Compensation Expense Journal Entry - Web expense journal entry forms a significant part of: To recognize compensation expense in 20x1. Web journal entry for the redemption of stock appreciation rights. This will typically include salaries and wages payable or cash disbursement account and payroll taxes payable account. ( both, balance sheet and profit and loss statement items) Sbc issued to direct labor is allocated to cost of goods sold. It usually provides to the key management such as ceo, cfo, and other executives. The following table summarizes the sars activities. Now, you can record the journal entry in your accounting system. Web on the grant date, company a would record the following journal entry:

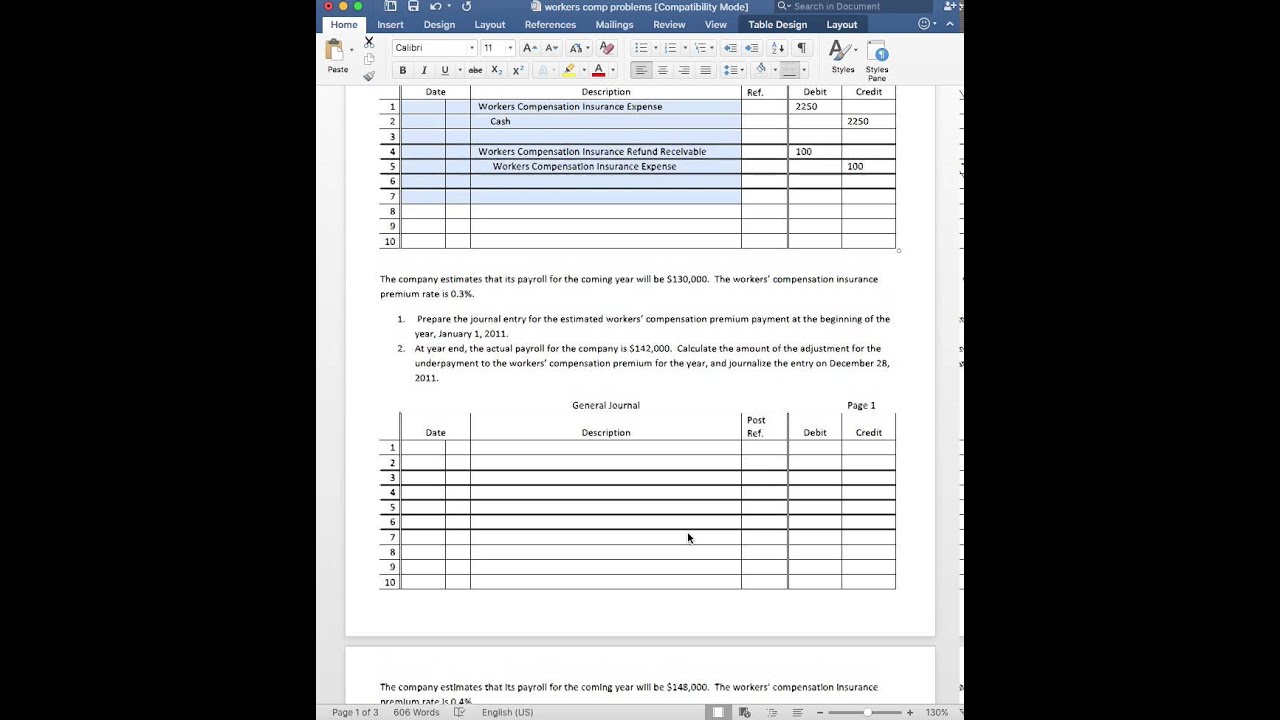

Solved Hi! I just need help with the two journal entries

Web expense journal entry forms a significant part of: To recognize compensation expense in 20x1. Stock based compensation is the expense in the income statement.

Journal Entry For Tax Payable

The journal entries would be: At the end of 202x+4, share price increase to $270, the company need to pay compensation expense of $ 70,000.

Stock Based Compensation Expense Journal Entry In Powerpoint And Google

(balance sheet items) revenue expenditure (profit and loss statement items) provisions (both, balance sheet and profit and loss statement items) deferred revenue expenditures. Web reduction.

Journal Entry Examples

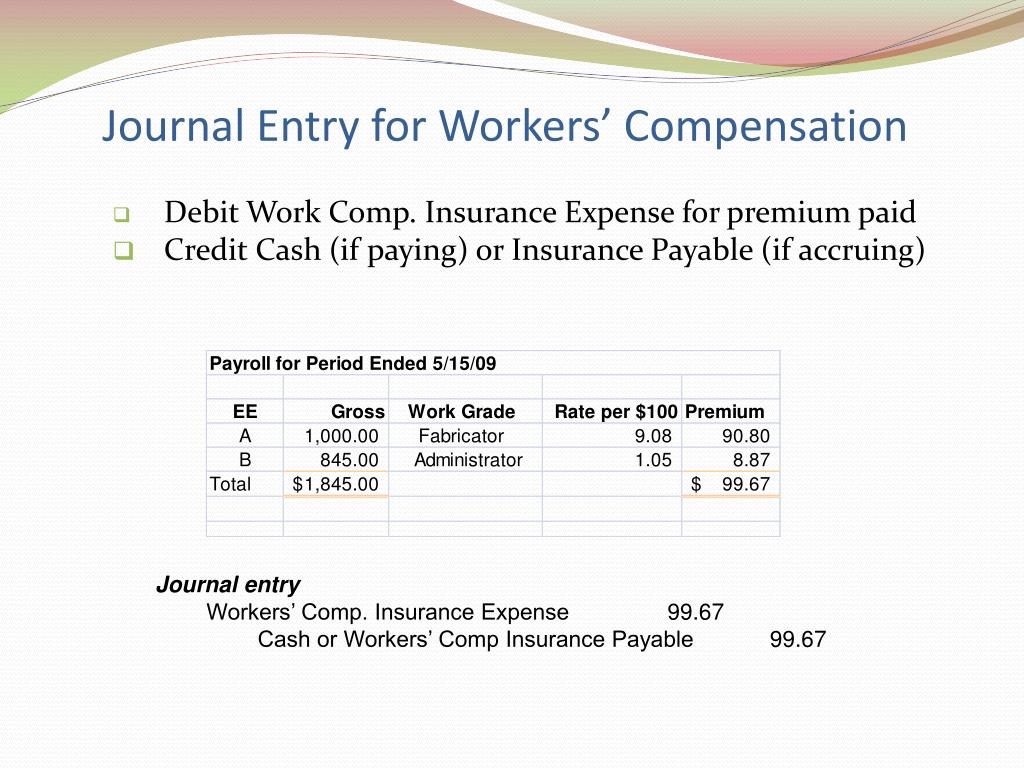

Web expense journal entry forms a significant part of: Web to create a journal entry for compensation expense, start by identifying the accounts involved in.

Journal Entry For Tax Payable

Web accounting for stock based compensation. Web to create a journal entry for compensation expense, start by identifying the accounts involved in this transaction. The.

10 Payroll Journal Entry Template Template Guru

In order to be recorded in journal entries, the stock compensation must be appropriately valued. It usually provides to the key management such as ceo,.

Accounting Worker's Compensation Insurance Journal Entries YouTube

Sc corporation would record the following journal entries. The two most common methods recognized by the financial accounting standards board (fasb) are intrinsic value and.

PPT CHAPTER 6 PowerPoint Presentation, free download ID352083

The following table summarizes the sars activities. Web to create a journal entry for compensation expense, start by identifying the accounts involved in this transaction..

Your BookKeeping Free Lessons Online Examples of Payroll Journal

It usually provides to the key management such as ceo, cfo, and other executives. Expected future issuance of dilutive securities. Web on the grant date,.

What Is Stock Based Compensation?

Sc corporation would record the following journal entries. In order to be recorded in journal entries, the stock compensation must be appropriately valued. Web to create a journal entry for compensation expense, start by identifying the accounts involved in this transaction. Business expenses can include a range of things, like rent, payroll, and inventory.

At The End Of 202X+4, Share Price Increase To $270, The Company Need To Pay Compensation Expense Of $ 70,000 But Company Already Record Expense $ 26,500 From Year 1 To Year 4.

Sbc issued to direct labor is allocated to cost of goods sold. Web stock based compensation accounting: Web the forfeiture estimate impacts the estimated amount of compensation expense to be recorded over the requisite service period. The offset to this expense recognition is either an increase in an equity or liability account, depending on the nature of the transaction.

To Recognize Compensation Expense In 20X1.

Web armed with key details, including the stock type, vesting conditions and schedule, grant date, and fmv, you’re now prepared to make journal entries. Expected future issuance of dilutive securities. The two most common methods recognized by the financial accounting standards board (fasb) are intrinsic value and fair value methods. Now, you can record the journal entry in your accounting system.

The Following Table Summarizes The Sars Activities.

Speci cally, sbc expense is an operating expense (just like wages) and is allocated to the relevant operating line items: Web reduction in tax expense. It usually provides to the key management such as ceo, cfo, and other executives. The journal entries would be: