Deferred Tax Benefit Journal Entry - Web the tax rate is 25%. When there’s a temporary difference leading to a future. Compute the future income tax disbenefit ($900 = $300 + $600). Web deferred tax valuation allowance journal entry. Company z should record the following journal entries in. Your ask joey ™ answer. Deferred tax liability (dtl) or deferred tax asset (dta) forms an important part of financial statements. Web deferred tax (ias 12) last updated: Web a deferred tax liability is a listing on a company's balance sheet that records taxes that are owed but are not due to be paid until a future date. Web the remaining increase in deferred tax of $25 will be charged to the statement of profit or loss as before.

3 Accounting for deferred tax Journal Entries with practice

Company z should record the following journal entries in. In our course, income taxes: The overall journal entry required would be: When there’s a temporary.

Deferred Tax Asset Deferred Tax Asset Journal Entry Journal Entries

Web a deferred tax liability is a listing on a company's balance sheet that records taxes that are owed but are not due to be.

Deferred Tax Liabilities Explained With Reallife

The deferred tax liability would be recognized using the following journal entry: The bookkeeping implications of the preceding illustration are best understood in the context.

Provision For Tax Journal Entry

Allocating the deferred tax charge or credit. In our course, income taxes: Web a deferred tax asset (dta) is an entry on the balance sheet.

Worked example accounting for deferred tax assets The Footnotes Analyst

Web journal entries for deferred tax assets and liabilities play a pivotal role in accurately representing a company’s financial health and tax planning strategies. Web.

Accounting for Deferred Taxes (IFRS) and Future Taxes

What deferred taxes should be recorded by company z in acquisition accounting? In our course, income taxes: Web deferred tax (ias 12) last updated: Web.

Great Short Statement Deferred Tax Asset Journal Entry Example

The bookkeeping implications of the preceding illustration are best understood in the context of the. This publication does not cover. For the year ended 31.

Deferred Double Entry

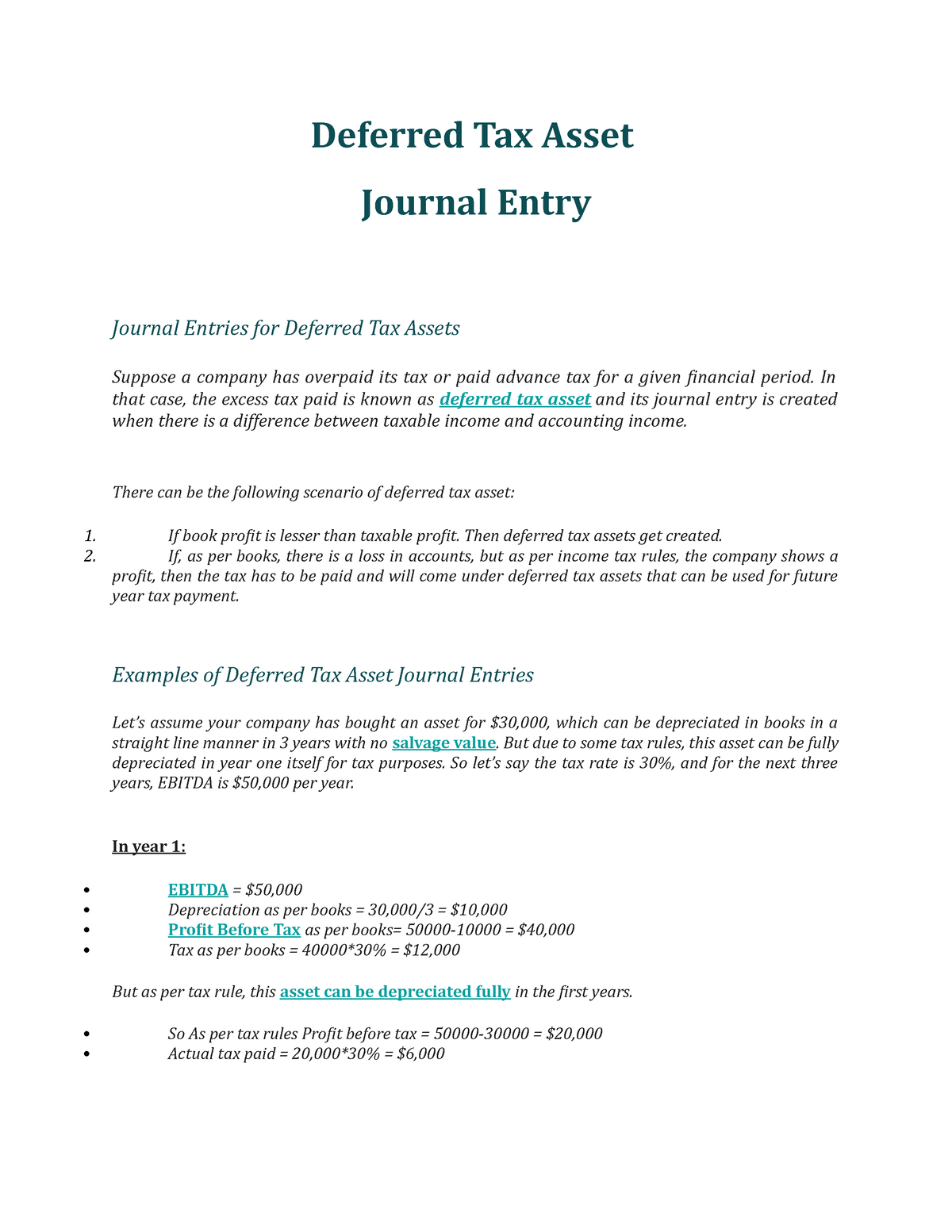

Web deferred tax asset is an asset recognized when taxable income and hence tax paid in current period is higher than the tax amount worked.

Solved 1. Prepare Journal Entry to record tax

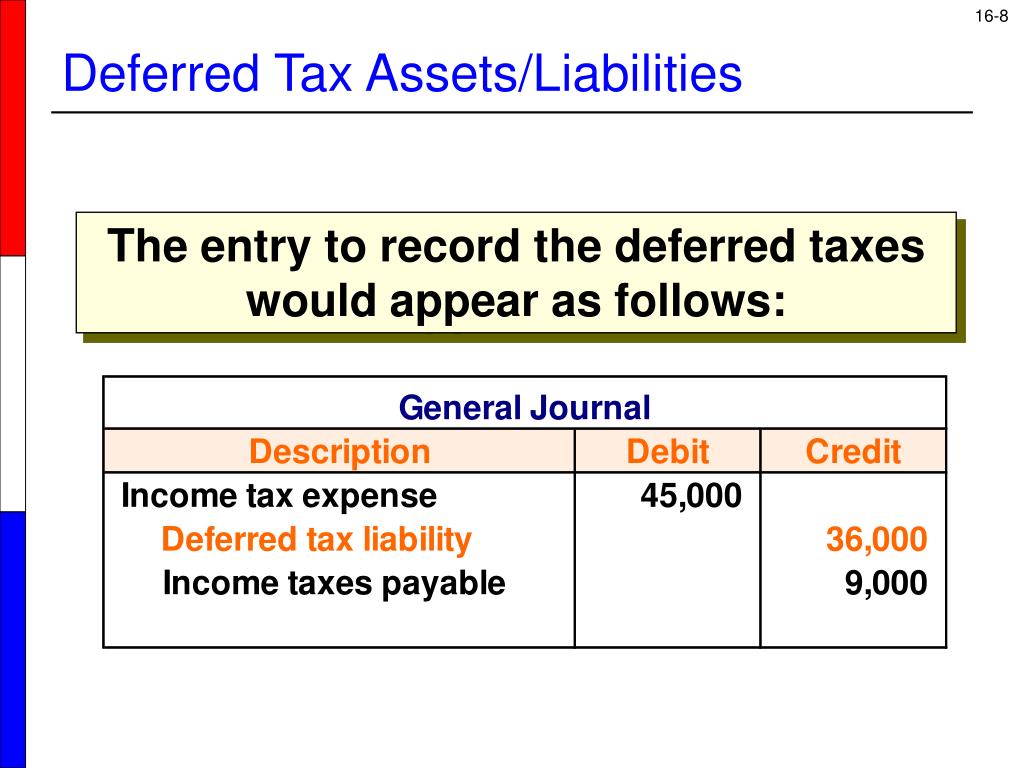

What is the journal entry to record a deferred tax liability? The overall journal entry required would be: For the year ended 31 march 2023,.

Company Z Should Record The Following Journal Entries In.

The deferred tax liability would be recognized using the following journal entry: When there’s a temporary difference leading to a future. Dr tax expense in income. A deferred tax asset (or potentially a current tax receivable depending on the.

Deferred Tax Is A Concept In Accounting Used To Address The Discrepancies Arising From The Different.

The bookkeeping implications of the preceding illustration are best understood in the context of the. Allocating the deferred tax charge or credit. Web a deferred tax asset (dta) is an entry on the balance sheet that represents a difference between the company’s internal accounting and taxes owed. Web preparing the journal entry to record the recognition or discharge of deferred income taxes consists of three steps:

Web The Remaining Increase In Deferred Tax Of $25 Will Be Charged To The Statement Of Profit Or Loss As Before.

Web deferred tax assets are recognized to the extent that it is probable (more than 50%) that sufficient taxable profits will be available to realize the deductible temporary difference or. Web learn the basics of deferred tax accounting, including the causes, reversal and valuation of deferred tax assets and liabilities. In future periods, when the deferred tax liability would be used. Web deferred tax asset is an asset recognized when taxable income and hence tax paid in current period is higher than the tax amount worked out based on accrual.

The Overall Journal Entry Required Would Be:

Web deferred tax (ias 12) last updated: For the year ended 31 march 2023, taxable profit is £150,000 and forecasts indicate that this level of profit is expected to continue for the next five years. Setting up current deferred tax asset on current year’s excess tax credits. Web the tax rate is 25%.

+and+the+Journal+Entry+to+Record+Income+Taxes.jpg)