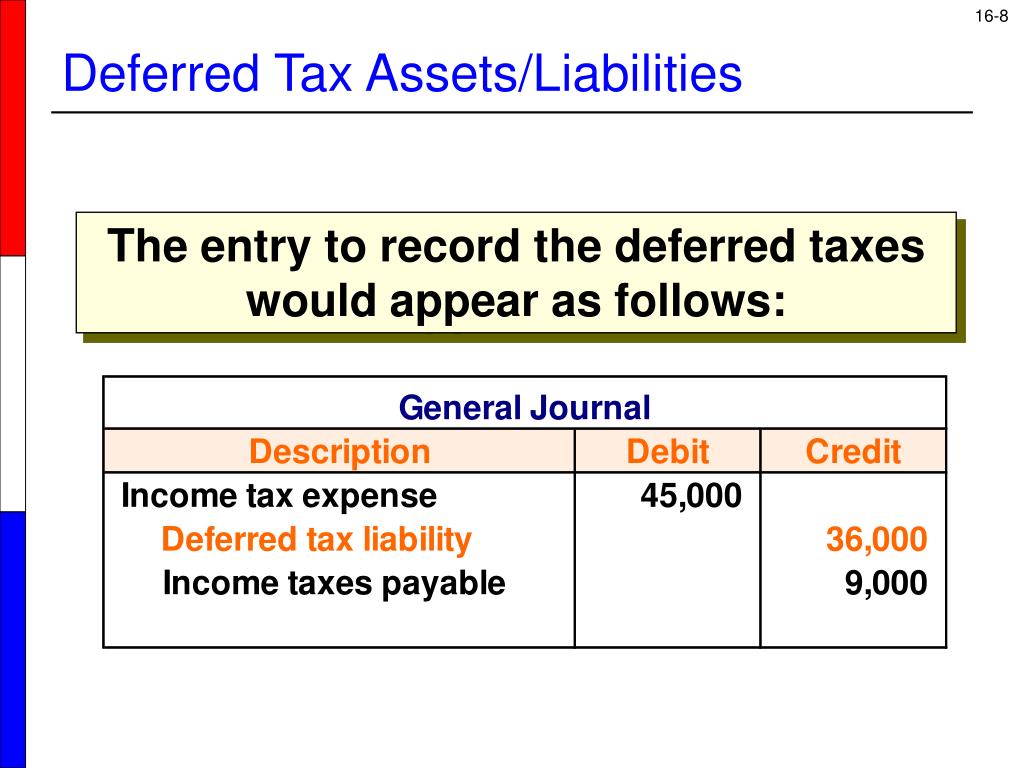

Deferred Tax Expense Journal Entry - Web deferred tax is a topic that is consistently tested in financial reporting (fr) and is often tested in further detail in strategic business reporting (sbr). Web if the effective tax rate is 40 percent, the business records a $40 ($100 × 40 percent) deferred income tax liability on its december 31, year one, balance sheet. Web the tax authority gave an allowance of 2,400 on the asset, and the business charged a depreciation expense of 1,000, the difference of 1,400 at the tax rate of 25% is the. Web the journal entry is debiting income tax expense and credit income tax payable, deferred tax liability. Web a deferred tax liability is a listing on a company's balance sheet that records taxes that are owed but are not due to be paid until a future date. Web preparing the journal entry to record the recognition or discharge of deferred income taxes consists of three steps: Web deferred tax asset journal entry. Web the following journal entry shows the recognition of second year income tax: Web to account for deferred taxes requires completion of the following steps: Web deferred tax expense (resulting from a temporary difference) and current tax expense are both reported on the income statement.

Provision For Tax Journal Entry

Web journal entries for deferred tax liability. Edited by ashish kumar srivastav. Updated on january 3, 2024. 10.4.2 expected manner of recovery or settlement. Deferred.

3 Accounting for deferred tax Journal Entries with practice

Edited by ashish kumar srivastav. Web journal entries for deferred tax liability. Web a deferred tax liability is a listing on a company's balance sheet.

Deferred Tax Liabilities Explained With Reallife

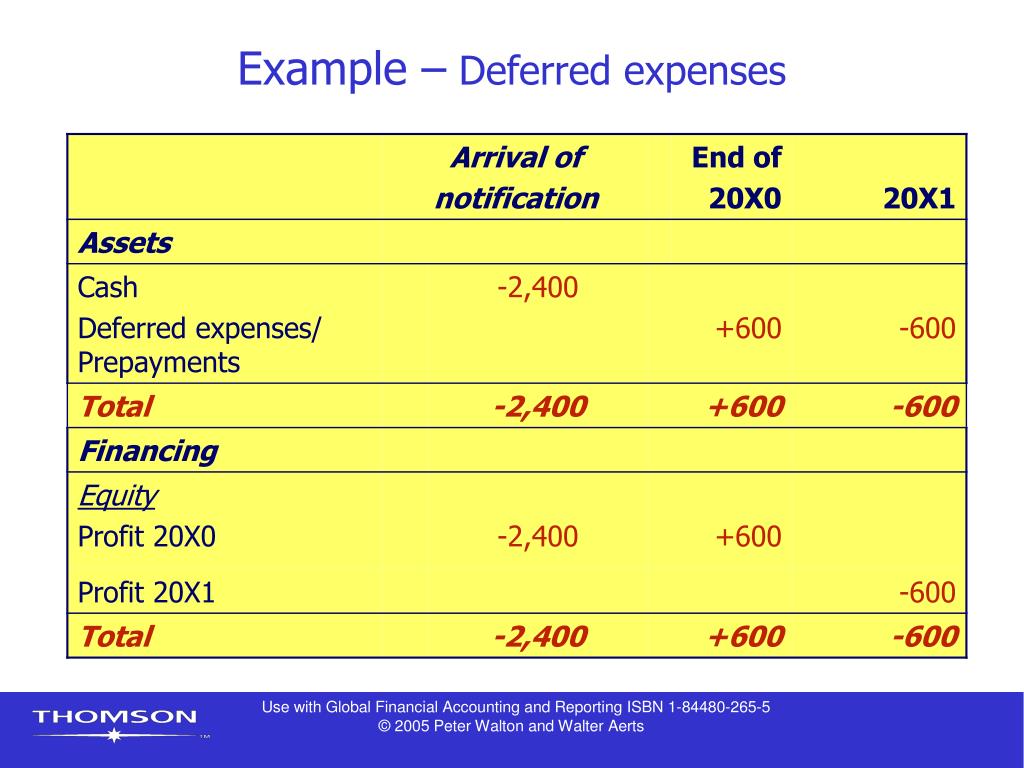

Web the tax authority gave an allowance of 2,400 on the asset, and the business charged a depreciation expense of 1,000, the difference of 1,400.

PPT CHAPTER 6 Refining the accounting database PowerPoint

Updated on january 3, 2024. The carrying amount of an asset will. Identify the existing temporary differences and carryforwards. This publication does not cover journal.

PPT Accounting for Taxes PowerPoint Presentation, free

Deferred tax assets and liabilities are crucial components of a company’s financial reporting, reflecting differences in the timing of recognizing income or expenses for accounting.

Deferred Taxes Cash Flow Statement Financial Tath

Web learn how to account for deferred tax liabilities arising from temporary timing differences between taxable income and accounting income. Web deferred tax expense (resulting.

Worked example accounting for deferred tax assets The Footnotes Analyst

Web what is the journal entry to record a deferred tax liability? Identify the existing temporary differences and carryforwards. Web learn the basics of deferred.

Journal Entry Deferred Revenue Expenditure in Accounting

Deferred tax asset is an asset. Web company z should record the following journal entries in acquisition accounting: This article will start by. Web the.

Accounting for Deferred Taxes (IFRS) and Future Taxes

It arises when tax accounting. The liability is deferred due to a. Web deferred tax expense (resulting from a temporary difference) and current tax expense.

Deferred Tax Could Be Deferred Tax Asset Or Deferred Tax Liability, In Which It Will Be Deductible Or Taxable In The Future.

Web the tax authority gave an allowance of 2,400 on the asset, and the business charged a depreciation expense of 1,000, the difference of 1,400 at the tax rate of 25% is the. Last updated december 6, 2023. Web the following journal entry shows the recognition of second year income tax: This article will start by.

The Overall Journal Entry Required Would Be:

Web learn how to account for deferred tax liabilities arising from temporary timing differences between taxable income and accounting income. Deferred tax asset is an asset. Edited by ashish kumar srivastav. Web learn the basics of deferred tax accounting, the causes and reversal of timing differences, and the role of valuation allowances.

Web To Account For Deferred Taxes Requires Completion Of The Following Steps:

The carrying amount of an asset will. Web journal entries for deferred tax liability. Reviewed by dheeraj vaidya, cfa, frm. A deferred tax liability occurs as a result of a temporary difference between taxable income and financial income under u.s.

Deferred Tax Assets And Liabilities Are Crucial Components Of A Company’s Financial Reporting, Reflecting Differences In The Timing Of Recognizing Income Or Expenses For Accounting And Tax Purposes.

This publication does not cover journal entries. Web deferred tax expense (resulting from a temporary difference) and current tax expense are both reported on the income statement. Determine the deferred tax liability. Compute the future income tax disbenefit ($900 = $300 + $600).

+and+the+Journal+Entry+to+Record+Income+Taxes.jpg)