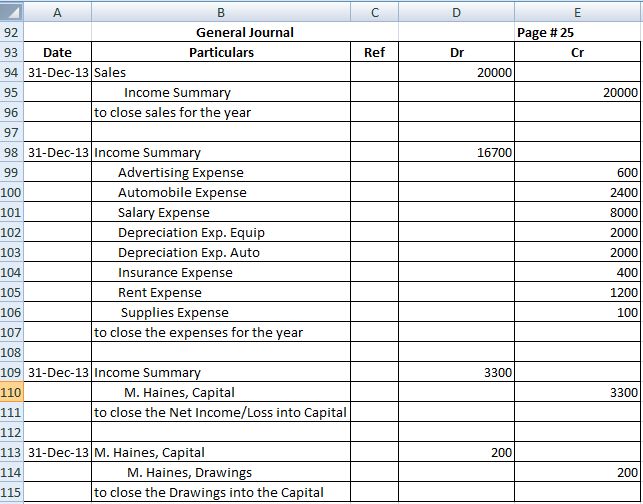

Closing Entries General Journal - It helps prepare the books for the next accounting period. Suppose a business had the following trial balance before any closing journal entries at the end of an accounting period. Web below is the journal entry for closing stock when it is reduced from purchases. Web closing entries in accounting allow businesses to start a new accounting period when the time comes. Closing stock appearing in the trial balance. Web a revenue closing entry is a journal entry made at the end of an accounting period to transfer the balances of temporary accounts (like revenues, expenses, and dividends) to the permanent accounts (like retained earnings). Web a closing entry is a journal entry made at the end of accounting periods that involves shifting data from temporary accounts on the income statement to. Web journalizing and posting closing entries. Transfer between subsidiary ledger personal accounts. Revenue, income and gain accounts.

Accounting An Introduction Adjusting and Closing Journal Entries

Revenue, income and gain accounts. Web closing entries are journal entries used to empty temporary accounts at the end of a reporting period and transfer.

Journalizing Closing Entries Closing Entries Types Example My Riset

Web closing entries prepare a company for the next accounting period by clearing any outstanding balances in certain accounts that should not transfer over to.

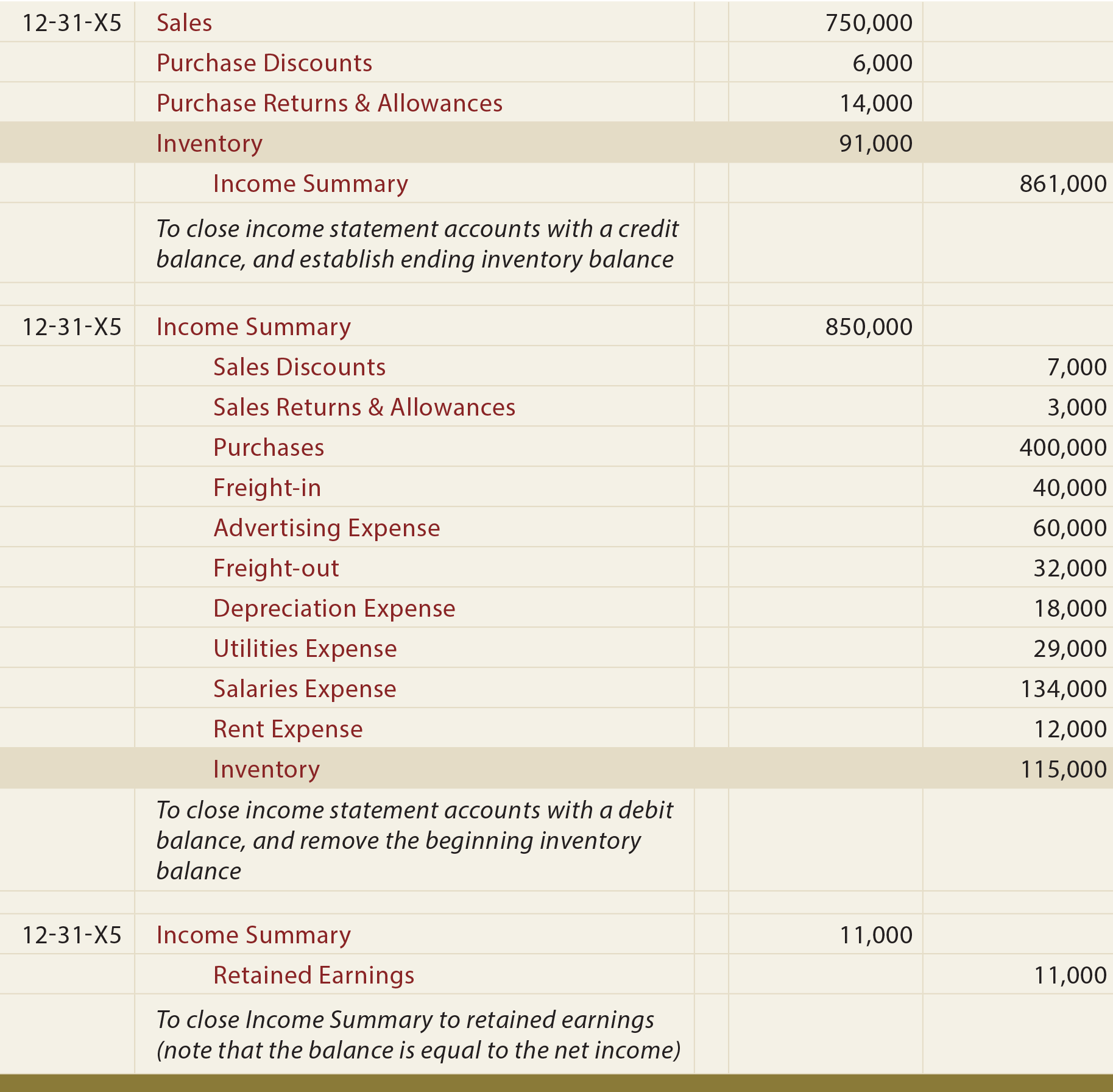

Purchase Considerations For Merchandising Businesses

Suppose a business had the following trial balance before any closing journal entries at the end of an accounting period. The purpose of closing entries.

Closing Entries Accountancy Knowledge

Web closing entries are journal entries that reduce the balances of all revenue and expense accounts to zero. Typical closing journal entries for a generic.

Closing Entries Definition, Types, and Examples

Closing entries are those journal entries made in a manual accounting system at the end of an accounting period to shift the balances in temporary.

PPT Completing the Accounting Cycle for a Sole Proprietorship

The goal is to make the posted balance of the retained earnings account match what we reported on the statement of retained earnings and start.

Closing Entries are journal entries made to close

Closing stock appearing in the trial balance. It helps prepare the books for the next accounting period. Four entries occur during the closing process. By.

Closing Entries Example, Preparing Closing Entries, Summary, Next Step

Web in simple words, closing entries are a set of journal entries made at the end of the accounting period to move balances from temporary.

Closing entries In this stage of the accounting

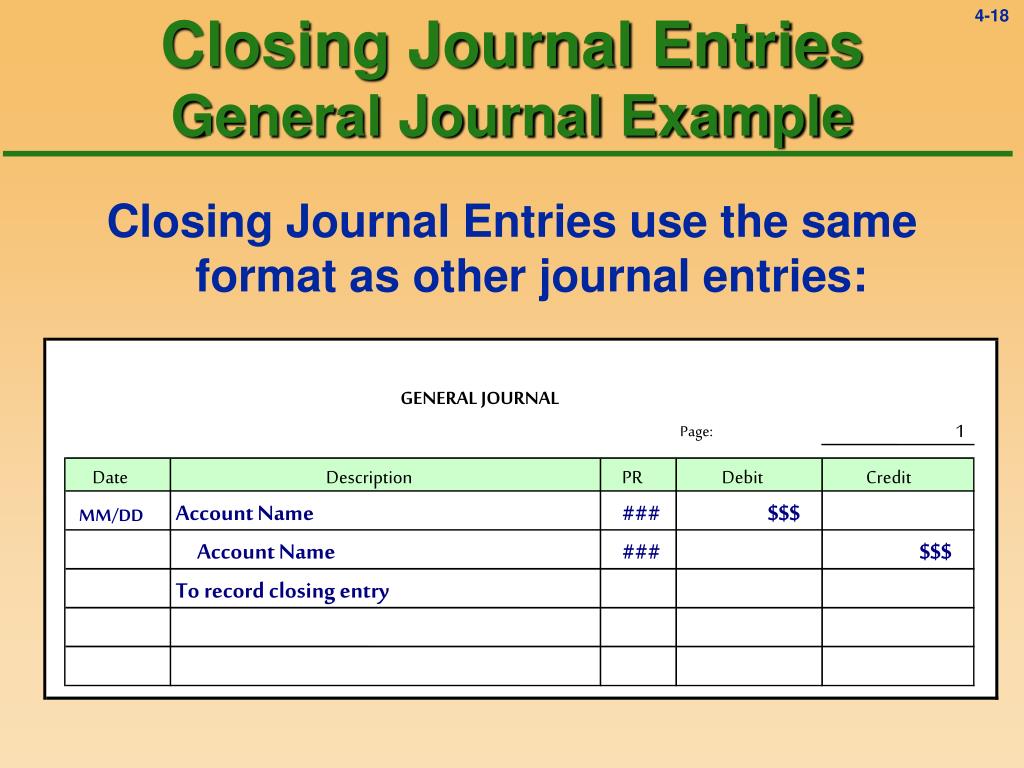

Web the closing entries are dated in the journal as of the last day of the accounting period. Journalizing and posting closing entries. Web let’s.

Web Closing Entries Are Journal Entries Made At The End Of An Accounting Period, That Transfer Temporary Account Balances Into A Permanent Account.

Suppose a business had the following trial balance before any closing journal entries at the end of an accounting period. Web let’s now look at how to prepare closing entries. Web the main purpose of these closing entries is to bring the temporary journal account balances to zero for the next accounting period, which keeps the accounts reconciled. Closing entries are those journal entries made in a manual accounting system at the end of an accounting period to shift the balances in temporary accounts to permanent accounts.

Four Entries Occur During The Closing Process.

Goods taken for personal use. Web journalizing and posting closing entries. As similar to all other journal entries, closing entries are posted in the general ledger. The first entry closes revenue accounts to the income summary account.

At The Beginning And End Of Every Period, Companies Must Open And Close Their Temporary Accounts In Order To Record Their.

Web a closing entry is a journal entry that is made at the end of an accounting period to transfer balances from a temporary account to a permanent account. Web what are closing entries? Web closing entries | financial accounting. Temporary accounts are used to accumulate income statement activity during a reporting period.

Since Income Statement Accounts Are Temporary Accounts, Their Balances Don’t Transfer From One Accounting Period To Another.

Web in simple words, closing entries are a set of journal entries made at the end of the accounting period to move balances from temporary ledger accounts like revenue, expense, and withdrawal/dividends to permanent ledger accounts. The purpose of closing entries is to merge your accounts so you can determine your retained earnings. Revenue, income and gain accounts. Typical closing journal entries for a generic temporary account are shown below: