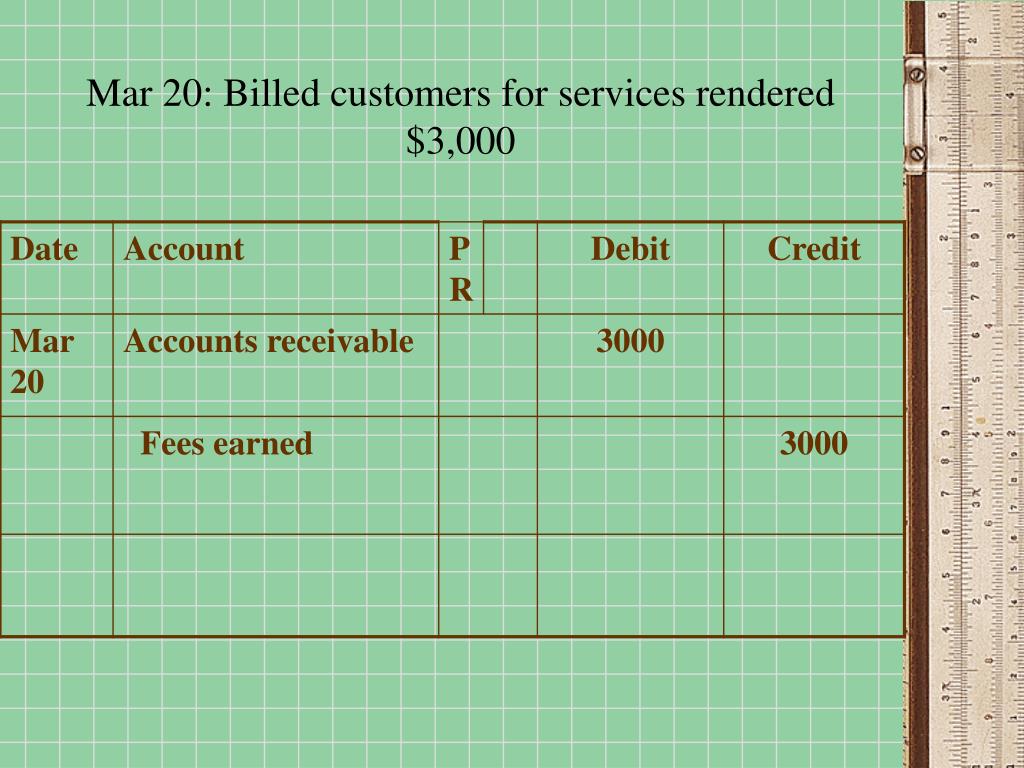

Billed Customers For Services Performed Journal Entry - Exercise d for each of the following unrelated transactions, give the journal entry to record the transaction. Published on 20 oct 2018. Unbilled revenue is the amount that a company earns after goods or services are delivered but not yet billed invoice to customers. On january 10, 2019, provides $5,500 in services to a customer who asks to be billed for the services. Web how do you enter services rendered in an accounting journal? In the journal entry, accounts receivable has a debit of $5,500. Web services were performed for customers on account, $ 1,200. In certain types of business transactions, it is a requirement for the customer to pay a part of the total amount or the. To list your services on the invoice, you. Web what is the journal entry for billed services?

Solved In 2016, Lee Inc. billed its customers 56,800 for

Web what is the journal entry to record when a customer pays their invoice? If a customer has an unpaid invoice, then that represents an.

Example of business transaction with journal entries

The company paid a 50% down payment and the balance will be paid after 60 days. Unbilled revenue is the amount that a company earns.

3.3 Use Journal Entries to Record Transactions and Post to TAccounts

Web journal entry for advance received from a customer. Published on 20 oct 2018. Web ch 10 & 11 special journals. Web what is the.

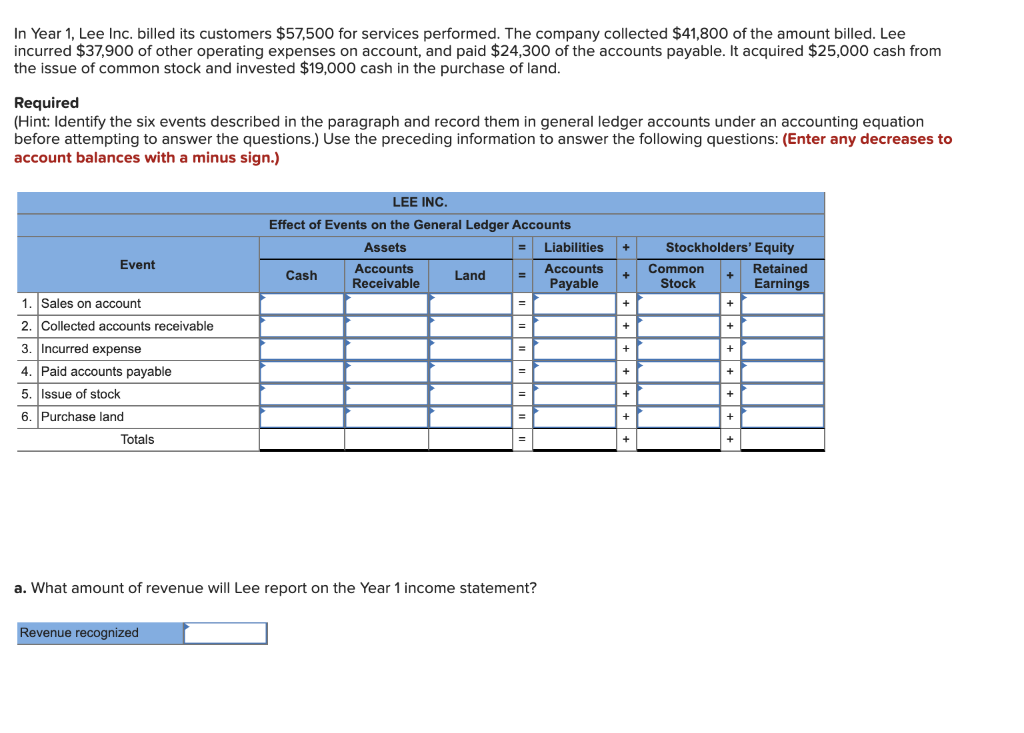

Solved In Year 1, Lee Inc. billed its customers 57,500 for

Web this type of journal entry is important for businesses to keep accurate records of their financial transactions and to make sure that customers are.

Journal Entry Problems and Solutions Format Examples MCQs

The accounting records will show the following bookkeeping entries for the web design services sold on account: Billed customers $3,260 for cleaning. Web how do.

Solved Billed customer 3500 for services performed. elect

A) debit to cash, debit to service revenue. In certain types of business transactions, it is a requirement for the customer to pay a part.

3.3 Use Journal Entries to Record Transactions and Post to TAccounts

In certain types of business transactions, it is a requirement for the customer to pay a part of the total amount or the. If a.

Prepare summary journal entries to record the following transactions

Journal entries consist of at least one debit and one credit, and the amounts of the debits and credits should match. Web sold services on.

PPT Analyzing Transactions PowerPoint Presentation, free download

Published on 20 oct 2018. In the journal entry, accounts receivable has a debit of $5,500. In certain types of business transactions, it is a.

Web Journal Entry For Cash Received For Services Provided.

Web journal entry for advance received from a customer. Web this type of journal entry is important for businesses to keep accurate records of their financial transactions and to make sure that customers are billed for services correctly. In the journal entry, accounts receivable has a debit of $5,500. We analyzed this transaction to increase the asset accounts receivable (since we have not gotten paid but will receive it.

The Company Paid A 50% Down Payment And The Balance Will Be Paid After 60 Days.

Billed customers $2,200 for cleaning services performed. On january 10, 2019, provides $5,500 in services to a customer who asks to be billed for the services. Web what is the journal entry to record when a customer pays their invoice? Journalize the transaction analyze the transaction and prepare the journal entry.

Analyze The Transaction And Prepare The Journal Entry.

A) debit to cash, debit to service revenue. Web an asset/revenue adjustment may occur when a company performs a service for a customer but has not yet billed the customer. Received $1,500 cash for services performed. Billed customers $3,260 for cleaning.

We Analyzed This Transaction To Increase The Asset Accounts Receivable (Since We Have Not Gotten Paid But Will Receive It Later) And Increase Revenue.

Web the journal entry is debiting cash $ 1,000 and a credit fee earned $ 1,000. Web ch 10 & 11 special journals. Billed customers $3,760 for services performed. Web services were performed for customers on account, $ 1,200.