Discount On Bonds Payable Journal Entry - Web the total par value of the bonds is $100,000 with an interest of 10% semiannually with a maturity of 5 years. Since there is no indication that the bonds were issued at either premium or discount, so the journal entry to record the bonds shall be: Here we discuss a discount on bonds payable journal entry and its bond pricing and constituents. Historically, bonds where issued in paper form. If investors buy the bonds at a discount, the difference between the face value of the bonds and the amount of cash received is recorded in. When the company purchases the bonds at discount, they have to record cash outflow and the investment in bonds. Under ifrs, these bonds would be reported as. Bonds payable → credit by $1 million. Web the quick answer, without covering how the discount arises or the method of amortisation, is the journal entry requires a debit to the interest expense account and a credit to the. Web when the company issues a bond at the discount, it can make the bond discount journal entry by debiting the cash account and the unamortized bond discount account and.

Premium On Bonds Payable Journal Entry / Bonds Issued At A Premium

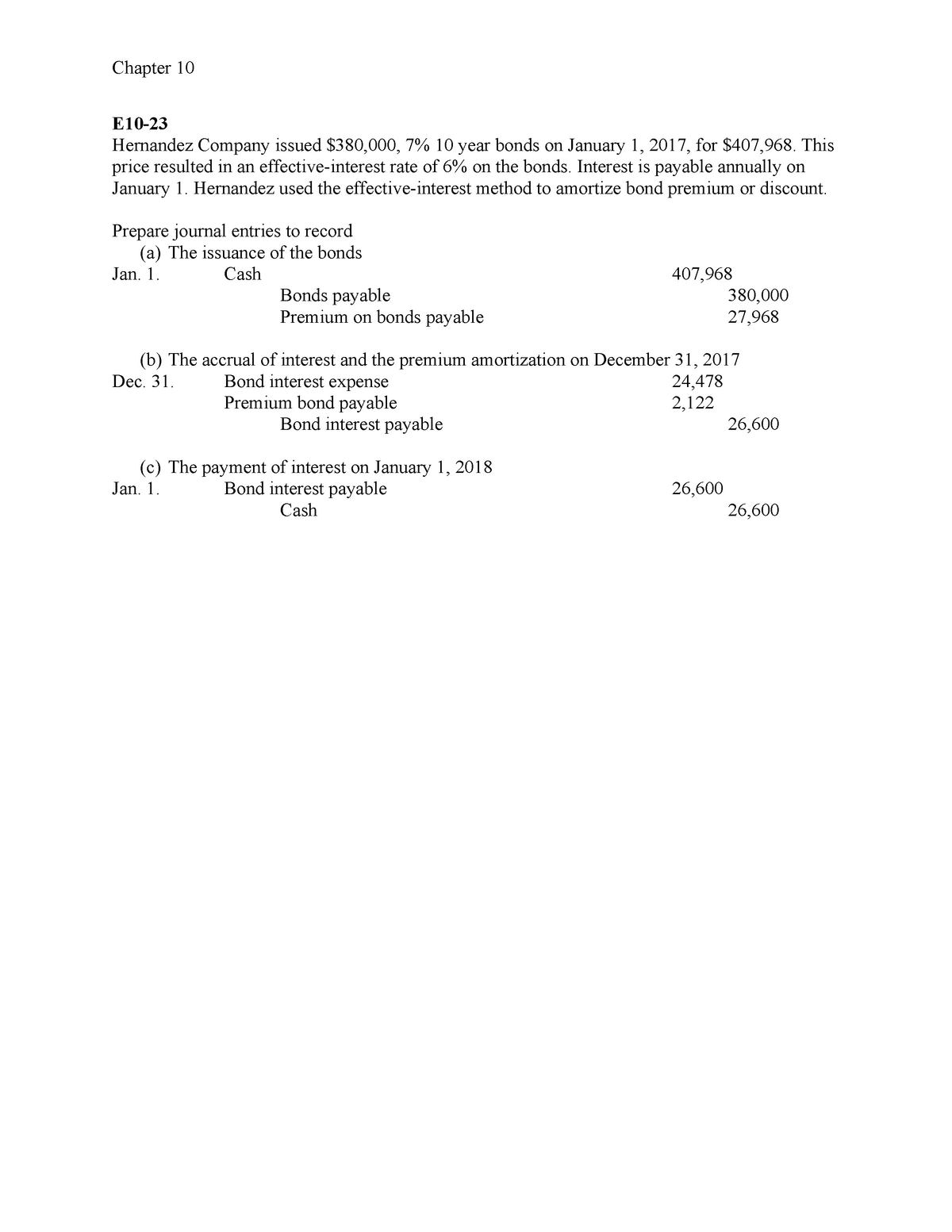

Web the journal entries would be as follows: Under ifrs, these bonds would be reported as. Web journal entry for discount on bonds payable. Web.

Chapter 11 Journal Entry Bond&Discount Bonds YouTube

Web the quick answer, without covering how the discount arises or the method of amortisation, is the journal entry requires a debit to the interest.

A Discount On Bonds Payable

Web the company can make the journal entry for the bond retirement with the gain by debiting the bonds payable account and crediting the gain.

Premium On Bonds Payable Journal Entry / Bonds Issued At A Premium

Web the bond coupon rate is normally a fixed rate for the term of the bond and interest is usually paid every six months. Web.

How To Calculate Discount On Bonds Payable Haiper

Web for example, $100,000 bonds issued at a discount of $4,000 would be recorded under us gaap as. Web the total par value of the.

A Discount On Bonds Payable Slide Reverse

3.2k views 4 years ago accounting videos. Under ifrs, these bonds would be reported as. We are using the effective. Web for example, $100,000 bonds.

Bonds Issued Between Interest Dates

Web when the company issues a bond at the discount, it can make the bond discount journal entry by debiting the cash account and the.

Bond Issuance Journal Entries and Financial Statement Presentation

This has been a guide to discounts on bonds payable. Web journal entry for bond purchased at discount. When the company purchases the bonds at.

Bonds Payable Lecture 2 Journal Entries YouTube

Web the journal entries would be as follows: We can make the journal entry for issuing the $500,000 bonds at a discount by debiting the.

Learn How To Calculate Pv, Complete A Bond Table, And Prepare Journal Entries For Bonds Payable Issued At A Discount.

When the company purchases the bonds at discount, they have to record cash outflow and the investment in bonds. Web discount on bonds payable is a contra account to bonds payable. This has been a guide to discounts on bonds payable. Web the total par value of the bonds is $100,000 with an interest of 10% semiannually with a maturity of 5 years.

For Each Month That The Bond Is.

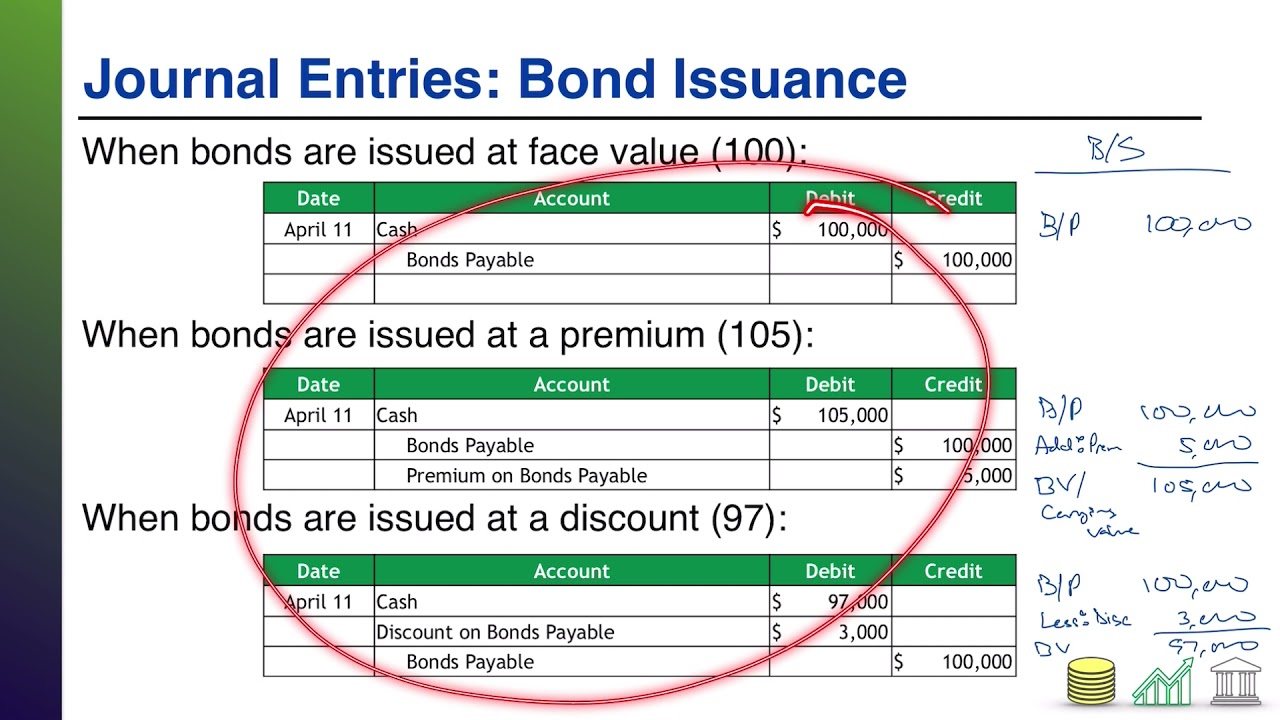

Here we discuss a discount on bonds payable journal entry and its bond pricing and constituents. When a bond is sold at a discount, the issuer records the cash received from the bond sale with a debit to a bank account. Web issuing bonds at a discount. Historically, bonds where issued in paper form.

Since There Is No Indication That The Bonds Were Issued At Either Premium Or Discount, So The Journal Entry To Record The Bonds Shall Be:

Web the company can make the journal entry for the bond retirement with the gain by debiting the bonds payable account and crediting the gain on retirement of bonds and cash. 3.2k views 4 years ago accounting videos. Later on, we will show you how this is a contra account to bonds payable and how it will appear on the balance. Bonds payable → credit by $1 million.

We Are Using The Effective.

Web the journal entries would be as follows: Web the bond coupon rate is normally a fixed rate for the term of the bond and interest is usually paid every six months. We can make the journal entry for issuing the $500,000 bonds at a discount by debiting the $485,000 to the cash account and the $15,000 of the. Web the quick answer, without covering how the discount arises or the method of amortisation, is the journal entry requires a debit to the interest expense account and a credit to the.