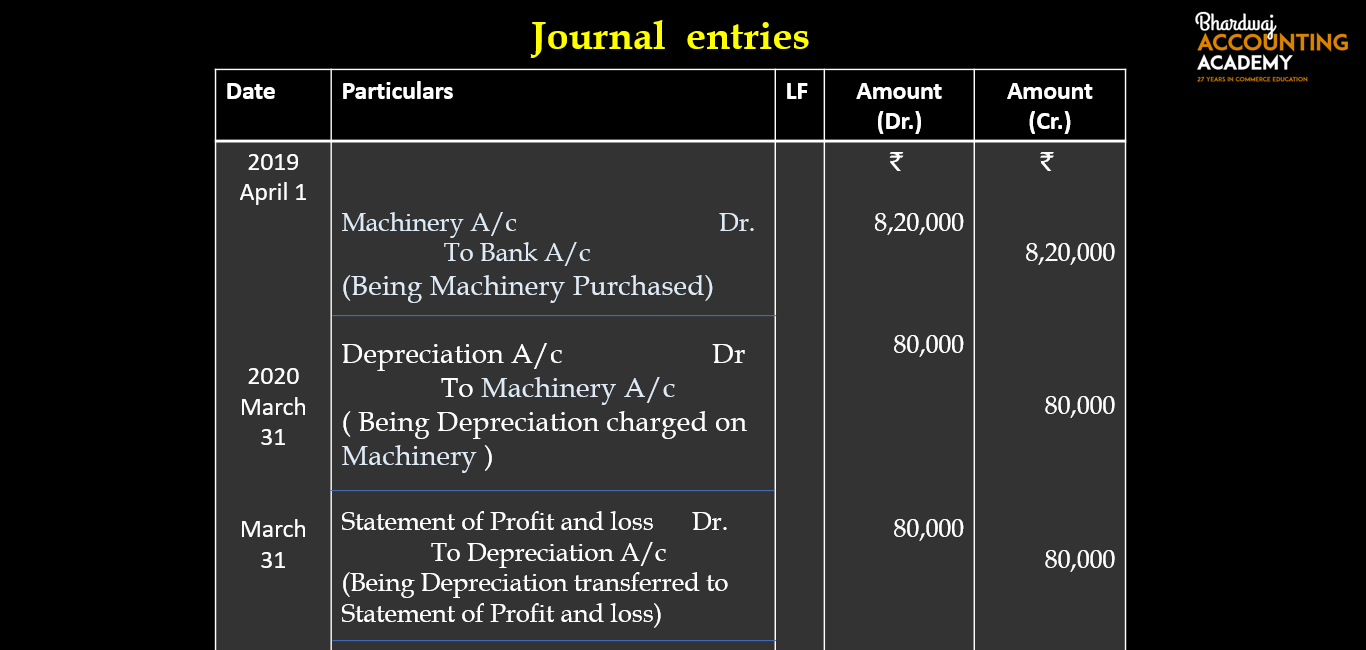

Depreciation In Journal Entry - Web depreciation expense can be recorded using the following journal entry: Depreciation is a term used in accounting to. Web the dow jones segment — which includes the wall street journal — of parent company news corp. Web the basic journal entry for depreciation is to debit the depreciation expense account (which appears in the income statement) and credit the accumulated depreciation. Web a depreciation journal entry is a journal entry used to record the depreciation of an asset. Recently ended its third quarter with an ebitda (earnings before interest,. Web journal entry for depreciation. Web a depreciation journal entry is used at the end of each period to record the fixed asset or plant asset depreciation in the accounting system. Debit to the income statement account depreciation expense; When depreciation is charged to the ‘asset’ account.

Journal Entry for Depreciation Example Quiz More..

Unlike journal entries for normal. In this case, we can make the journal entry of depreciation expenses in the june 30 adjusting entry as. Learn.

Depreciation Journal Entry With Example Howto Diy Today

Learn how depreciation journal entry functionality within. Web a depreciation journal entry is a journal entry used to record the depreciation of an asset. When.

Depreciation and Disposal of Fixed Assets Finance Strategists

The journal entry to record this expense is straightforward. Web the journal entry for depreciation is: A truck costing $40,000 has a useful life of.

Describing the Depreciation Methods Used in the Financial Statements

Simplifying and automating accounting processes. Depreciation is a term used in accounting to. Web = $8,000 per year. As can be seen the asset has.

Adjusting Entries Journalizing Depreciation Adjusting Entries

Depreciation is the gradual charging to. Web journal entry for depreciation. In this case, we can make the journal entry of depreciation expenses in the.

13.4 Journal entries for depreciation

As can be seen the asset has no value and the business writes off this amount. In the books of accounts, depreciation can be recorded.

Journal Entry for Depreciation Example Quiz More..

By debiting the depreciation expense and crediting accumulated depreciation, the book value of the asset decreases on the balance sheet. When recording a journal entry,.

Accounting Entries for Depreciation, Accounting Lecture Sabaq.pk

We simply record the depreciation on debit and accumulated depreciation on credit. Depreciation of fixed assets entries explained. Web a depreciation journal entry is a.

Depreciation journal Entry Important 2021

When recording a journal entry, you have two options, depending on your current accounting method. Web journal entry for depreciation. Learn how depreciation journal entry.

To Calculate Depreciation Expense, You Need To.

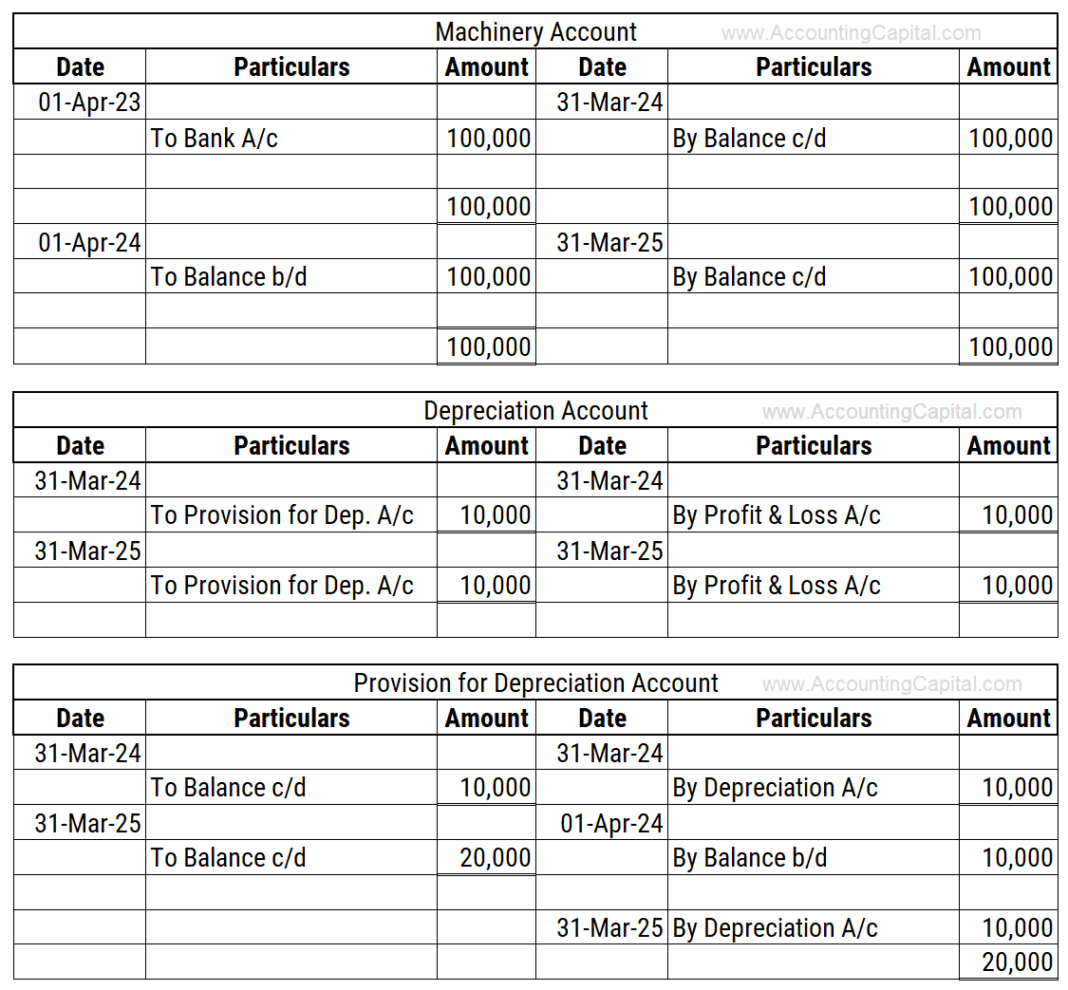

Web depreciation journal entry example: Web depreciation journal entry is the journal entry passed to record the reduction in the value of the fixed assets due to normal wear and tear, normal usage or technological changes, etc., where the depreciation account will be debited, and the respective fixed asset. As can be seen the asset has no value and the business writes off this amount. Web depreciation expense can be recorded using the following journal entry:

Web Journal Entry For Depreciation.

How to keep your journal entries and accounting under control. Accelerated depreciation methods, on the other. What if the delivery van has an estimated residual value of $10,000 after 5 years? Web = $8,000 per year.

When Depreciation Is Charged To The ‘Asset’ Account.

The depreciation expense then would. In the books of accounts, depreciation can be recorded by any of the following two methods, 1. Learn how depreciation journal entry functionality within. The credit is always made to the accumulated depreciation, and not to the cost account directly.

The Journal Entry To Record This Expense Is Straightforward.

We simply record the depreciation on debit and accumulated depreciation on credit. When recording a journal entry, you have two options, depending on your current accounting method. For example, a company purchases a machine for $50,000. Before you record depreciation, you must first select.