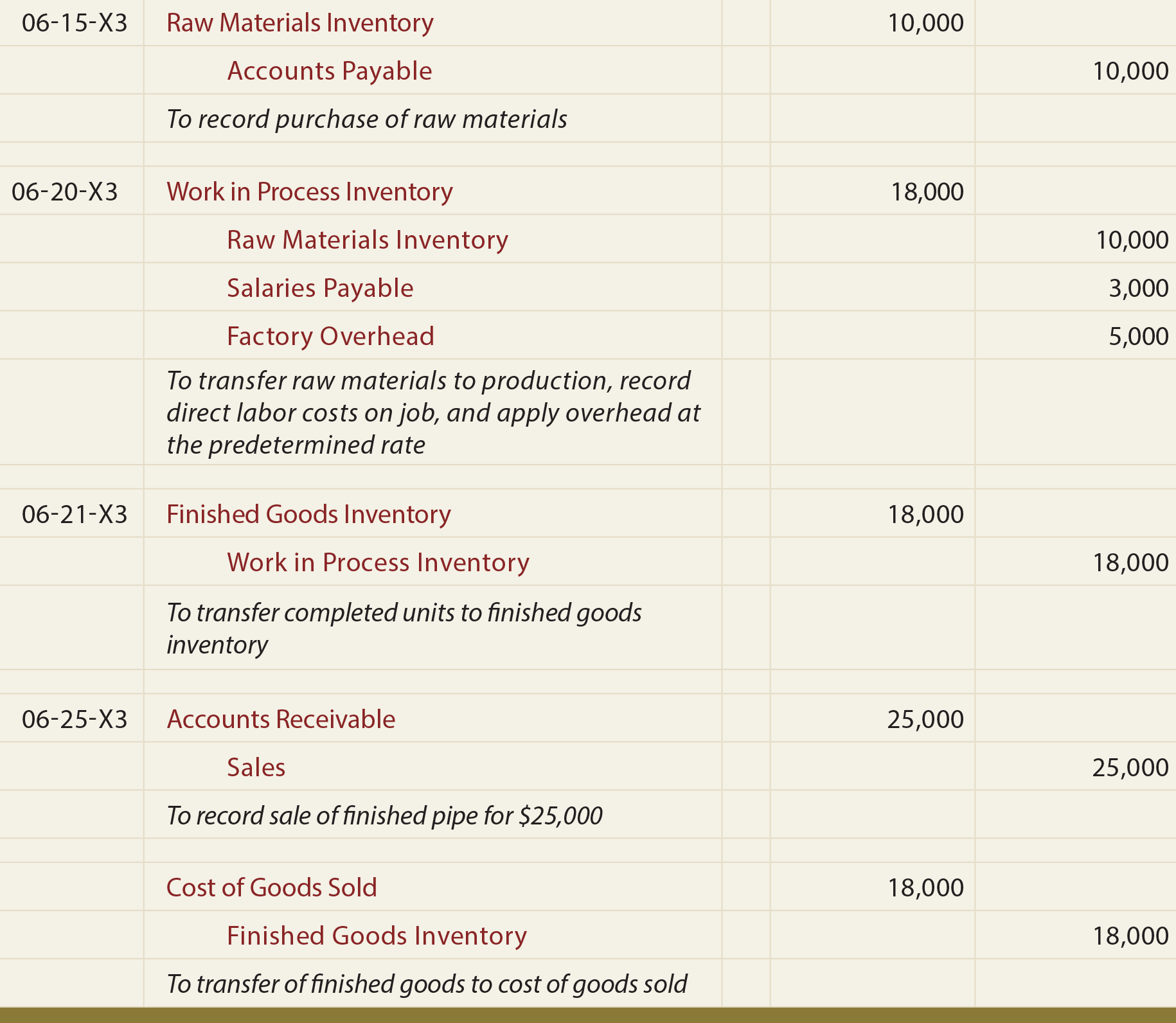

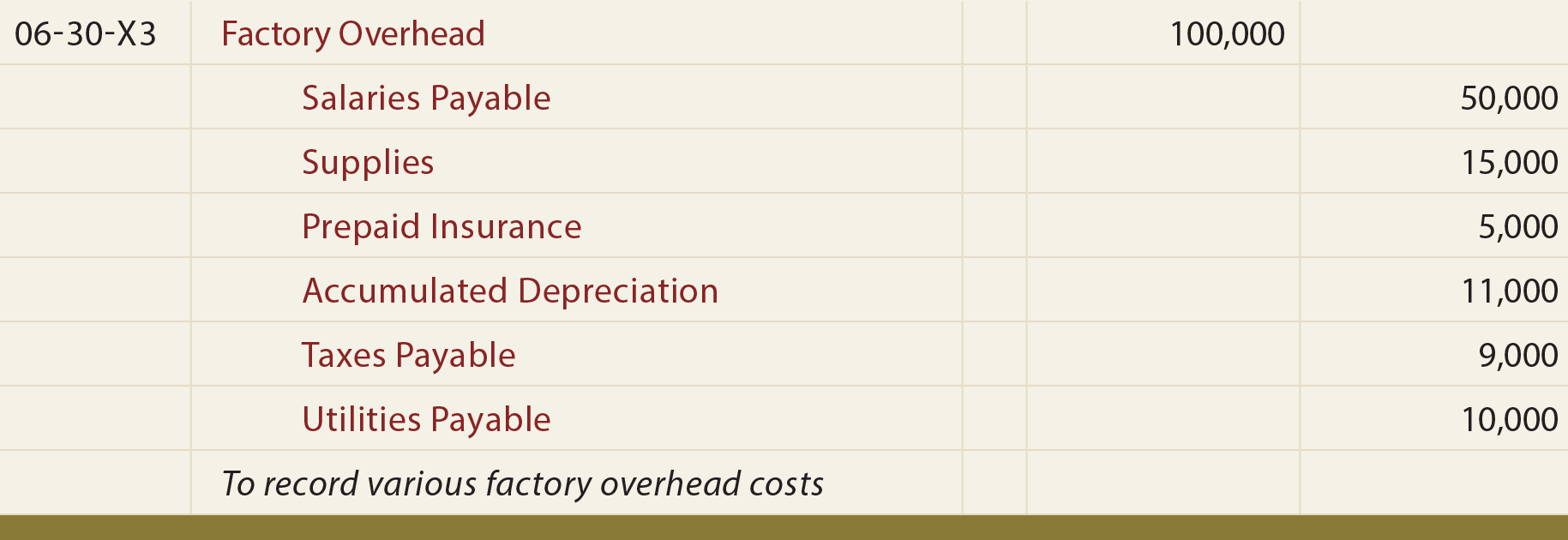

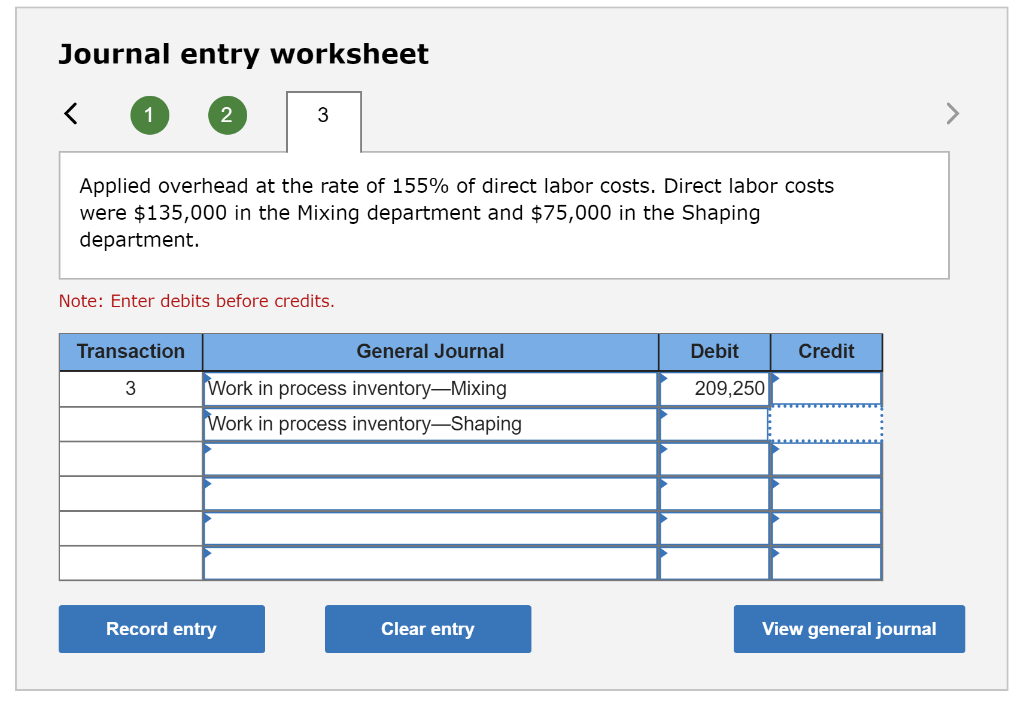

Direct Labor Cost Journal Entry - Journal entries to move finished goods into cost of goods sold. Web the entries would be: Applied manufacturing overhead to all production departments. Highly skilled and motivated workers exhibit enhanced efficiency and contribute towards controlling and reducing the total direct labor cost of the entity. This is because direct labor costs are expenses in nature, and therefore, they are supposed to be treated as such. Web the journal entry required would be: In this section, you’ll be assigning direct material and direct labor costs to a job. Web during july, the shaping department incurred $15,000 in direct labor costs and $600 in indirect labor. To record direct materials, direct labor, and apply factory overhead. Web the standard costing journal entry to record the direct labor variances and to post the standard and actual labor cost is as follows:

Job Order Costing Accountancy Knowledge

Web journal entries to move direct materials, direct labor, and overhead into work in process; The posting to wages payable reflects the actual amount (4,140).

Job Costing (material, labor, overhead)

This is because direct labor costs are expenses in nature, and therefore, they are supposed to be treated as such. Web the entries would be:.

Job Costing (material, labor, overhead)

During july, creative printers sent direct materials from the materials storeroom to jobs as follows: During july, the shaping department incurred \$15,000 in direct labor.

The Journal Entry to Record Labor Costs Credits

$ 9,000 to job no. Applied manufacturing overhead to all production departments. Web normal costing tracks actual direct material costs and actual direct labor costs.

Solved Prepare journal entries to record the following

During july, creative printers sent direct materials from the materials storeroom to jobs as follows: This is because direct labor costs are expenses in nature,.

5.5 Prepare Journal Entries for a Process Costing System Business

$ 9,000 to job no. To record direct materials, direct labor, and apply factory overhead. Applied manufacturing overhead to all production departments. The company also.

Journal Entries for Recording Labour Cost, Accounting Lecture Sabaq

The cost flow is as follows: Web during july, the shaping department incurred $15,000 in direct labor costs and $600 in indirect labor. Journal entries.

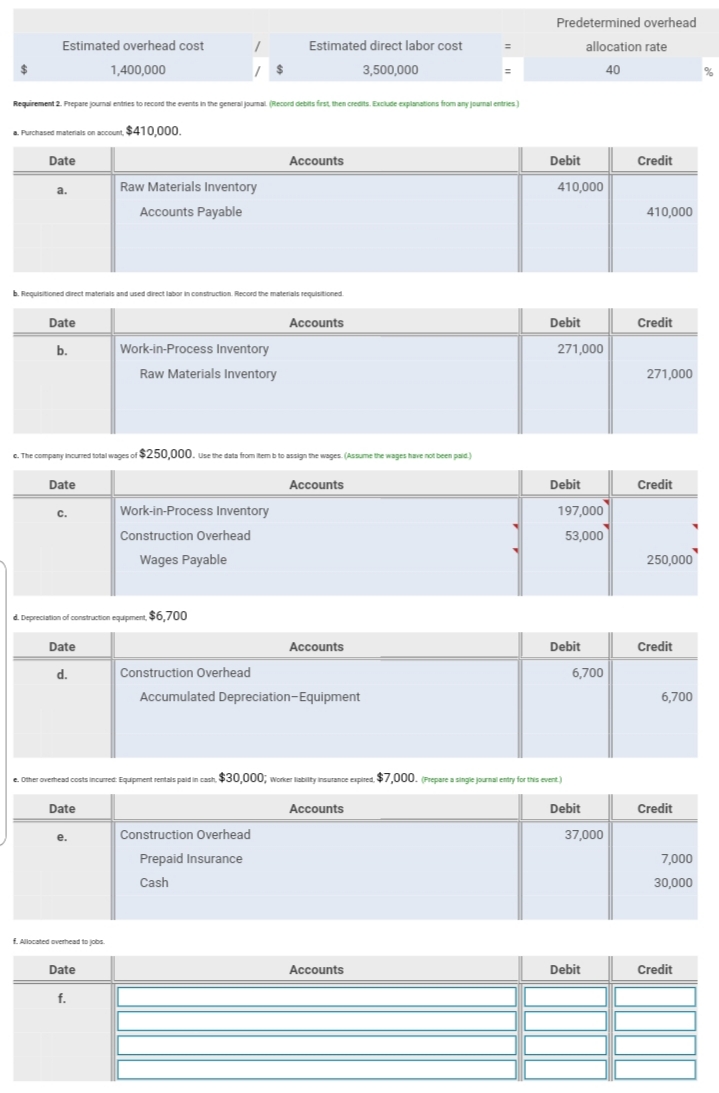

Answered Predetermined overhead Estimated… bartleby

Web during july, the shaping department incurred $15,000 in direct labor costs and $600 in indirect labor. In this section, you’ll be assigning direct material.

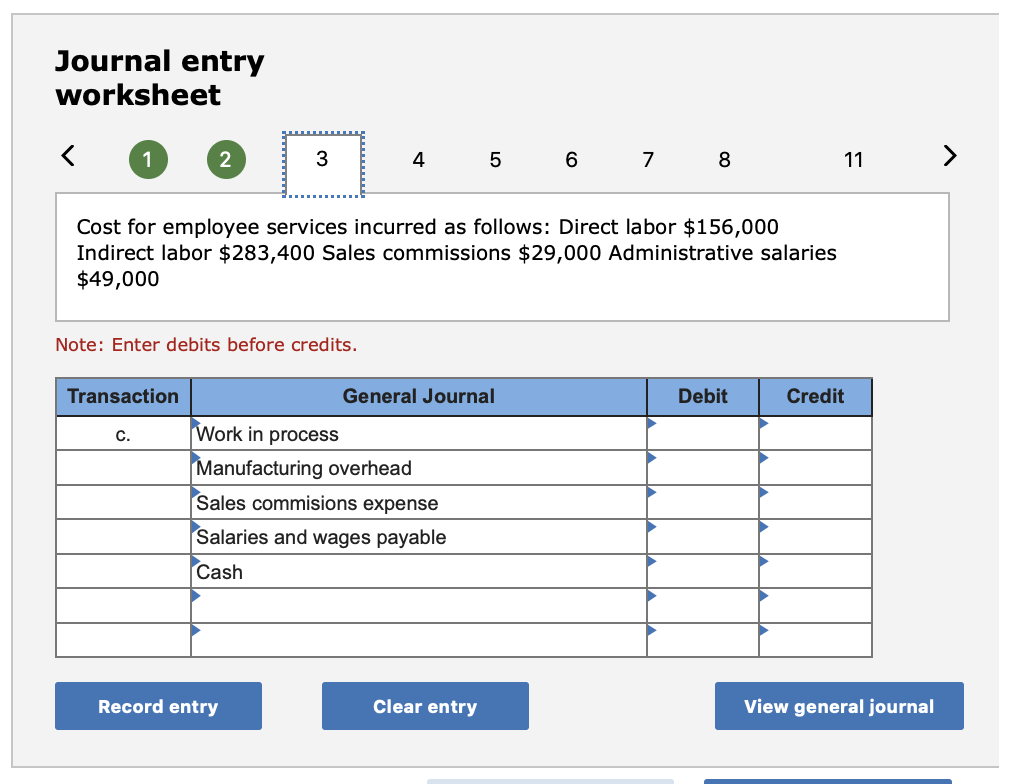

Solved Journal entry worksheet 4 5 6 7 8 11 > Cost for

Journal entries to move finished goods into cost of goods sold. 106, $ 16,000 to job no. Web journal entries to move direct materials, direct.

The Company Also Sent Indirect Materials Of $ 1,000 To Jobs.

During july, the shaping department incurred \$15,000 in direct labor costs and \$600 in indirect labor. Web the journal entry required would be: Web during july, the shaping department incurred $15,000 in direct labor costs and $600 in indirect labor. The journal entry to record the labor costs is:

Web The Journal Entry To Record The Labor Costs Is:

106, and $ 14,000 to job no. In the job order costing, the labor cost of production during the period usually includes both direct labor cost and indirect labor cost. 107, and indirect labor of $ 2,000 to overhead. 106, and $ 14,000 to job no.

Web The Cost Of Direct Labor Is Recorded By The Employees And Assigned To Each Individual Job.

So far, maboards has accumulated the following costs: The posting to wages payable reflects the actual amount (4,140) due to the employees for wages. During july, creative printers sent direct materials from the materials storeroom to jobs as follows: An entity’s total direct labor cost largely depends on skill level and motivation of its direct labor workers.

Web The Entries Would Be:

This is because direct labor costs are expenses in nature, and therefore, they are supposed to be treated as such. The cost flow is as follows: Web normal costing tracks actual direct material costs and actual direct labor costs for each job and charges manufacturing overhead to jobs using a predetermined overhead rate. Later on, the company will need to assign the labor cost to appropriate manufacturing accounts.