Closing Journal Entries Example - Web table of contents. A closing entry is an entry made in a journal. A closing entry is a journal entry made at the end of the accounting period. Four entries occur during the closing process. Most accountants write closing journal entries. Web what are closing entries? Closing entries are journal entries used to empty temporary accounts at the end of a reporting period and transfer their balances into permanent accounts. What is a closing entry? These entries signify the end of an accounting period, where a balance transfers from a temporary account to a permanent account. By doing so, the company moves these.

Accounting An Introduction Adjusting and Closing Journal Entries

A process where all temporary accounts opened in the fiscal year are transferred and closed to a permanent arrangement. Web closing journal entries: A closing.

Closing Entries I Summary I Accountancy Knowledge

Web closing journal entries: The process involves moving data from a temporary account on the income statement. Temporary accounts are the type of accounts that.

Journalizing Closing Entries 1 / It involves shifting data from

This ledger is used to record all transactions over the specific accounting period in question. Shift all $10,000 of revenues generated during the month to.

Journalizing Closing Entries Closing Entries Types Example My Riset

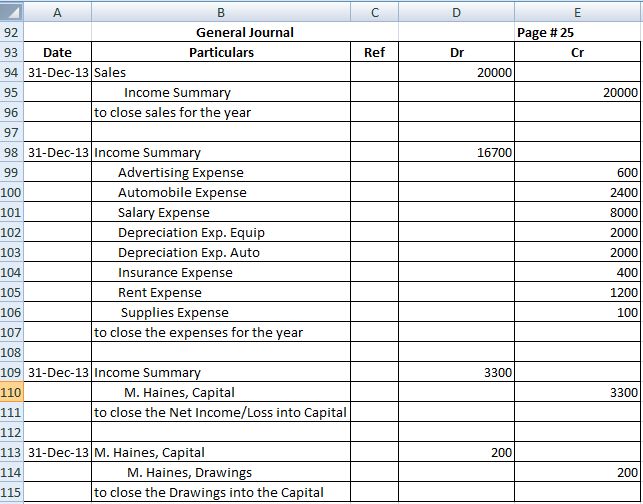

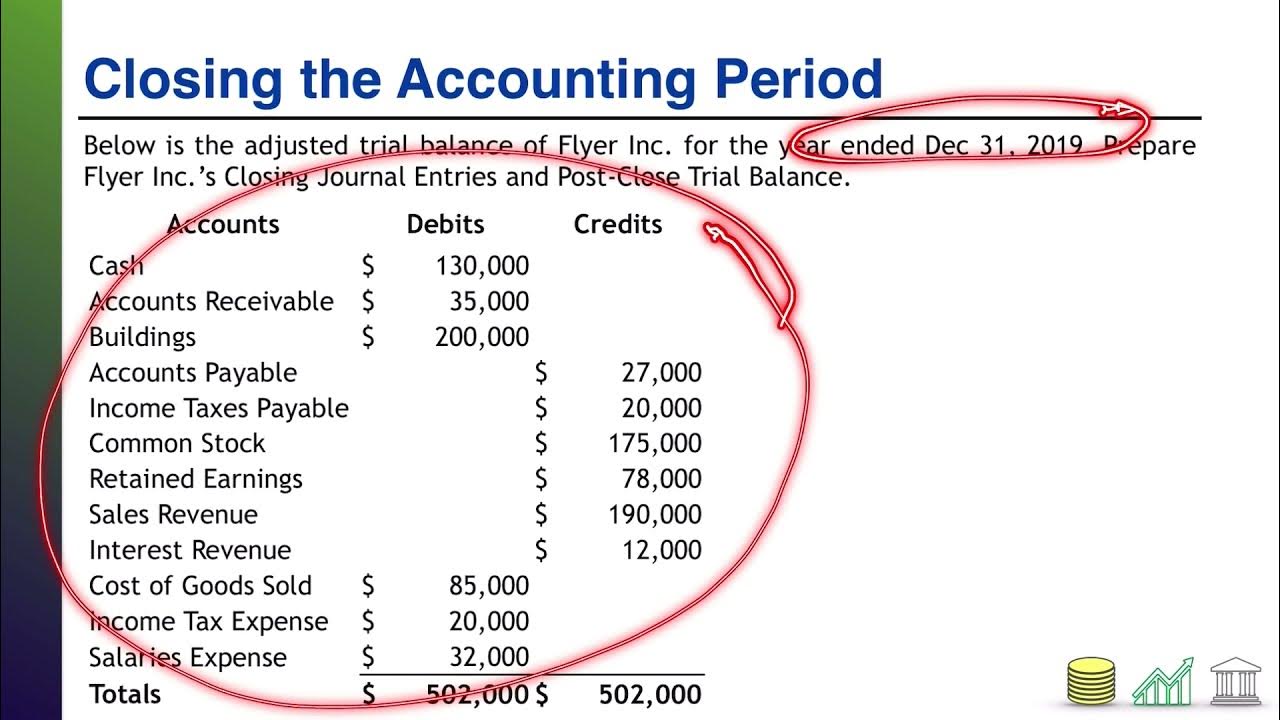

Four entries occur during the closing process. Web examples of closing entries. The following journal entries show how closing entries are used: What are the.

Closing Journal Entries PDF

A closing entry is an entry made in a journal. Web closing entries are better explained via an example. A process where all temporary accounts.

Closing Entries Examples

Most accountants write closing journal entries. What is the significance of closing entries? Closing entries are journal entries that reduce the balances of all revenue.

Closing entries explanation, process and example Accounting For

When are the closing entries made? Web closing journal entries: Web closing entries, also called closing journal entries, are entries made at the end of.

Practice Problem CLOSE01 Closing Entries and the Post Close Trial

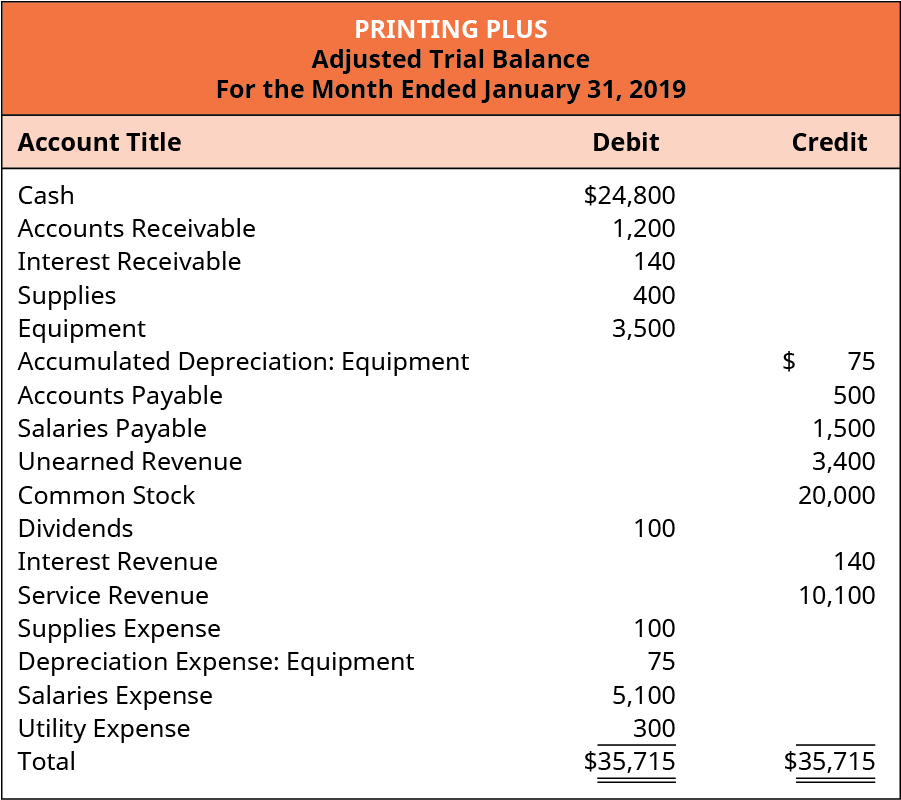

Web steps 1 through 4 were covered in analyzing and recording transactions and steps 5 through 7 were covered in the adjustment process. When are.

Closing Entries Definition, Types, and Examples

In other words, the temporary. Web closing journal entries are used at the end of the accounting cycle to close the temporary accounts for the.

In Other Words, The Temporary.

Web closing journal entries are used at the end of the accounting cycle to close the temporary accounts for the accounting period, and transfer the balances to the retained earnings account. Web closing entries are better explained via an example. A closing entry is an entry made in a journal. Web how to write closing journal entries (with examples) indeed editorial team.

Closing Journal Entries Are Made At The End Of An Accounting Period To Prepare The Accounting Records For The Next Period.

The process involves moving data from a temporary account on the income statement. The first entry closes revenue accounts to the income summary account. It is done when an accounting period comes to an end. Web a closing entry is a journal entry that is made at the end of an accounting period to transfer balances from a temporary account to a permanent account.

What Is The Significance Of Closing Entries?

What are closing entries in accounting? Web what accounts do you open and close? The main purpose of these closing entries is to bring the temporary journal account balances to zero for the next accounting period, which keeps the accounts reconciled. The purpose of closing entries is to merge your accounts so you can determine your retained earnings.

Web In Accounting Terms, These Journal Entries Are Termed As Closing Entries.

Web examples of closing entries. To look at it more practically, let’s take closing entries journal example of a small manufacturing company abc ltd which is going for the annual closing of books: These entries signify the end of an accounting period, where a balance transfers from a temporary account to a permanent account. It involves shifting data from temporary accounts on the income statement to permanent accounts on.