Depreciation Expense Journal Entry - Web at the end of every accounting period, a depreciation journal entry is recorded as part of the usual periodic adjusting entries. Web an accumulated depreciation journal entry is the journal entry passed by the company at the end of the year. It states that this cost should be. It is done to adjust the book values of the different. See examples, formulas, and tables for different. Therefore, it is very important to understand that when a depreciation. See examples of journal entries for different years of a fixed asset. Web learn how to record depreciation expense and accumulated depreciation in the accounting journal. Web the basic journal entries under this approach are: Web learn how to record depreciation expense and accumulated depreciation in a journal entry for different types of fixed assets.

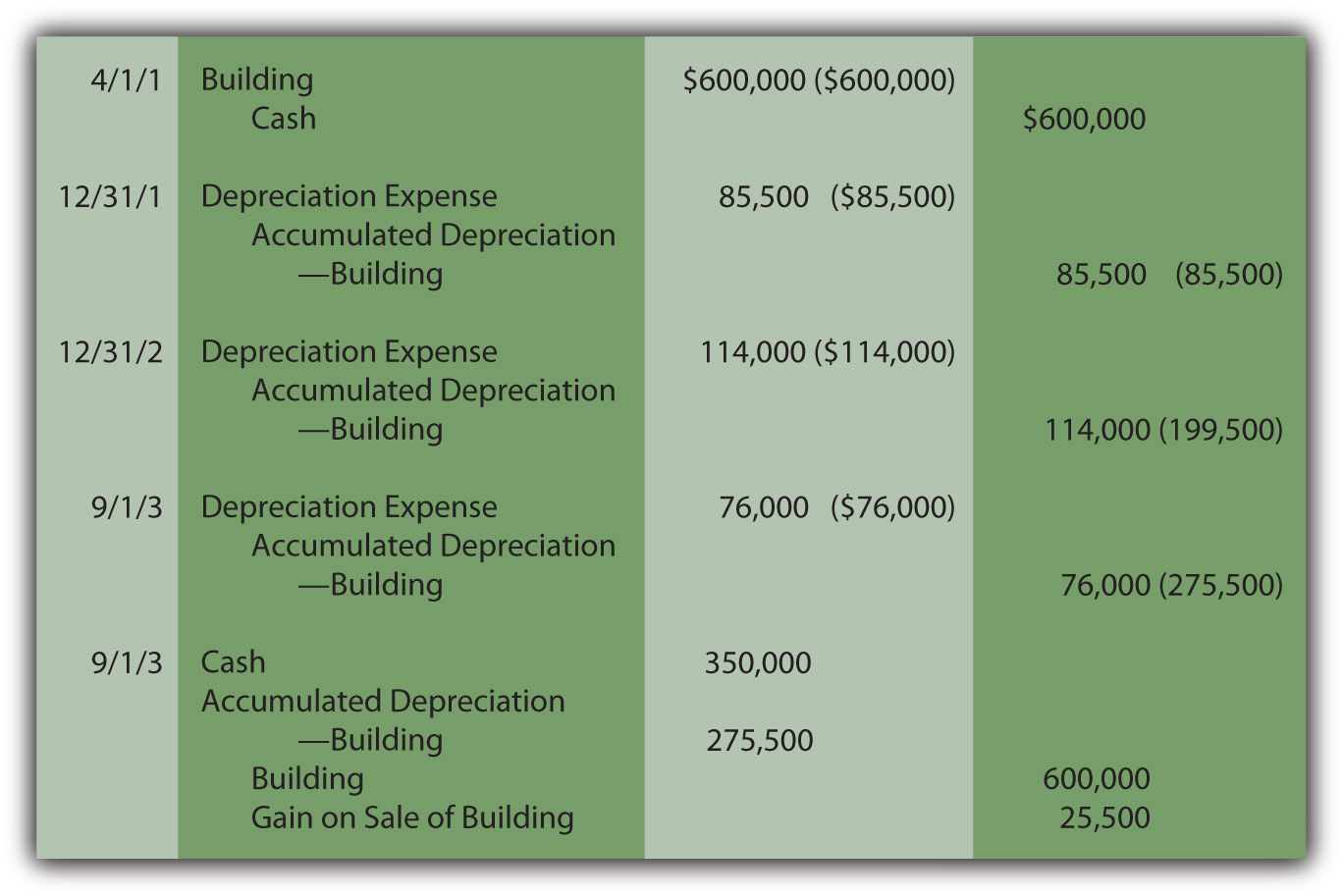

13.4 Journal entries for depreciation

See examples of journal entries for different years of a fixed asset. Therefore, it is very important to understand that when a depreciation. Web learn.

Adjusting Entries Journalizing Depreciation Adjusting Entries

Web learn how to record depreciation in four easy steps, including choosing a depreciation method, computing depreciation expense, recording the journal entry, and. It states.

adjustments accounting DriverLayer Search Engine

Web the journal entry is used to record depreciation expenses for a particular accounting period and can be recorded manually into a ledger or in.

Depreciation Expense in a Not for Profit Organization Should Be

Web an accumulated depreciation journal entry is the journal entry passed by the company at the end of the year. Web the adjusting entry for.

为什么累计折旧是贷方余额?

Web learn how to record depreciation expense and accumulated depreciation in the accounting journal. Web learn how to record depreciation expense and accumulated depreciation in.

Journal Entry for Depreciation Example Quiz More..

Web the journal entry is used to record depreciation expenses for a particular accounting period and can be recorded manually into a ledger or in.

What is the journal entry for depreciation? Leia aqui What is

It states that this cost should be. See examples of journal entries for different years of a fixed asset. Web the adjusting entry for a.

General Ledger Entries

Web the journal entry is used to record depreciation expenses for a particular accounting period and can be recorded manually into a ledger or in.

Journal Entry For Depreciation

Web an accumulated depreciation journal entry is the journal entry passed by the company at the end of the year. Web a depreciation journal entry.

From The View Of Accounting, Accumulated Depreciation Is An Important Aspect As It Is Relevant For Capitalized Assets.

Web at the end of the year after you've talked to your accountant, create a journal entry to record the lost value. Web the adjusting entry for a depreciation expense involves debiting depreciation expense and crediting accumulated depreciation. Web depreciation is recorded in the company’s accounting records through adjusting entries. Web learn how to record depreciation expense and accumulated depreciation in a journal entry for different types of fixed assets.

See Examples, Formulas, And Tables For Different.

See the definition, formula, and examples of depreciation entry with video and quiz. Web initial journal entry. Web learn how to record depreciation expense and accumulated depreciation in the accounting journal. It is done to adjust the book values of the different.

It States That This Cost Should Be.

Web learn how to record depreciation in four easy steps, including choosing a depreciation method, computing depreciation expense, recording the journal entry, and. Web at the end of every accounting period, a depreciation journal entry is recorded as part of the usual periodic adjusting entries. Web an accumulated depreciation journal entry is the journal entry passed by the company at the end of the year. Web the journal entry is used to record depreciation expenses for a particular accounting period and can be recorded manually into a ledger or in your accounting.

Monthly Depreciation = 10,000/12 Months = $ 833.33 Per Year.

See the cash impact of depreciation and. See examples of journal entries for different years of a fixed asset. Adjusting entries are recorded in the general journal using the last. Web a depreciation journal entry is used at the end of each period to record the fixed asset or plant asset depreciation in the accounting system.

:max_bytes(150000):strip_icc()/dotdash_Final_Why_is_Accumulated_Depreciation_a_Credit_Balance_Jul_2020-01-34c67ae5f6a54883ba5a5947ba50f139.jpg)