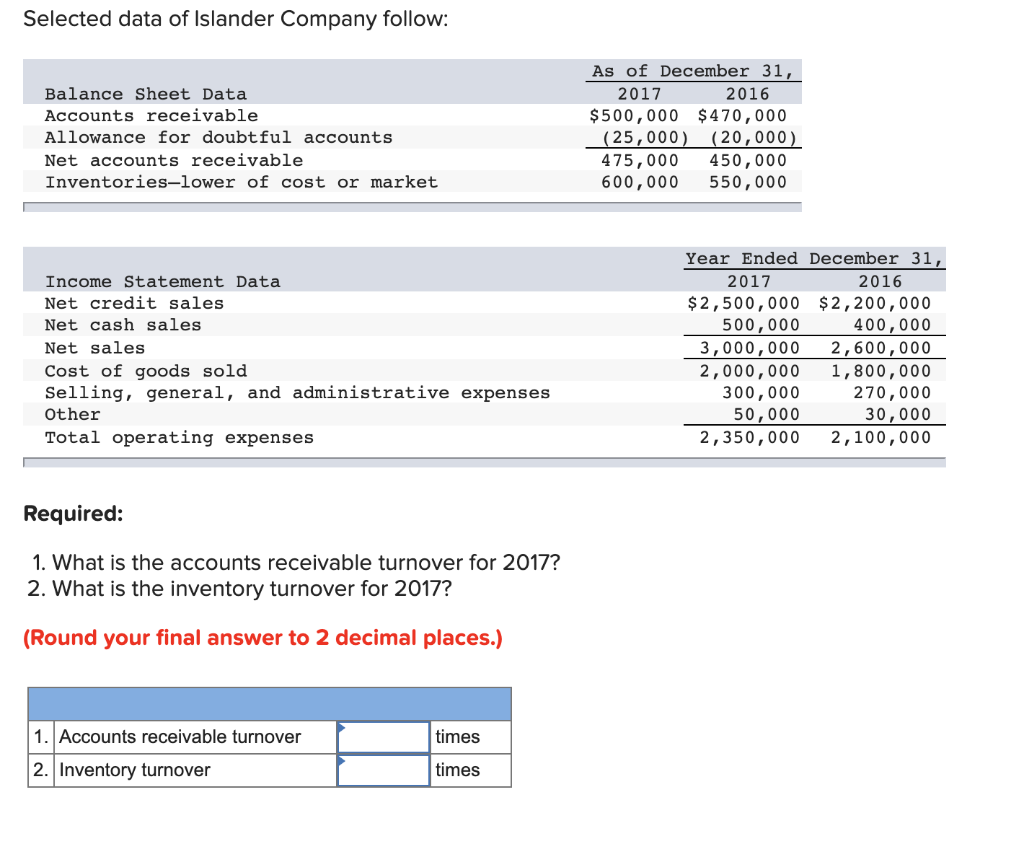

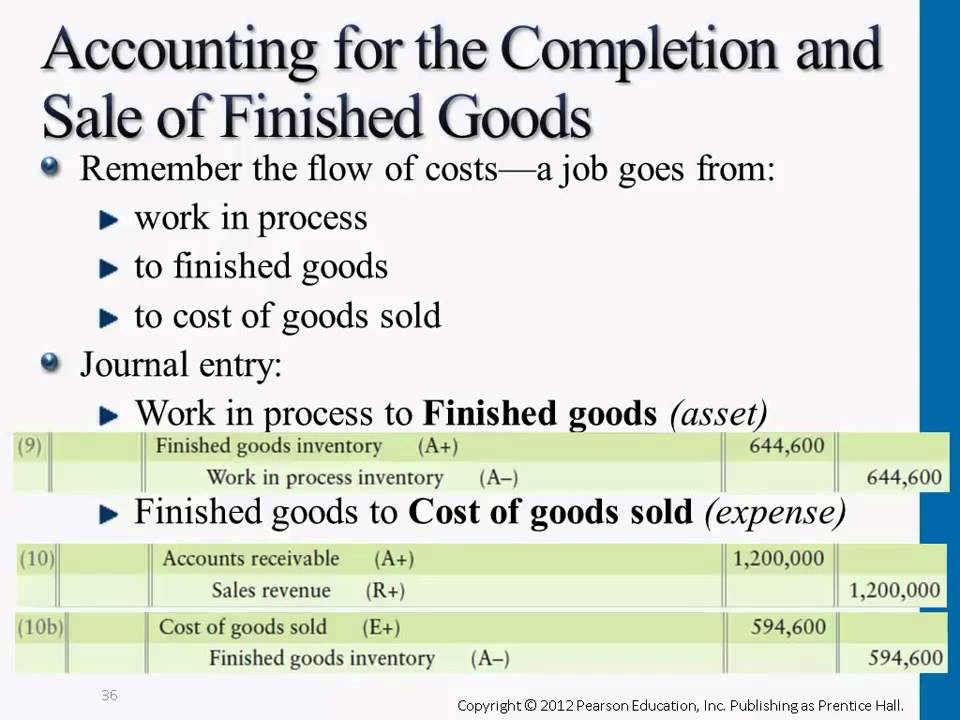

Cost Of Goods Sold And Inventory Journal Entries - Web a sale of goods will result in a journal entry to record the amount of the sale and the cash or accounts receivable. How to calculate cost of goods. The cost of goods sold entry records the total of all. Web sold 180 units, 20 from lot 1 (beginning inventory), costing $21 per unit; A second journal entry reduces the account inventory and increases the account cost of goods sold. With the information in the example, we can calculate the cost of goods sold as below: Web accounting for costs of goods sold in financial statements: Web what is the journal entry to record the cost of goods sold at the end of the accounting period? Various kinds of journal entries are made to record the inventory transactions based on the type of circumstance. Then, subtract the cost of inventory remaining at the end of the year.

Recording a Cost of Goods Sold Journal Entry

To correct the cost of goods sold in the income statement we simply need to reduce the purchases by the ending inventory. The periodic inventory.

Cost of Goods Sold Statement Basic Accounting

160 from the lot 2 (july 10 purchase), costing $27 per unit. Remember, under accrual basis accounting, we recognize revenue as it is earned and.

[Solved] Develop journal entries and find out the cost of goods sold

A journal entry transfers costs from the balance sheet to the income statement. Web what is the journal entry to record the cost of goods.

Recording a Cost of Goods Sold Journal Entry ⋆ Accounting Services

Web a sale of goods will result in a journal entry to record the amount of the sale and the cash or accounts receivable. Web.

How to Account for Cost of Goods Sold (with Pictures) wikiHow

Web how to record a journal entry for inventory? The specific identification method of cost allocation directly tracks each of the units purchased and costs.

Completion of Sale & Finished Goods Journal Entries YouTube

Web cogs journal entry examples. Web what is the journal entry to record the cost of goods sold at the end of the accounting period?.

Cost of Goods Sold Journal Entries Video & Lesson Transcript

Inventory transactions are journalized to keep track of inventory movements. Cost of goods sold, commonly referred to as cogs, is the sum of costs directly.

Cost of Goods Sold Journal Entry How to Record & Examples

A second journal entry reduces the account inventory and increases the account cost of goods sold. With the information in the example, we can calculate.

LO 6.4a Analyze and Record Transactions for the Sale of Merchandise

A journal entry transfers costs from the balance sheet to the income statement. The cost of goods sold entry records the total of all. Web.

Web Inventory Cost Is An Asset Until It Is Sold;

The periodic inventory system is a method of accounting for inventory that involves taking physical counts of inventory at regular intervals and. This lesson focuses on inventories of. Web compute the cost of goods sold and the cost of inventory in hand at the end of the month of january 2023. Web sold 180 units, 20 from lot 1 (beginning inventory), costing $21 per unit;

A Second Journal Entry Reduces The Account Inventory And Increases The Account Cost Of Goods Sold.

Web a sale of goods will result in a journal entry to record the amount of the sale and the cash or accounts receivable. Web you credit the finished goods inventory, and debit cost of goods sold. Web calculations of costs of goods sold, ending inventory, and gross margin, specific identification; Web the journal entry for cost of goods sold is a calculation of beginning inventory, plus purchases, minus ending inventory.

160 From The Lot 2 (July 10 Purchase), Costing $27 Per Unit.

This entry matches the ending balance in the inventory account to the costed actual ending inventory, while eliminating the $450,000 balance in the purchases account. Remember, under accrual basis accounting, we recognize revenue as it is earned and expenses as they are incurred in order to match. Web home > inventory > periodic inventory system journal entries. Fine electronics company has sold 16 units for $25,600 (16 units × $1,600) on january 4, 2023.

Web Cost Of Goods Sold | Financial Accounting.

If you purchase for resale one item at 100 and the carriage costs to deliver the item to your warehouse are 20 then the double entry would. The specific identification method of cost allocation directly tracks each of the units purchased and costs them out as they are actually sold. Web calculate cogs by adding the cost of inventory at the beginning of the year to purchases made throughout the year. Description of journal entries for inventory sales, perpetual, specific identification;