Credit Purchase Journal Entry - Web the journal entries would be as follows: Web learn how to record credit purchase transactions in journal entries with examples. However, let us consider the effect of the credit terms 2/10 net 30 on this purchase. Credit sales journal entry is passed to show the sales transactions done in credit. See examples of journal entries for periodic and perpetual inventory systems and compare them with cash purchases. Web learn how to record credit purchases of inventory, fixed assets, and expenses in accounting journal. Web when goods/services are sold in credit, the transactions are known as credit sales, i.e., when the customer promises to pay in future, credit sales occur. The procedure for doing this is outlined below: Here is an example, debit fixed assets amount usd 10,000. The journal entries would be as follows:

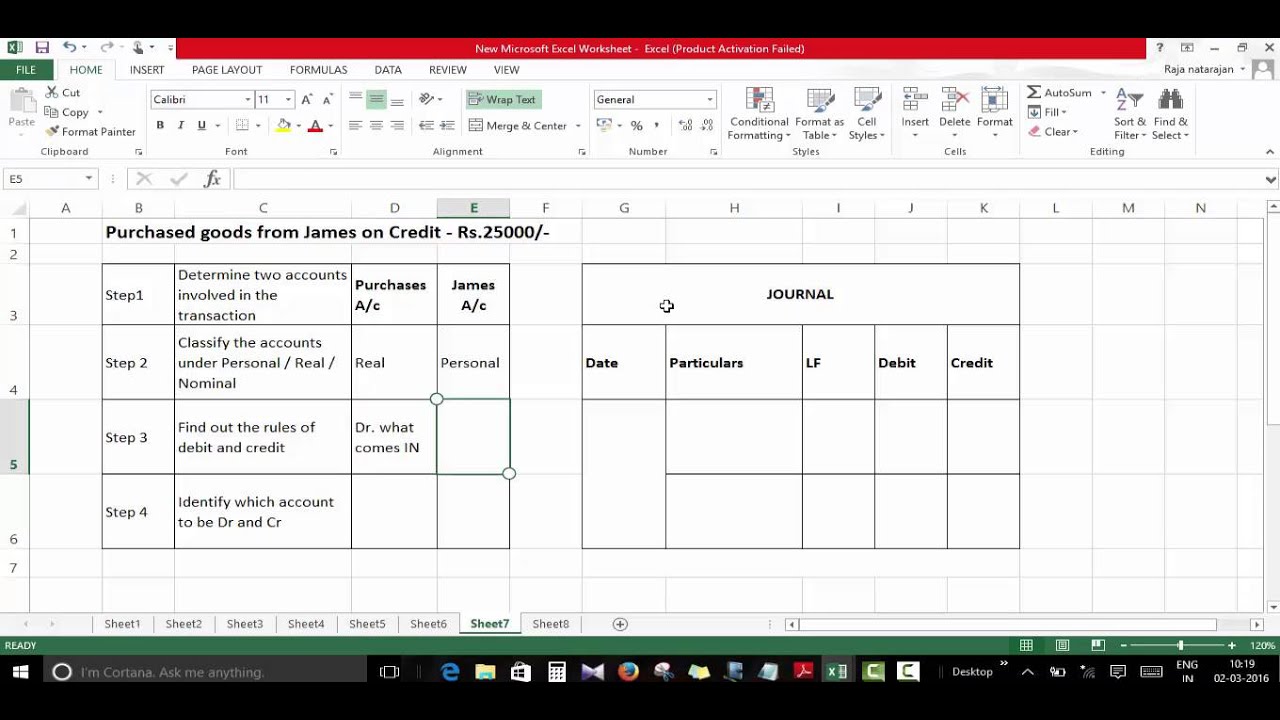

Journal entries Meaning, Format, Steps, Different types, Application

Credit sales journal entry is passed to show the sales transactions done in credit. Sale of goods on creditsale of an asset for creditcredit sales.

6.5 Analyze and Record Transactions for the Sale of Merchandise Using

The purchases journal is simply a chronological list of all the purchase invoices and is used to save time, avoid cluttering the general ledger with.

How to Pass Journal Entries for Purchases Accounting Education

Web learn how to record the liability and cost of goods purchased on credit in different inventory systems. Here is an example, debit fixed assets.

Creditors Basics in Accounting Double Entry Bookkeeping

For example, this week, the entity purchased 10 computers amount usd 10,000 on credit from a local supplier. Web in every journal entry that is.

Purchases Journal (Purchase Day Book) Double Entry Bookkeeping

It is vital for companies that sell their goods on credit. Web learn how to record the purchase of goods on credit and payment of.

Accounting Journal Entries For Dummies

Sale of goods on creditsale of an asset for creditcredit sales jour Web a journal entry is made up of at least one account that.

Sales Credit Journal Entry What Is It, Examples, How to Record?

Traditional journal entry format dictates that debited accounts are listed before credited accounts. How to record a credit sale with credit terms. Web learn how.

Accounting Entry for Credit Purchase YouTube

In this case, the account involves these entries, including fixed assets (to record 10 computers) and accounts payable. See examples of cash, inventory, freight, accounts.

Journal Entry Examples

There are mainly two types of credit sales: When the buyer avails of the cash discount offered, the following journal entry is posted: Web learn.

Purchased Goods Worth $2,000 From Blenda Co.

A compound journal entry contains more than 1 account on either the debit or credit side. Web the purchases journal, sometimes referred to as the purchase day book, is a special journal used to record credit purchases. On april 1, cbs purchases 10 electronic hardware packages at a cost of $620 each. The following are examples of credit note journal entries.

See The Journal Entry Format, A Step By Step Example, And The Advantages And Limitations Of This Accounting Method.

However, let us consider the effect of the credit terms 2/10 net 30 on this purchase. The amounts from the purchases journal are posted as credits to individual suppliers' accounts in the accounts payable subsidiary ledger. Web learn how to record a credit purchase in accounting with a journal entry example. How to record a credit sale with credit terms.

Each Journal Entry Is Also Accompanied By The Transaction Date, Title, And Description Of The Event.

Web in every journal entry that is recorded, the debits and credits must be equal to ensure that the accounting equation (assets = liabilities + shareholders’ equity) remains in balance. Web learn how to record the journal entries for buying goods on credit from a supplier using the accounting equation. Traditional journal entry format dictates that debited accounts are listed before credited accounts. Web it is a document issued by a seller to a buyer that reduces the amount owed by the buyer for goods or services.

This Entry Typically Involves Debiting The Inventory Account To Increase The Company’s Assets, Showing That Inventory Has Been Added To The Stock.

See examples, rules, and explanations for each case. Which accounts are affected by the transaction. When doing journal entries, we must always consider four factors: Web entries from the purchases journal are posted to the accounts payable subsidiary ledger and general ledger.