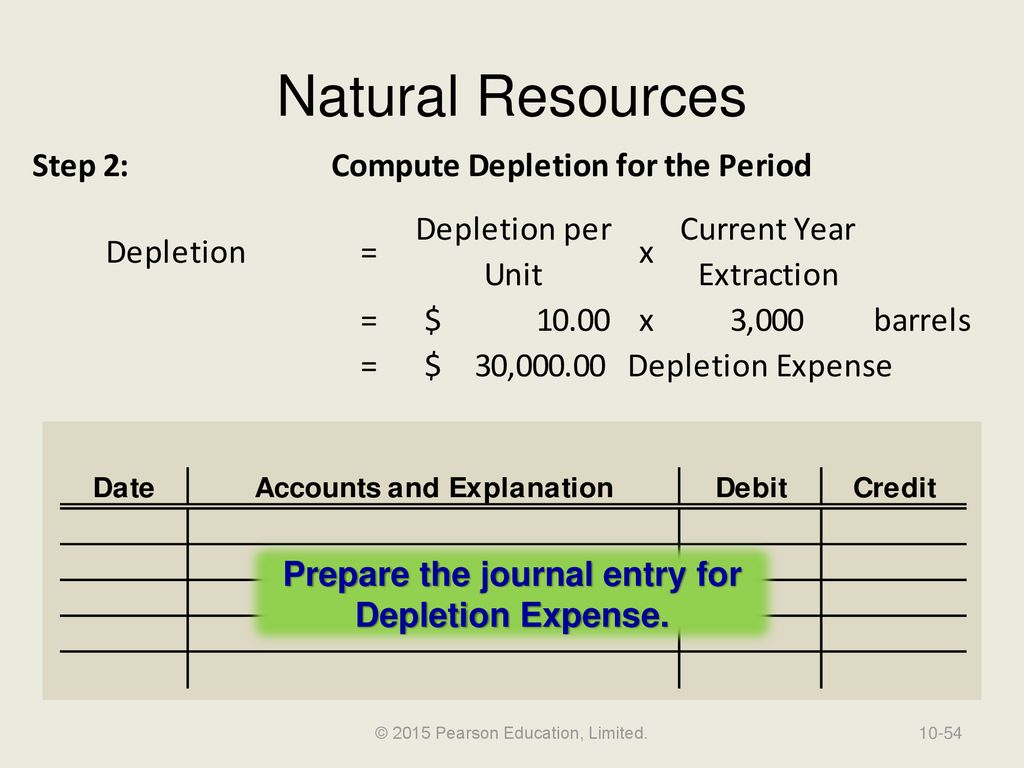

Depletion Journal Entry - Journal entry for depreciation on equipment. Web proper accounting for depletion expense is essential to accurately reflect the mining company's financial position and performance. An adjusting journal entry is usually made at the end of an accounting period to recognize an income or expense in the period that it is incurred. Web remember, the adjusting entry for depreciation, regardless of the method used to calculate depreciation was: These expenses are often recorded at the end of period because they are usually calculated on a period basis. Web depletion refers to the cost recovery in accounting terms for natural resources owned by a company. Depletion is the allocation of the cost of the natural resource to the unites extracted. In each accounting period, the depletion recognized is an estimate of the cost of the natural resource that was removed from its natural setting during the period. When the property is purchased, a journal entry assigns the purchase price to the two assets purchased—the natural resource and the land. Web depletion is a method of recording the use of natural resources over time.

Plant Assets, Natural Resources, and Intangibles ppt download

Companies working in mining, coal, timber, and metal industries use the depletion method of depreciation. It is the amount of resources used in each accounting.

13.4 Journal entries for depreciation YouTube

It is done to adjust the book values of the different capital assets of the company and add the depreciation expense of the current year.

[Solved] QUESTION ANSWER What would be the journal entry

Web depletion expense = 150,000 * 3 = $450,000 [$0.45mm] thus, every year zebra crude will record depletion expenses until the complete $2.1mm of cost.

Prepare the journal entry to record the depletion

Web journal entries of depletion expenses. In each accounting period, the depletion recognized is an estimate of the cost of the natural resource that was.

Accounting for Depletion of Natural Resources YouTube

Web remember, the adjusting entry for depreciation, regardless of the method used to calculate depreciation was: It is a result of accrual accounting and follows.

journal entry format accounting accounting journal entry template

The above example can also be extended to. If all of the resources extracted during a period are sold, then depletion expense equals depletion per.

[Solved] Prepare the journal entry to record depletion for the first

When do we use the depletion method? Web a journal entry is a method of recording increases and decreases to accounts. In each accounting period,.

Journal Entry Problems and Solutions Format Examples

Web the basic journal entry for depreciation is to debit the depreciation expense account (which appears in the income statement) and credit the accumulated depreciation.

Amortization and Depletion Entries Data related to the acquisition of

When the property is purchased, a journal entry assigns the purchase price to the two assets purchased—the natural resource and the land. Depletion is the.

A Truck Costing $40,000 Has A Useful Life Of 10 Years And A Salvage Value Of $5,000 At The End Of Its Useful Life.

Similar to depreciation, the journal entry for depletion includes the depletion. Web total cost subject to depletion is the net cost assignable to the natural resource plus the exploration and development costs. Companies working in mining, coal, timber, and metal industries use the depletion method of depreciation. If all of the resources extracted during a period are sold, then depletion expense equals depletion per unit times the number of units extracted and sold.

See Also Bank Overdraft Journal Entry With Example.

The correct accounting treatment of depletion expenses is depicted in the following journal entry: Journal entry for depreciation on furniture. Web remember, the adjusting entry for depreciation, regardless of the method used to calculate depreciation was: Web the basic journal entries under this approach are:

The Above Example Can Also Be Extended To.

It is the amount of resources used in each accounting period that is expensed for u.s. If we purchased an ore mine for $650,000 cash and we determined the land value was $50,000 and the ore deposit value was $600,000, the entry would be: When charged directly to the asset. Web the following journal entry records the depletion expense and inventory on jan 31, 20x5:

Tax And Financial Reporting Purposes.

Web a journal entry is a method of recording increases and decreases to accounts. Web depletion is a method of recording the use of natural resources over time. Web an accumulated depreciation journal entry is the journal entry passed by the company at the end of the year. Web when property is purchased, a journal entry assigns the purchase price to the two assets purchased—the natural resource and the land.

![[Solved] QUESTION ANSWER What would be the journal entry](https://media.cheggcdn.com/media/bbe/bbee36cd-6279-493c-b86c-75194f8e7a80/phpip8M3Z)