Capital Lease Accounting Journal Entries - Step 2 recognize the unwinding of the lease liability and amortization of the right of use asset. Cashflow requirements under asc 842. The new lease accounting standard, asc 842, has introduced significant changes to how companies record and report leases. Web preparation for journal entries. Lease contracts with a bargain purchase option will also be treated as capital leases (see proposed. Web the capital lease journal entry would consist of a debit of $2900 (to the account for the capital lease liability), a debit of $100 (to the account for the interest expense), and a credit of $3,000 (to the account for accounts payable). The capital lease accounting journal entries are entered in such a way that the lessee owns the asset and is recorded accordingly in their balance sheet. If the lessee paid less in the first year, and then more in subsequent years for the lease payments, journal entries will look like the following: To illustrate the capital lease accounting treatment, consider the following example: Web capital lease journal entries.

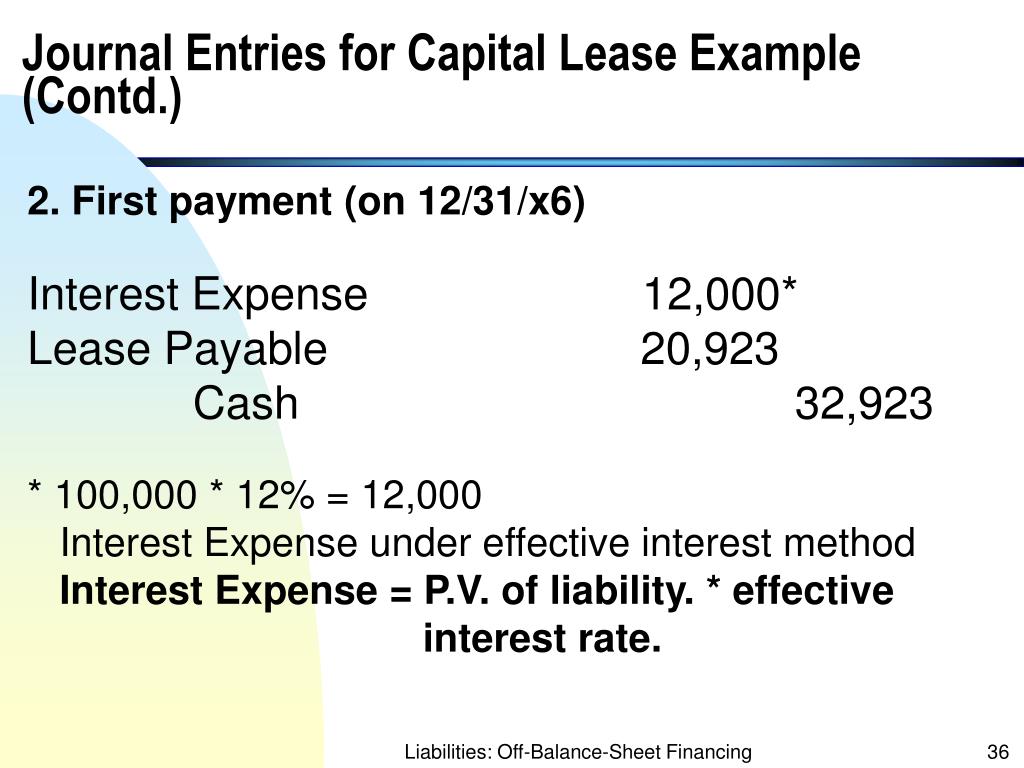

PPT Liabilities OffBalanceSheet Financing PowerPoint Presentation

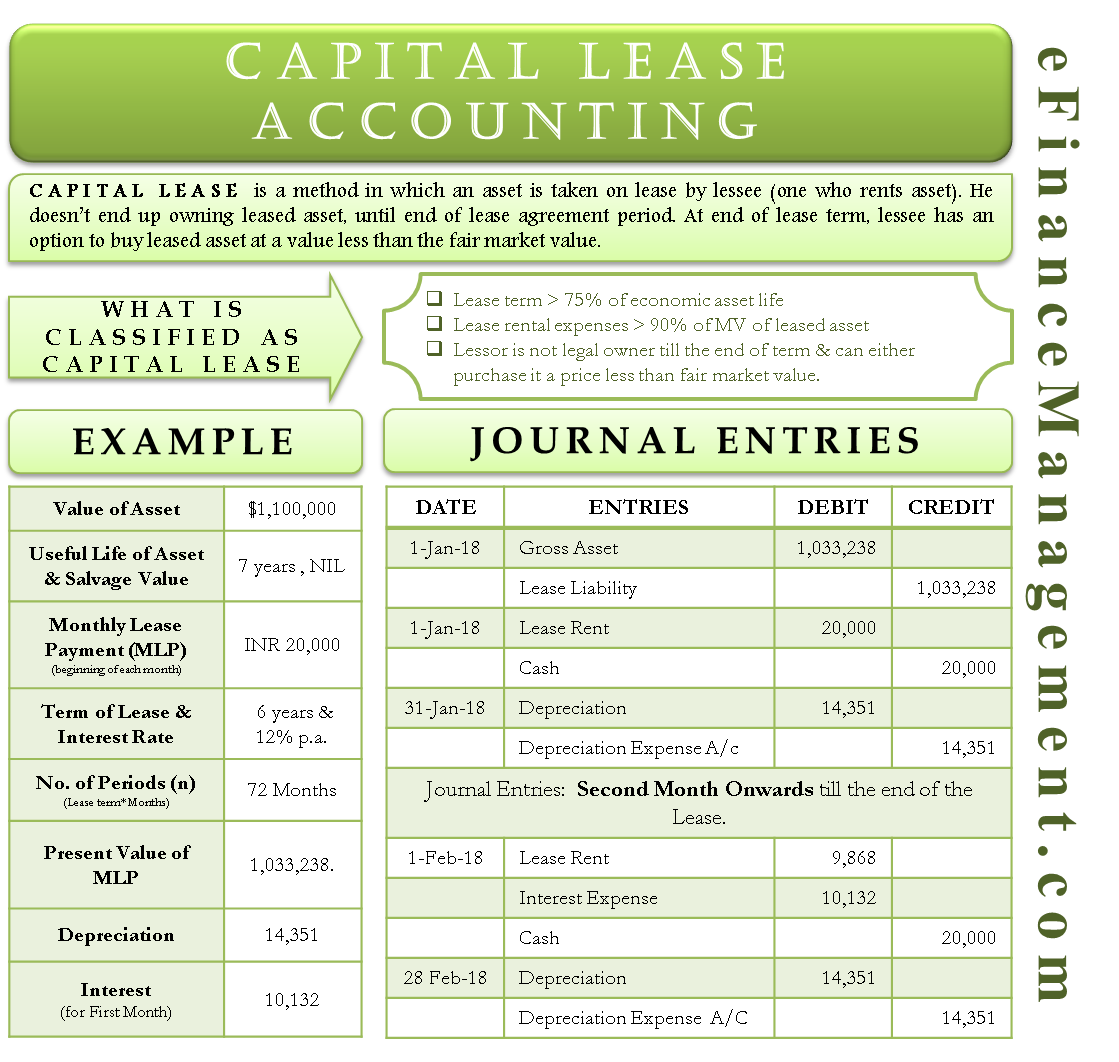

Meanwhile the lessor (or the owner of the asset) acts as the financing party. In a capital lease, the lessee (or the company renting the.

Journal entries for lease accounting

Capital lease refers to a lease where all the rights related to the assets are transferred to the lessee, and the lessor only finances the.

Check this out about Capital Lease Accounting Journal Entries

Before moving to journal entries, let’s list all the business events taking place during the course of the lease. Lease contracts with a bargain purchase.

Finance Lease Journal Entries businesser

Cashflow requirements under asc 842. Sale and leaseback transactions—updated june 2021 6.1 sale and leaseback. A capital lease is a lease in which the lessee.

Journal entries for lease accounting

Web the two most common types of leases in accounting are operating and finance (or capital) leases. What is considered a lease under ifrs 16?.

How to Calculate the Journal Entries for an Operating Lease under ASC 842

In a capital lease, the lessee (or the company renting the asset) is treated as if they purchased the asset using borrowed funds. Keep in.

Finance Lease Journal Entries Lessor businesser

Web the capital lease journal entry would consist of a debit of $2900 (to the account for the capital lease liability), a debit of $100.

Capital Lease Accounting Example, Preparation, Explanation & Criteria

What is considered a lease under ifrs 16? Web a lessee must use the capital lease accounting method in their new lease accounting journal entries.

Finance Lease Journal Entries businesser

Web capital lease journal entries for a capital lease were the fair value of all future lease payments, calculated as the present value of future.

Consistent With The Journal Description, The Lease Liability And Right Of Use Asset Are Recognized On The Balance Sheet.

This means that the lessee is assuming the risks and rewards of ownership of the leased asset. Web capital lease journal entries. For many businesses, navigating the complexities of asc 842 journal entries can be a daunting task. Web preparation for journal entries.

Capital Lease Refers To A Lease Where All The Rights Related To The Assets Are Transferred To The Lessee, And The Lessor Only Finances The Asset.

The annual lease payments are $25,000, and the implicit interest rate is 5%. Web when establishing an appropriate capitalization threshold, a lessee should evaluate all relevant quantitative and qualitative factors impacting both the financial statements and the footnote disclosures, including quantitative information about a lessee's lease costs. Web to account for a capital lease, familiarize yourself with the terms of the arrangement and make the appropriate journal entries. Capital lease journal entries included the initial recognition of the lease, along with finance lease interest, depreciation, and recording payments.

Meanwhile The Lessor (Or The Owner Of The Asset) Acts As The Financing Party.

Web as a result, on the commencement of the lease, you will recognize the following journal entries: The capital lease accounting journal entries are entered in such a way that the lessee owns the asset and is recorded accordingly in their balance sheet. Web understanding asc 842 journal entries for lease accounting. Web the two most common types of leases in accounting are operating and finance (or capital) leases.

Sale And Leaseback Transactions—Updated June 2021 6.1 Sale And Leaseback.

Accounting for lease incentives under asc 842. Web the ongoing accounting for finance leases will be substantially the same as the existing accounting for capital leases; It is the new normal for lease accounting around the world. Web asc 842 journal entries for finance leases.