Distribution Journal Entry - Web there is no journal entry for taking a distribution. Sam contributes $100,000 cash to the partnership. After several years of operation, company has accumulated retained earnings of $ 500,000. Cash dividends are cash distributions of accumulated earnings by a corporation to its stockholders. As shown in the general ledger above, the retained earnings account is debited by $50,000 while the payables account is credited $50,000. Journal entries are rightly called the backbone of the modern accounting system as they are the first. Every amount that must be accounted for when the vendor invoice is journalized has one or more accounting distributions. Web this journal entry is to eliminate the dividend liabilities that the company has recorded on december 20, 2019, which is the declaration date of the dividend. That is already what you would enter on the check or banking transaction that pays you the amount. For the small dividend, the journal entry would be made as follows:

Journal Entry Problems and Solutions Format Examples MCQs

Web for the large dividend above, the following journal entry would be recorded on the distribution date: After year end entries from tax preparation are.

Journal Entry for Distribution of Goods as Free Samples Example

Web settings > chart of accounts > new > equity > save account under 'equity' > tax form section 'partner distributions' (technically, this isn't correct.

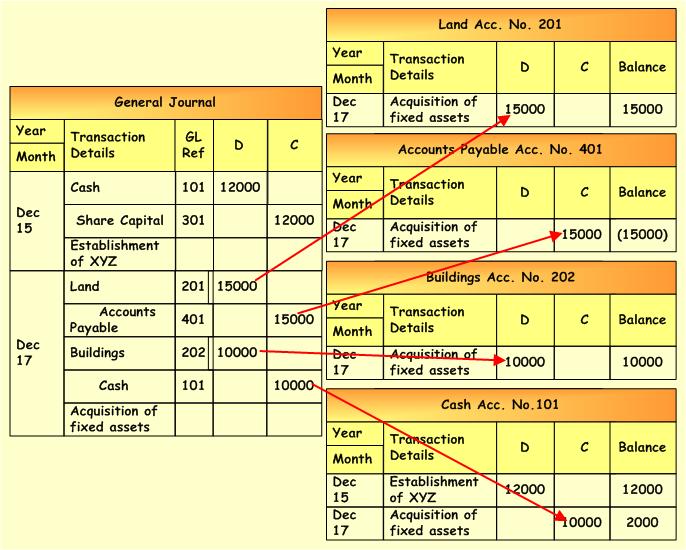

General Journal Accounting Corner

An increase (credit) to the common stock dividends distributable is recorded. 2 set up accounts for distribution of income. 3,000 shares × $9, or $27,000..

Current developments in S corporations

On january 3, 2019, issues $20,000 shares of common stock for. Cash dividends are cash distributions of accumulated earnings by a corporation to its stockholders..

11.2 Analyze, Journalize, and Report Current Liabilities Business

After several years of operation, company has accumulated retained earnings of $ 500,000. 3 map report codes to the accounts. Subtract the total deductions from.

LO 3.5 Use Journal Entries to Record Transactions and Post to T

The following are the journal entries recorded earlier for printing plus. Web on the distribution date of the stock dividend, the company can make the.

Distribution Journal Entry CArunway

Now, you can record the journal entry in your accounting system. By obaidullah jan, aca, cfa and last modified on oct 31, 2020. The journal.

[Solved] Merchandising operations accounting journal entries Problem

That is already what you would enter on the check or banking transaction that pays you the amount. Web settings > chart of accounts >.

LO 3.5 Use Journal Entries to Record Transactions and Post to T

The dividends payable account appears as a current liability on the balance sheet. Web this journal entry is to eliminate the dividend liabilities that the.

Accordingly, The Journal Entry Would Debit Distributable Reserves (Equity) And Credit Dividends Payable.

Web on the distribution date of the stock dividend, the company can make the journal entry by debiting the common stock dividend distributable account and crediting the common stock account. Every amount that must be accounted for when the vendor invoice is journalized has one or more accounting distributions. Now, you can record the journal entry in your accounting system. Once the previously declared cash dividends are.

John Is The Owner Of Company Abc.

3 map report codes to the accounts. If the net income of the partnership was 40,000 but partner a receives interest on the opening capital. Ron is also going to transfer the $20,000 note on the. If a balance sheet date intervenes between the declaration and distribution.

Web The Journal Entry Reduces The Cash Balance Which Needs To Distribute To The Owners.

Web this journal entry is to eliminate the dividend liabilities that the company has recorded on december 20, 2019, which is the declaration date of the dividend. Web no journal entry is required on the date of record. An increase (credit) to the common stock dividends distributable is recorded. The journal entry is debiting a net income $ 100,000 and a credit partner account $ 100,000.

Web There Is No Journal Entry For Taking A Distribution.

Subtract the total deductions from the gross pay to find the net pay—the amount that will actually be disbursed to the employee. 2 set up accounts for distribution of income. Web journal entry on the date of distribution: 4 create and post a manual journal.