Depreciation Journal Entries - Web depreciation after revaluation. Depreciation refers to the method of accounting which allocates a tangible asset's cost over its useful. Web depreciation = $5,000 / 5 years = $1,000 per year. Depreciation in periods after revaluation is based on the revalued amount. It is done to adjust the book values of the different. A truck costing $40,000 has a useful life of 10 years and a salvage value of $5,000 at the end of its. Web an accumulated depreciation journal entry is the journal entry passed by the company at the end of the year. Learn how depreciation journal entry functionality within. Web definition of journal entry for depreciation. Simplifying and automating accounting processes.

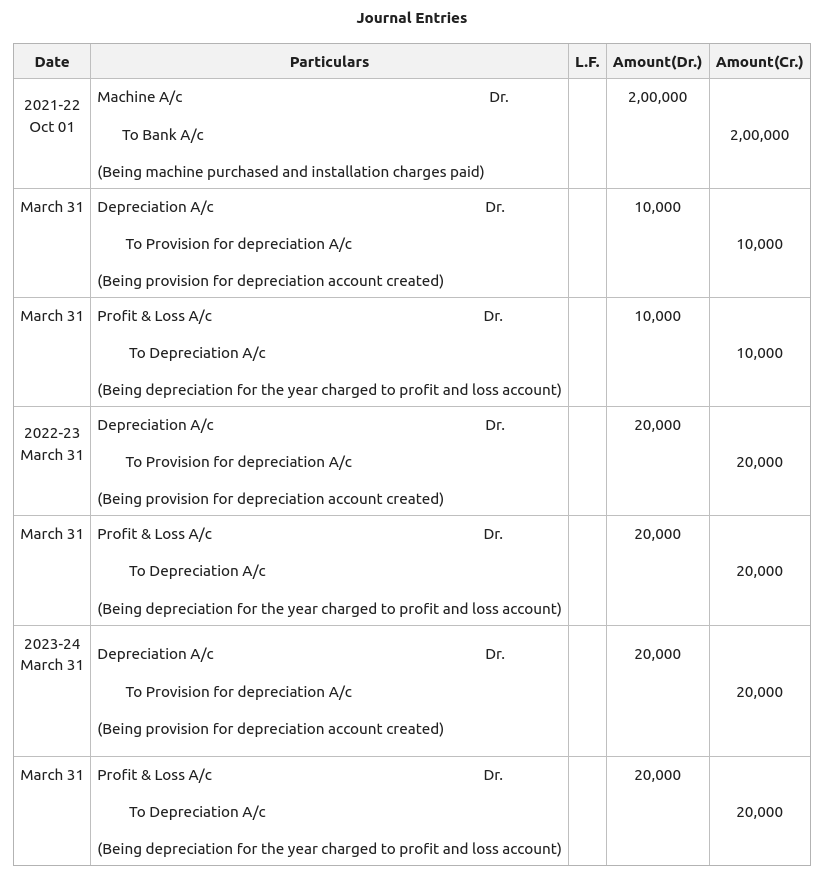

13.4 Journal entries for depreciation

Simplifying and automating accounting processes. A truck costing $40,000 has a useful life of 10 years and a salvage value of $5,000 at the end.

Depreciation and Disposal of Fixed Assets Finance Strategists

In this case, the company can make the accumulated depreciation journal entry with the $1,000 for each year of the three. In year 3, the.

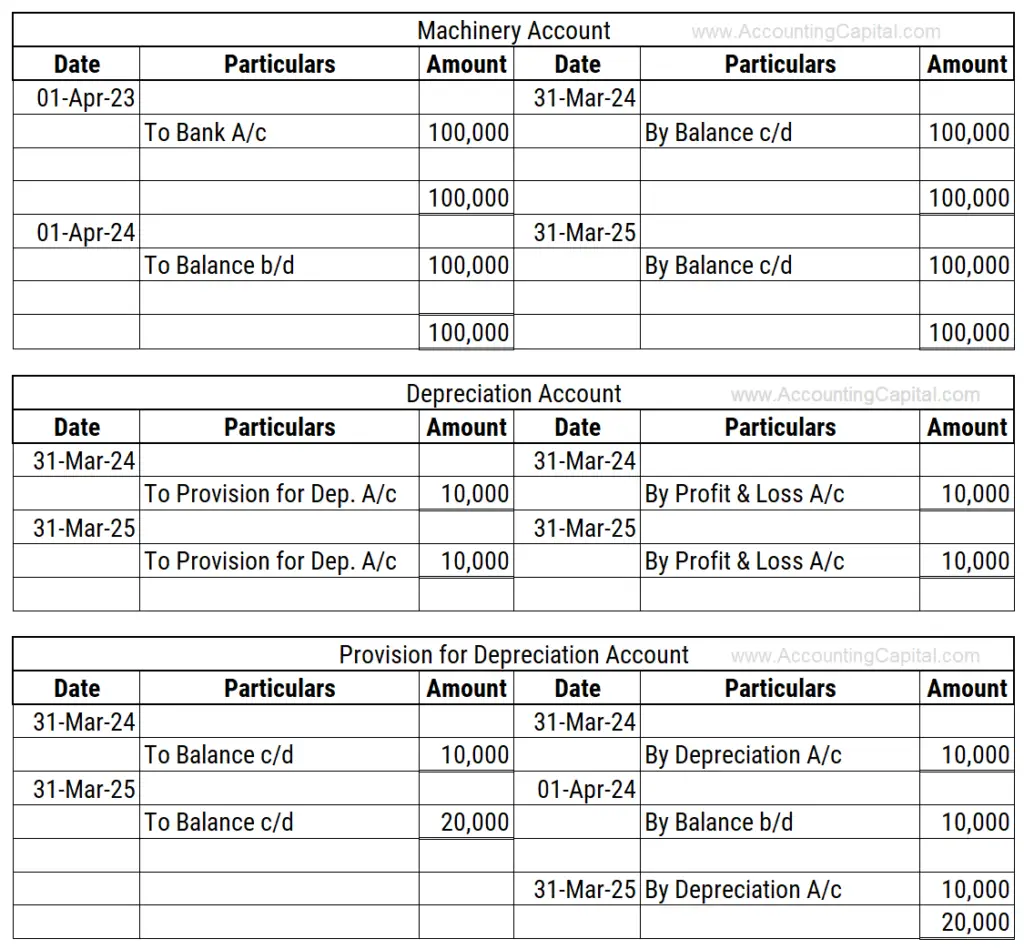

Provision for Depreciation and Asset Disposal Account

The journal entry for depreciation is: Credit to the balance sheet account. Web the journal entry is used to record depreciation expenses for a particular.

Describing the Depreciation Methods Used in the Financial Statements

Web the basic journal entry for depreciation is to debit the depreciation expense account (which appears in the income statement) and credit the accumulated. Web.

Journal Entry for Depreciation Example Quiz More..

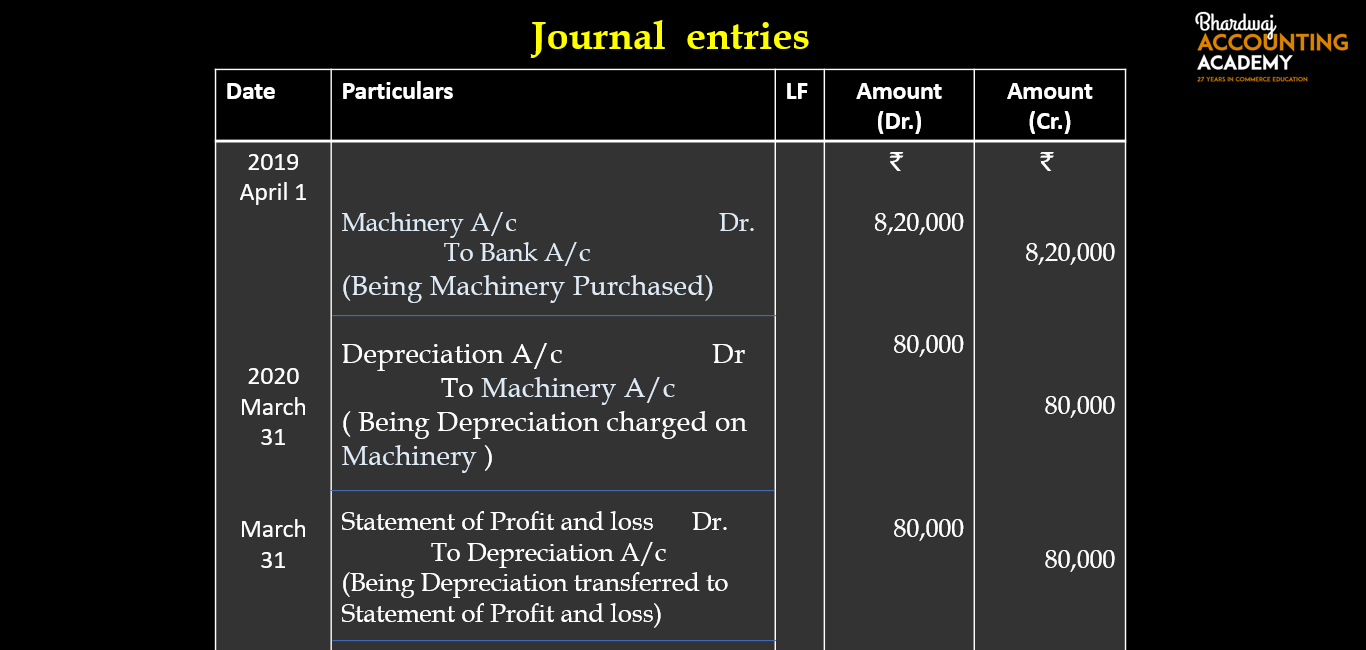

Web depreciation after revaluation. In case of axe ltd. Web journal entries for the straight line depreciation. It is done to adjust the book values.

What is the journal entry for depreciation? Leia aqui What is

How to keep your journal entries and accounting under control. Web depreciation = $5,000 / 5 years = $1,000 per year. In this case, the.

Adjusting Entries Journalizing Depreciation Adjusting Entries

In case of axe ltd. Web at the end of every accounting period, a depreciation journal entry is recorded as part of the usual periodic.

Journal Entry for Depreciation Example Quiz More..

The journal entry for depreciation is: Web the journal entry is used to record depreciation expenses for a particular accounting period and can be recorded.

Depreciation journal Entry Important 2021

Web at the end of every accounting period, a depreciation journal entry is recorded as part of the usual periodic adjusting entries. How to keep.

Web The Journal Entry For Depreciation For Year 3 Is As Follow:

Web depreciation after revaluation. Web when a business disposes of fixed assets it must remove the original cost and the accumulated depreciation to the date of disposal from the accounting records. Learn how depreciation journal entry functionality within. Debit to the income statement account depreciation expense.

Web The Basic Journal Entry For Depreciation Is To Debit The Depreciation Expense Account (Which Appears In The Income Statement) And Credit The Accumulated.

Web an accumulated depreciation journal entry is the journal entry passed by the company at the end of the year. In year 3, the total accumulated depreciation is $29,400. In this case, the company can make the accumulated depreciation journal entry with the $1,000 for each year of the three. Web depreciation journal entry:

Web The Journal Entry Is Used To Record Depreciation Expenses For A Particular Accounting Period And Can Be Recorded Manually Into A Ledger Or In Your Accounting.

The journal entry for depreciation is: Depreciation is a term used. How to keep your journal entries and accounting under control. Web a depreciation journal entry is used at the end of each period to record the fixed asset or plant asset depreciation in the accounting system.

Credit To The Balance Sheet Account.

A truck costing $40,000 has a useful life of 10 years and a salvage value of $5,000 at the end of its. Depreciation refers to the method of accounting which allocates a tangible asset's cost over its useful. Web journal entries for the straight line depreciation. In this case, we can make the journal entry of depreciation expenses in the june 30 adjusting entry as.