Bonds Payable Journal Entry - When a corporation issues a bond, they are essentially taking out loans from bondholders. Web journal entry of discount on bond payable. Web journal entry and example. Bond issue at par value. The receipt of cash when the bond is. The bond issuer must then make. The receipt of cash when the bond is. The accounting process carried out when working with bonds payable is. Web bonds payable are financial instruments representing a company’s commitment to pay back a specified sum to the owner of the instrument in a specified. Set up a bonds payable account.

Adjusting Entries for Bonds Payable YouTube

As a bond issuer, the company is a borrower. Bond carrying amount after first payment shall. Web the journal entry for this transaction is: Introduction.

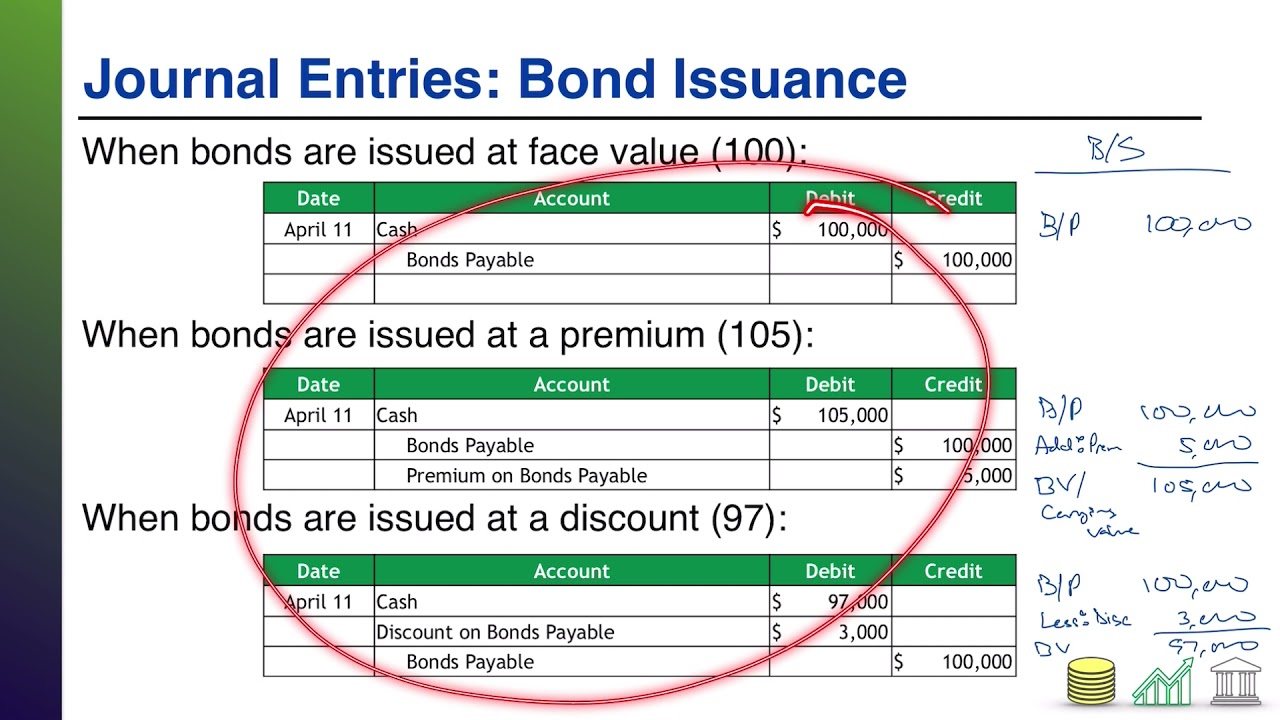

Bond Issuance Journal Entries and Financial Statement Presentation

Web the journal entry for this transaction is: Web journal entry and example. Introduction to bonds payable, bond interest and principal payments. Web with two.

Premium On Bonds Payable Journal Entry / Bonds Issued At A Premium

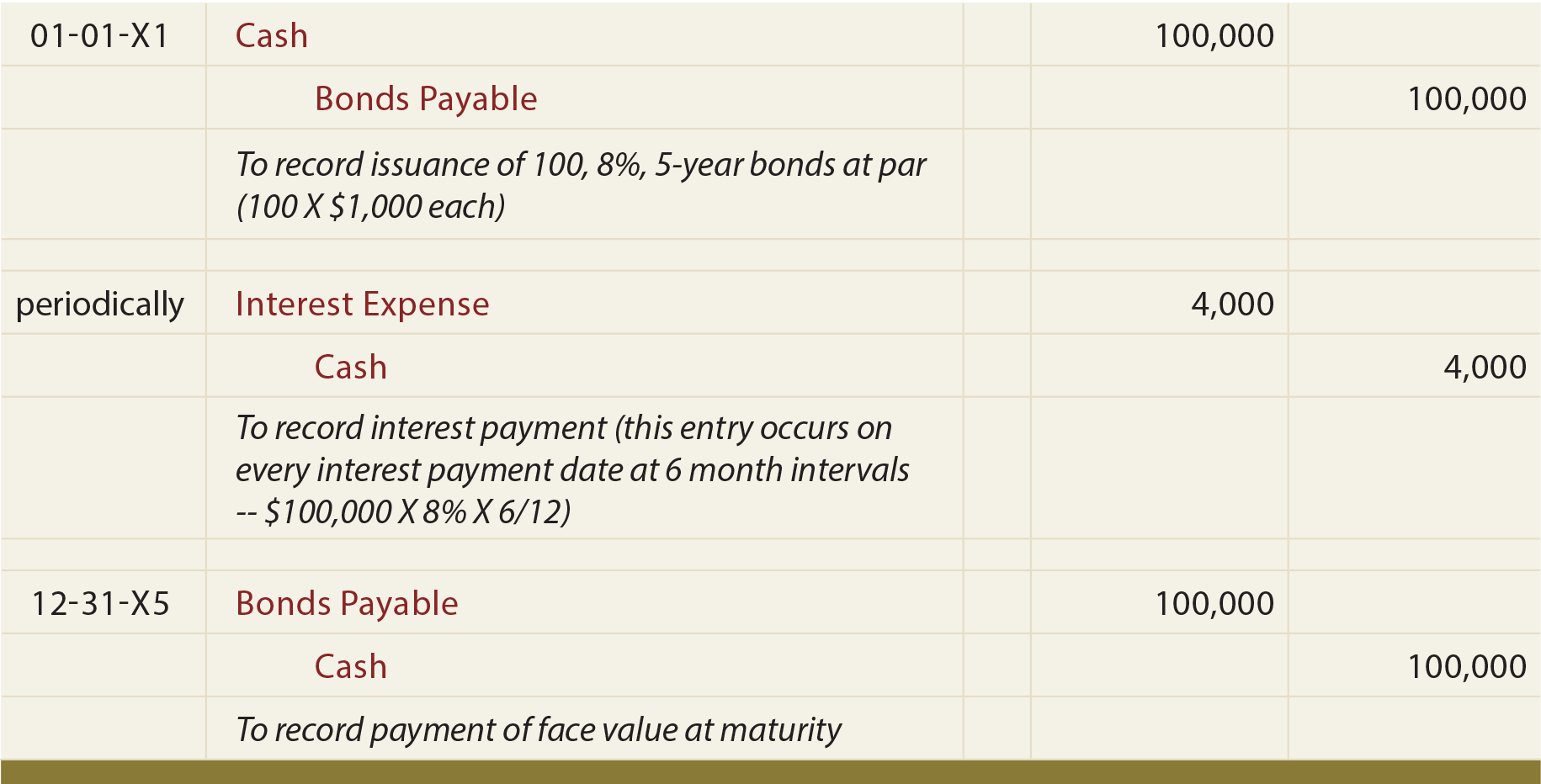

Web at the end of 5 years, the company will retire the bonds by paying the amount owed. The first difference pertains to the method.

Bonds Payable Lecture 2 Journal Entries YouTube

The receipt of cash when the bond is. Bonds payable are recorded when a company issues bonds to generate cash. Web there are four journal.

Solved Bonds Payable Journal Entries; Effective Interest

Earlier, we found that cash flows related to a bond include the following: Bonds issue at par value mean that the issuer sell bonds to.

Bonds Payable in Accounting Double Entry Bookkeeping

Accrued interest, bonds issued at par with no accrued interest. Introduction to bonds payable, bond interest and principal payments. Web journal entry of discount on.

Mastery Problem Liabilities Bonds Payable Journal Entries, Year 2

Bond carrying amount after first payment shall. Bonds can either be issued at par or a discount by the company. Web journal entry and example..

Bonds Issued Between Interest Dates

Web in this section, we will explore the journal entries related to bonds. As a bond issuer, the company is a borrower. Set up a.

Accounting For Bonds Payable

Bonds issue at par value mean that the issuer sell bonds to investors at par value. Web the journal entry is: Web the journal entry.

Bond Issue At Par Value.

The receipt of cash when the bond is. Web at the end of 5 years, the company will retire the bonds by paying the amount owed. Bonds issue at par value mean that the issuer sell bonds to investors at par value. If investors buy the bonds at a discount, the difference between the face value of the bonds and the amount of cash received is recorded in a.

Web Journal Entry And Example.

As a bond issuer, the company is a borrower. Web in this section, we will explore the journal entries related to bonds. Interest = interest amount per payable period. Web written by cfi team.

Introduction To Bonds Payable, Bond Interest And Principal Payments.

The accounting process carried out when working with bonds payable is. Accrued interest, bonds issued at par with no accrued interest. Note that the total amount received is debited to the cash account and the bond’s face amount is credited to bonds payable. Web journal entry for bonds.

Web In This Section, We Will Explore The Journal Entries Related To Bonds.

When a corporation issues a bond, they are essentially taking out loans from bondholders. Bonds can either be issued at par or a discount by the company. Web similarly, the journal entry for interest payment and bond amortization under the effective interest method is as follows: Web read our explanation (11 parts) free.