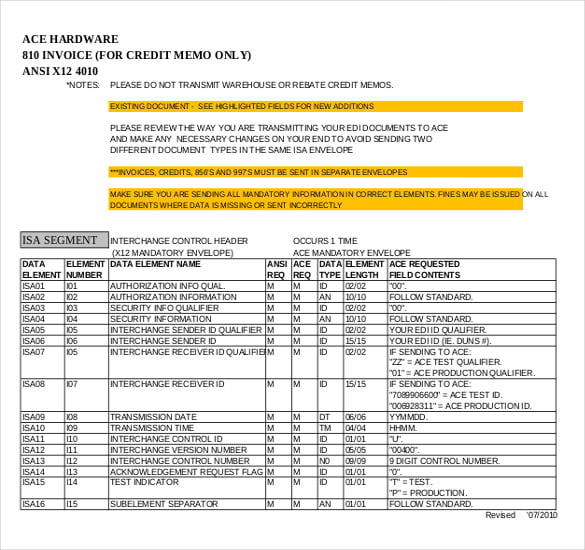

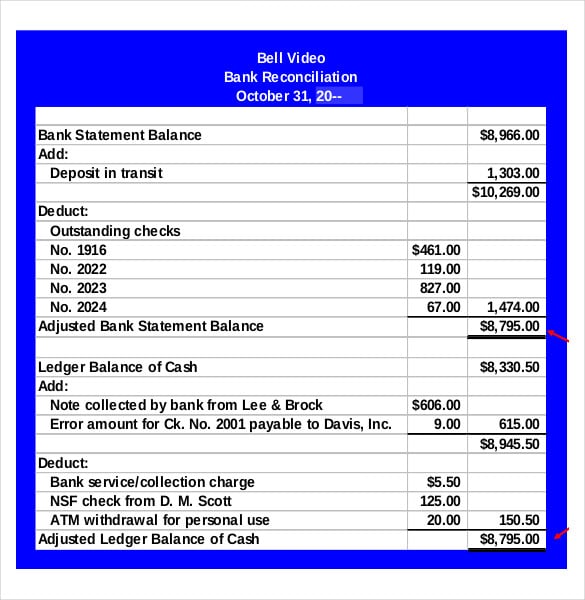

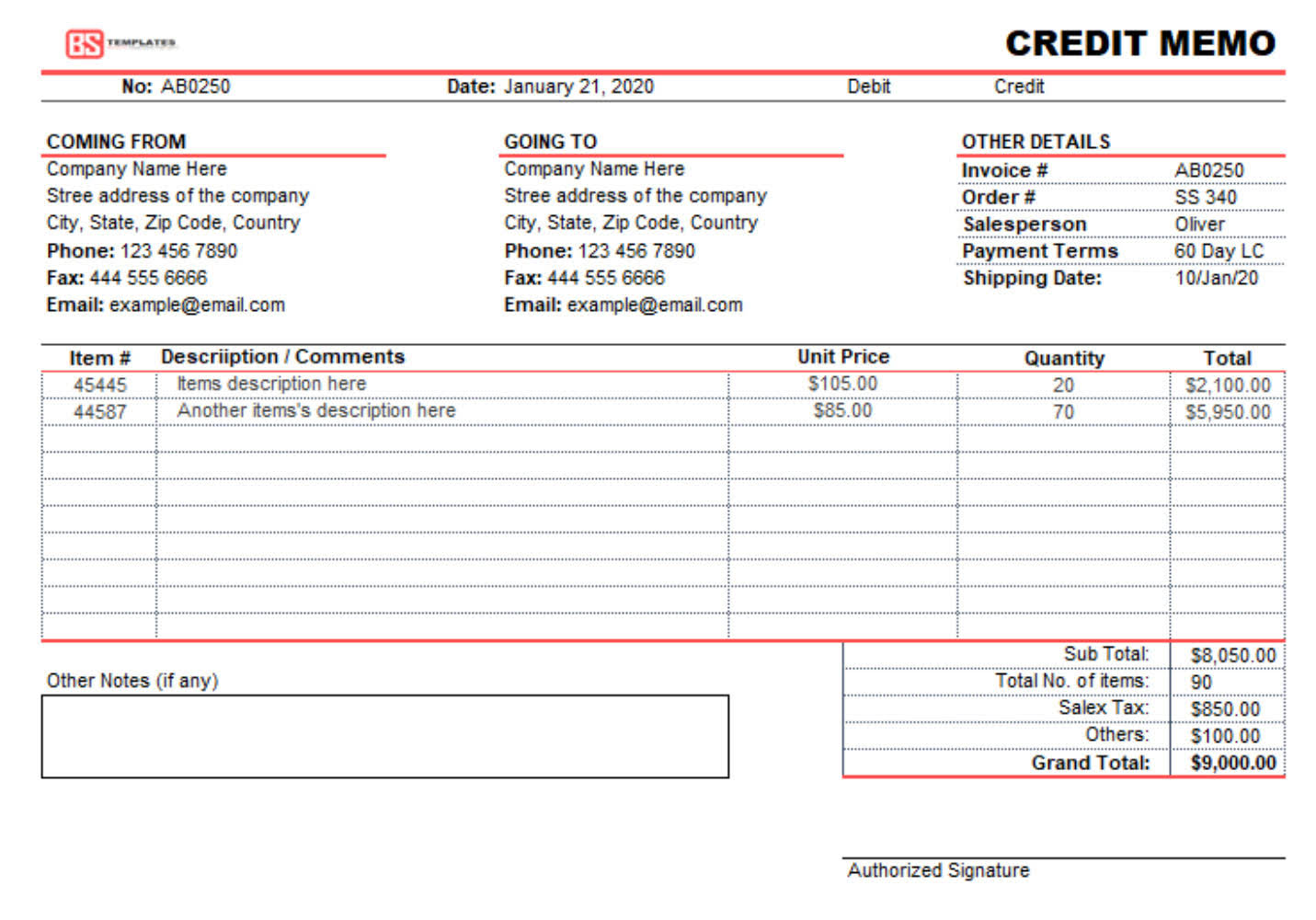

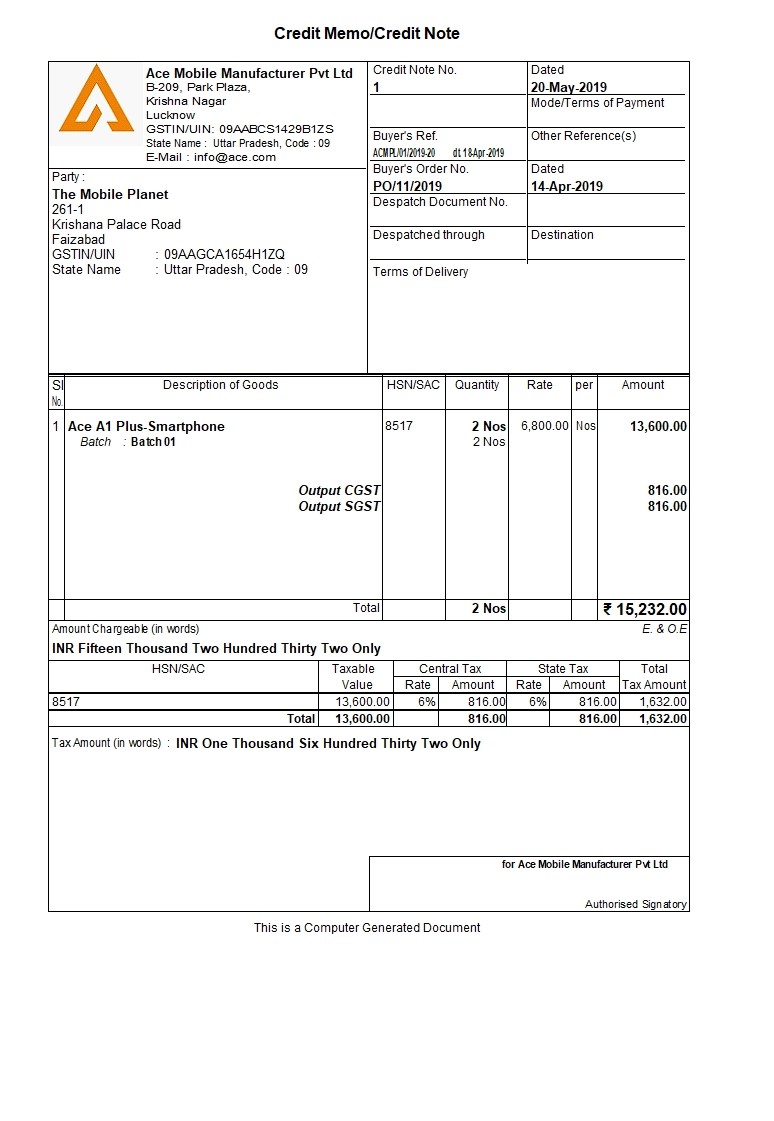

Credit Memorandum Journal Entry - Web in the event of a credit memo, the journal entry you will make is a debit to the supplier’s account, which reduces your liability. Sales returns (revenue contra account) debit: In another article, we explained what a credit note is. In other words, the credit memo reduced sellercorp’s net sales and. If it is a cash sale, it implies the amount of benefit that the supplier owes to the customer. Accounts receivable ($x) this entry reflects the reduction in your receivables and your. It’s a formal acknowledgment that a credit has been issued to the customer’s account, often to correct errors, address customer concerns, or. Web journal entry for credit memo. The amount taken out of accounts payable will equal the amount put into inventory or the cost of goods sold. Learn how to make credit memo journal entry for various reasons such as goods returned, discount, or invoice error.

13+ Credit Memo Templates Google Docs, MS Word, Apple Pages

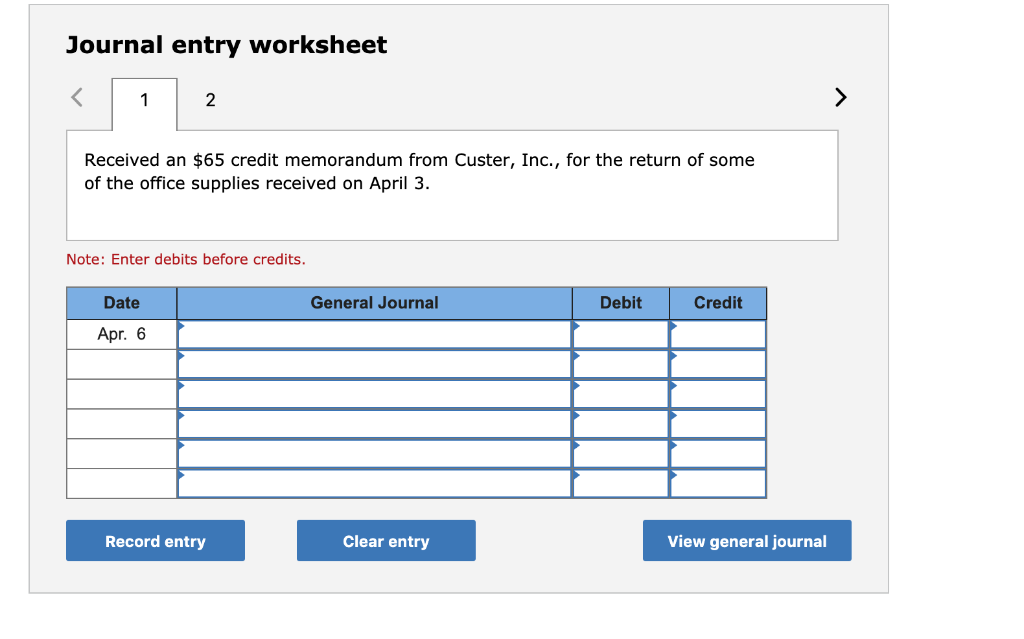

1) a debit of $8 to sales returns and allowances, and 2) a credit of $8 to accounts receivable. A credit memo is called credit.

Journal entry worksheet 2 Received an 65 credit

Web by jeel patel. It is a negative invoice sent from the seller to decrease the amount owed by the buyer for previously billed sales..

Memo Credit Invoice Templates 10+ Free Word, Excel & PDF Formats

Recording a credit memo’s journal entry is a must for an. Along with case studies and examples. Sales returns and allowances ($x) credit: It is.

Journal Entry For Customer Credit Memo

Then you credit the purchase return account, which decreases the expense. A credit memo is called credit memorandum and more popularly known as ‘credit note’..

How to Write a Credit Memo Easily A Complete Guide

It is not a complete journal entry because it does not contain debit and credit amounts. Then you credit the purchase return account, which decreases.

Credit Memo Accounting A Complete Guide (+ Free Templates Included)

Web depending on the type of transaction, the credit memo journal entry involves recording a debit to accounts payable and a credit to either inventory.

What is a credit memo Definition and Example BooksTime

It serves as an official acknowledgment that the buyer’s account needs to be credited, essentially reducing the amount owed. Web credit memos are documents that.

Journal Entry Format.pdf Debits And Credits Corporations

1) a debit of $8 to sales returns and allowances, and 2) a credit of $8 to accounts receivable. Web journal entry for credit memo..

Solved How to create Journal entry for credit note for a

In other words, the credit memo reduced sellercorp’s net sales and. Prepare a journal entry to record the credit memo. Web this way, the buyer.

Web A Credit Memorandum Or Credit Memo Is A Document Issued By The Seller To The Buyer, Which Acts As The Source Document For The Sales Journal That Informs The Buyers That The Seller Will Decrease Or Credit The Amount The Buyer Owes The Seller In The Trade Receivables In The Seller’s Account.

1) a debit of $8 to sales returns and allowances, and 2) a credit of $8 to accounts receivable. What does credit memo mean? In other words, it’s a way for seller to notify a buyer that his account was credited. It’s a formal acknowledgment that a credit has been issued to the customer’s account, often to correct errors, address customer concerns, or.

In Other Words, The Credit Memo Reduced Sellercorp’s Net Sales And.

Contents [ show] don’t get this confused with a debit memo. Web making a credit note entry in the account. A credit note is also known as a credit memo, which is short for “credit memorandum.” Web definition of memorandum entry.

A Credit Memorandum, Aka Credit Memo, Is An Articulated Form Indicating An Amount The Contractor Owes To The Client.

Accounts receivable ($x) this entry reflects the reduction in your receivables and your. Credit memos are an important factor in managing your accounts receivable and, more. Web in the event of a credit memo, the journal entry you will make is a debit to the supplier’s account, which reduces your liability. Debit the accounts receivable account by the amount credited in the credit memo.

The Amount Taken Out Of Accounts Payable Will Equal The Amount Put Into Inventory Or The Cost Of Goods Sold.

Sales returns (revenue contra account) debit: It serves as an official acknowledgment that the buyer’s account needs to be credited, essentially reducing the amount owed. Sales returns and allowances ($x) credit: Web this way, the buyer will have the ability to make the proper credit memo journal entry from an accounting perspective, document the transaction, and ultimately pay the right amount.