Dividend Payable Journal Entry - The total value of the dividend is $0.50 x 500,000, or $250,000, to be paid to. Read our technical factsheet on company law, reporting and tax issues. The first entry moves the payment amount from retained. Web dividends paid to shareholders also have a normal balance that is a debit entry. Web what is the journal entry for the stock dividend? Web what is the journal entry for the cash dividend? Cash dividends are cash distributions. It reduces the dividends payable account (with a debit). Web there is no journal entry on the date of record. Learn how to account for dividends by making journal entries for declared and paid dividends.

Dividends Payable Accounting Journal Entry

To record the payment of a dividend, you would need to debit the dividends payable account and credit the cash account. Web what is the.

How To Record And Report Dividend Payments In Accounting Records And

Web dividends paid to shareholders also have a normal balance that is a debit entry. The first entry moves the payment amount from retained. On.

Journal Entry for Dividends YouTube

Web the journal entry is debiting retained earnings and credit accrued dividend payable. Why does company need to distribute dividend? Web dividends paid to shareholders.

What type of account is the Dividends account? ⋆ Accounting Services

Web a dividend is a payment, either in cash, other assets (in kind), or stock, from a reporting entity to its shareholders. Web what is.

How to Record Dividends in a Journal Entry Accounting Education

Web despite the cash remaining within the company at the time of declaration, declaring a dividend requires a new entry on the balance sheet: Learn.

Journal Entry Dividends Payable Ppt Powerpoint Presentation Summary

Suppose a corporation currently has 100,000 common shares outstanding with a par value of $10. Why does company need to distribute dividend? Web journal entry.

Dividend Paid Double Entry MakailataroMartin

To record the payment of a dividend, you would need to debit the dividends payable account and credit the cash account. On january 12, 2021,.

Calculating Dividends, Recording Journal Entries YouTube

Web journal entry for payment of a dividend. On december 14, 2020, when the company declares the cash dividend. Web what is the journal entry.

Dividend Received Journal Entry YouTube

Web what are journal entry examples of dividends payable? Suppose a corporation currently has 100,000 common shares outstanding with a par value of $10. Learn.

Web What Are Journal Entry Examples Of Dividends Payable?

On december 18, 2020, when the company declares the stock dividend. If a balance sheet date intervenes between the declaration and distribution dates, the. The dividends payable account appears as a current liability on the balance sheet. Web when companies pay dividends, they make two different journal entries to document the process.

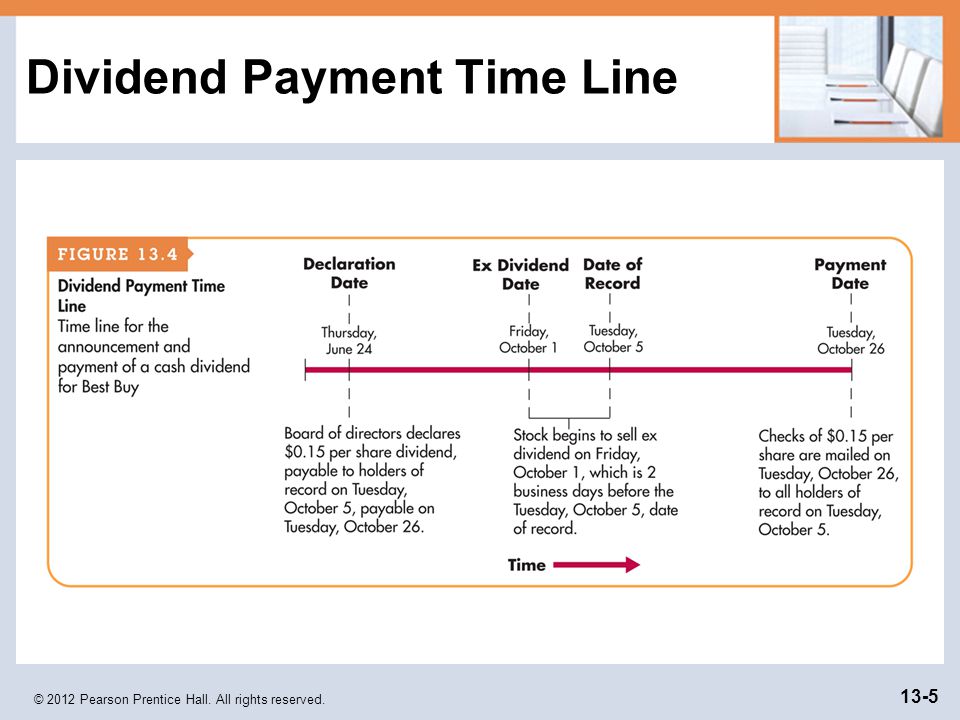

See An Example Of Dividend Declaration, Record, And Payment Dates And Amounts.

Read our technical factsheet on company law, reporting and tax issues. To record the declaration, you’ll debit the retained earnings account — the company’s undistributed accumulated profits for the year or. To record the payment of a dividend, you would need to debit the dividends payable account and credit the cash account. Why does company need to distribute dividend?

The Total Value Of The Dividend Is $0.50 X 500,000, Or $250,000, To Be Paid To.

On december 14, 2020, when the company declares the cash dividend. It reduces the dividends payable account (with a debit). The transaction will reduce the company accumulated profit which is the retained. Web journal entry for payment of a dividend.

Web The Journal Entry Is Debiting Retained Earnings And Credit Accrued Dividend Payable.

Web a dividend payment to stockholders is usually a cash payment which reduces the corporation’s asset cash and the corporation’s stockholders’ equity. Web despite the cash remaining within the company at the time of declaration, declaring a dividend requires a new entry on the balance sheet: On january 12, 2021, when the company. Web upon the declaration of dividends by the board of directors, the company must make an entry in its journal to reflect the creation of a dividend payable liability.