Bond Issuance Journal Entry - The money receive equal to bonds par value. Compare the accounting methods and reporting. The first accounting treatment occurs when the bond originates and warrants an entry in the. Earlier, we found that cash flows related to a bond include the following: The valenzuela corporation is required to make semiannual interest payments of $6,000 or $100,000 x 6%. Web learn how to account for bond issuance, interest payments, amortization, and redemption from the perspective of the issuer. The receipt of cash when the bond is. Web bonds payable journal entry example (debit, credit) suppose a company raised $1 million in the form of bond issuances. Bond accounting means accounting for cash received from the buyer upon issuance of the. Web reviewed by dheeraj vaidya, cfa, frm.

Accounting For Bonds Payable

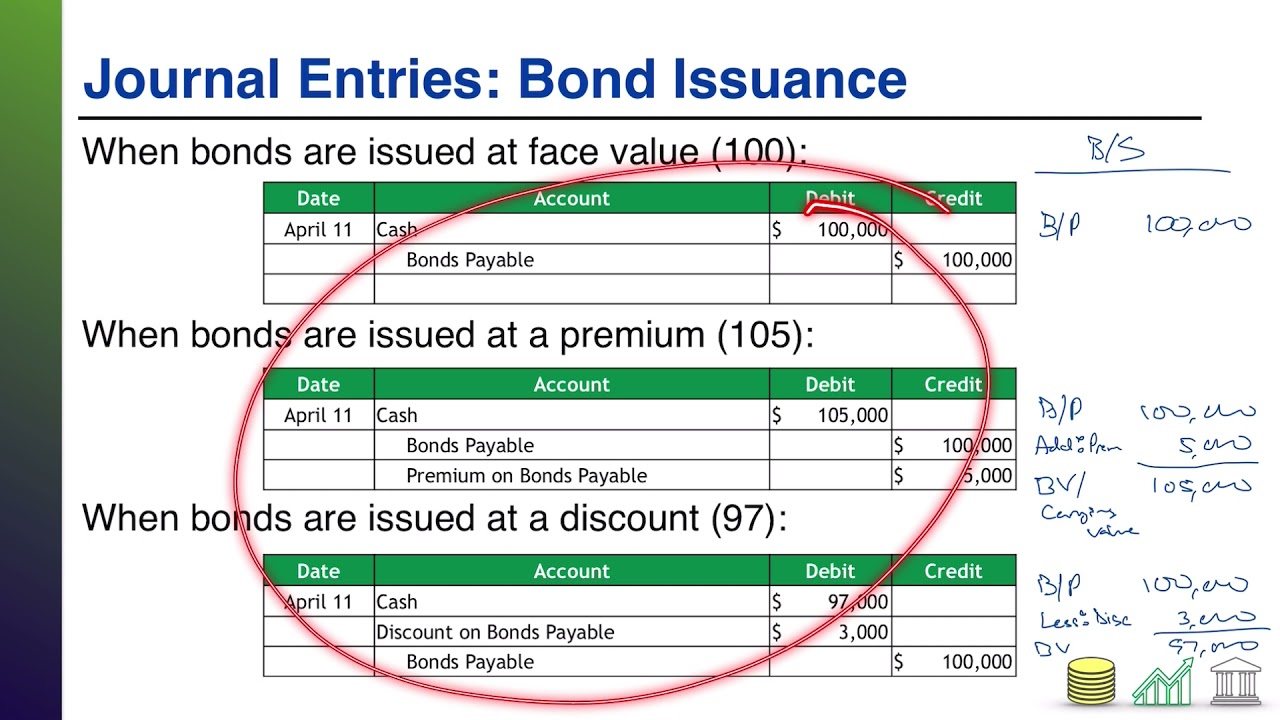

The first accounting treatment occurs when the bond originates and warrants an entry in the. As this entry illustrates, cash is debited for the actual.

Bonds Payable Lecture 2 Journal Entries YouTube

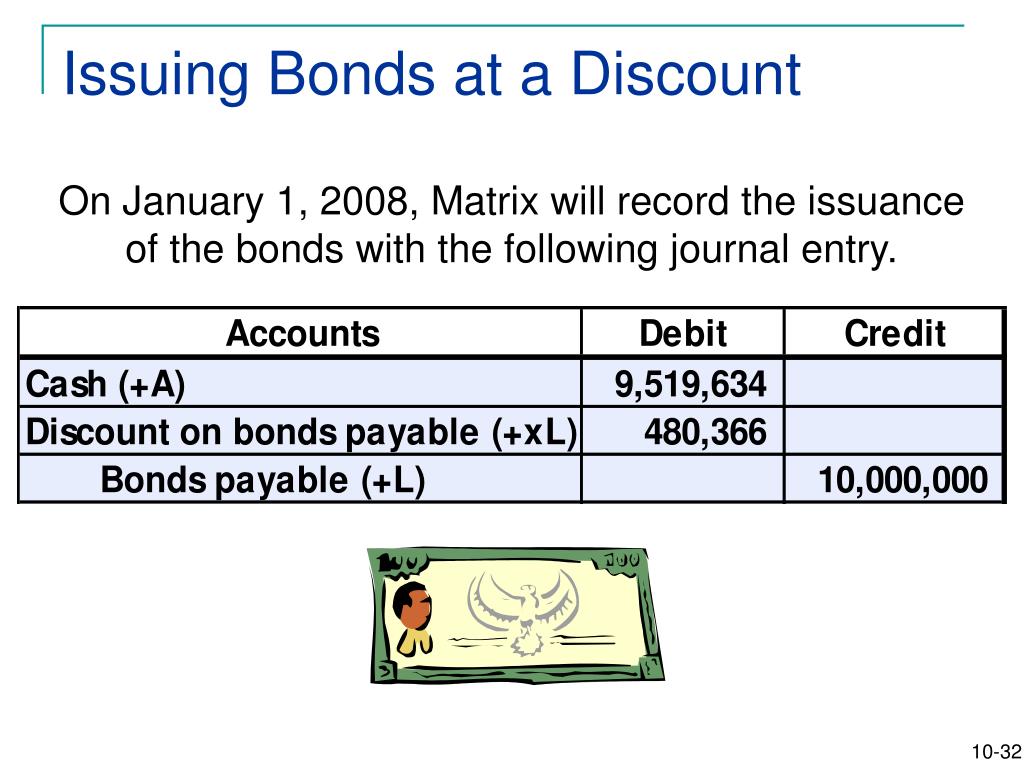

Web record the appropriate book entries upon issuing the bond. Learn how to record bond issuance, interest payment, and principal repayment in different scenarios. Web.

PPT Chapter 10 PowerPoint Presentation, free download ID5555855

Learn how to record bond issuance, interest payment, and principal repayment in different scenarios. Web reviewed by dheeraj vaidya, cfa, frm. See how to calculate.

Journal Entries for Bond Issuance YouTube

Web learn how to account for the issuance of bonds at par, premium, or discount with examples and journal entries. Web learn how to account.

Bond Issuance Journal Entries and Financial Statement Presentation

This video walks students through the journal. See how to calculate the present value, coupon. Web in this journal entry, the cash we receive from.

Bonds Issued Between Interest Dates

This web page has a glitch and cannot be. Earlier, we found that cash flows related to a bond include the following: The valenzuela corporation.

Issuance of Bonds Journal Entries YouTube

Web learn how to account for bond issuance, interest payments, amortization, and redemption from the perspective of the issuer. The money receive equal to bonds.

Prepare The Journal Entry For The Issuance Of Thes...

Web reviewed by dheeraj vaidya, cfa, frm. Web if monthly financial statements are issued by the corporation, the following journal entries are needed in the.

P108A, Prepare journal entries to record issuance of bonds, interest

Bond issue at par value. Web learn how to account for bond issuance, interest payments, amortization, and redemption from the perspective of the issuer. See.

See Examples Of Journal Entries For Bonds Issued At Par, Disco…

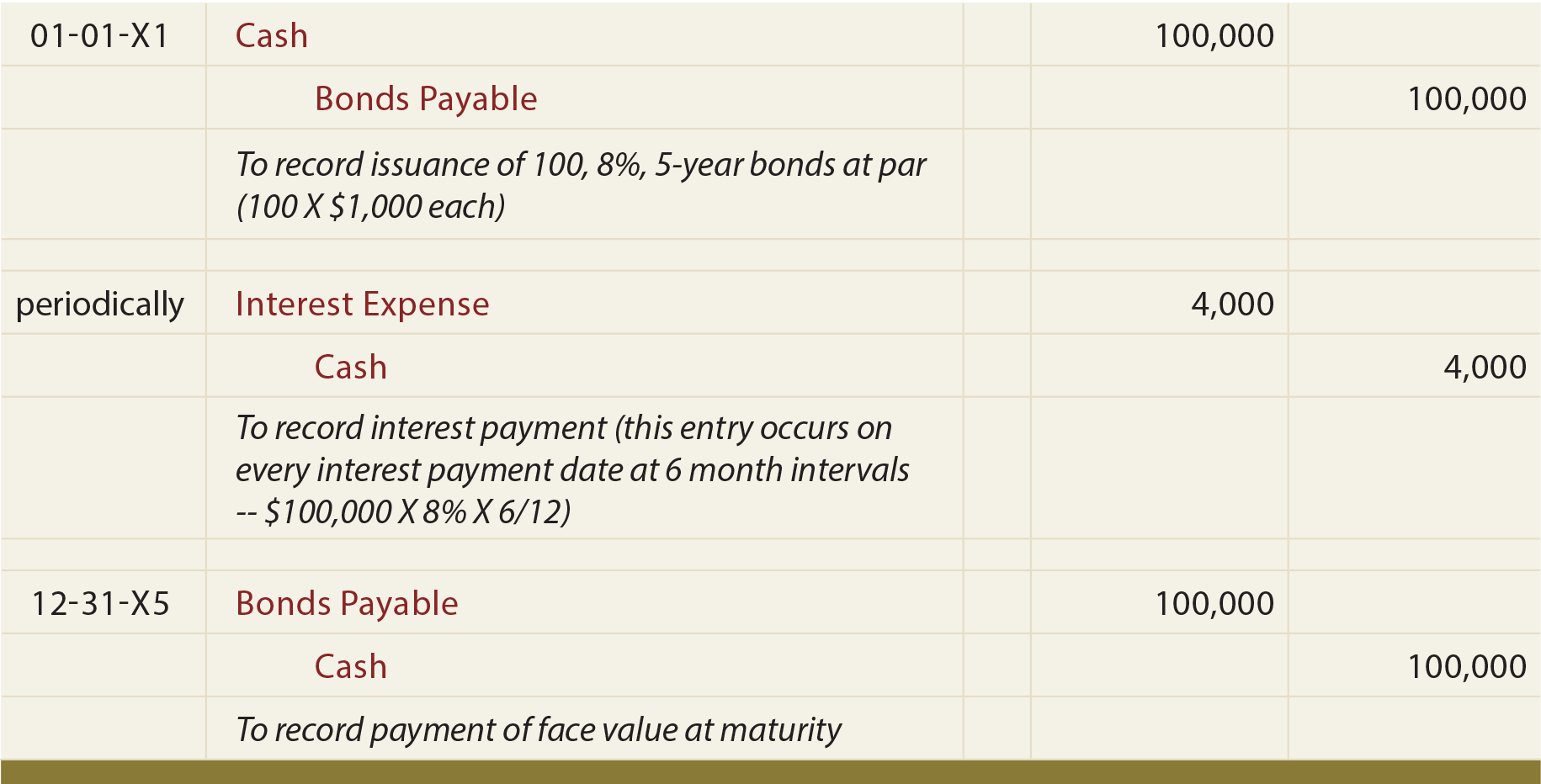

The journal entries would be as follows:. Bonds issue at par value mean that the issuer sell bonds to investors at par value. Web learn how to account for the issuance of bonds at par, premium, or discount with examples and journal entries. Learn how to record bond issuance, interest payment, and principal repayment in different scenarios.

4.9K Views 2 Years Ago Notes Payable, Bonds Payable.

Web the journal entry to record this bond issue is: Compare the accounting methods and reporting. Web bonds payable journal entry example (debit, credit) suppose a company raised $1 million in the form of bond issuances. Bond issue at par value.

The Valenzuela Corporation Is Required To Make Semiannual Interest Payments Of $6,000 Or $100,000 X 6%.

The money receive equal to bonds par value. See how to calculate the present value, coupon. The first accounting treatment occurs when the bond originates and warrants an entry in the. Explain the handling of notes and bonds that are sold.

Web In This Journal Entry, The Cash We Receive From Issuing The Bonds Equals The Face Value Of The Bonds.

See examples of journal entries for different scenarios and bond features. Web the corporation’s journal entry to record the issuance of the bond on january 1, 2023 will be: Hence, the carrying value of the bonds payable on the balance sheet equals. Web learn how to account for bond issuance, interest payments, amortization, and redemption from the perspective of the issuer.