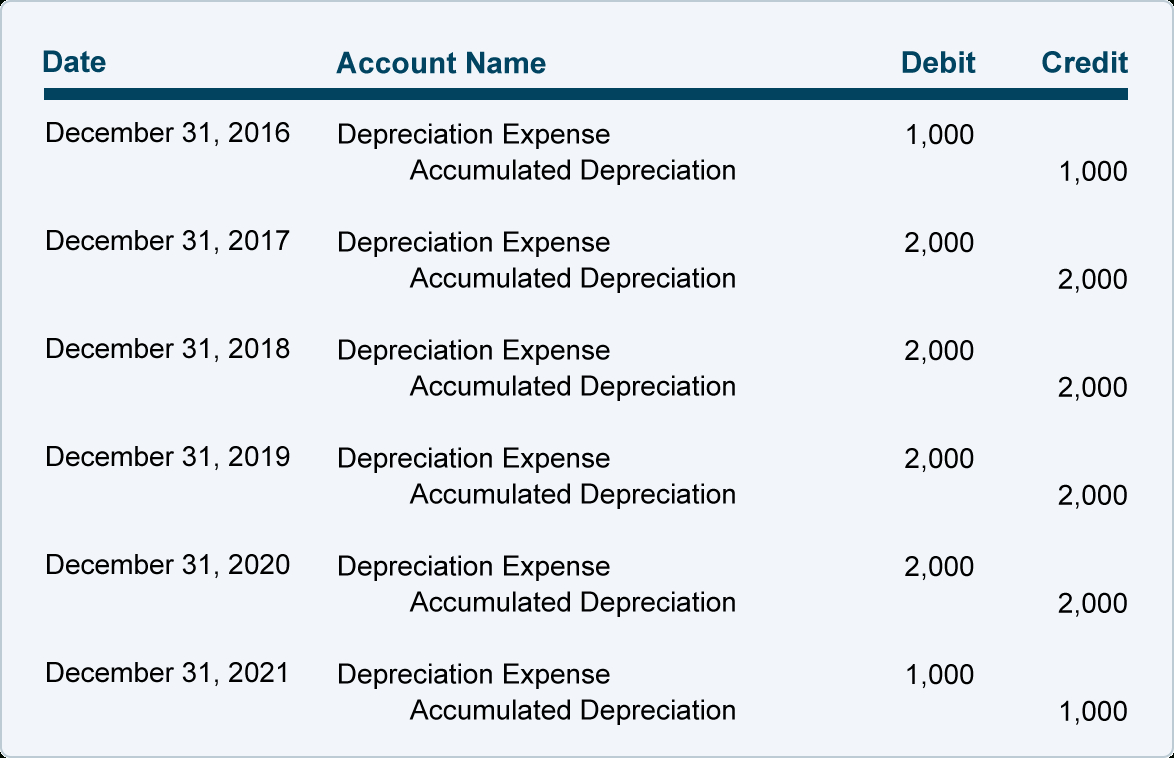

Depreciation Journal Entry - Web journal entries for the straight line depreciation. Web the journal entry consists of a: Debit to depreciation expense, which flows through to the income statement. Depreciation refers to the method of accounting which allocates a tangible asset's cost over its useful. See the definition, formula, and examples of depreciation entry with. See the basic and detailed journal entries for depreciation,. Web learn how to record depreciation expense and accumulated depreciation in the accounting journal. See the accounting equation and examples of. Web learn how to record depreciation in four easy steps, including choosing a depreciation method, computing depreciation expense, recording the journal. Find out how to record depreciation journal.

Depreciation journal Entry Important 2021

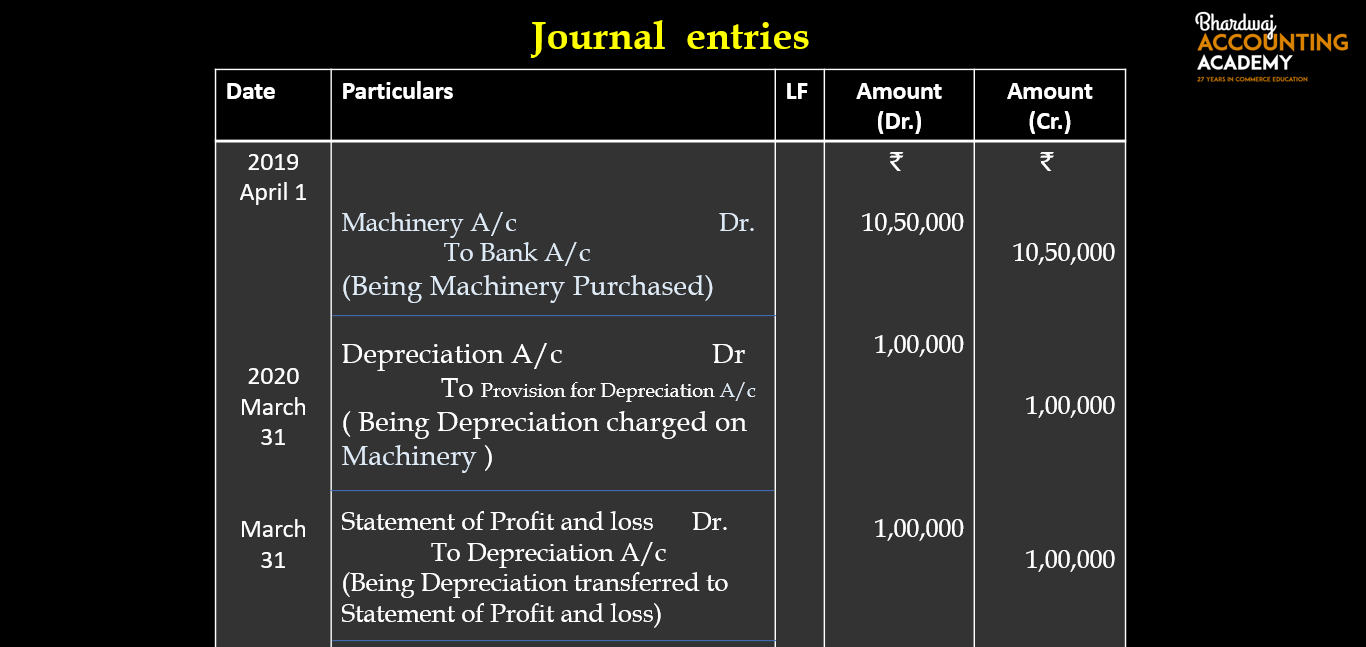

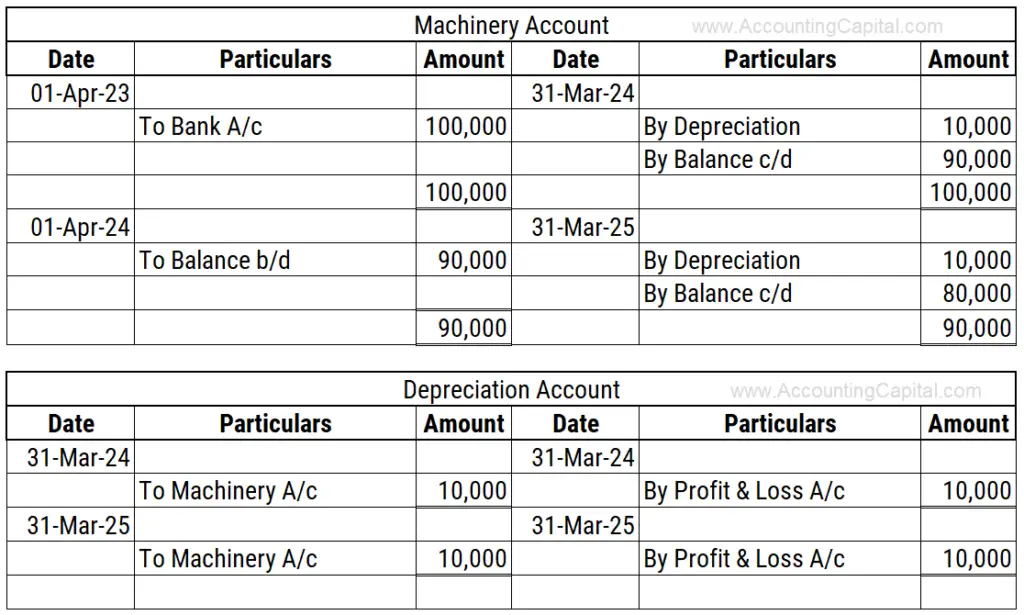

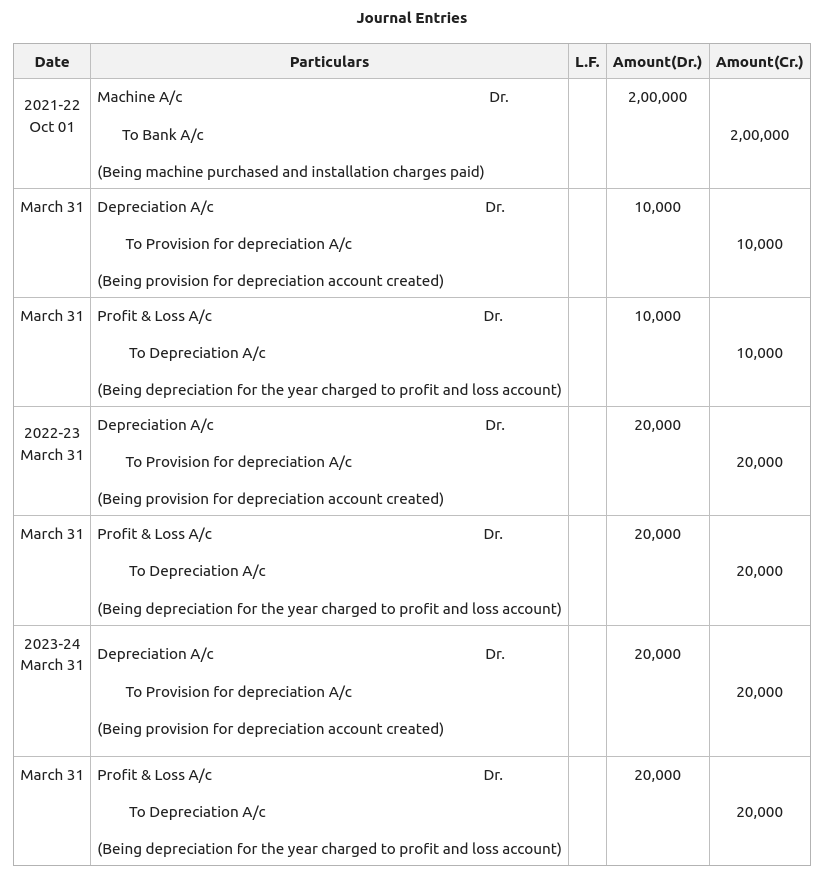

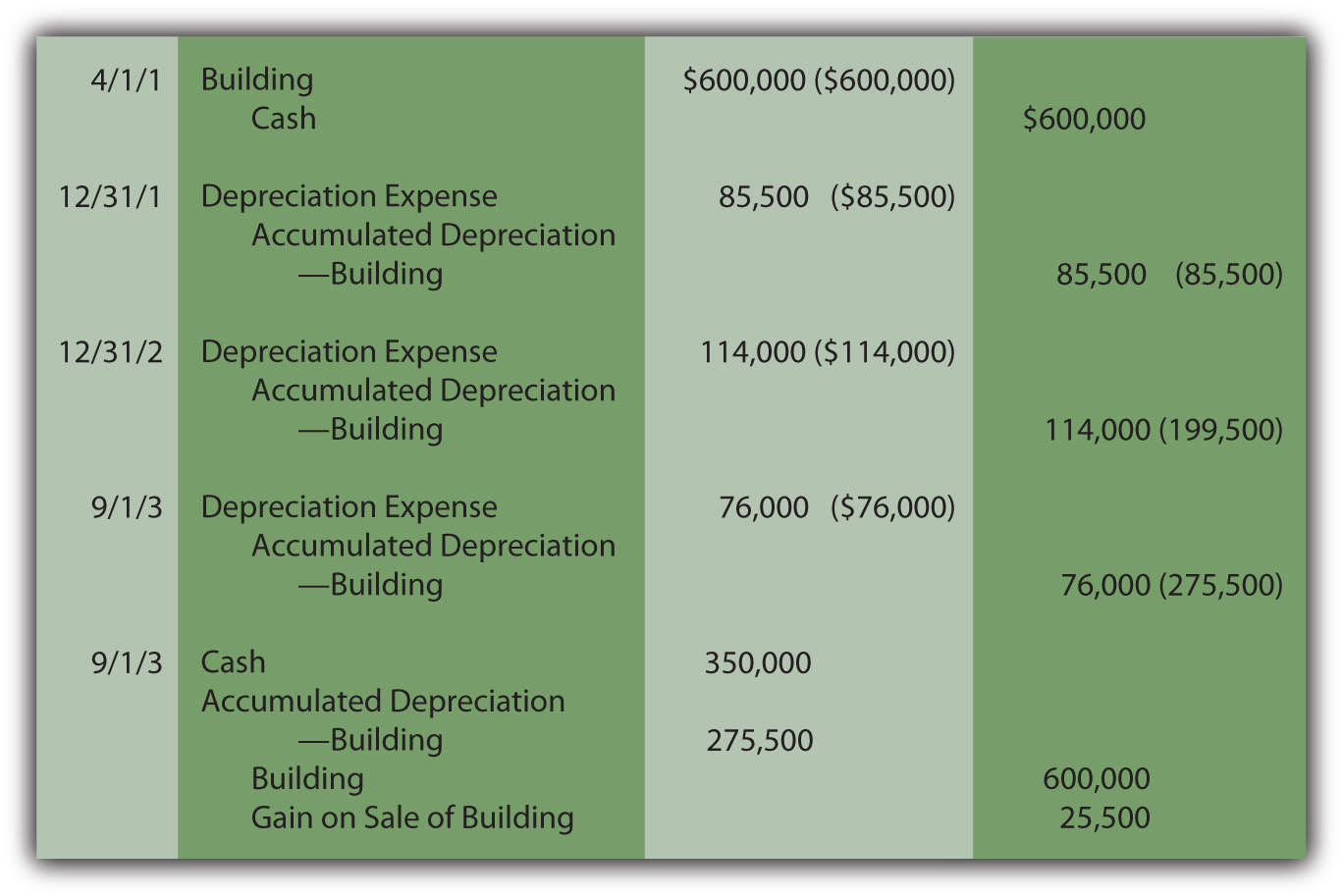

Web a depreciation journal entry is used at the end of each period to record the fixed asset or plant asset depreciation in the accounting.

Journal Entry for Depreciation Example Quiz More..

Web learn how to record depreciation in four easy steps, including choosing a depreciation method, computing depreciation expense, recording the journal. Learn how to record.

Accounting Journal Entries For Dummies

Web learn how to calculate and record depreciation expense for different methods and assets. Web learn how to record depreciation expense and accumulated depreciation for.

Journal Entry For Depreciation

Web learn how to record depreciation expense and accumulated depreciation in the accounting journal. It was supposed to explain and apply depreciation methods to allocate.

Provision for Depreciation and Asset Disposal Account

Web the basic journal entries under this approach are: Web journal entries for the straight line depreciation. Learn how to record depreciation expense and accumulated.

Recording Depreciation Expense for a Partial Year

See the accounting equation and examples of. See the definition, formula, and examples of depreciation entry with. Debit to depreciation expense, which flows through to.

Adjusting Entries Journalizing Depreciation Adjusting Entries

Unlike journal entries for normal. Web learn how to calculate and record the depreciation of fixed assets using the straight line method and a journal.

Depreciation Explanation Accountingcoach with Bookkeeping Reports

We'll work through a straight l. Web the web page you requested is not available due to a technical error. Learn how depreciation journal entry.

Class 11 Chapter 7 Depreciation Provisions and Reserves Notes

See examples of depreciation for fixed assets. Unlike journal entries for normal. Web learn how to record depreciation expense and accumulated depreciation in the accounting.

Web The Journal Entry Consists Of A:

Web learn how to record depreciation expense and accumulated depreciation for different types of fixed assets. Web the basic journal entries under this approach are: It was supposed to explain and apply depreciation methods to allocate capitalized costs, but it failed to. Web a depreciation journal entry is used at the end of each period to record the fixed asset or plant asset depreciation in the accounting system.

Web Journal Entries For The Straight Line Depreciation.

Debit to depreciation expense, which flows through to the income statement. Simplifying and automating accounting processes. Unlike journal entries for normal. Web learn what depreciation is, why it is important for tax purposes, and how to use different methods to calculate it.

See The Definition, Formula, And Examples Of Depreciation Entry With.

Web learn how to calculate and record the depreciation of fixed assets using the straight line method and a journal entry. Depreciation refers to the method of accounting which allocates a tangible asset's cost over its useful. Web the web page you requested is not available due to a technical error. Find out how to record depreciation journal.

Web Learn How To Record Depreciation In Four Easy Steps, Including Choosing A Depreciation Method, Computing Depreciation Expense, Recording The Journal.

Learn how depreciation journal entry functionality within netasset simplifies. See examples of journal entries for different years of a fixed asset. See examples of depreciation journal entry for different assets and methods. Learn how to record depreciation expense and accumulated depreciation in the income statement and balance sheet, respectively.