Closing Entries Are Dated In The Journal As Of - Web closing entries are dated in the journal as of: It helps prepare the books for the next accounting period. Web harold averkamp, cpa, mba. These are accounts that are reset to zero at the end of each accounting period. Closing entries transfer the balances from the temporary accounts to a permanent or real account at the end of the accounting year. The first entry closes revenue accounts to the income summary account. Closing entries are journal entries that close all temporary accounts and transfer their balances to the permanent accounts. As a result, the temporary accounts will begin the following accounting year with zero balances. Web learn what a closing entry is and how it is used to transfer balances from temporary accounts to permanent accounts at the end of an accounting period. The last day of the accounting period, although they are actually journalized after the end of the accounting period.

Closing Entries are journal entries made to close

Four entries occur during the closing process. See examples of closing entries for revenue, expense, income summary, and dividends accounts. Closing, or clearing the balances,.

Closing Entries Definition, Types, and Examples

Web closing entries are journal entries that are made at the end of an accounting period to transfer the balances of temporary accounts to permanent.

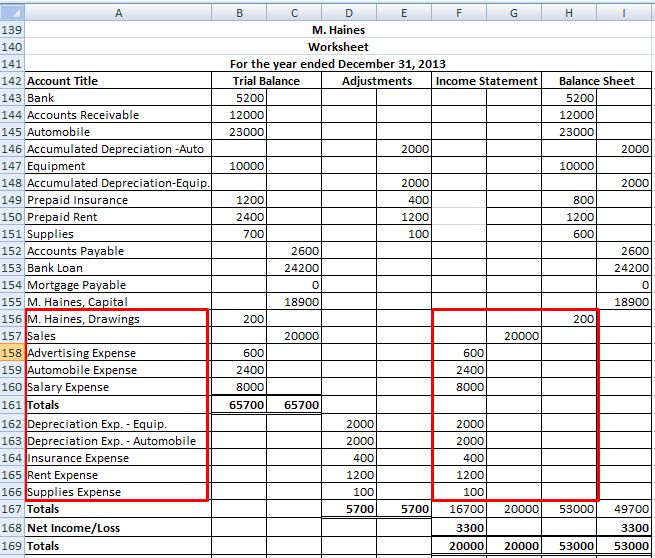

Accounting An Introduction Adjusting and Closing Journal Entries

Web a closing entry is a journal entry that transfers data from temporary accounts on the income statement to permanent accounts on the balance sheet..

Closing Entries are journal entries made to close

These are accounts that are reset to zero at the end of each accounting period. Web learn how to prepare closing entries to zero out.

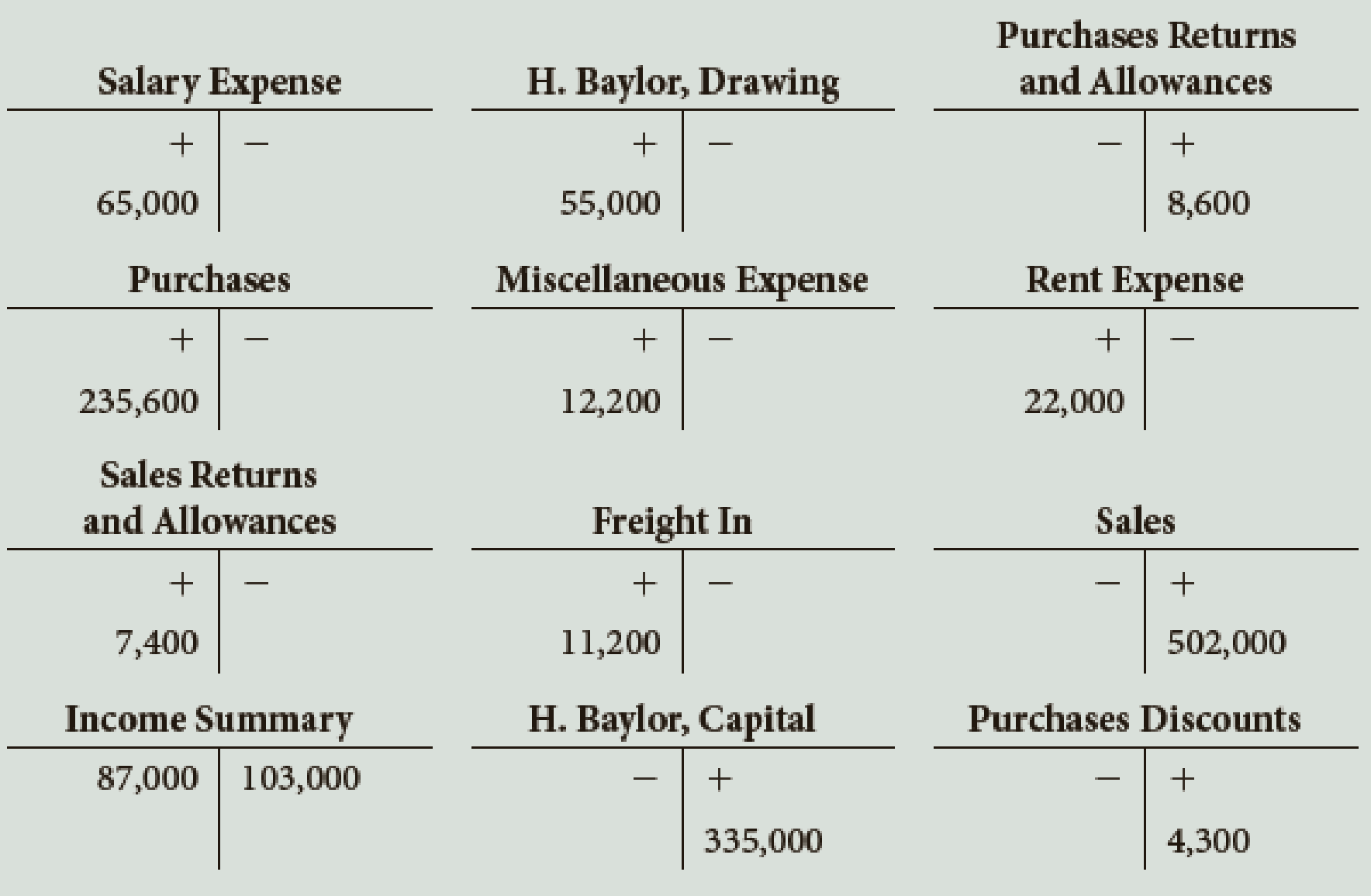

From the following T accounts, journalize the closing entries dated

Option ‘b’ the last day of the accounting period, although they are actually journalized after the end of the accounting period. It helps prepare the.

Closing entries explanation, process and example Accounting For

The last day of the accounting period, although they are actually journalized after the end of the accounting period. Option ‘b’ the last day of.

Closing Revenue Accounts Journal Entry KristopheroiWeaver

See the four steps, the example, and the key takeaways of closing entries. Suppose a business had the following trial balance before any. Option ‘b’.

Journalizing Closing Entries Closing Journal EntriesSole

Web find out the correct answer to the question about closing entries in the journal as of date. Web learn how to make closing entries.

Closing Entries I Summary I Accountancy Knowledge

Revenue, income and gain accounts. As a result, the temporary accounts will begin the following accounting year with zero balances. See the full solution from.

The Last Day Of The Accounting Period, Although They Are Actually Journalized After The End Of The Accounting Period.

It helps prepare the books for the next accounting period. The goal is to make the posted balance of the retained earnings account match what we reported on the statement of retained earnings and start the next period with a zero balance for all temporary accounts. See examples of closing entries for macroauto, a company that creates exhaust systems for race cars. As similar to all other journal entries, closing entries are posted in the general ledger.

Web Learn What A Closing Entry Is And How It Is Used To Transfer Balances From Temporary Accounts To Permanent Accounts At The End Of An Accounting Period.

Web learn what closing entries are, how they are made, and why they are important for accounting. Closing entries transfer the balances from the temporary accounts to a permanent or real account at the end of the accounting year. Four entries occur during the closing process. Web a revenue closing entry is a journal entry made at the end of an accounting period to transfer the balances of temporary accounts (like revenues, expenses, and dividends) to the permanent accounts (like retained earnings).

Web The Closing Entries Are Dated In The Journal As Of The Last Day Of The Accounting Period.

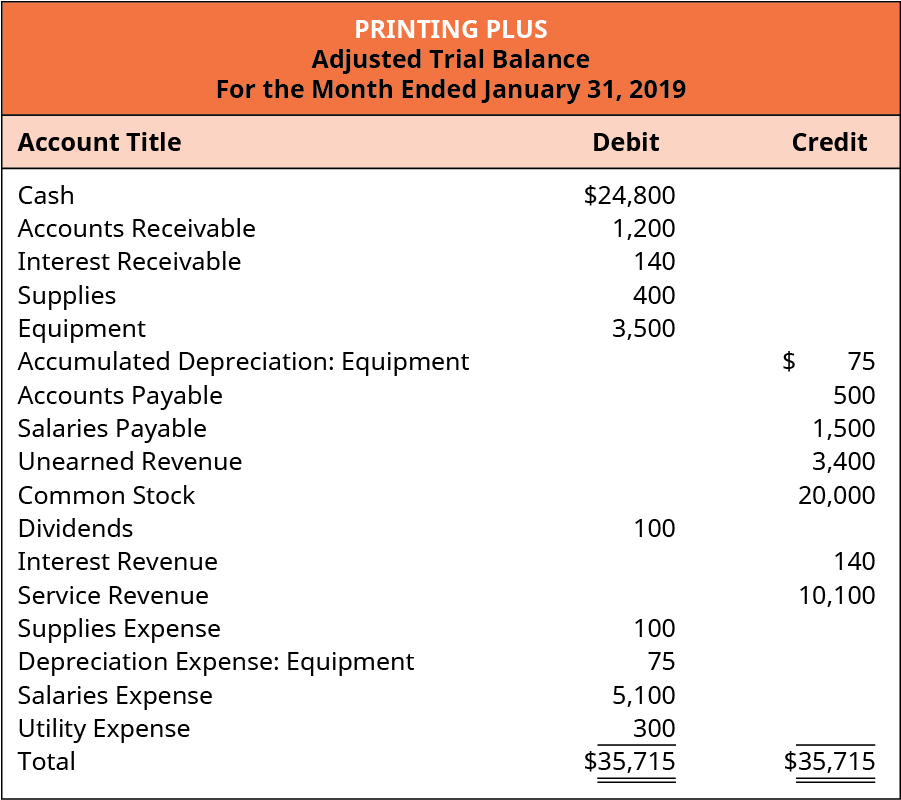

Closing entries are based on the account balances in an adjusted trial balance. See a practical example of closing revenue, expense, income summary, and dividend accounts. Web closing entries prepare a company for the next accounting period by clearing any outstanding balances in certain accounts that should not transfer over to the next period. The eighth step in the accounting cycle is preparing closing entries, which includes journalizing and posting the entries to the ledger.

Web Closing Entries Are Dated In The Journal As Of:

The main purpose of these closing entries is to bring the temporary journal account balances to zero for the next accounting period, which keeps the accounts reconciled. Web learn how to prepare closing entries to zero out temporary accounts and match net income or loss with retained earnings. Closing, or clearing the balances, means returning the account to a zero balance. The closing process ensures that the transactions affecting the income statement are separated between accounting periods to determine the financial performance of a company within a given period.