Deposit In Transit Journal Entry - The account holder has recorded the. Web the journal entry for an outstanding check involves recording the check when it is issued and then adjusting the records when the check is eventually cashed or. Access your quickbooks online company. Web in general journal format the bank’s entry is: To do this, make a journal. Cash and checks that have been received and recorded by the company but have not yet been recorded on the bank statement. Web the process of tracking and recording deposits in transit begins with establishing a systematic approach to document cash inflows. Deductions for a bank service fee : Web (also called deposits in transit.) this is money that has been received by your company and recorded on the books, but which has not been processed by the bank. Web learn what a deposit in transit is and how to record it in the accounting journal.

On A Bank Reconciliation Deposits In Transit Are slidesharetrick

Web a deposit in transit: Web the journal entry for an outstanding check involves recording the check when it is issued and then adjusting the.

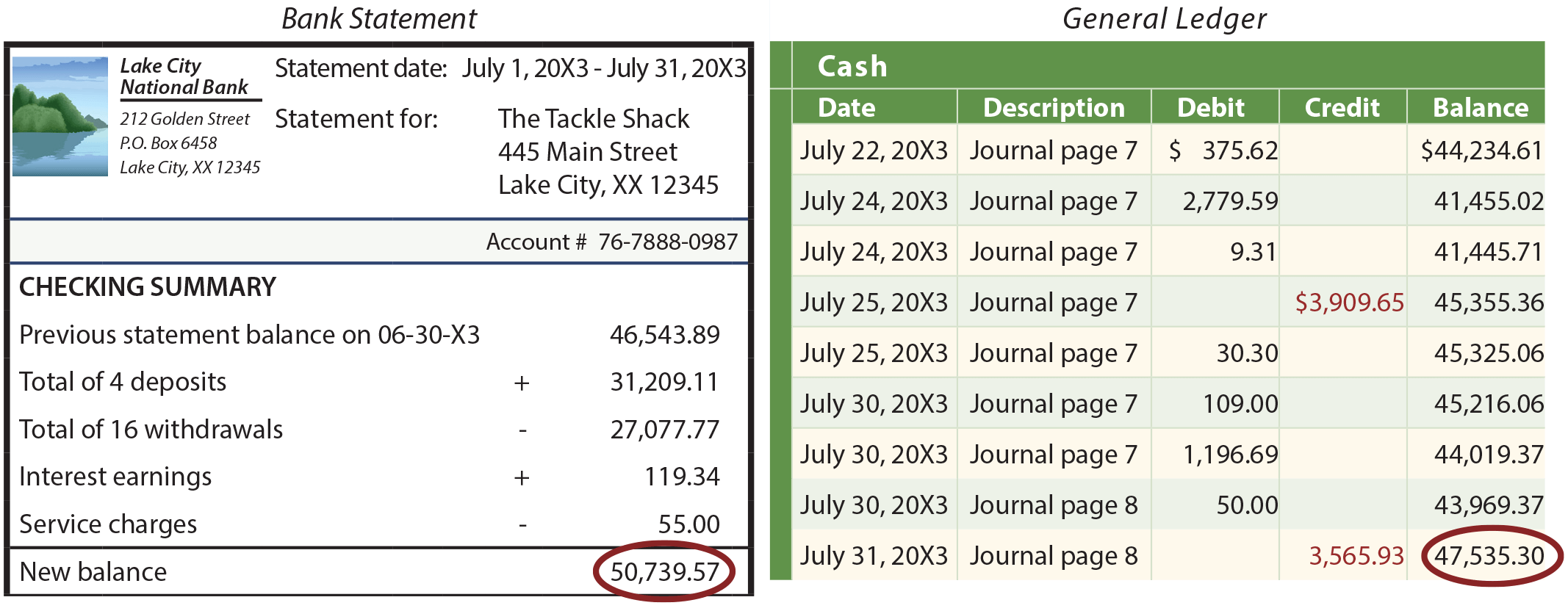

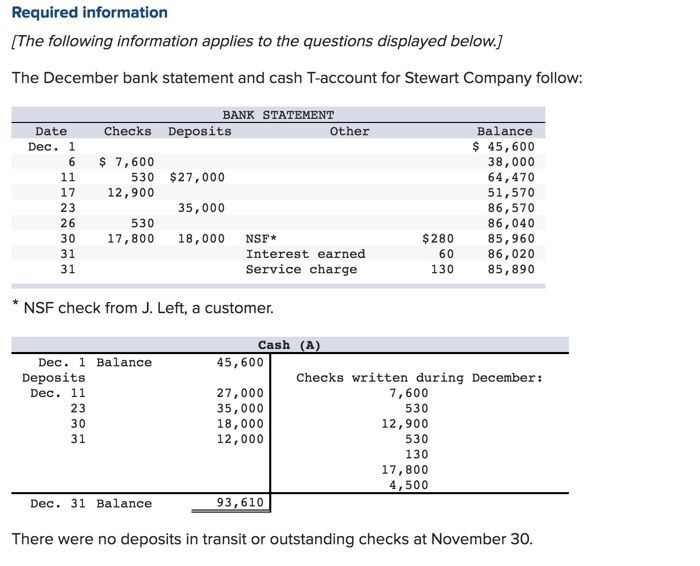

Solved 1. Compute the deposits in transit and outstanding

See an example of how to adjust the. Web the journal entry for an outstanding check involves recording the check when it is issued and.

PA53 Identifying Outstanding Checks and Deposits in Transit and

These adjusting entries for bank reconciliation. On the left navigational bar, click the +new button. Web learn what a deposit in transit is and how.

Solved Prepare any journal entries that the company should

Other items on the bank statement must be. Therefore, the company’s monthly bank statement excluded the funds, even though they have already recorded the receipt.

On A Bank Reconciliation Deposits In Transit Are slidesharetrick

Web also, check the deposits in transit listed in last month’s bank reconciliation against the bank statement. Cash and checks that have been received and.

PA53 Identifying Outstanding Checks and Deposits in Transit and

Web a deposit in transit: Web (also called deposits in transit.) this is money that has been received by your company and recorded on the.

On A Bank Reconciliation Deposits In Transit Are slidesharetrick

Web learn how to account for deposits in transit, which are outstanding deposits that are not reflected in the bank statement due to time lag..

Solved 1. Identify and list the deposits in transit at the

A deposit in transit is cash and checks that have been received and recorded by. (trustworthy bank’s journal entry) as the entry shows, the bank’s.

PA53 Identifying Outstanding Checks and Deposits in Transit and

Web a deposit in transit: Web a deposit in transit: The bank’s detailed records show that debris disposal’s checking account is the specific liability that.

Once You’ve Identified A Deposit In Transit, You’ll Need To Record It In Your Company’s Accounting Records.

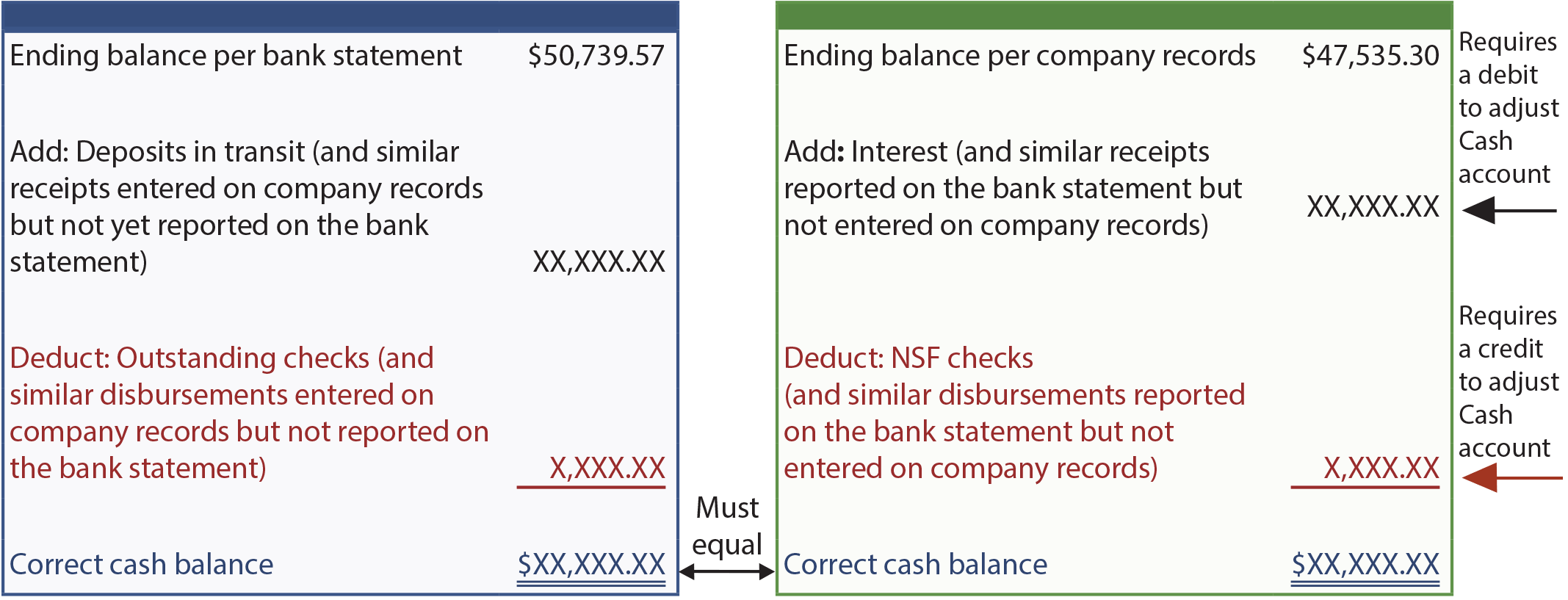

These adjusting entries for bank reconciliation. Immediately investigate any deposit made during the month but. Web learn how to account for deposits in transit, which are outstanding deposits that are not reflected in the bank statement due to time lag. Web a deposit in transit is money that has been received by a company and sent to the bank, but has yet to be processed and posted to the account by the bank.

Web Prepare A List Of Deposits In Transit.

Web also, check the deposits in transit listed in last month’s bank reconciliation against the bank statement. A deposit in transit is cash and checks that have been received and recorded by. Web any differences, such as a deposit in transit and/or errors, will become part of the adjustments listed on the bank reconciliation. Web (also called deposits in transit.) this is money that has been received by your company and recorded on the books, but which has not been processed by the bank.

Cash And Checks That Have Been Received And Recorded By The Company But Have Not Yet Been Recorded On The Bank Statement.

Choose an account from the account field on the initial line. Web the additions and subtractions to the bank balance to account for timing differences, usually deposits in transit and outstanding checks, are not “adjustments” in the sense of the. Web a deposit in transit is when the company sends a check or cash to the bank, but as of the end of the month, the bank has not yet processed the receipt of the funds. Create a bank adjustment in the bank register during the reconciliation month for the amount that still needs to be cleared to bring the out of balance back to $0.

Journal Entries Are Rightly Called The Backbone Of The Modern Accounting System As They Are The First.

A deposit in transit is the cash and checks received by a company that are not reflected on the bank. Web the process of tracking and recording deposits in transit begins with establishing a systematic approach to document cash inflows. The account holder has recorded the. A deposit that was made by the business and recorded on its books but has not yet been recorded by the bank.