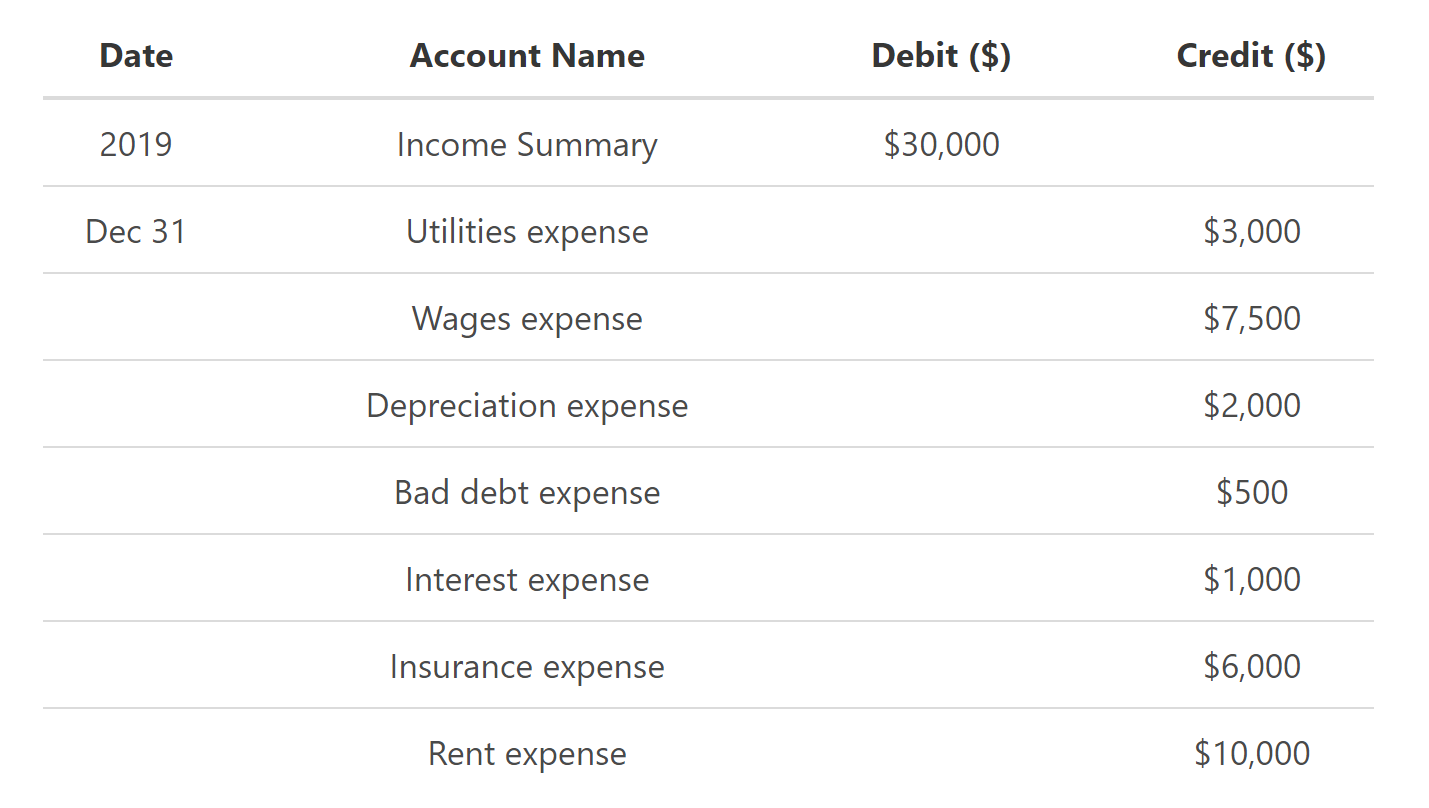

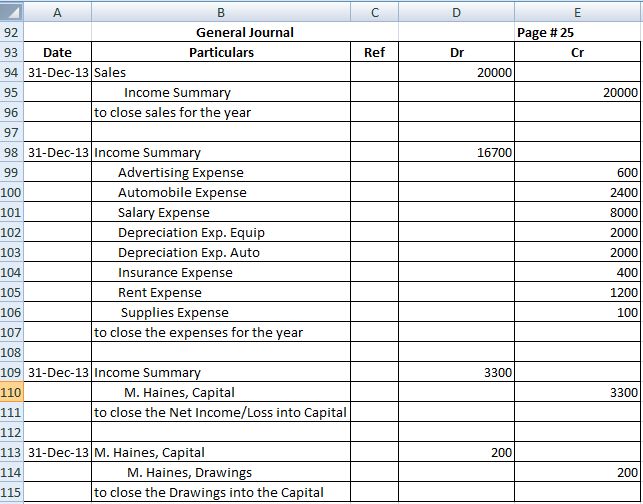

Closing Revenue Accounts Journal Entry - Most accountants write closing journal entries. Closing the revenue accounts —transferring the credit balances in the revenue accounts to a clearing account called income summary. Transferring the debit balances in the expense accounts to a clearing account called income summary. Web closing entries are journal entries used to empty temporary accounts at the end of a reporting period and transfer their balances into permanent accounts. At the beginning and end of every period, companies must open and close their temporary accounts in order to record their. Web closing the revenue accounts: Web closing entries prepare a company for the next accounting period by clearing any outstanding balances in certain accounts that should not transfer over to the next period. In other words, the temporary accounts are closed or reset at the end of the year. Closing, or clearing the balances, means returning the account to a zero balance. The second is to update the balance in retained earnings to agree to the statement of retained earnings.

Accounting An Introduction Adjusting and Closing Journal Entries

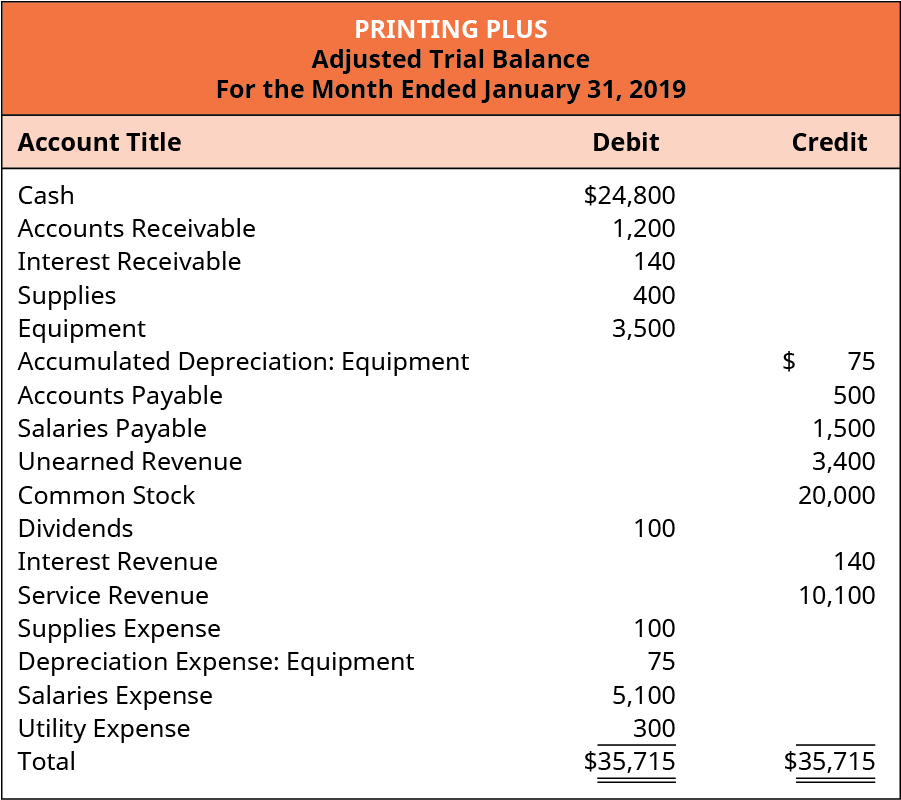

Web updated october 17, 2023. The first entry closes revenue accounts to the income summary account. Since income statement accounts are temporary accounts, their balances.

Closing Entries Definition, Types, and Examples

Closing, or clearing the balances, means returning the account to a zero balance. By doing so, the company moves these. Web lifetime/nicole brown simpson. Closing.

Closing Revenue Accounts Journal Entry KristopheroiWeaver

Web closing entries in accounting allow businesses to start a new accounting period when the time comes. Web closing journal entries are used at the.

Closing entries explanation, process and example Accounting for

The goal is to make the posted balance of the retained earnings account match what we reported on the statement of retained earnings and start.

Closing Entries Example, Preparing Closing Entries, Summary, Next Step

Most accountants write closing journal entries. In other words, the temporary accounts are closed or reset at the end of the year. Transferring the credit.

Determine The Journal Entry To Close Revenues

Web the closing entries are the journal entry form of the statement of retained earnings. The purpose of closing entries is to merge your accounts.

How To Close Revenue Accounts Journal Entry

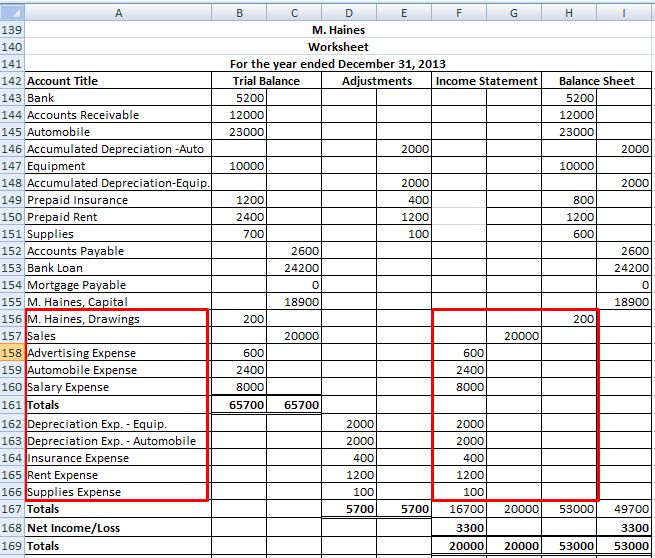

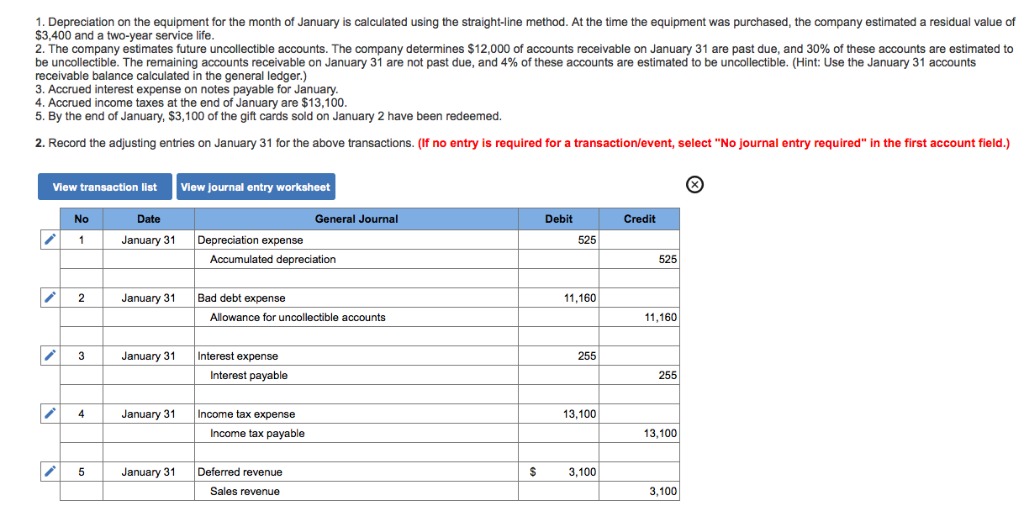

Examples of journal entries for numerous sample transactions. Web the eighth step in the accounting cycle is preparing closing entries, which includes journalizing and posting.

Accounting An Introduction Adjusting and Closing Journal Entries

The first is to close all of the temporary accounts in order to start with zero balances for the next year. As similar to all.

Closing Entries Accountancy Knowledge

Doing so will give zero balance to the brief history to use for the next fiscal year. Web a closing entry is a journal entry.

Transferring The Credit Balances In The Revenue Accounts To A Clearing Account Called Income Summary.

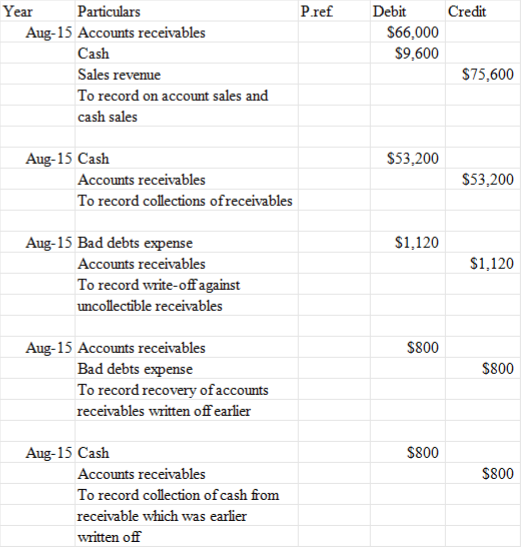

Web closing entries are journal entries made at the end of an accounting period, that transfer temporary account balances into a permanent account. Closing entries serve two objectives. Closing the expense accounts —transferring the debit balances in the expense accounts to a clearing account called income summary. Web lifetime/nicole brown simpson.

Web What Is A Closing Entry?

Web a revenue closing entry is a journal entry made at the end of an accounting period to transfer the balances of temporary accounts (like revenues, expenses, and dividends) to the permanent accounts (like retained earnings). Typical financial statement accounts with debit/credit rules and disclosure conventions. Since income statement accounts are temporary accounts, their balances don’t transfer from one accounting period to another. Web the eighth step in the accounting cycle is preparing closing entries, which includes journalizing and posting the entries to the ledger.

Web Closing Entries Prepare A Company For The Next Accounting Period By Clearing Any Outstanding Balances In Certain Accounts That Should Not Transfer Over To The Next Period.

Web closing entries, also called closing journal entries, are entries made at the end of an accounting period to zero out all temporary accounts and transfer their balances to permanent accounts. Transferring the debit balances in the expense accounts to a clearing account called income summary. In other words, the temporary accounts are closed or reset at the end of the year. By doing so, the company moves these.

Web The Closing Entries Are The Journal Entry Form Of The Statement Of Retained Earnings.

The goal is to make the posted balance of the retained earnings account match what we reported on the statement of retained earnings and start the next period with a zero balance for all temporary accounts. This is commonly referred to as closing the books. Web closing entries in accounting allow businesses to start a new accounting period when the time comes. Web closing the revenue accounts: