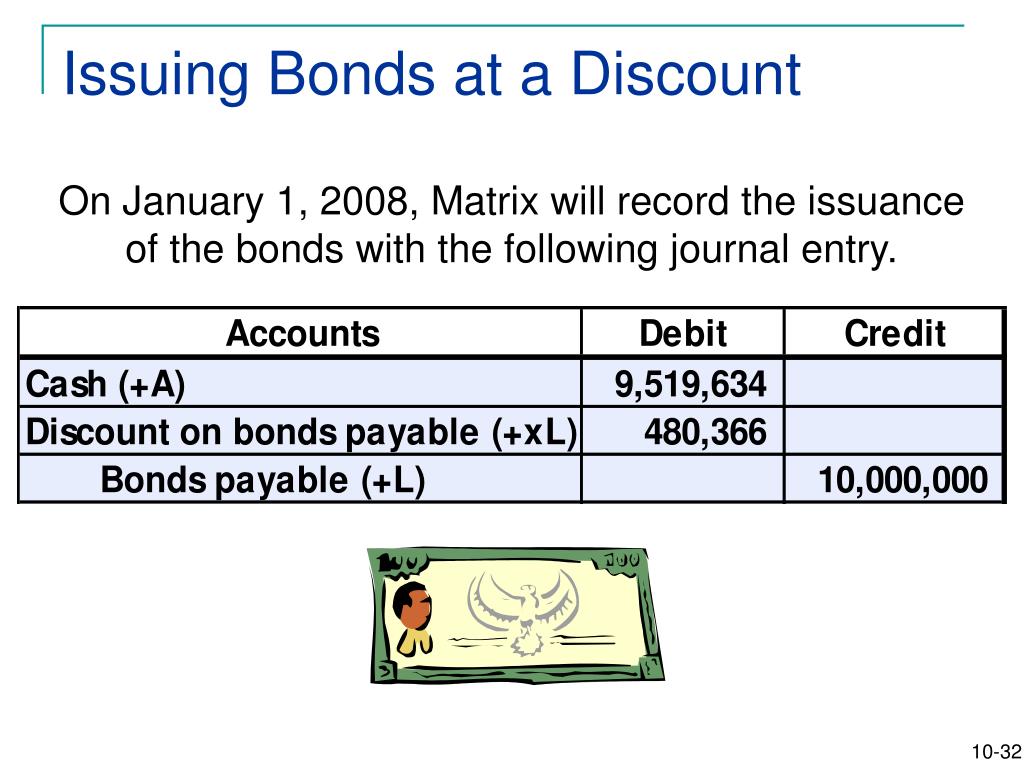

Bond Discount Journal Entry - Unamortized bond discount is a contra account to bonds payable which its normal balance is on. The transaction will increase the investment account on the balance sheet and reduce the cash amount. If investors buy the bonds at a discount, the difference between the face value of the bonds and the amount of cash received is recorded in a. On 31 dec 202x, the company needs to record debit interest expense and credit cash or interest payable. Web the bond premium of $4,100 must be amortized to interest expense over the life of the bond. Web the journal entry to record the valenzuela bonds is shown as: Today, the company receives cash of $91,800.00, and it agrees to pay $100,000.00 in the future for 100. Web bond discount amortization is the process through which bond discount is written off over the life of the bond. The amount a bond sells for below face value is a discount. Web the bond discount account in this journal entry is a contra account to bonds payable on the balance sheet, in which its normal balance is on the debit side.

PPT Chapter 10 PowerPoint Presentation, free download ID5555855

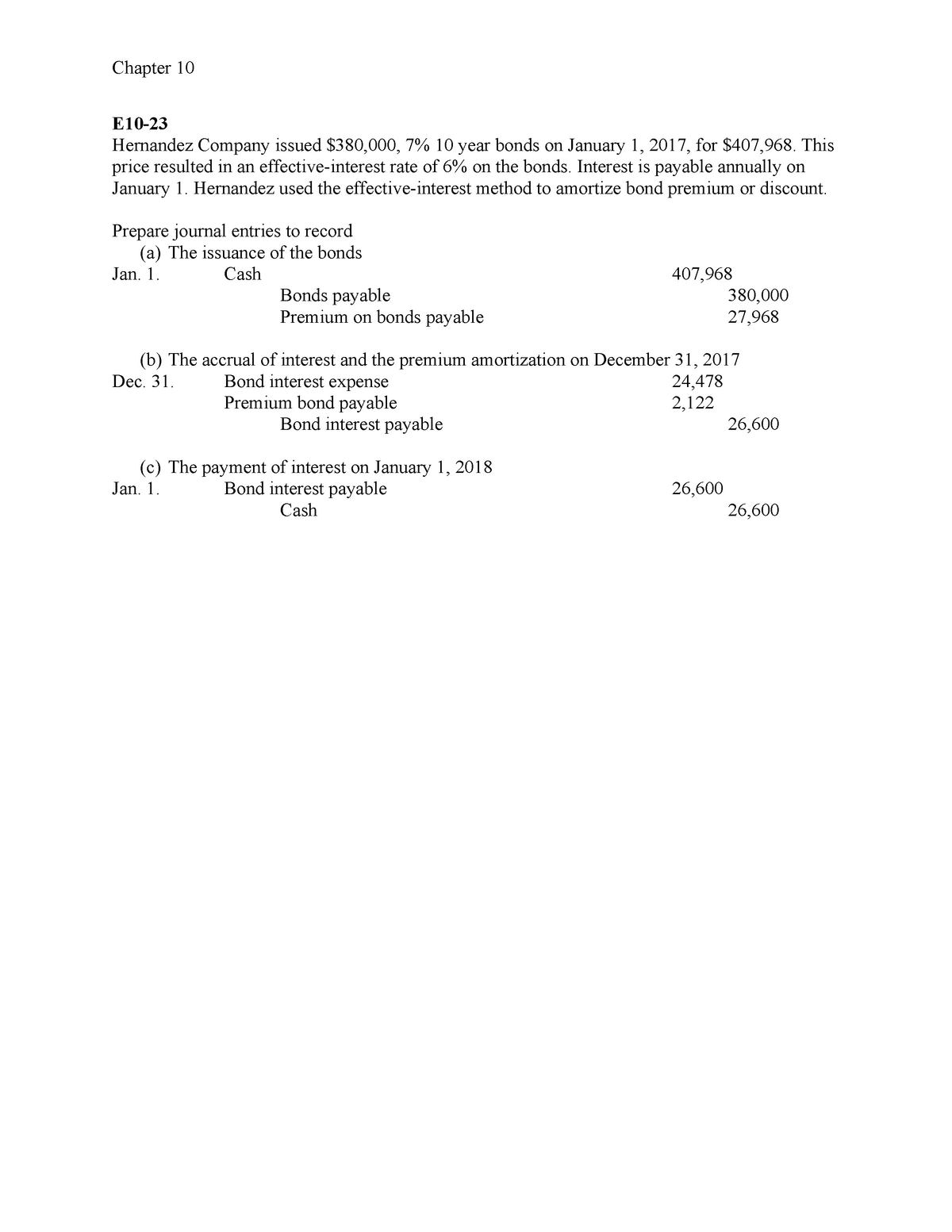

The credits go to discount on bonds payable for $2,635 and cash for $7,000. Using the effective interest rate method;. Web the journal entry is.

Chapter 11 Journal Entry Bond&Discount Bonds YouTube

Web the quick answer, without covering how the discount arises or the method of amortisation, is the journal entry requires a debit to the interest.

Bonds Payable at a Discount

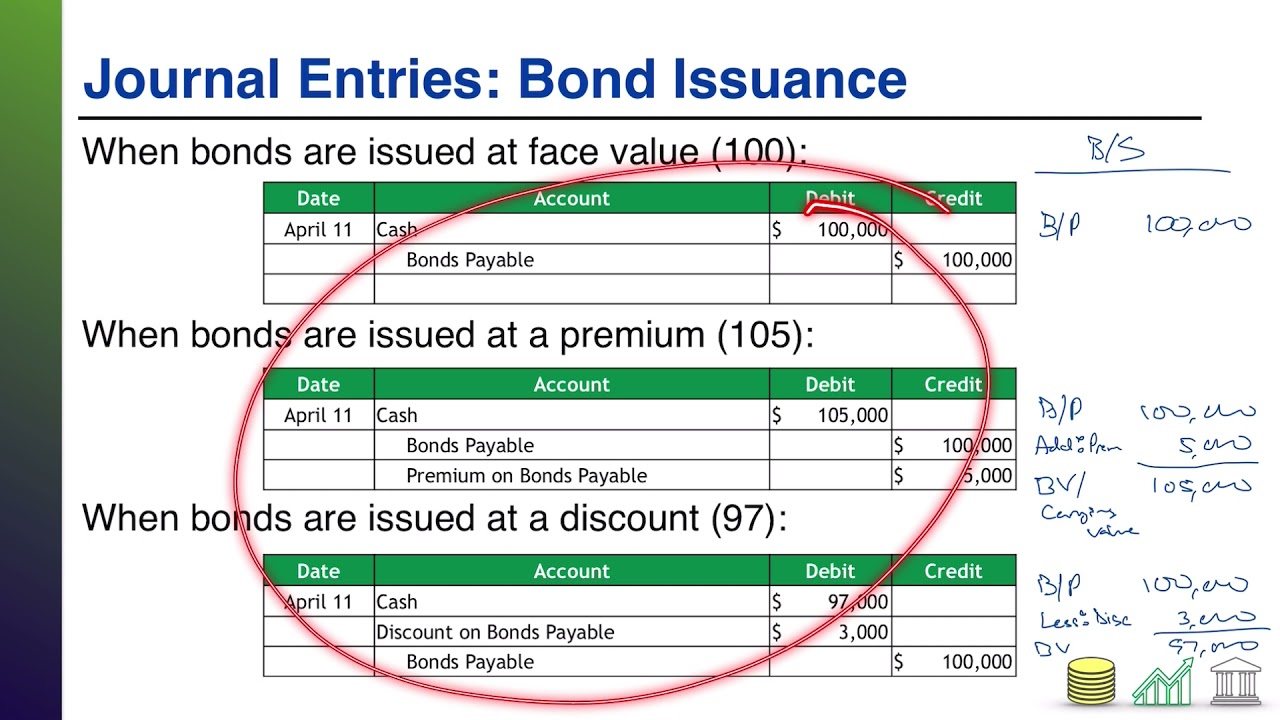

A difference between face value and issue price exists. Web the journal entry is debiting investments in bonds and credit cash. Web guide to bond.

Bonds Payable Lecture 2 Journal Entries YouTube

Web on selling 100 of the $1,000 bonds today, the journal entry would be: Web what is the journal entry for issuing bond at a.

Amortizing Bond Discount with the Effective Interest Rate Method Góc

Web on selling 100 of the $1,000 bonds today, the journal entry would be: There are two primary methods of bond amortization:. Web what is.

Bond Issuance Journal Entries and Financial Statement Presentation

The transaction will increase the investment account on the balance sheet and reduce the cash amount. Web journal entry for interest expense: This journal entry.

Bonds Issued Between Interest Dates

A difference between face value and issue price exists. Web the bond discount account in this journal entry is a contra account to bonds payable.

Bond discount, entries for bonds payable transactions, interest method

As this entry illustrates, cash is debited for the actual proceeds received, and bonds payable is. Web guide to bond accounting. Web the bond discount.

Bond Discount with StraightLine Amortization AccountingCoach

Web the bond discount account in this journal entry is a contra account to bonds payable on the balance sheet, in which its normal balance.

Web The Journal Entry To Record Year 1 Is To Debit Interest Expense For $9,635.

The amount a bond sells for below face value is a discount. Using the effective interest rate method;. This journal entry need to record. Web what is the journal entry for issuing bond at a discount and the amortization of bond discount using:

Web Bond Discount Amortization Is The Process Through Which Bond Discount Is Written Off Over The Life Of The Bond.

A difference between face value and issue price exists. Today, the company receives cash of $91,800.00, and it agrees to pay $100,000.00 in the future for 100. Web since a bond’s discount is caused by the difference between a bond’s stated interest rate and the market interest rate, the journal entry for amortizing the discount will involve the. There are two primary methods of bond amortization:.

Here We Discuss A Discount On Bonds Payable Journal Entry And Its Bond Pricing And Constituents.

If investors buy the bonds at a discount, the difference between the face value of the bonds and the amount of cash received is recorded in a. Web the bond premium of $4,100 must be amortized to interest expense over the life of the bond. Web the journal entry to record the valenzuela bonds is shown as: When the company issues a bond at the discount, it can make the bond discount journal entry by debiting the cash account and the unamortized bond discount account and crediting the bonds payable account.

Unamortized Bond Discount Is A Contra Account To Bonds Payable Which Its Normal Balance Is On.

The credits go to discount on bonds payable for $2,635 and cash for $7,000. Web the journal entry is: This amortization will cause the bond’s book value to decrease from $104,100 on. Web guide to bond accounting.