Depreciation General Journal Entry - Journal entry for discount allowed. Web journal entries record the entire spectrum of monetary transactions performed by a business, including the buying and selling of goods and services, expenses, company. Credit to the balance sheet account accumulated depreciation;. Web journal entry for depreciation. Debit to the income statement account depreciation expense; Web a depreciation journal entry is a journal entry used to record the depreciation of an asset. Journal entry for free samples/charity. Explanation of what depreciation is. The company needs to make monthly journal entry by debiting depreciation expenses and credit accumulated depreciation. See examples of journal entries for different years of a fixed asset.

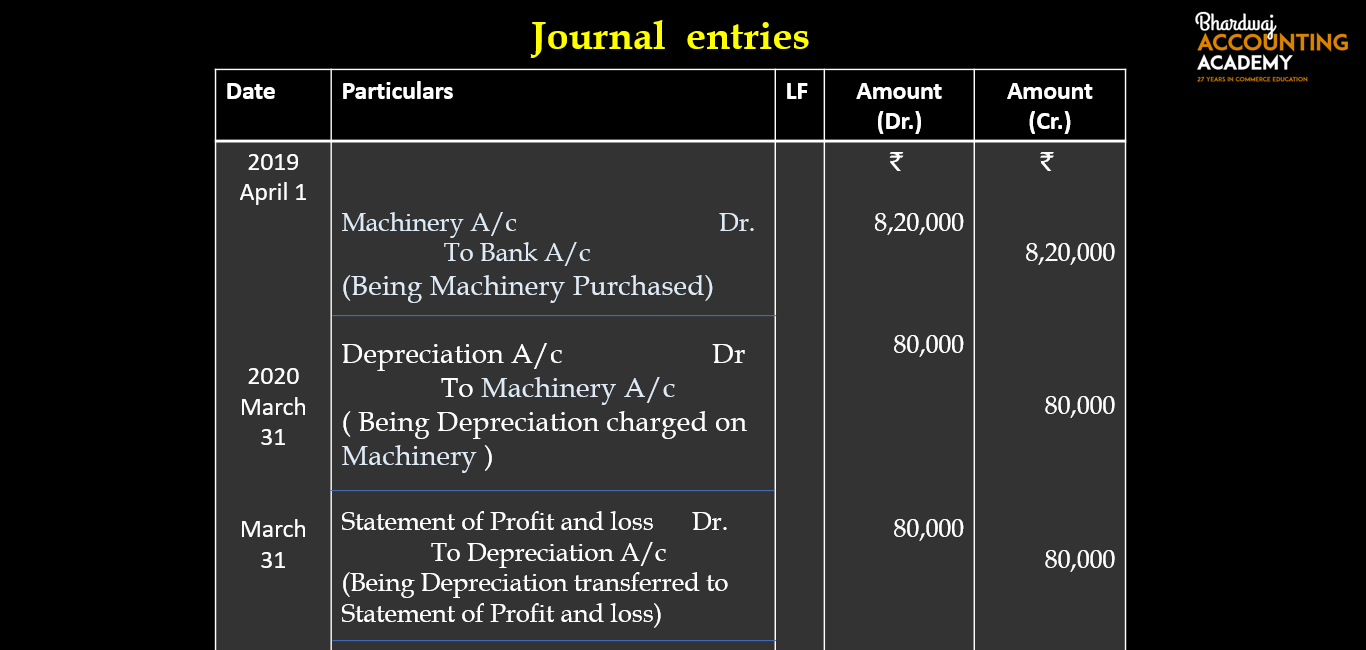

13.4 Journal entries for depreciation YouTube

Debit the accumulated depreciation account for the amount of. The company needs to make monthly journal entry by debiting depreciation expenses and credit accumulated depreciation..

DEPRECIATION ACCOUNTING Definition, Methods, Formula & All you should

In this case, we can make the journal entry of depreciation expenses in the june 30 adjusting entry as. Depreciation refers to the method of.

Depreciation journal Entry Important 2021

In this case, we can make the journal entry of depreciation expenses in the june 30 adjusting entry as. In this case, the company can.

Adjusting Entries Journalizing Depreciation Adjusting Entries

Web years 2019 to 2022 will have full $6,000 annual depreciation expense. The company needs to make monthly journal entry by debiting depreciation expenses and.

Depreciation Journal Entry Howto Diy Today

Web straight line depreciation journal entry. Journal entry for discount allowed. Web a depreciation journal entry is used at the end of each period to.

What is the journal entry for depreciation? Leia aqui What is

When recording a journal entry, you have two options, depending on your current accounting method. Web journal entry for depreciation. Web depreciation is a systematic.

General Journal in Accounting Double Entry Bookkeeping

Web depreciation is a systematic process for allocating (spreading) the cost of an asset that is used in a business to the accounting periods in.

Depreciation Explanation Accountingcoach with Bookkeeping Reports

From the view of accounting, accumulated depreciation is an important aspect as it is relevant for capitalized assets. Overview of depreciation calculation methods. Web the.

Journal Entry for Depreciation Example Quiz More..

Therefore, it is very important to. In this case, the company can make the accumulated depreciation journal entry with the $1,000 for each year of.

To Do This, A Number Of Unique Steps Are Taken.

See examples of journal entries for different years of a fixed asset. The company needs to make monthly journal entry by debiting depreciation expenses and credit accumulated depreciation. Debit the accumulated depreciation account for the amount of. Web a depreciation journal entry is used at the end of each period to record the fixed asset or plant asset depreciation in the accounting system.

Web The Journal Entry Is Used To Record Depreciation Expenses For A Particular Accounting Period And Can Be Recorded Manually Into A Ledger Or In Your Accounting.

Web depreciation = $5,000 / 5 years = $1,000 per year. Web journal entries for the straight line depreciation. Web the basic journal entry for depreciation is to debit the depreciation expense account (which appears in the income statement) and credit the accumulated. Web the journal entry for depreciation is:

Web Years 2019 To 2022 Will Have Full $6,000 Annual Depreciation Expense.

Web journal entry for depreciation. Web straight line depreciation journal entry. Explanation of what depreciation is. Debit to the income statement account depreciation expense;

Credit To The Balance Sheet Account Accumulated Depreciation;.

Therefore, it is very important to. Web at the end of every accounting period, a depreciation journal entry is recorded as part of the usual periodic adjusting entries. For example, a company purchases a machine for $50,000. Journal entry for discount allowed.