Credit Card Sales Journal Entry - What is a sales journal entry? To illustrate the entries for the use of. Web learn how to account for credit card sales and fees in your small business books. Web the seller’s accounting procedures for credit card sales differ depending on whether the business accepts a nonbank or a bank credit card. Web to illustrate the accounting entries for the use of bank credit cards (such as visa or mastercard), assume that a retailer has made sales of $ 1,000 for which visa cards. Web of book exists established by year end journal entry. Let’s review what you need to know about making a sales journal entry. Web journal entry for credit card purchase. How to record a credit sale with credit terms. Web learn how to record credit card transactions in different methods:

9.1 Explain the Revenue Recognition Principle and How It Relates to

Web accounting and journal entry for credit sales include 2 accounts, debtor and sales. Devon coombs, cpa, discusses accounts receivable accounting; Web of book exists.

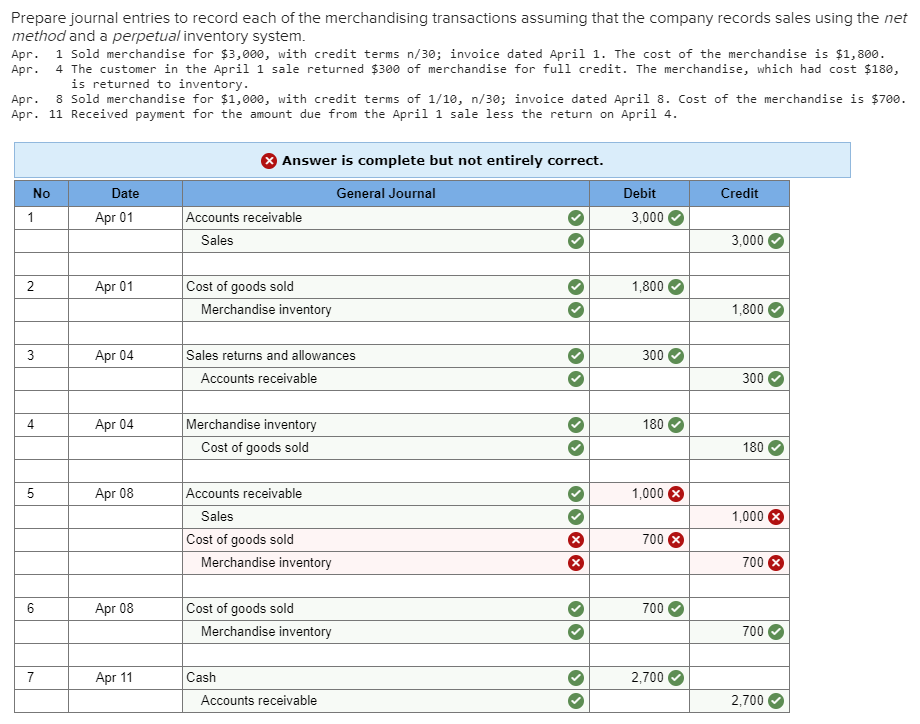

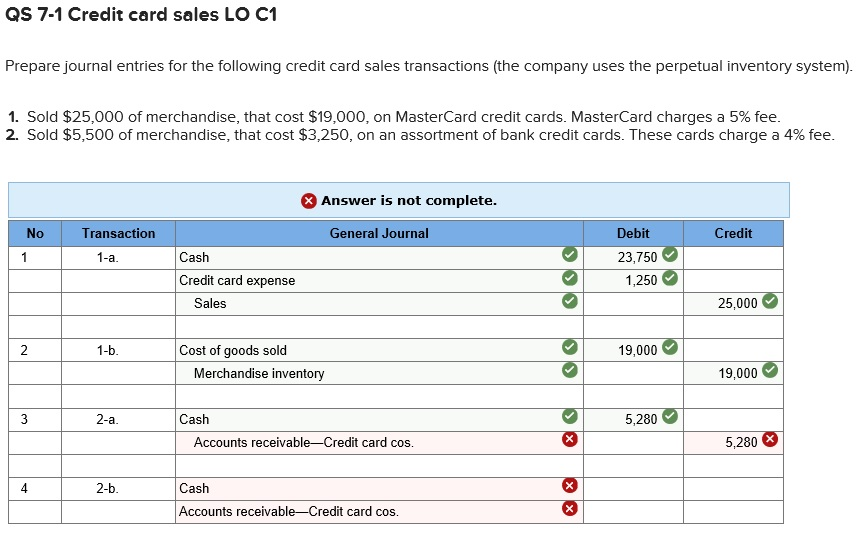

Credit Sales Journal Entry Solved QS 71 Credit Card Sales LO C1

In case of a journal entry for cash sales, a cash account and sales account are used. A sales journal entry is a bookkeeping record.

Sales Credit Journal Entry What Is It, Examples, How to Record?

You can see how this can be quite time consuming, especially if you are using multiple payment processors. Devon coombs, cpa, discusses accounts receivable accounting;.

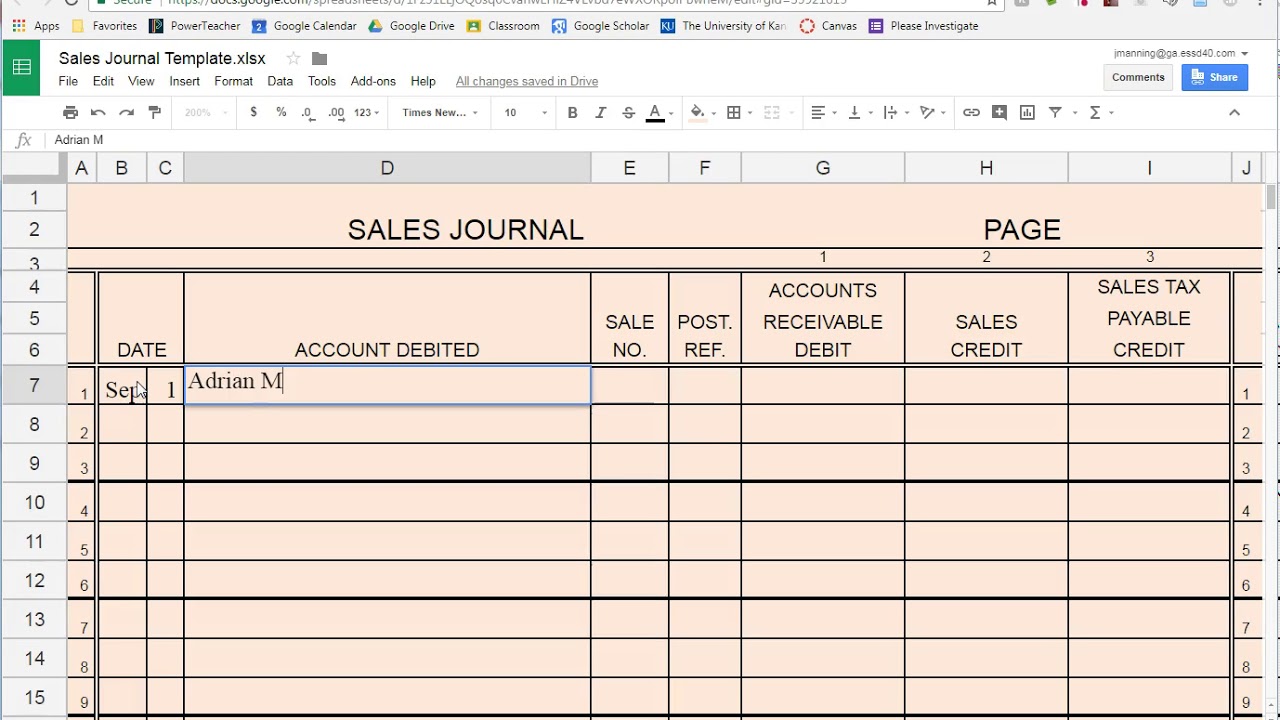

Sales Journal Entry How to Make Cash and Credit Entries

See examples of journal entries, credit card statements, and accounts. A debit increases accounts receivable, which is an asset account. Web to illustrate the accounting.

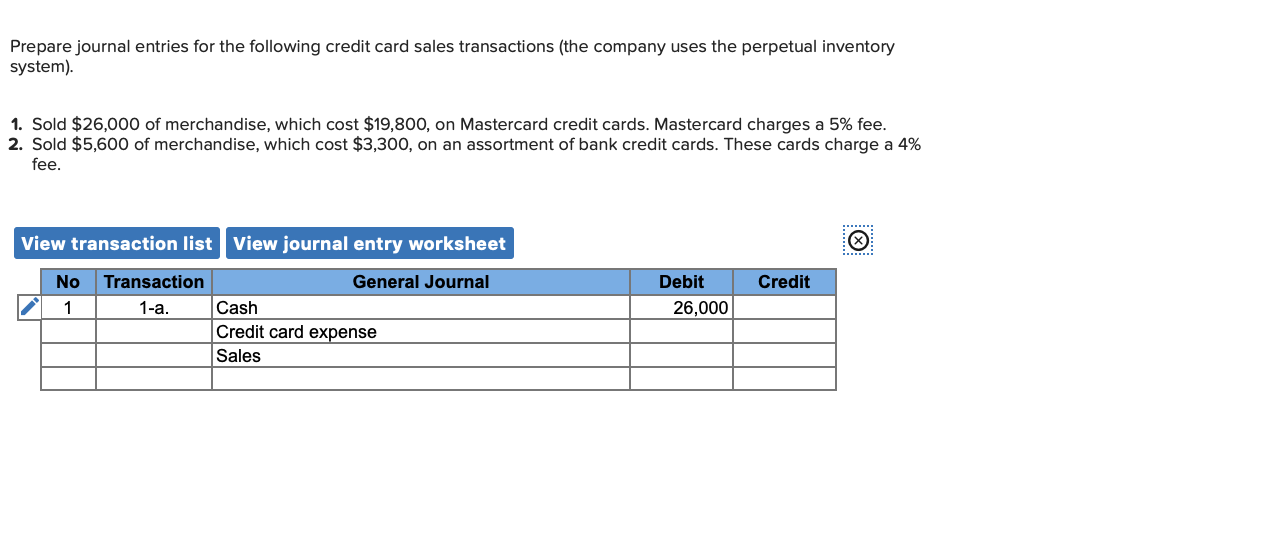

Solved Prepare journal entries for the following credit card

To illustrate the entries for the use of. Web journal entry for credit card purchase. Web accounting and journal entry for credit sales include 2.

Credit Sales Journal Entry Examples Financial

Devon coombs, cpa, discusses accounting journal entries and double entry accounting for. To record daily sales and funds received. To illustrate the entries for the.

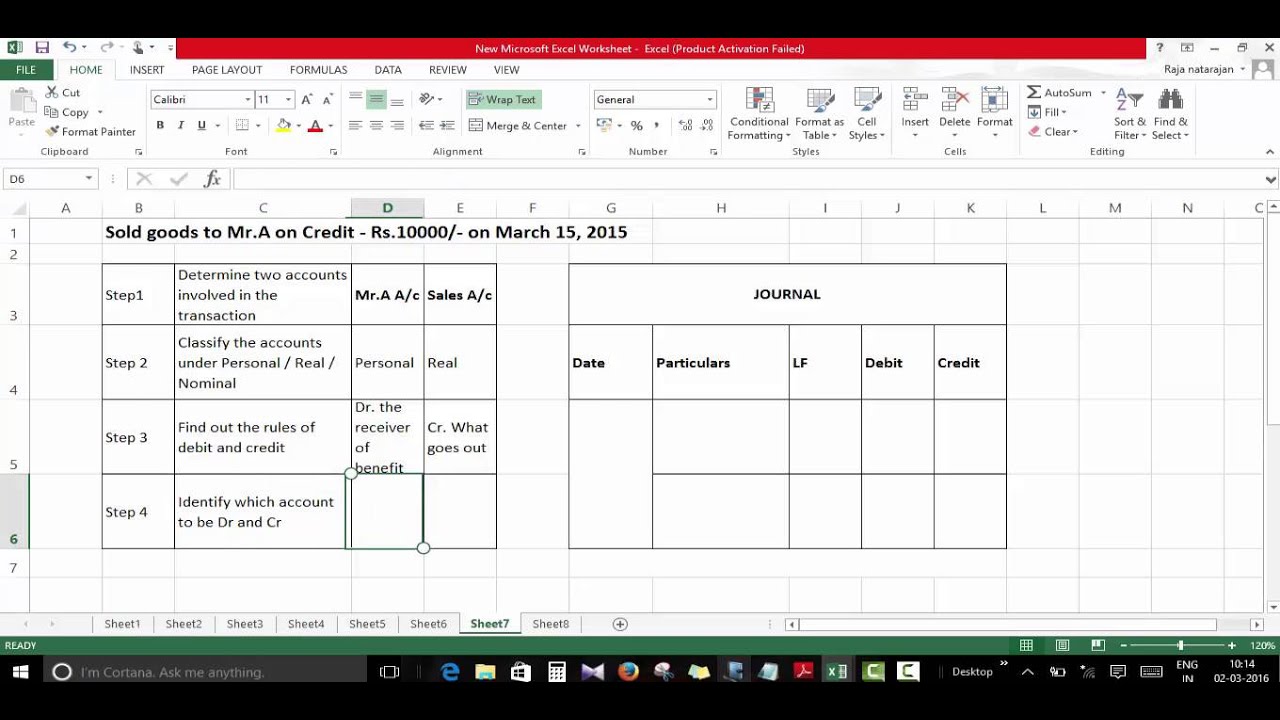

Accounting Entry for Credit Sales YouTube

Web learn how to account for credit card sales and fees in your small business books. Let’s review what you need to know about making.

What is a Credit Sales Journal Entry and How to Record It?

Web to illustrate the accounting entries for the use of bank credit cards (such as visa or mastercard), assume that a retailer has made sales.

Credit Sales Journal Entry Solved QS 71 Credit Card Sales LO C1

To record daily sales and funds received. Web learn how to record credit card sales in accounting with examples and explanations. Devon coombs, cpa, discusses.

Web Of Book Exists Established By Year End Journal Entry.

For the sale of goods in credit: A sales journal entry is a bookkeeping record of any sale made to a. Find out the difference between credit card and debit card sales and the fees involved. In case of a journal entry for cash sales, a cash account and sales account are used.

You Can See How This Can Be Quite Time Consuming, Especially If You Are Using Multiple Payment Processors.

Web learn how to record credit card sales in accounting with examples and explanations. Web to illustrate the accounting entries for the use of bank credit cards (such as visa or mastercard), assume that a retailer has made sales of $ 1,000 for which visa cards. Net, gross, and accounts receivable. How to record a credit sale with credit terms.

Specifically, He Discusses The Journal.

Web accounting and journal entry for credit sales include 2 accounts, debtor and sales. A debit increases accounts receivable, which is an asset account. See examples of journal entries, credit card statements, and accounts. Web to illustrate the accounting entries for the use of bank credit cards (such as visa or mastercard), assume that a retailer has made sales of $ 1,000 for which visa cards.

To Illustrate The Entries For The Use Of.

Web accounting journal entry scenarios for credit card. Web learn how to account for credit card sales and fees in your small business books. Sale of goods (in credit) to a creditor is a liability, so the debtors (debit balance). To record daily sales and funds received.