Cash Over And Short Journal Entry - For example, assume the $100 petty cash. Web the cash over and short account is an account that keeps a record of any discrepancies between the expected cash on hand and the actual cash on hand. Web definition of cash short and over account the account cash short and over is an income statement account (within a company’s general ledger) in which. Web learn the basics of financial accounting with this video tutorial on cash short and over and petty cash. You will see how to record and reconcile cash transactions,. To record a cash short journal entry, you will need two accounts—a “cash over/short account” and a “cash account.”. If the petty cash fund is short, the shortage is debited to cash over and short. Especially on the cash over and short journal entry. Web in this article, we cover how to account for the cash short and over; Journal entry for removing money from the petty cash fund.

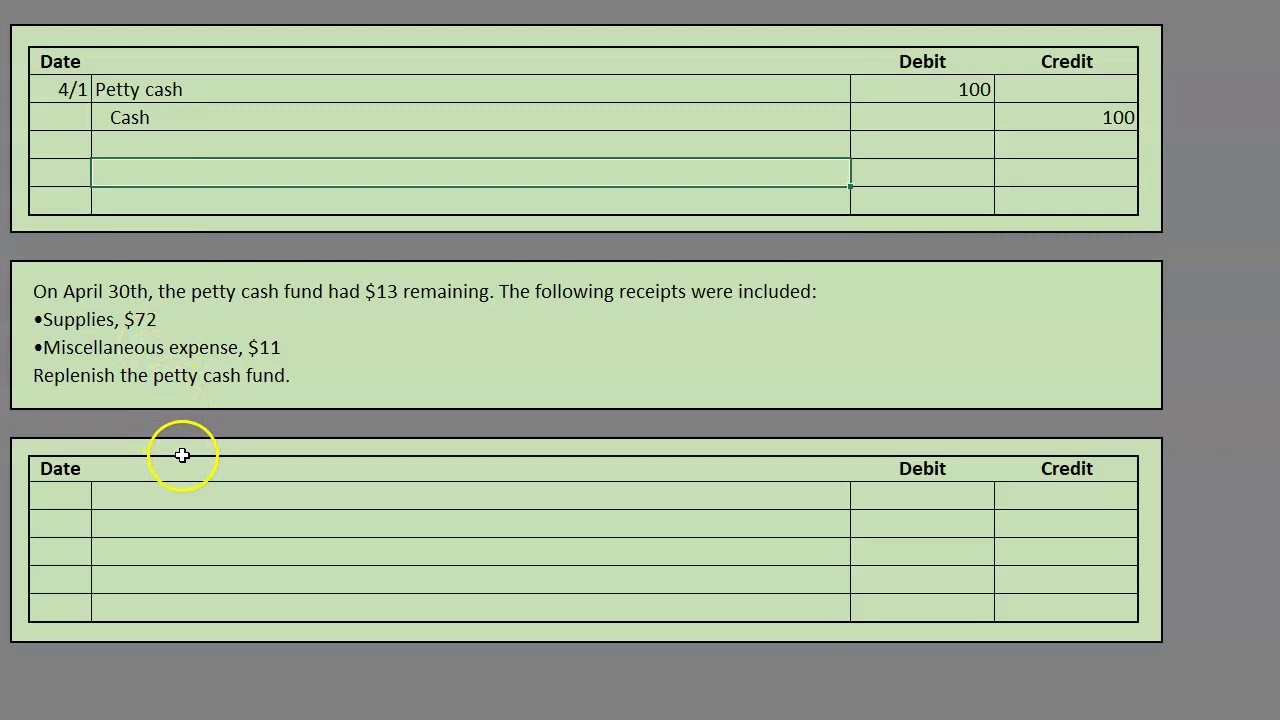

Petty Cash

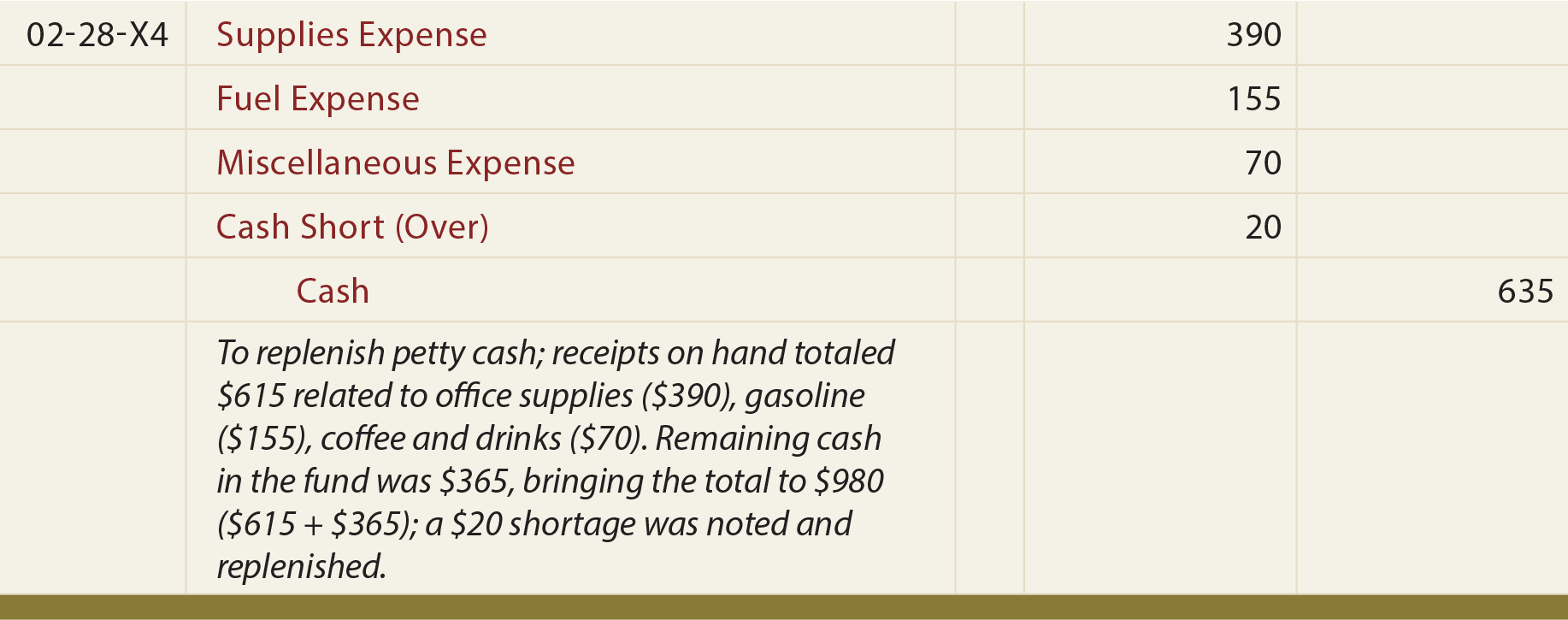

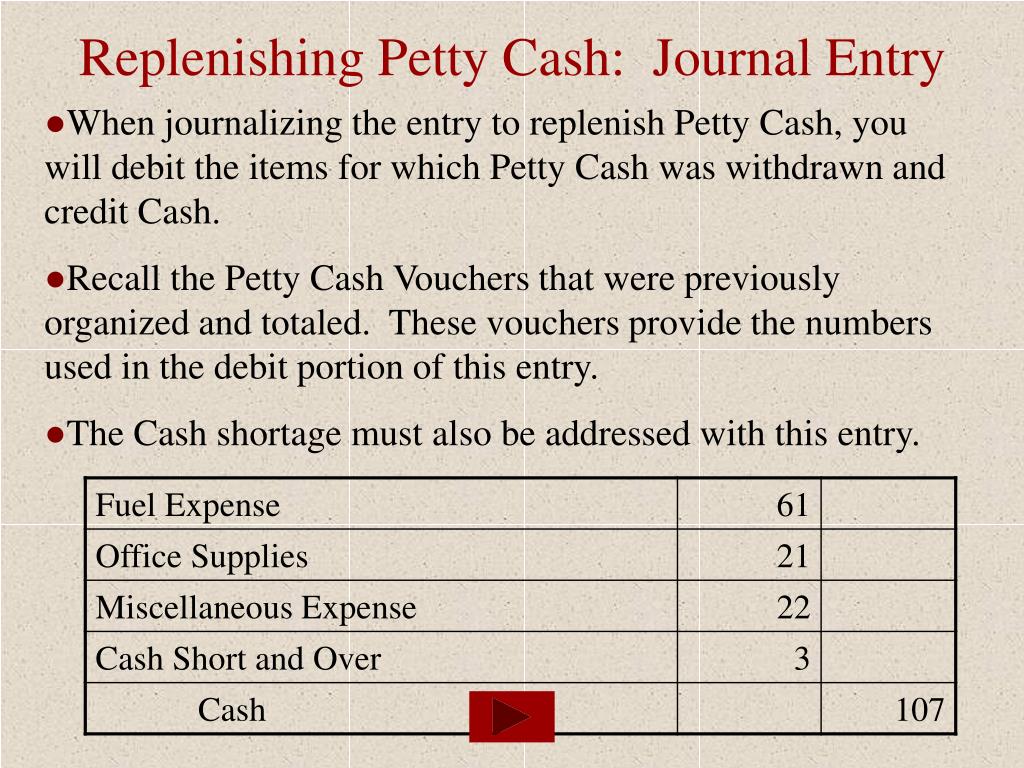

Web using the above information, the journal entry to replenish the petty cash fund will include a credit of $94.00 to the account cash: The.

PPT Chapter 07 PowerPoint Presentation, free download ID303914

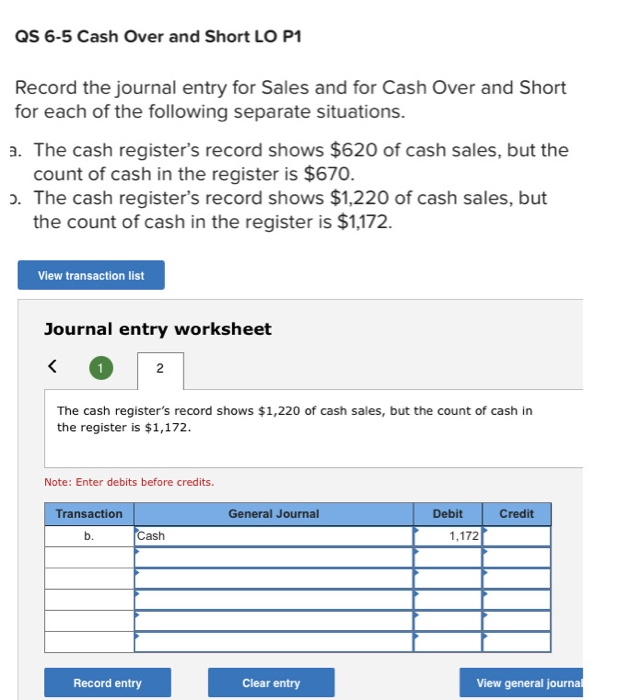

Web the journal entry to record the transaction would be: Web in this article, we cover how to account for the cash short and over;.

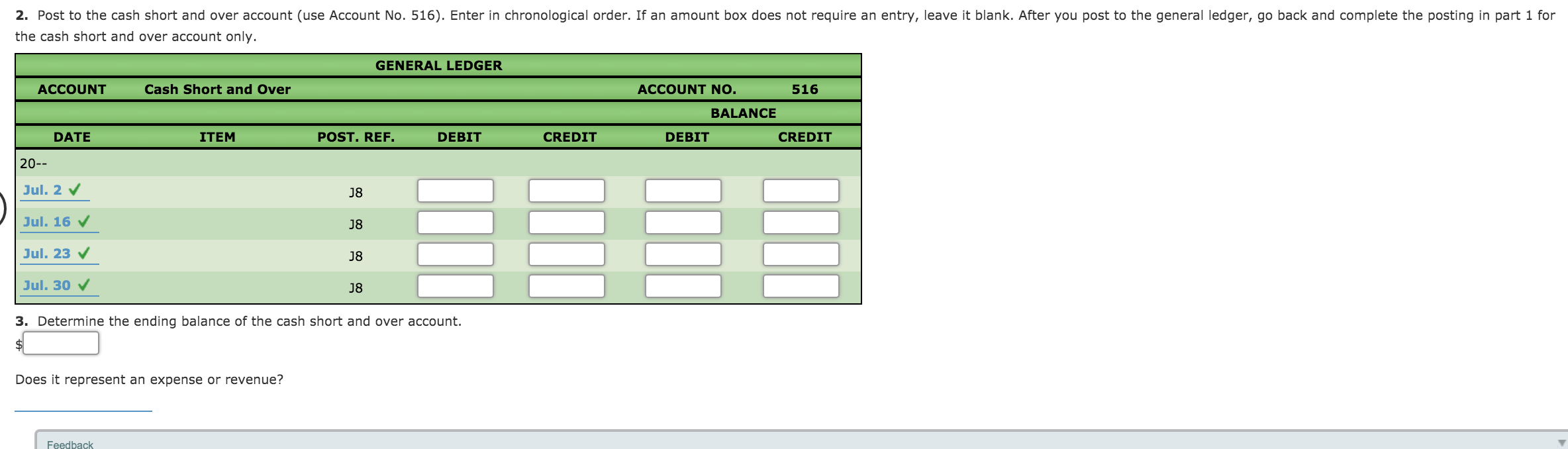

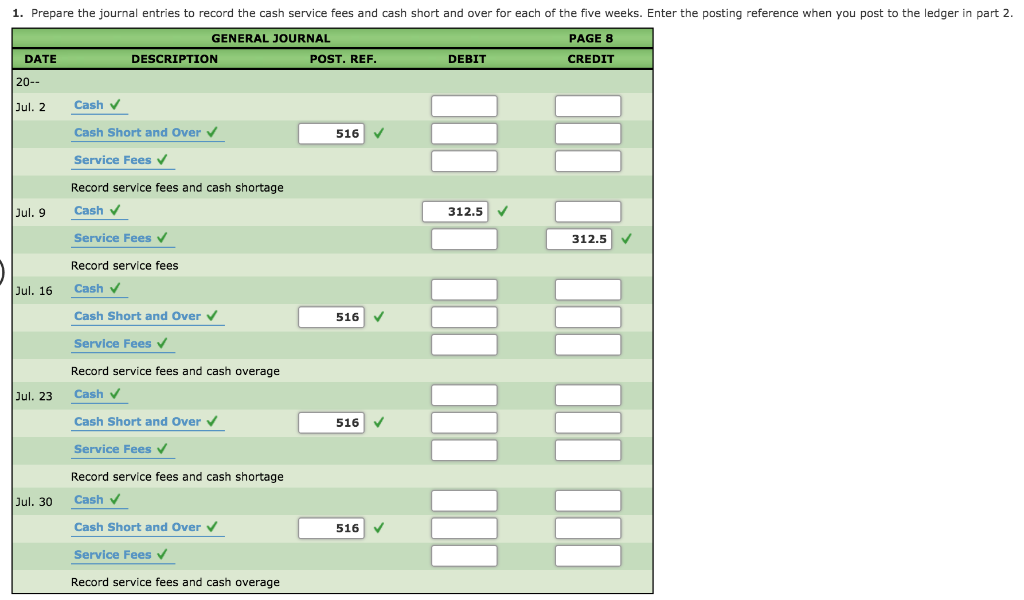

Solved QS 65 Cash Over and Short LO P1 Record the journal

In accounting, cash over and short journal entry is usually made when the company replenishes its petty cash fund. The opposite is true for transactions.

journal entry format accounting accounting journal entry template

Web learn the basics of financial accounting with this video tutorial on cash short and over and petty cash. Web recording the cash short journal.

PPT Accounting for Petty Cash and Cash Short and Over PowerPoint

Journal entry for removing money from the petty cash fund. The cash over and short account is an account in the general ledger. Journal entry.

Financial Accounting Chapter 7 Cash Short & Over / Petty Cash YouTube

Web learn the basics of financial accounting with this video tutorial on cash short and over and petty cash. To record a cash short journal.

Solved Cash Short and Over Entries Listed below are the

Web the journal entry to record the transaction would be: What is cash over and short?. Some key characteristics of this written promise to pay.

Cash Short and Over Entries Listed below are the weekly cash...ask 1

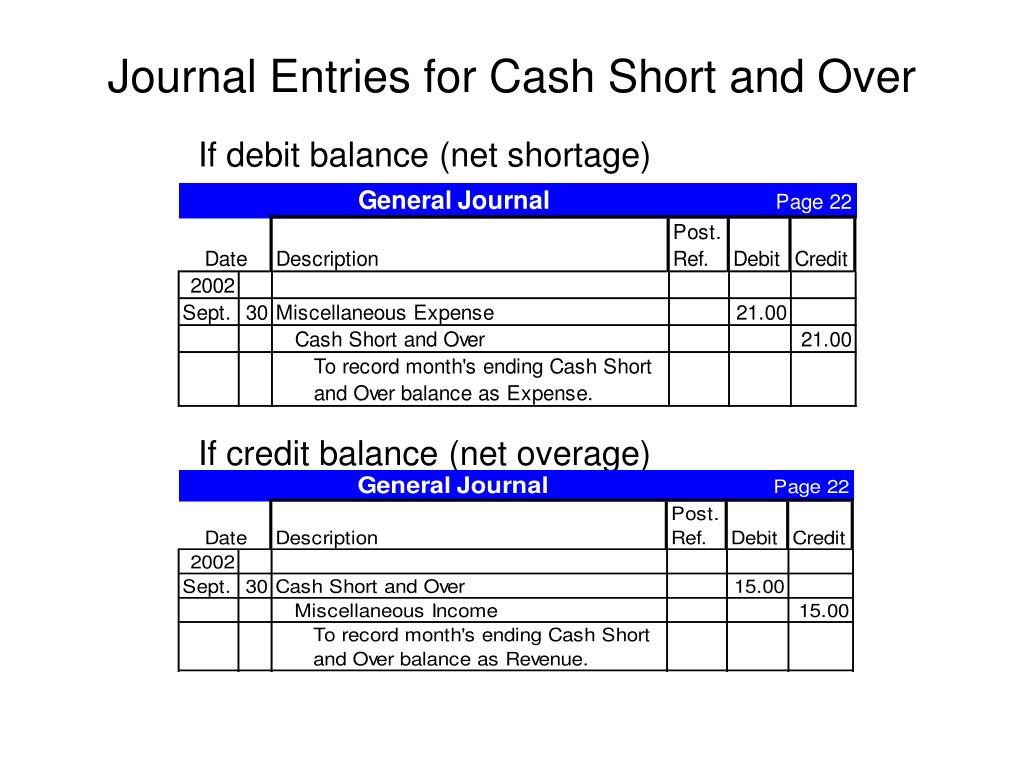

Especially on the cash over and short journal entry. The journal entry to record this sale would debit cash for $101, credit sales for $100,.

Petty Cash Journal Entries YouTube

Web when the company has the cash overage in the petty cash fund, it can make the journal entry by debiting the expenses account and.

Web Posted On May 31, 2021July 6, 2023 By Jaszac.

Because only $15.48 is on. Web the journal entry for this sale would debit cash for $96, credit sales for $95, and credit cash over short for $1. Some key characteristics of this written promise to pay (see figure. If the petty cash fund is short, the shortage is debited to cash over and short.

Web The Journal Entry To Record The Transaction Would Be:

Web learn the basics of financial accounting with this video tutorial on cash short and over and petty cash. Web using the above information, the journal entry to replenish the petty cash fund will include a credit of $94.00 to the account cash: You will see how to record and reconcile cash transactions,. (this is the amount of the.

The Journal Entry To Record This Sale Would Debit Cash For $101, Credit Sales For $100, And Credit Cash Over.

Web in this article, we cover how to account for the cash short and over; Especially on the cash over and short journal entry. The opposite is true for transactions that. Web actual cash remaining on hand is $15.48, indicating a shortage of $0.20 ($100 $84.32 $15.68, which is the amount that should be on hand;

How To Account For Credit Card.

Web if the account does not prove out, the following journal entries would be made: To record a cash short journal entry, you will need two accounts—a “cash over/short account” and a “cash account.”. Web the journal entry to record replenishing the fund would debit the various accounts indicated by the summary and credit cash. This is due to the cash remaining and.