Capital Contribution Journal Entry - So far we have demonstrated how to create a partnership, distribute the income or loss, and calculate income distributed at the end of the year after salaries have been paid. Web journal entry for cash withdrawn for personal use. Journal entry for the capital introduction. To record assets and note contributed by owner. Click on add new record button. Similarly create a bank account. When an investor pays a company for shares of its stock, the typical journal entry is for the company to debit the cash account for the amount of cash received and to credit the contributed capital account. Select the bank account and enter the amount in debit column. The company needs to make journal entries by debiting fixed assets or cash and credit share. Curtis begins with a remark in the introduction section that in a worldwide pandemic, leadership is the first victim.

PPT C H A P T E R PowerPoint Presentation ID348025

Select the bank account and enter the amount in debit column. You will have one capital account and one withdrawal (or drawing) account for each.

Capital Invested In Business Journal Entry Invest Walls

Journal entry for business started (in cash) when a business commences and capital is introduced in form of cash. Journal entry for the capital introduction..

a. On January 1, 2017, Frances Corporation started doing business and

Web what would be the journal entry to record the capital contribution? When the owner invests additional capital into the company, we need to record.

Capital Introduction Double Entry Bookkeeping

Capital contribution is a commonly used term in ifrs terminology when talking about accounting for group transactions in separate financial statements. When the owner invests.

Additional paid in capital vs contributed capital Journal Entries

Web when you start your business you need a capital introduction. Curtis begins with a remark in the introduction section that in a worldwide pandemic,.

Share Capital Problems and Solutions

You will have one capital account and one withdrawal (or drawing) account for each partner. Cash is an asset for the business hence debit the.

Accounting for Share Capital Accountancy Knowledge

Investors make capital contributions when a company. To record assets and note contributed by owner. (bank balance reduced by 5,000) adjustment entry to show the.

Journal Entries for Accounting Made Easy / Capital Contribution

Go to accounting and open journal entry. The journal entry is debiting cash $ 100,000 and crediting owner capital $ 100,000 account Suppose for example.

What Is A Cash Receipts Journal Report Printable Form, Templates and

To record assets and note contributed by owner. Web the accounting entry for the contributed capital are to debit cash or asset and credit shareholders’.

Either Way, This Reconciliation Helps Identify Any Items That Were Posted Incorrectly Or Back Dated.

It is a personal a/c and is adjusted from the capital. Web ahmed tanveer, aca. Web when you start your business you need a capital introduction. (owner’s capital reduced by 5,000) type of account and where is it shown in the financial statements.

Create An Account For Owner’s Contribution Under ‘Capital Accounts’ Head.

The capital account will be credited and the cash or assets brought in will be debited. Web usually, if there are differences then there are one of two likely culprits: In this journal entry, the debit is to the cash account, which represents the increase in cash that the company has received from the owner’s contribution. Click on add new record button.

Web The Payments Due On March 1, 2020, And March 1, 2021, However, Are Subject To A Time Restriction Because The Donor Does Not Make These Funds Available Until Those Dates.

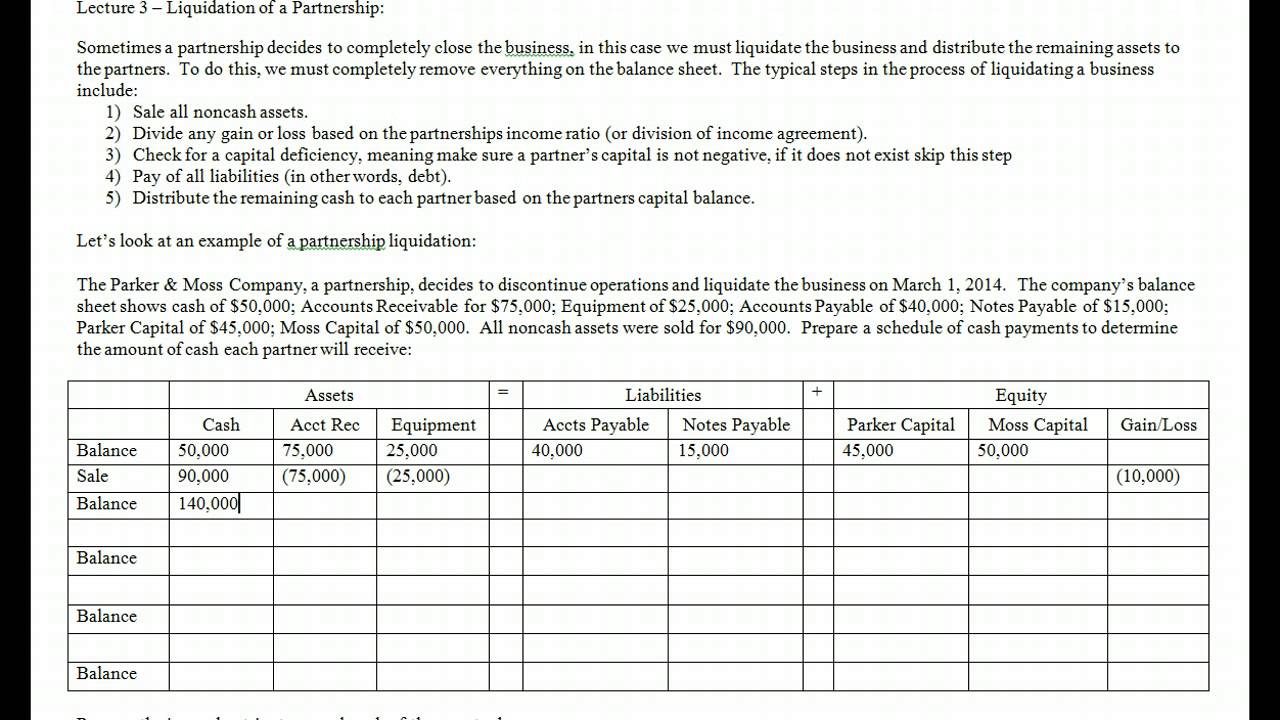

The capital introduction transaction is shown in the accounting records with the following bookkeeping entries: So far we have demonstrated how to create a partnership, distribute the income or loss, and calculate income distributed at the end of the year after salaries have been paid. Web accounting for contributed capital. Investors make capital contributions when a company.

Web This Entry Will Be Made In The Books Of The Company To Record The Capital Contribution.

Web the accounting entry for the contributed capital are to debit cash or asset and credit shareholders’ equity, reflecting the increase in assets and balance owed to shareholders. Journal entry for the capital introduction. Web journal entry for cash withdrawn for personal use. The business received an asset in the form of the equipment with a fair value of 2,000.