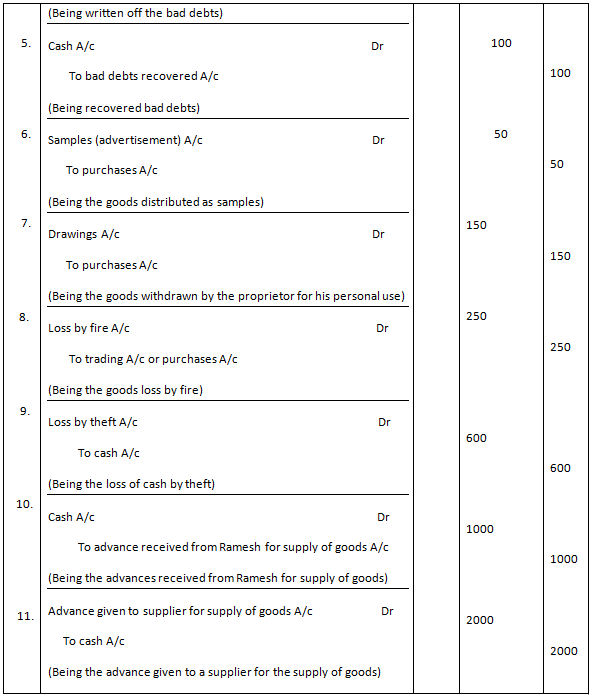

What is Journal Entry? Example of Journal Entry

Web what is a valuation allowance for deferred tax assets? In future periods, when the deferred tax liability would be used. Deferred tax asset is.

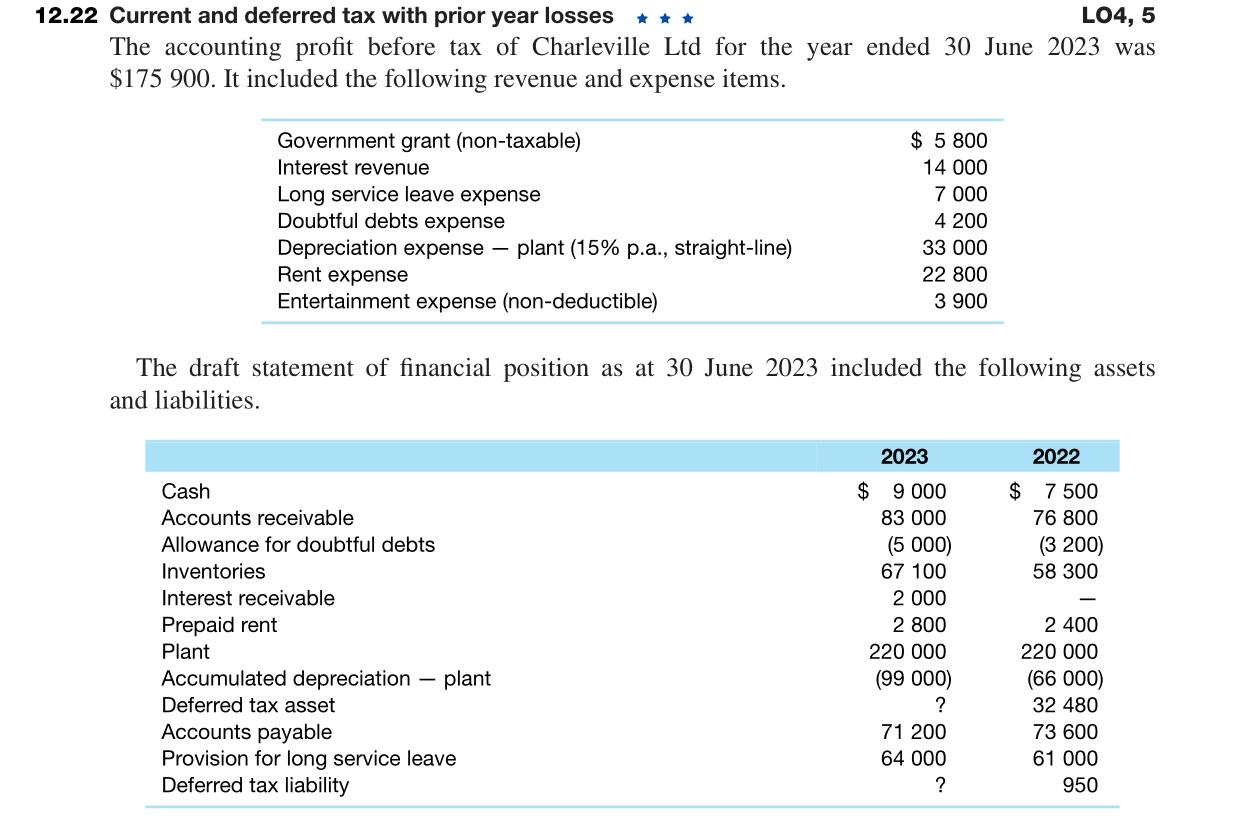

Solved 12.22 Current and deferred tax with prior year losses

Web note that net operating losses are not the same as deferred tax assets! Consider a company that reports $100,000 in accounting income in year.

DTA DTL examples YouTube

Web journal entries for deferred tax liability. What is the journal entry to record a deferred tax liability? 15.00 lacs dta newly introduced. Web this.

Regarding Question 4.7 p.189 study guide KnowledgEquity

Web note that net operating losses are not the same as deferred tax assets! Deferred tax asset is an asset recognized when taxable income and.

The Earning Before Tax Is $ 600,000.

Company abc has prepared the income statement and the main items are listed below: 10.4.2 expected manner of recovery or settlement. What is the journal entry to record a deferred tax liability? Illustrating deferred tax asset journal entry.

Web In General, You Need To Recognize The Deferred Tax Asset For Unused Tax Credits (If Probable They Will Be Used).

The carrying amount of an asset will. Recognition of deferred tax asset: Your ask joey ™ answer. The deferred tax liability would be recognized using the following journal entry:

A Valuation Allowance Is A Mechanism That Offsets A Deferred Tax Asset (Dta) Account.

The primary reason behind deferred tax. Web deferred tax asset journal entry example. Company z should record the following journal entries in acquisition accounting: Web what is a valuation allowance for deferred tax assets?

Consider A Company That Reports $100,000 In Accounting Income In Year 1.

In future periods, when the deferred tax liability would be used. Web journal entries for deferred tax liability. Web note that net operating losses are not the same as deferred tax assets! Web what is the journal entry to record a deferred tax liability?