Deferred Expense Journal Entry - Deferrals are adjusting entries for items purchased in advance and used up in the future (deferred expenses) or when cash is received in advance and earned in the. Web examples of prepaid expenses. An accrued expense is one we have incurred but not yet recorded for some reason. See examples of deferred revenue and prepaid expense deferrals and their journal entries. Example of deferral adjusting entry for expenses. (2) balance in prepaid insurance account on june 30, 20x5. Deferred revenue arises from payments received before revenue is earned. Deferrals are adjusting entries for items purchased in advance and used up in the future (deferred expenses) or when cash is received in advance and earned in the. 6+ hours of hd videos | 2 courses | verifiable certificate of completion | lifetime access. Web learn what a deferred expense is, when to record it as an asset, and how to charge it to expense.

What is Deferral? Definition + Journal Entry Examples

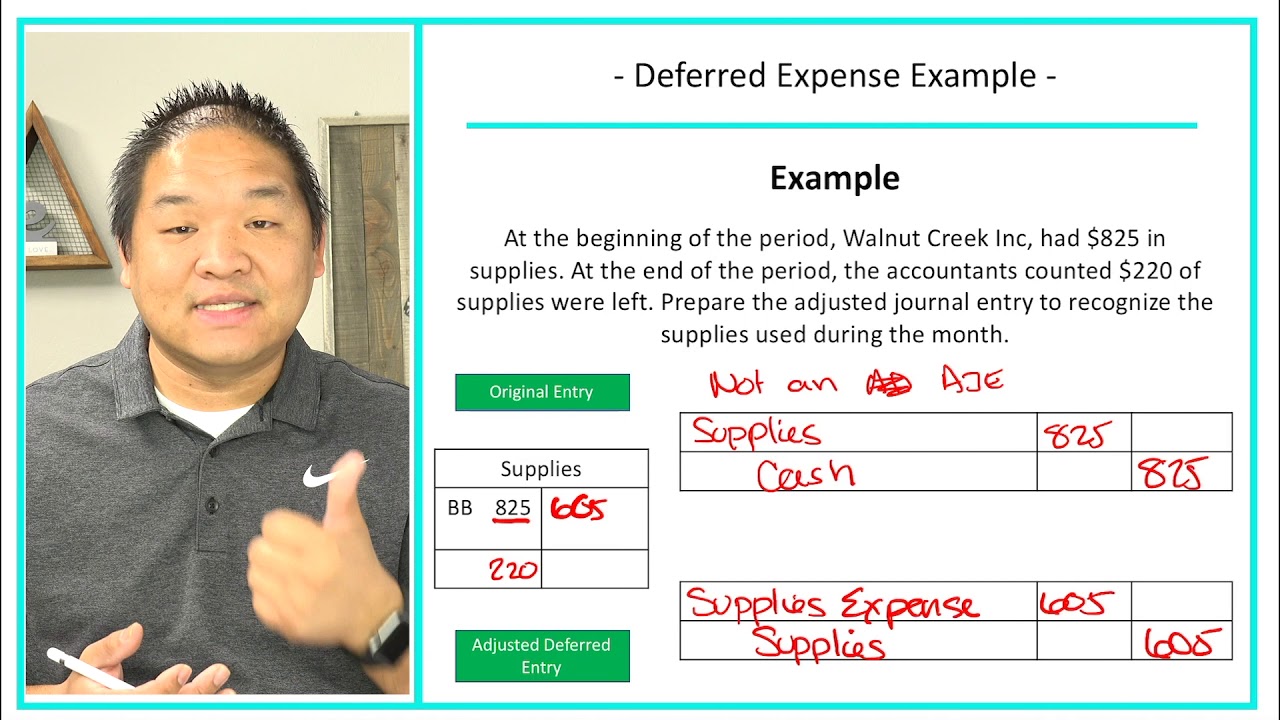

Let’s take on deferred expenses first. I've used $18,000 of the $24,000 that i prepaid. First you would start with the amount that you prepaid..

210 ch4

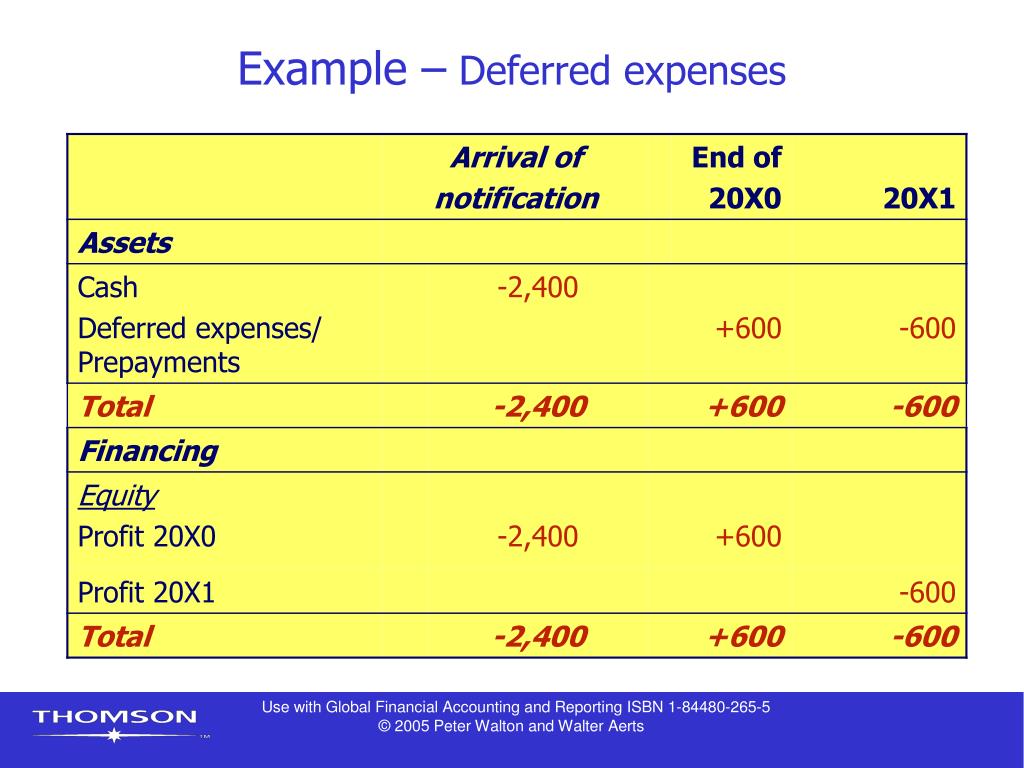

Deferrals are adjusting entries for items purchased in advance and used up in the future (deferred expenses) or when cash is received in advance and.

PPT CHAPTER 6 Refining the accounting database PowerPoint

An accrued expense is one we have incurred but not yet recorded for some reason. Web by recording a deferred expense journal entry , you.

Deferred Expenses Wize University Introduction to Financial

For instance, if a business pays $12,000 in rent for a. To record insurance expense for three months [=40000×3/12]. Web here we discuss the top.

Deferred Tax Liabilities Explained With Reallife

See examples of deferred expenses, such as prepaid rent, insurance, and software subscriptions, and their journal entries. We paid 24 000 for this year of.

Accruals and Deferrals Double Entry Bookkeeping

Accounts receivable journal entry examples Web learn how to distinguish between deferred expenses and prepaid expenses, two types of advance payments that affect the balance.

Deferred Revenue Journal Entry Double Entry Bookkeeping

To accomplish this, the deferred expense is reported on the balance sheet as an asset or a contra liability until it is moved from the.

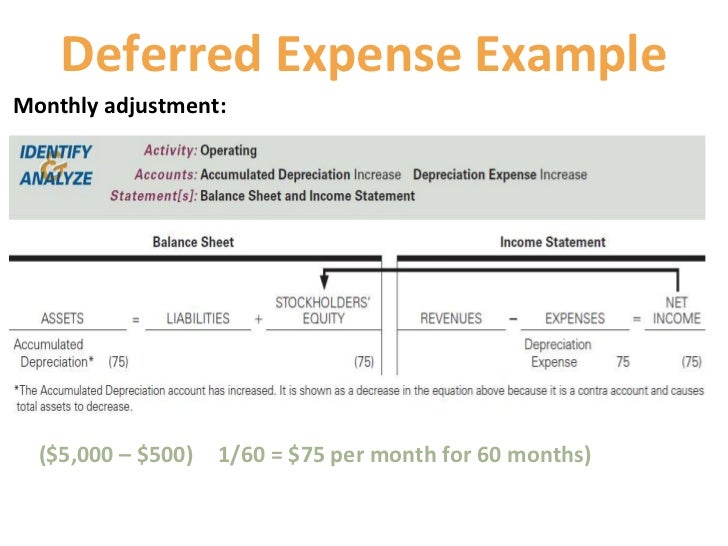

Financial Accounting Lesson 4.3 Deferred Expense Example YouTube

First you would start with the amount that you prepaid. See examples of deferred expenses and how they affect cash flow and financial statements. (2).

Deferred Revenue Expenditure EXPLAINED By Saheb Academy YouTube

Thereafter, it is classified as an expense within the current accounting. One of the most common deferred expenses is supplies. See examples of journal entries.

Web The Debit Amount Of Deferred Rent In This Journal Entry Is The Difference Between Cash Payment For Rent And Rent Expense.

Web learn what a deferred expense is, when to record it as an asset, and how to charge it to expense. Web examples of prepaid expenses. Example of deferral adjusting entry for expenses. First you would start with the amount that you prepaid.

When There’s A Temporary Difference Leading To A Future Deductible Amount.

To record insurance expense for three months [=40000×3/12]. Web journal entries for deferred tax asset. See examples of deferred expenses and how they affect cash flow and financial statements. Deferred expenses represent money paid in advance of receiving a good or service or before the related revenue is earned.

See Examples Of Journal Entries For Deferred Revenue And Expenses And How They Differ From Traditional Revenue And Expenses.

Web the deferral adjusting entry makes certain that the correct amounts will be reported on a company’s balance sheets and income statements. (2) balance in prepaid insurance account on june 30, 20x5. Web learn how to distinguish between deferred expenses and prepaid expenses, two types of advance payments that affect the balance sheet and income statement of a business. Web learn what a deferred expense is, how to record it in a journal entry, and how it differs from a capital expenditure.

Web Calculate The Deferred Expense And Pass The Journal Entries.

An accrued expense is one we have incurred but not yet recorded for some reason. When the temporary difference reverses,. 6+ hours of hd videos | 2 courses | verifiable certificate of completion | lifetime access. Thereafter, it is classified as an expense within the current accounting.