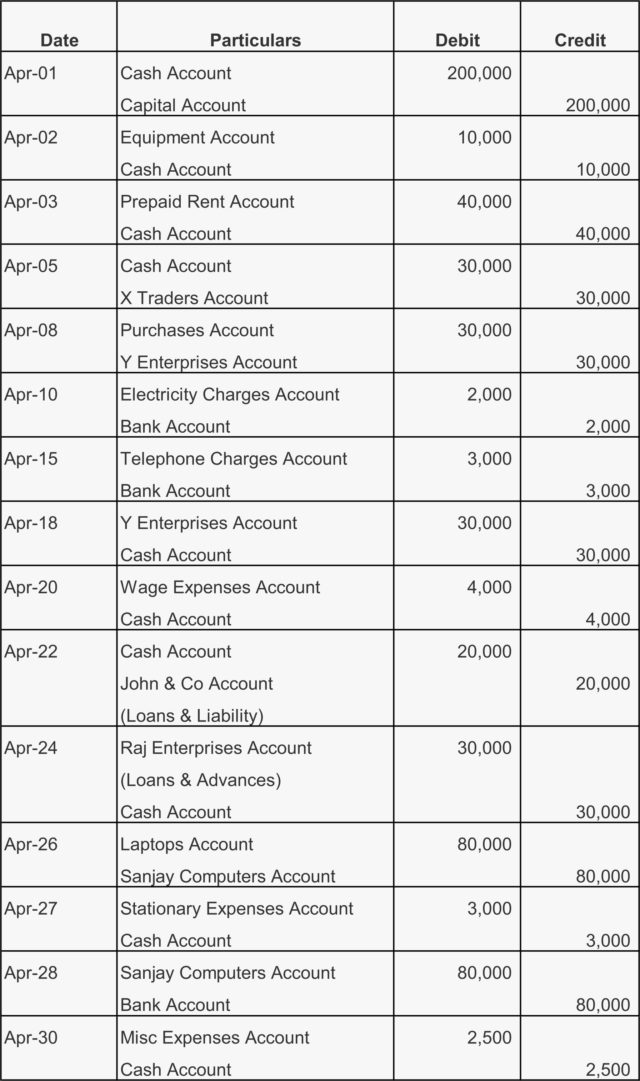

Cash Journal Entry - Web a cash sales journal entry is a type of accounting entry. In accounting, assets such as cash or goods which are withdrawn from a business by the owner (s) for their. Web following are common types of cash payment transactions along with relevant accounting entries: Transactions related to the purchase and sale of goods can be. Web as business events occur throughout the accounting period, journal entries are recorded in the general journal to show how the event changed in the accounting equation. Web when cash is debited and credited. Web in the journal entry, cash has a debit of $2,800. Whenever a business either spends or receives cash or a cash equivalent, then an entry must be recorded to account for this transaction. Normal balances, revenues & gains are usually credited, expenses & losses are usually. In this comprehensive guide, we will.

3 Purchase goods for Cash journal entry YouTube

Web therefore, the journal entry would look like this: For additional practice in preparing journal entries, here are some more examples of. Accounting for cash.

Accounting Journal Entries For Dummies

Web journal entry is the first step in the accounting cycle that helps you record financial transactions as and when required. Web in the journal.

Journal Entry Examples

Web what are drawings and its journal entry (cash, goods)? Knowing what to debit and what to credit are. Web therefore, the journal entry would.

How to Record Journal Entries in Accounting Waytosimple

Web therefore, the journal entry would look like this: Web in the journal entry, cash has a debit of $2,800. Knowing what to debit and.

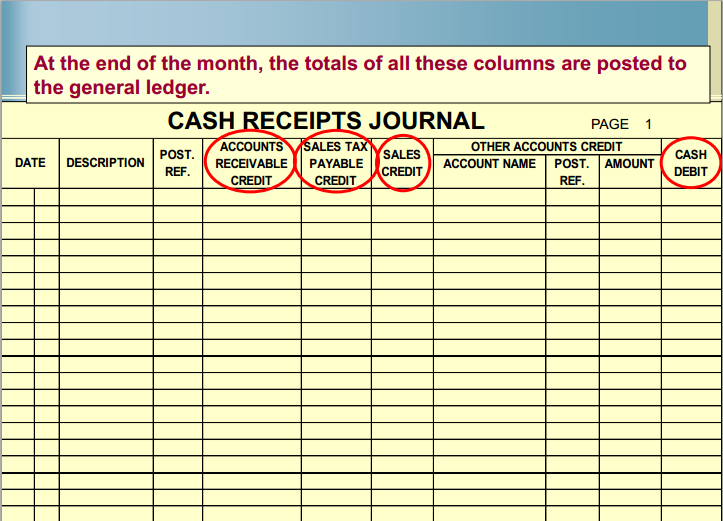

CASH RECEIPTS JOURNAL Accountaholic

Web in the journal entry, cash has a debit of $2,800. For additional practice in preparing journal entries, here are some more examples of. Web.

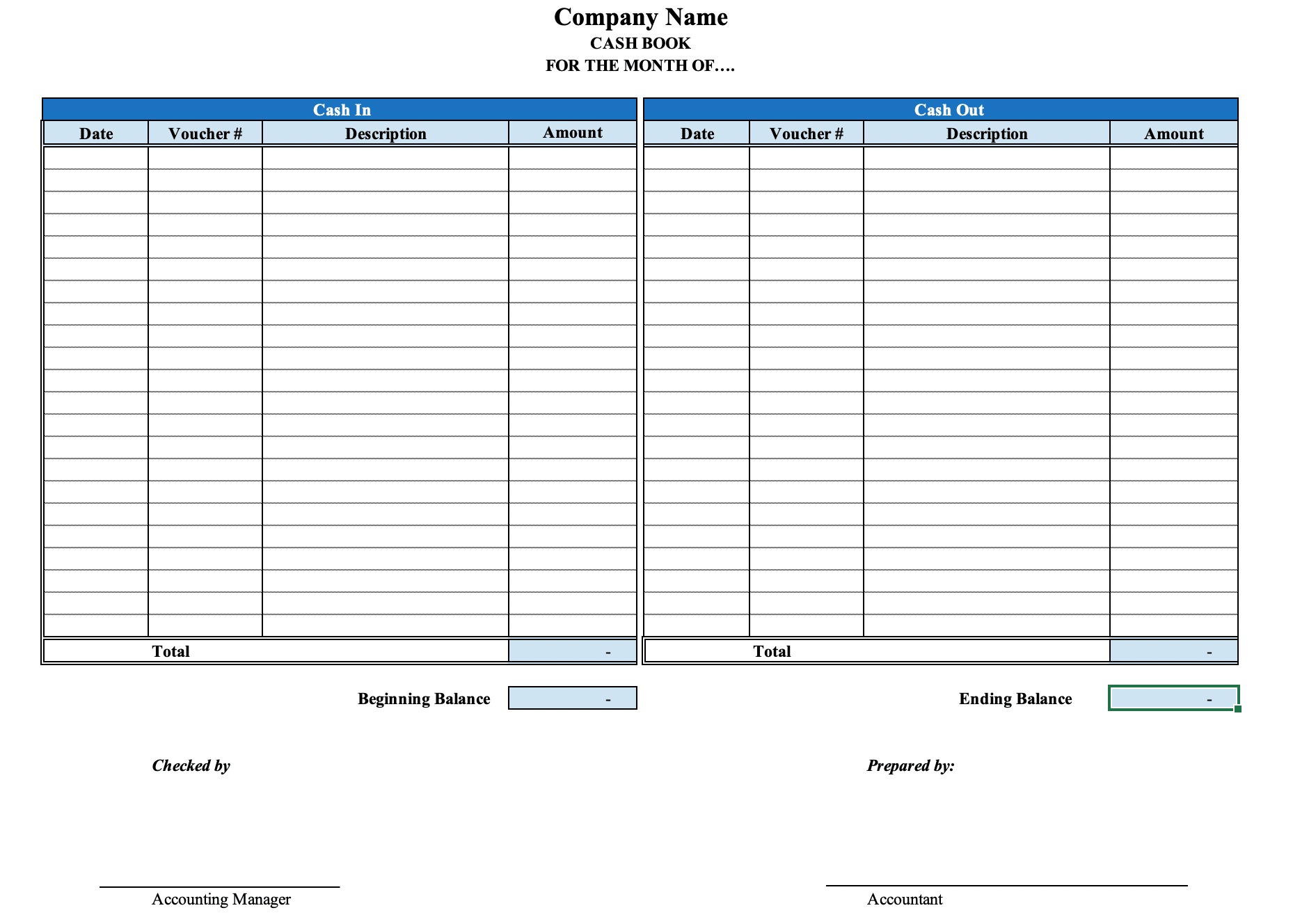

journal entry format accounting accounting journal entry template

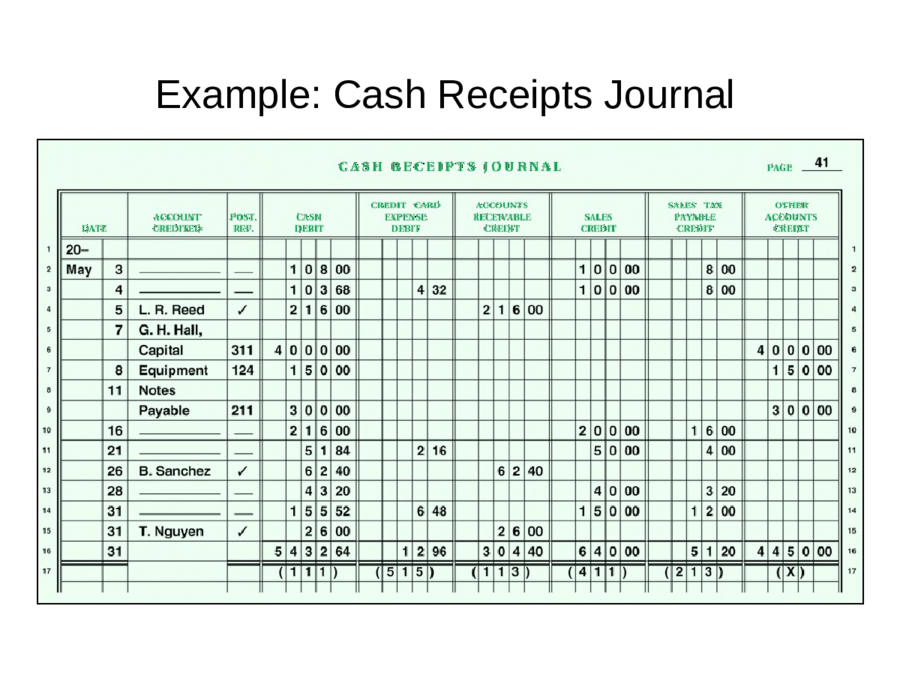

Web a cash receipts journal is a record of financial transactions that includes bank deposits and withdrawals as well as all cash payments and receipts..

Cash Receipts Journal Step by Step Guide With Examples

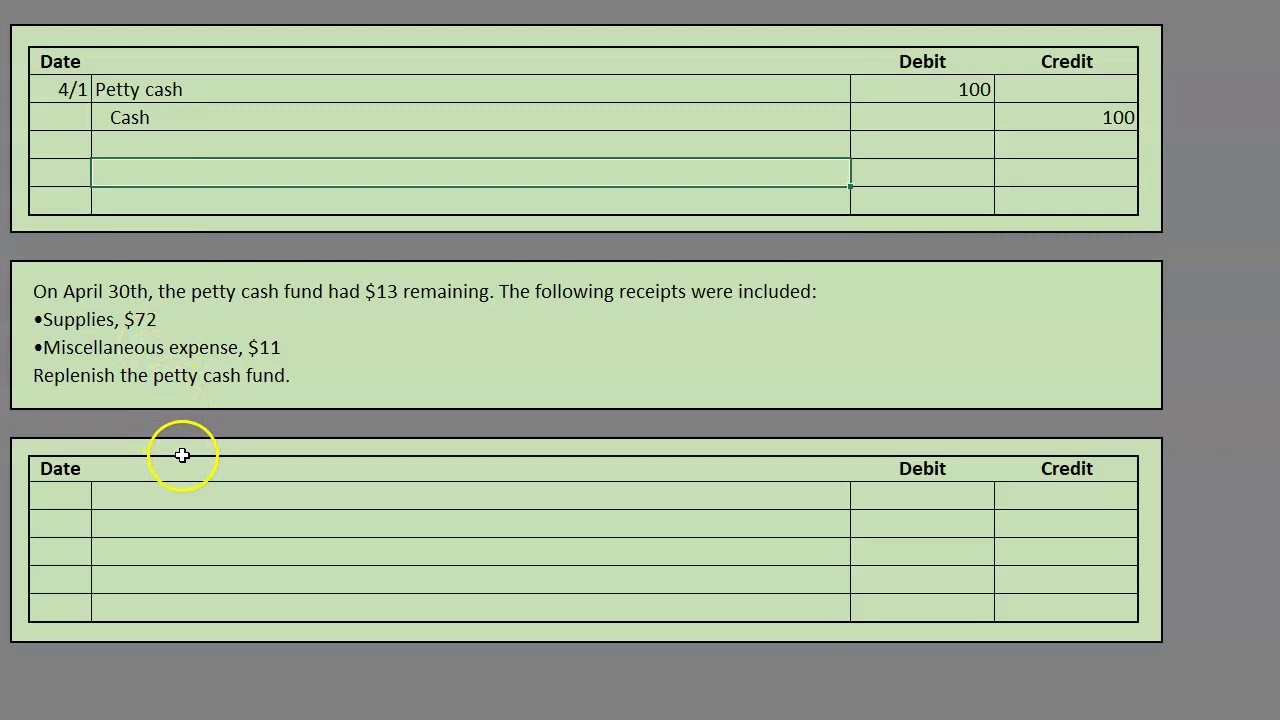

Web demonstrate petty cash journal entries and reconciliation. Web a cash sales journal entry is a type of accounting entry. Because cash is involved in.

Petty Cash Book Journal Entry Example Template Accountinguide

Normal balances, revenues & gains are usually credited, expenses & losses are usually. Web cash sales journal entry example. Web demonstrate petty cash journal entries.

Petty Cash Journal Entries YouTube

Whenever a business either spends or receives cash or a cash equivalent, then an entry must be recorded to account for this transaction. Hoover of.

In This Comprehensive Guide, We Will.

Web a cash sales journal entry is a type of accounting entry. Web in the journal entry, cash has a debit of $2,800. Normal balances, revenues & gains are usually credited, expenses & losses are usually. Knowing what to debit and what to credit are.

Web Therefore, The Journal Entry Would Look Like This:

Web when cash is debited and credited. Back to our example in the previous section: Cr bank loan payable 300,000. Transactions related to the purchase and sale of goods can be.

Web What Is The Cash Receipts Journal?

In accounting, assets such as cash or goods which are withdrawn from a business by the owner (s) for their. Web making accounting journal entries for cash are fundamental for a business. Web a cash receipts journal is a record of financial transactions that includes bank deposits and withdrawals as well as all cash payments and receipts. Web what are drawings and its journal entry (cash, goods)?

This Records Cash Sales Or Payment Received From The Buyer At The Time Of Transaction And Transfer Of.

Web the cash payment journal is used to record the cash disbursements made by check, including payments on account, payments for cash merchandise purchase,. Whenever cash is received, debit cash. The general ledger account is. Because cash is involved in many transactions, it is helpful to memorize the following: