Capitalization Accounting Journal Entries - Web the journal entry should be debiting repair and maintenance expenses and credit accounts payable or cash. Ifrs uses the term borrowing costs for costs incurred in relation to a debt used for construction of the asset. An item is capitalized when it is recorded as an asset, rather than an expense. Web to capitalize is to record a cost or expense on the balance sheet for the purposes of delaying full recognition of the expense. Web capitalize expense journal entry. Web journal entry of an asset capitalization records the acquisition of the asset on the balance sheet, debiting the fixed asset account, and crediting either cash or accounts payable. Web how to book capitalization and amortization for costs to obtain a contract journal entry. Capital lease accounting follows the principle of substance over form, wherein the assets are recorded in the lessee’s books as fixed assets. On the second line, record the. When you capitalize an asset in the period you added it, oracle assets creates the following journal entries:

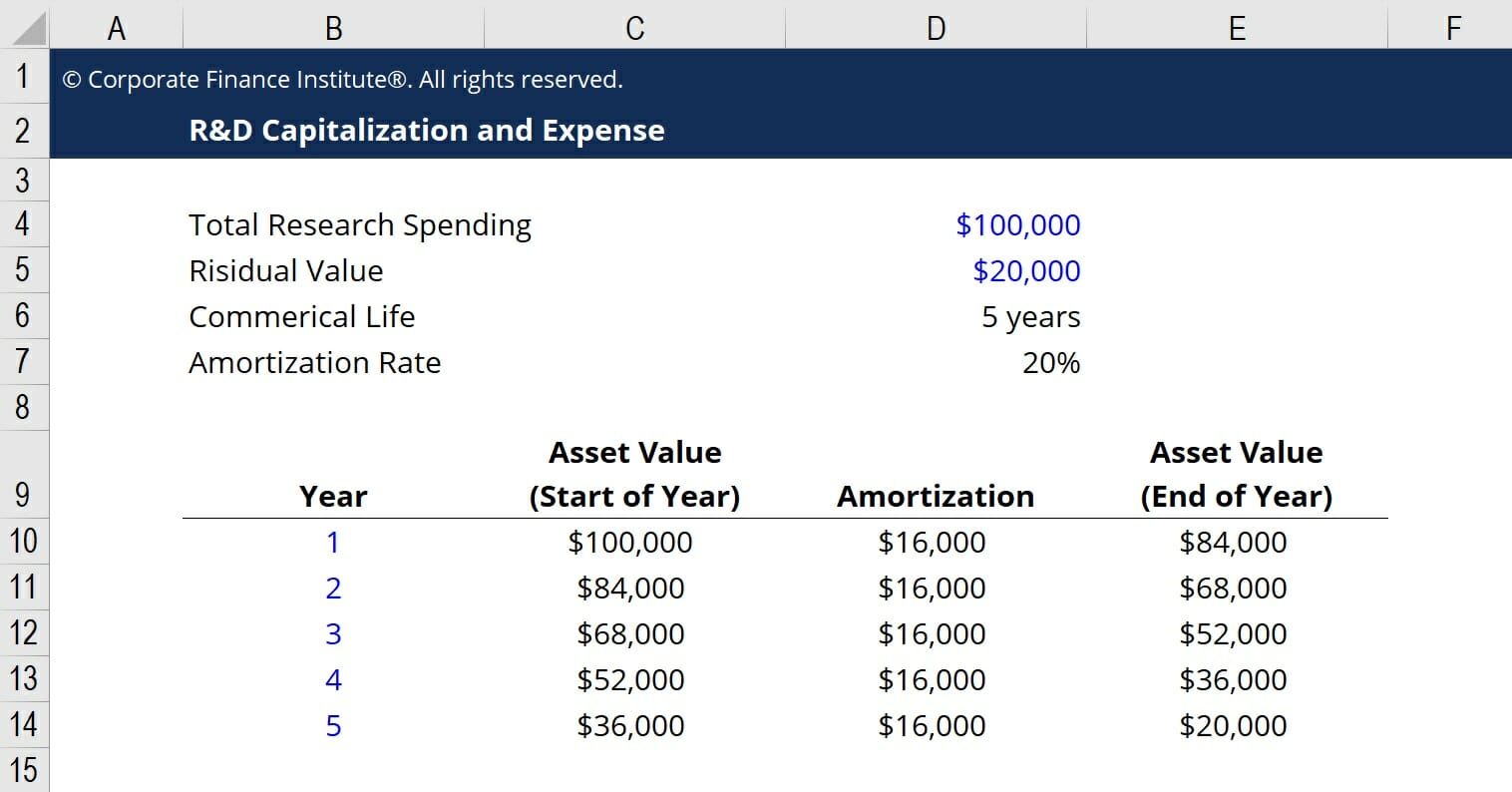

R&D Capitalization vs Expense How to Capitalize R&D

Revenue recognition under asc 606 requires the capitalization of costs to complete a contract. Web capitalization and amortization: This means that the expenditure will appear.

Basic Journal entry rule for CAPITAL [STEP BY STEP Guide] YouTube

Web in accountancy, capitalization means recording a cash outflow as an asset in the balance sheet. The journal entry is debiting fixed assets and credit.

Capitalize vs. Expense Cost Accounting Rules + Examples

This approach is used when a cost is not expected to be entirely consumed in the current period, but rather over an extended period of.

Capitalized cost — AccountingTools ⋆ Accounting Services

What are capitalized software costs? For example, when you purchase office supplies, you can expect you will use those supplies in the near future. The.

Mastering Accountancy A Comprehensive Guide to CBSE Board Exam Theory

This means that the expenditure will appear in the balance sheet, rather than the income statement. An item is capitalized when it is recorded as.

Capitalization What It Means in Accounting and Finance

Web how to book capitalization and amortization for costs to obtain a contract journal entry. What are capitalized software costs? Web to capitalize is to.

Capitalizing Versus Expensing Costs Learn accounting, Bookkeeping

It is depreciated ( expensed) over time. Web the purchase return process, also known as the returns outwards process, involves returning goods to a supplier.

Adjusting Journal Entries Defined Accounting Play

You place the asset in service so you can begin depreciating it. Web journal entry of an asset capitalization records the acquisition of the asset.

Accounting for Share Capital Accountancy Knowledge

The fixed assets on balance sheet will be increased. Reviewed by dheeraj vaidya, cfa, frm. Web prepare a journal entry to capitalize the total costs.

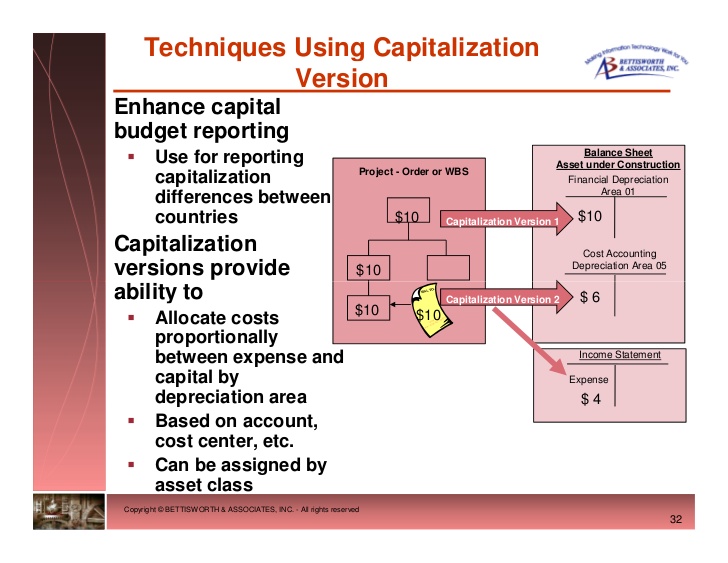

This Involves Recording The Incorporation Costs As An Asset On The Company’s Balance Sheet And Then Recognizing The Costs As An Expense Over A Period Of Time, Typically Through A Process Called Amortization.

Web capitalization and amortization: The journal entry is debiting fixed assets and credit accounts payable or cash. Web how to book capitalization and amortization for costs to obtain a contract journal entry. Repair and maintenance expenses will be present on income statement and reduce the company profit.

This Means That The Expenditure Will Appear In The Balance Sheet, Rather Than The Income Statement.

This is most often but is not limited to sales commissions. Capitalized software development costs example. Capitalization is the recordation of a cost as an asset, rather than an expense. A capitalization transaction is similar to an addition transaction:

Web In Accountancy, Capitalization Means Recording A Cash Outflow As An Asset In The Balance Sheet.

Capital lease accounting follows the principle of substance over form, wherein the assets are recorded in the lessee’s books as fixed assets. What are capitalized software costs? When you capitalize an asset in the period you added it, oracle assets creates the following journal entries: On the second line, record the.

Web The Purchase Return Process, Also Known As The Returns Outwards Process, Involves Returning Goods To A Supplier For Various Reasons Such As Defects, Wrong Quantity, Damaged Items, Or Overstock Situations.

Web capitalize expense journal entry. An item is capitalized when it is recorded as an asset, rather than an expense. Web prepare a journal entry to capitalize the total costs you've calculated. When the company spends on the capitalized expense, they need to record the fixed assets and credit cash or accounts payable.

![Basic Journal entry rule for CAPITAL [STEP BY STEP Guide] YouTube](https://i.ytimg.com/vi/QDkDDbSHIR8/maxresdefault.jpg)

:max_bytes(150000):strip_icc()/Capitalization-4199877-2f55ff48c0d64c698da654daec06325e.jpg)