Depreciation Equipment Journal Entry - Unlike journal entries for normal business transactions, the deprecation journal entry does not actually record a. In this case, we can make the journal entry of depreciation expenses in the june 30 adjusting entry as below: Web what is the journal entry for accumulated depreciation in the first, second, and third years? From the view of accounting, accumulated depreciation is an important aspect as it is relevant for capitalized assets. Depreciation is associated with buildings, equipment, vehicles, and other physical assets which will last for more than a year but will not last forever. Web here are four easy steps that’ll teach you how to record a depreciation journal entry. Depreciation is the gradual charging to expense of an asset’s cost over its expected useful life. Explanation of what depreciation is. Impact of a depreciation journal entry on accounting: $10,000 / 5 = $2,000 now, debit your depreciation expense account $2,000 and credit your accumulated depreciation account $2,000.

Adjusting Entries Journalizing Depreciation Adjusting Entries

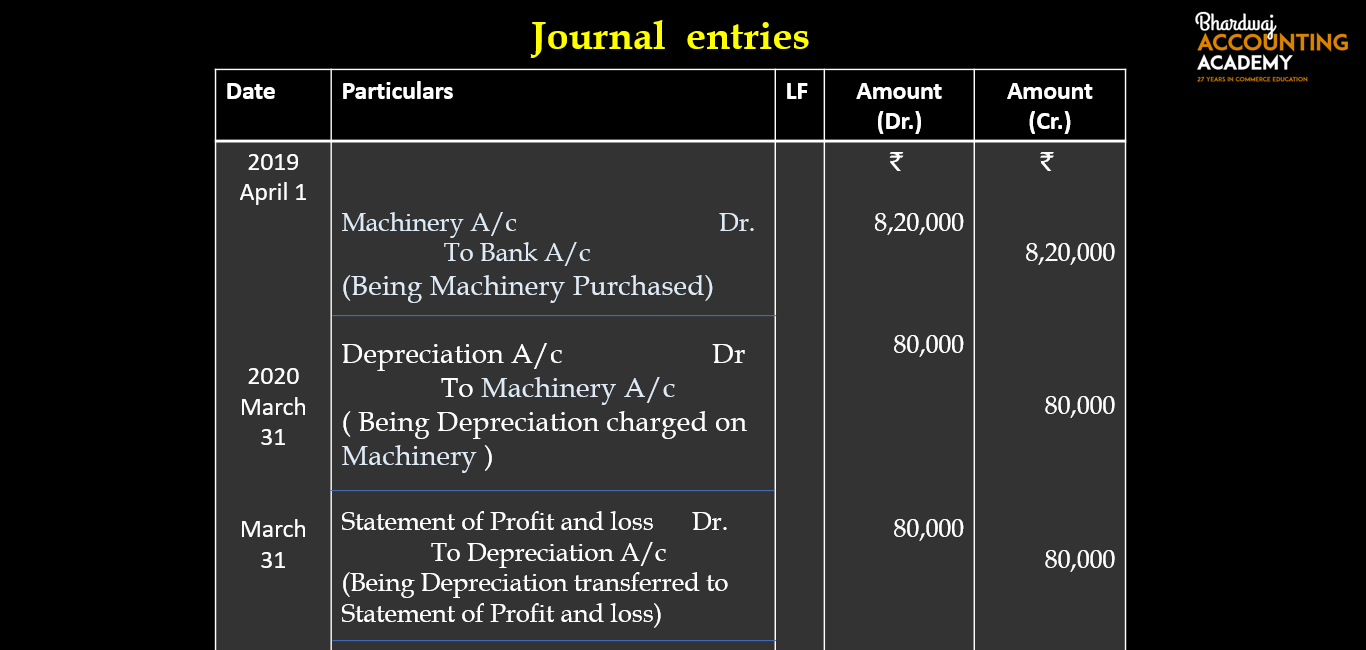

Debit the cash account for the proceeds from the. Web journal entry for depreciation. Credit the fixed asset account for the original cost of the.

Adjusting Journal Entries Equipment, Depreciation Expense YouTube

Web at the end of every accounting period, a depreciation journal entry is recorded as part of the usual periodic adjusting entries. This journal entry.

What is the journal entry for depreciation? Leia aqui What is

A disposal can occur when the asset is scrapped and written off, sold for a profit to give a gain on disposal, or sold for.

QuickBooks Adjusting Journal Entry 3 Furniture Depreciation YouTube

The income statement account depreciation expense is a temporary account. Web the basic journal entry for depreciation is to debit the depreciation expense account (which.

DEPRECIATION ACCOUNTING Definition, Methods, Formula & All you should

Depreciation is the gradual charging to expense of an asset’s cost over its expected useful life. Web journal entry for depreciation. Web the journal entry.

Depreciation and Disposal of Fixed Assets Finance Strategists

Journal entry for accumulated depreciation. The income statement account depreciation expense is a temporary account. When recording a journal entry, you have two options, depending.

Depreciation journal Entry Important 2021

Web a depreciation journal entry is used at the end of each period to record the fixed asset or plant asset depreciation in the accounting.

Depreciation Explanation Accountingcoach with Bookkeeping Reports

Web at the end of every accounting period, a depreciation journal entry is recorded as part of the usual periodic adjusting entries. The depreciable basis.

Recording Depreciation Expense for a Partial Year

Credit to the balance sheet account accumulated depreciation. The income statement account depreciation expense is a temporary account. Debit the accumulated depreciation account for the.

Once Depreciation Has Been Calculated, You’ll Need To Record The Expense As A Journal Entry.

The depreciable basis of an asset includes all the costs to acquire the item and place it in service. Overview of depreciation calculation methods. Web the journal entry for depreciation expense is: Journal entries are key to ensuring the financial integrity and viability of a business.

Web Journal Entry For Depreciation.

Impact of a depreciation journal entry on accounting: Web the basic journal entry for depreciation is to debit the depreciation expense account (which appears in the income statement) and credit the accumulated depreciation account (which appears in the balance sheet as a contra account that reduces the amount of fixed assets). From the view of accounting, accumulated depreciation is an important aspect as it is relevant for capitalized assets. In this case, we can make the journal entry of depreciation expenses in the june 30 adjusting entry as below:

Web What Is The Journal Entry For Accumulated Depreciation In The First, Second, And Third Years?

Web depreciation is a systematic process for allocating (spreading) the cost of an asset that is used in a business to the accounting periods in which the asset is used. Depreciation is the gradual charging to expense of an asset’s cost over its expected useful life. To calculate depreciation expense, you need to know four things: Web here are four easy steps that’ll teach you how to record a depreciation journal entry.

Dr Depreciation Expense Cr Accumulated Depreciation

It is done to adjust the book values of the different capital assets of the company and add the depreciation expense of the current year to the accumulated depreciation account, where the depreciation expenses account will be. Web the journal entry to record depreciation is fairly standard. Debit the cash account for the proceeds from the. Journal entry for year 2.