Bond Redemption Journal Entry - At the end of bond maturity, we can redeem the bonds back by paying the bondholders the amount equal to the face value of the bonds. Web make an entry to record bond redemption. Bond retirement means that the company buys back the bond that it previously sold, either at the maturity date or before the maturity date. Web this journal entry for the redemption of bonds will decrease both total assets (credit cash) and total liabilities (debit bonds payable) on the balance sheet by the same amount. Web when a bond is issued at its face amount, the issuer receives cash from the buyers of the bonds (investors) and records a liability for the bonds issued. Repayment of the bond at maturity; Chapter 14 part 2 tutorial #28 (overall) Web bond retirement journal entry overview. Web the journal entry of bond interest payment will increase total expenses on the income statement while decreasing total assets on the balance sheet. 273 views 4 years ago.

Premium On Bonds Payable Journal Entry / Bonds Issued At A Premium

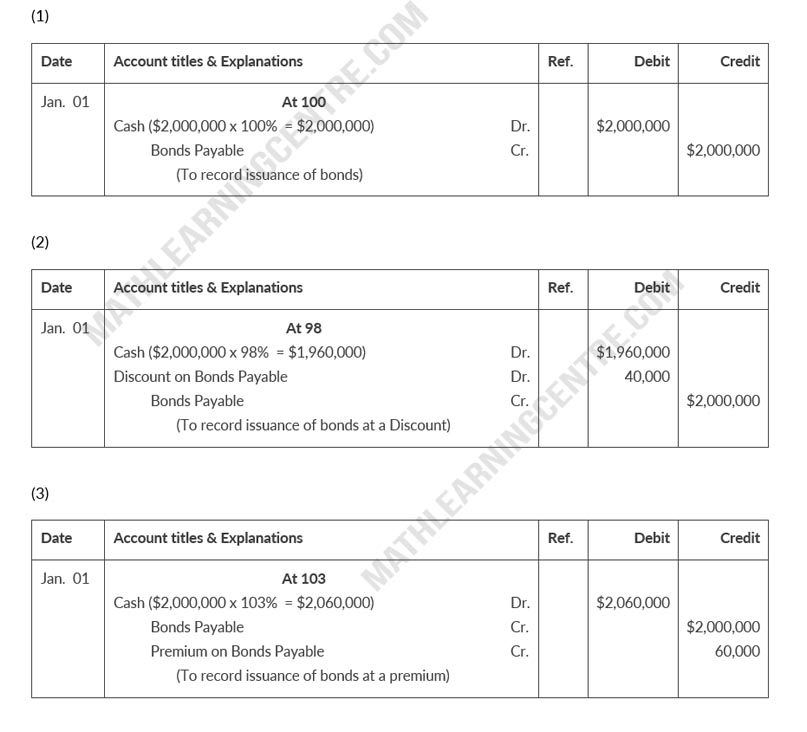

Be able to describe when a bond is issued at a premium, and prepare journal entries for its issuance. A bond is said to be.

Swisher Company issued 2,000,000 of bonds on January 1, 2019

This includes the retirement journal entry at the maturity, before maturity as well as by conversion. A journal entry must be made for each of.

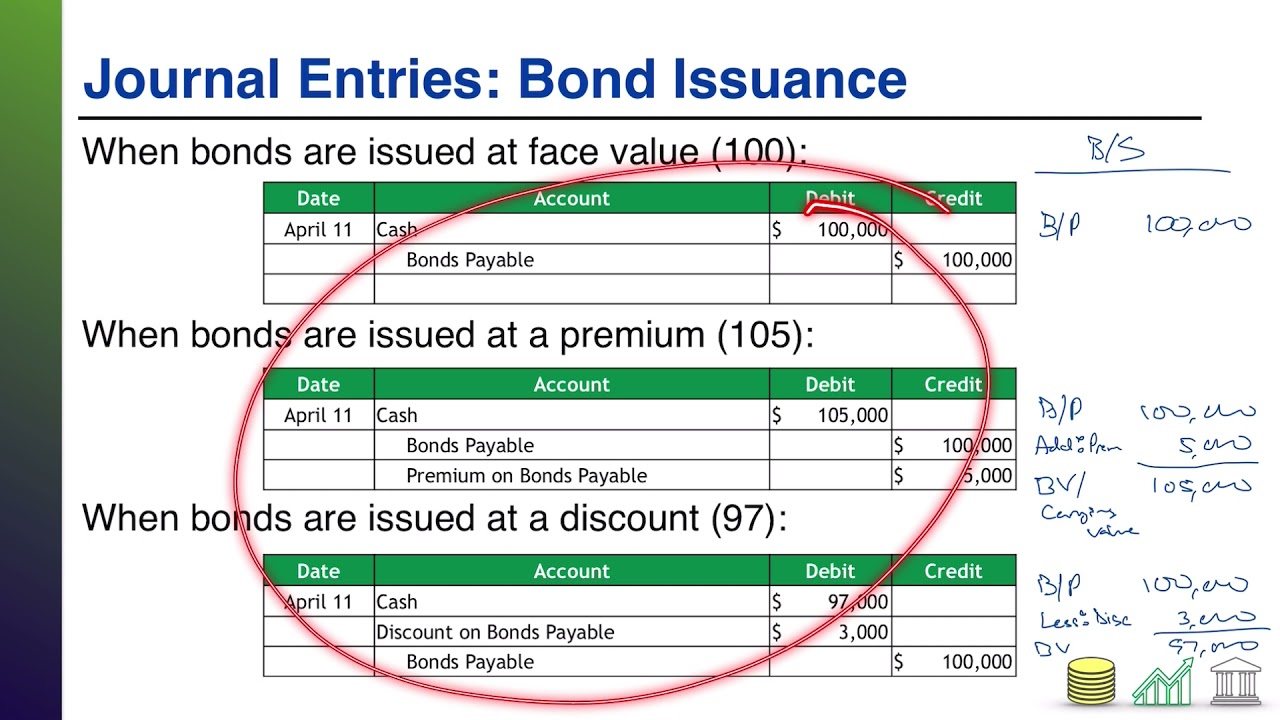

Bond Issuance Journal Entries and Financial Statement Presentation

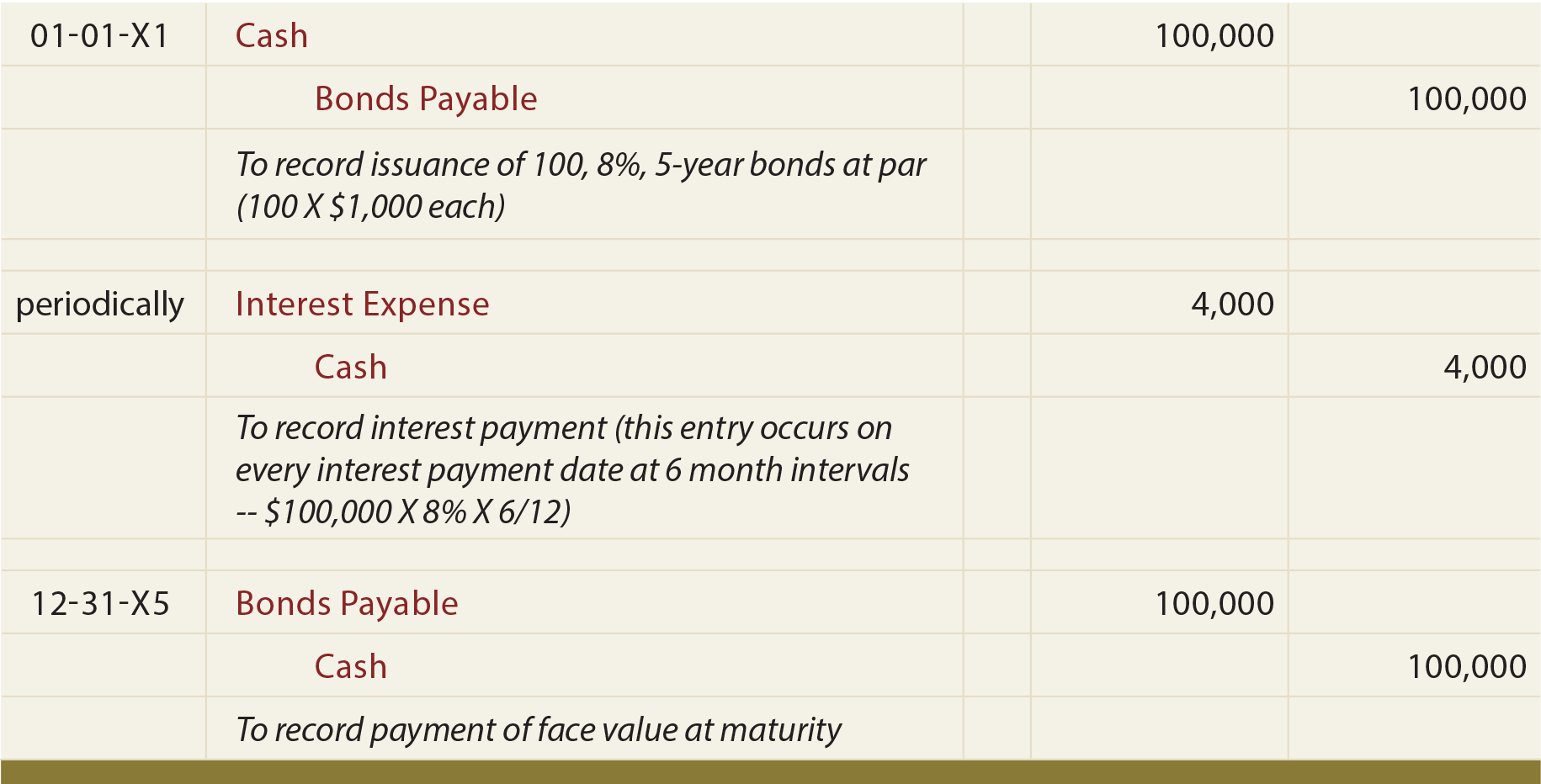

Prepare journal entries for the entire life cycle of a bond issued at par. 1.2k views 3 years ago acc 112. Web the journal entry.

Redeeming Bonds (Journal Entries) YouTube

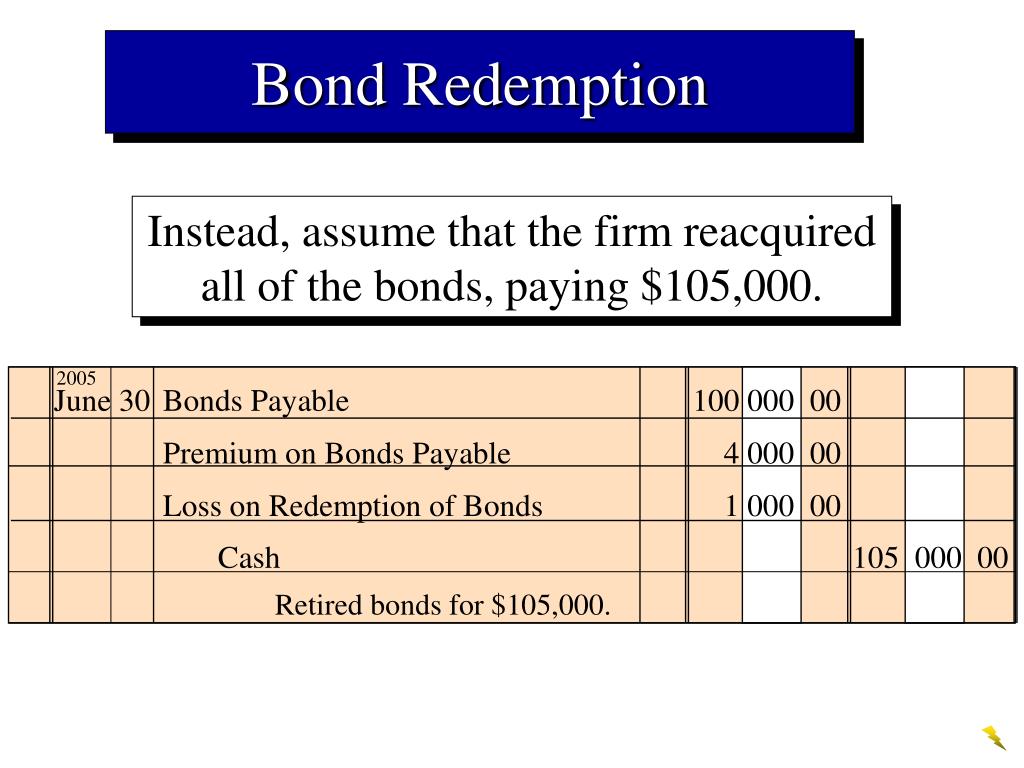

The following table summarizes the bond redemption journal entry: To record bonds issued at face value. Web company g should record the gain on early.

Accounting For Bonds Payable

273 views 4 years ago. Likewise, the company needs to properly make the journal entry for bond retirement as it usually results in gain or.

Calculate Gain or Loss on Bond Redemption YouTube

The liability is recorded because the issuer is now liable to pay back. Make entries for a debit to cash and a credit to investment.

PPT Chapter 13 PowerPoint Presentation, free download ID6561526

The conversion can be done at any time before the maturity date and it depends on the bond holder’s discretion. Reviewing journal entries for redeeming.

Chapter 11 Journal Entry Bond&Discount Bonds YouTube

A bond is said to be retired early when either the issuer or bondholder redeems the bond in exchange of cash before its original maturity.

Early Redemption of Bonds Wize University Introduction to Financial

Web this journal entry is made to eliminate the interest receivable that the company has recorded previously for the accrued interest on the bond investment..

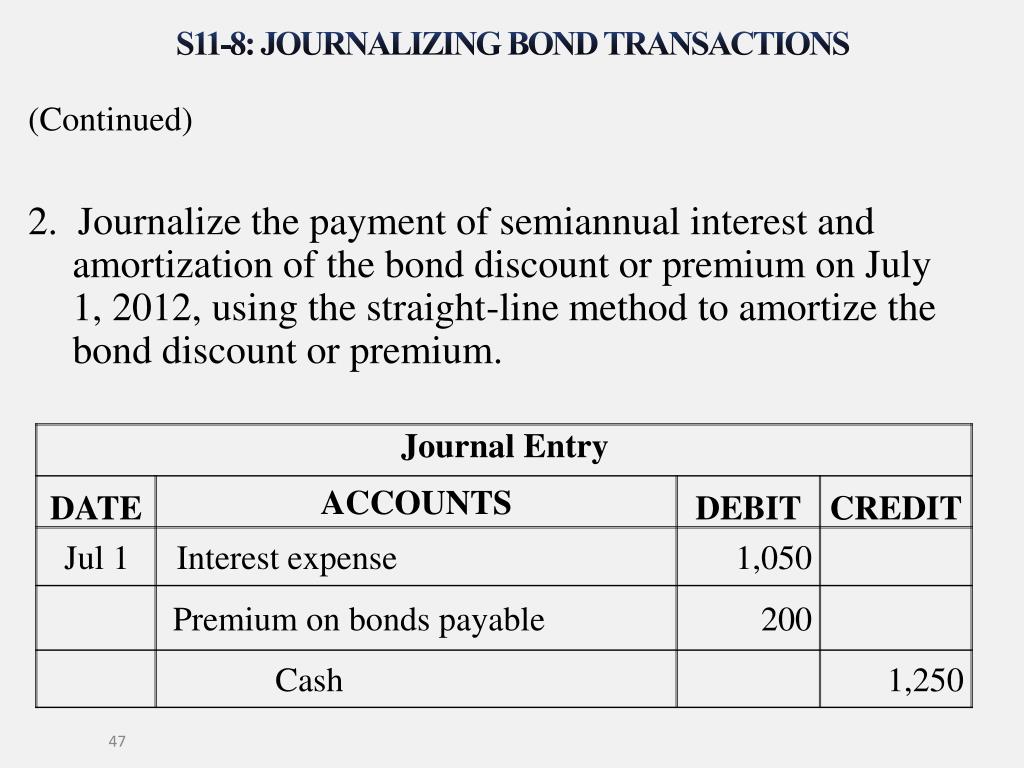

Amortize The Discount Or Premium;

Web in this section, we will explore the journal entries related to bonds. One entry to record cash received from investors and another entry to record liabilities incurred by issuing bonds. Web bond retirement journal entry overview. Web this video walks through how to account for a note that is redeemed prior to the maturity date.

A Journal Entry Must Be Made For Each Of These Transactions.

1.2k views 3 years ago acc 112. This includes the retirement journal entry at the maturity, before maturity as well as by conversion. Web in a bond redemption journal entry, the bonds payable account is decreased by the face value of the bonds that have been redeemed, while the cash account is decreased by the same amount. Web this journal entry for the redemption of bonds will decrease both total assets (credit cash) and total liabilities (debit bonds payable) on the balance sheet by the same amount.

Chapter 14 Part 2 Tutorial #28 (Overall)

Bond retirement means that the company buys back the bond that it previously sold, either at the maturity date or before the maturity date. Make entries for a debit to cash and a credit to investment in bonds for the face value of the redeemed bonds. When the bond is redeemed by the bond issuer at the maturity date, the company can make the journal entry to remove the investment in bonds from the. 273 views 4 years ago.

Web When A Bond Is Issued At Its Face Amount, The Issuer Receives Cash From The Buyers Of The Bonds (Investors) And Records A Liability For The Bonds Issued.

Web in this section, we will explore the journal entries related to bonds. At the end of bond maturity, we can redeem the bonds back by paying the bondholders the amount equal to the face value of the bonds. The liability is recorded because the issuer is now liable to pay back. Repayment of the bond at maturity;