Beginning Balance Journal Entry - Web preparing an unadjusted trial balance is the fourth step in the accounting cycle. Learn how to enter and manage an opening balance for bank, credit card, and other types of accounts. Web all opening entries should be recorded in the general ledger journal of the business and will represent the opening balance of accounts for the new period. It is only meant to be a temporary account. There comes a time for many small. Web from the + new button, select journal entry. Web by intuit• updated 1 week ago. Web the adjusting journal entry for interest payable is: The opening balance entry is as follows. Enter a date earlier than the oldest transaction in the account as the opening balance date.

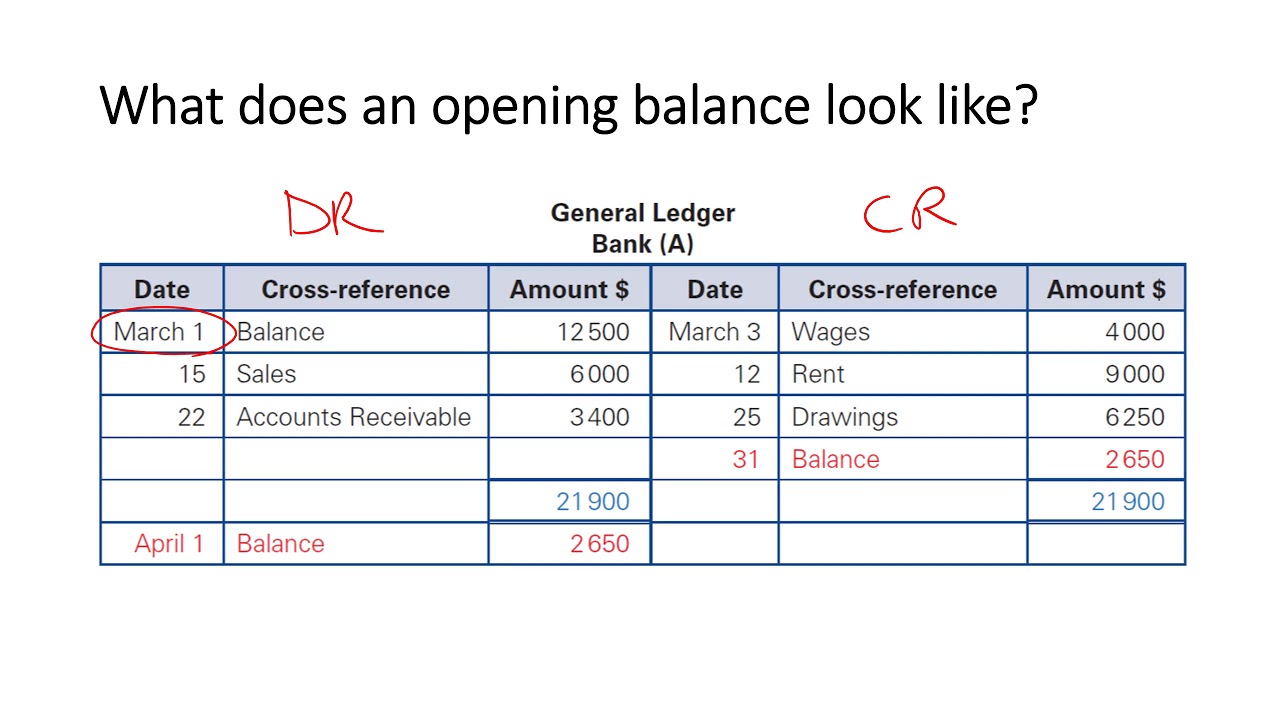

Year 12 Accounting How to record an opening balance YouTube

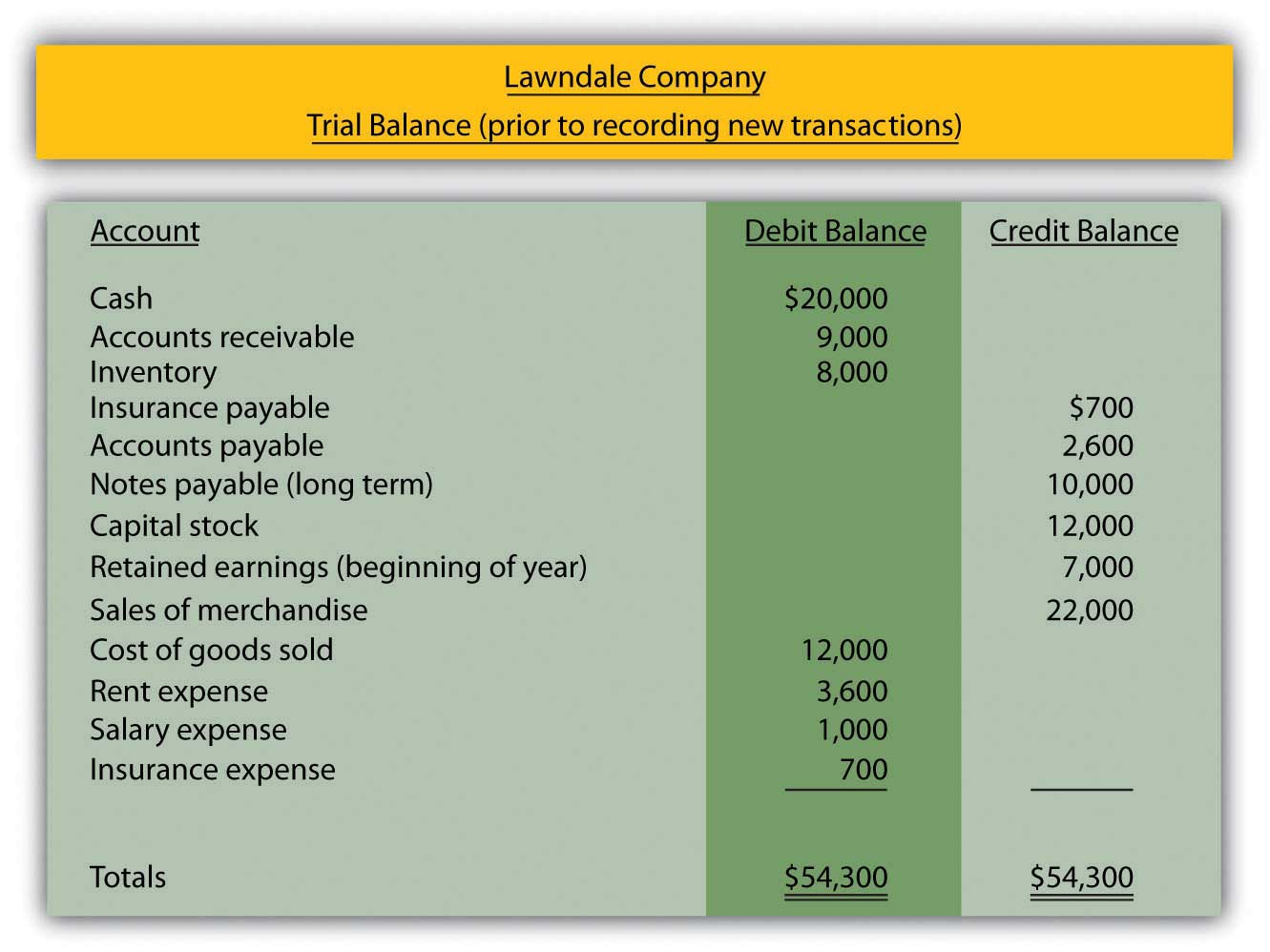

Web go to company, and then select make general journal entries. We will use the following preliminary balance. These entries are initially used. Web all.

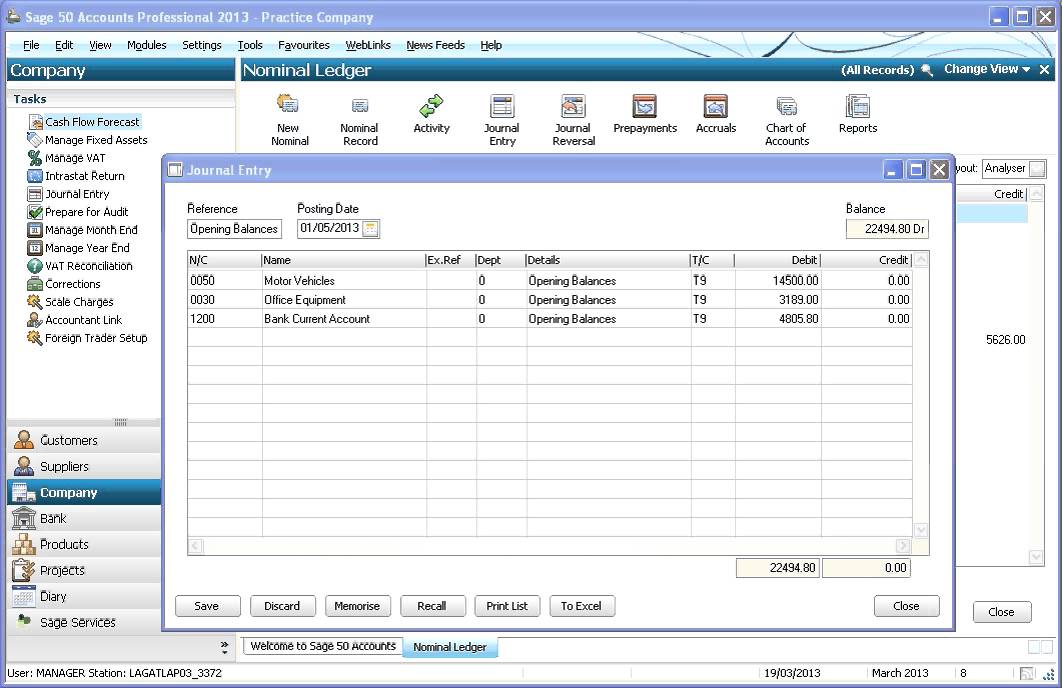

Entering your Opening Balances Cash VAT Method

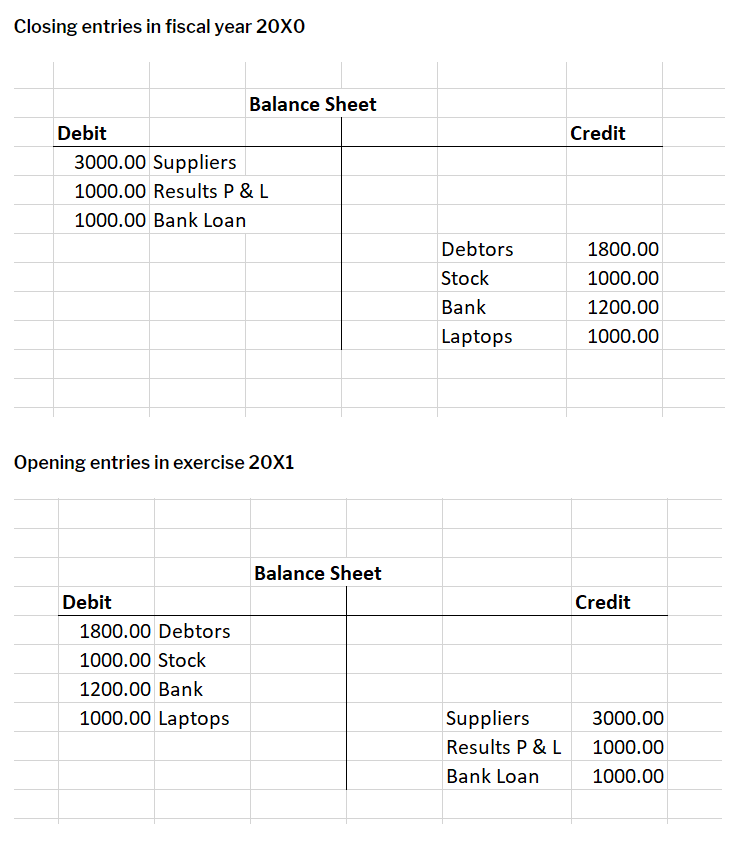

The journal records the assets, liabilities and equity of the business in the general ledger as opening balances. Select your beginning balances date. This will.

Accounting Journal Entries For Dummies

Web when the next financial year begins, the accountant passes one journal entry at the beginning of every financial year in which he shows all.

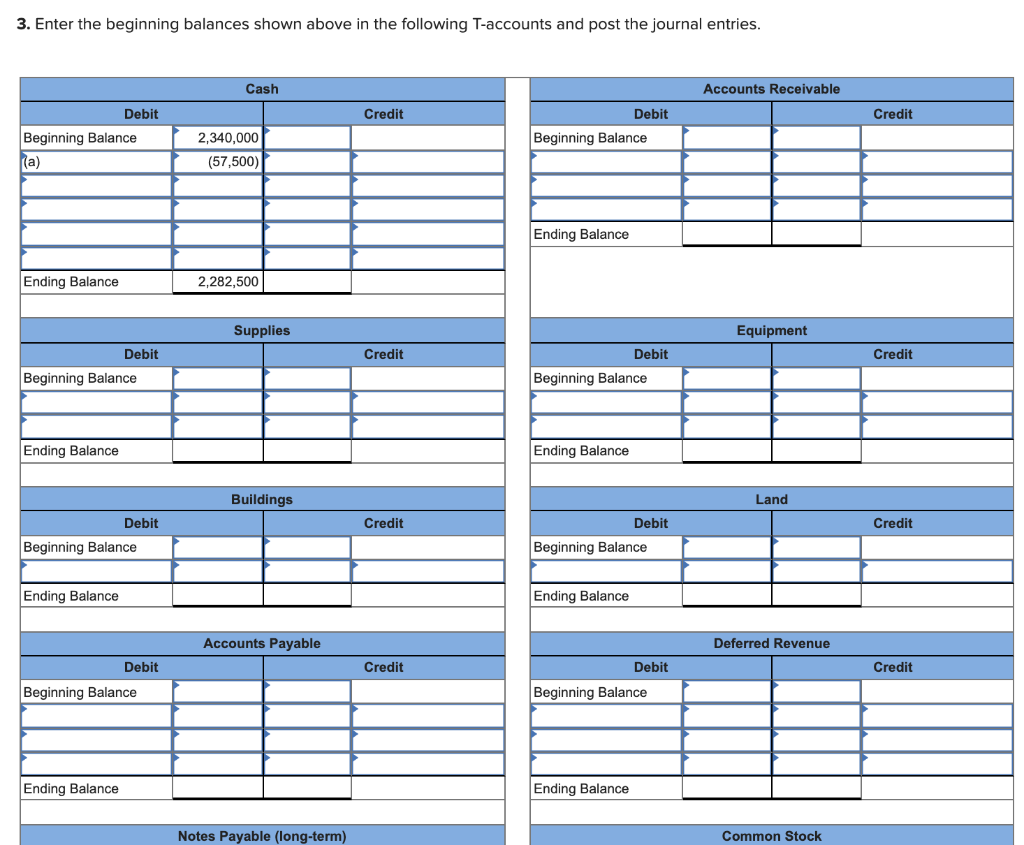

Solved 3. Enter the beginning balances shown above in

Not closing out this account makes your balance. Web by intuit• updated 1 week ago. Subsequent transactions for the accounting period can now be. Web.

21 BALANCE SHEET JOURNAL ENTRIES EXAMPLES BalanceSheet

The opening balance entry is as follows. The opening entry can now be recorded in the ledger using the general ledger journal. It should be.

What is Opening Entry In Accounting Definition and Example Personal

Web go to company, and then select make general journal entries. Web a reasonable way to begin the process is by reviewing the amount or.

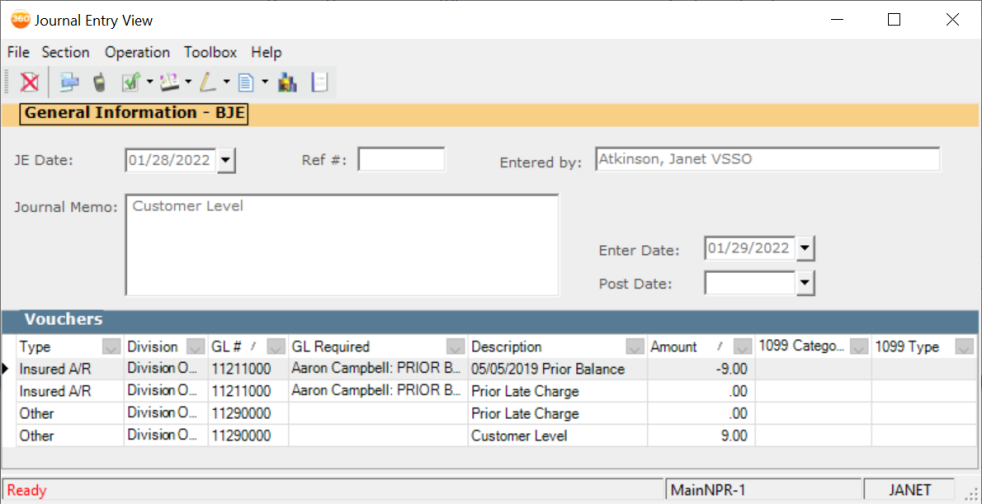

Beginning Balance Journal Entry Batches

In the journal entry, unearned revenue has a debit of $600. A journal entry records financial transactions that a business engages in throughout the accounting.

How To Enter a Journal (Opening Balances) in Sage Line 50 YouTube

Field in the transaction detail section. Enter a date earlier than the oldest transaction in the account as the opening balance date. Subsequent transactions for.

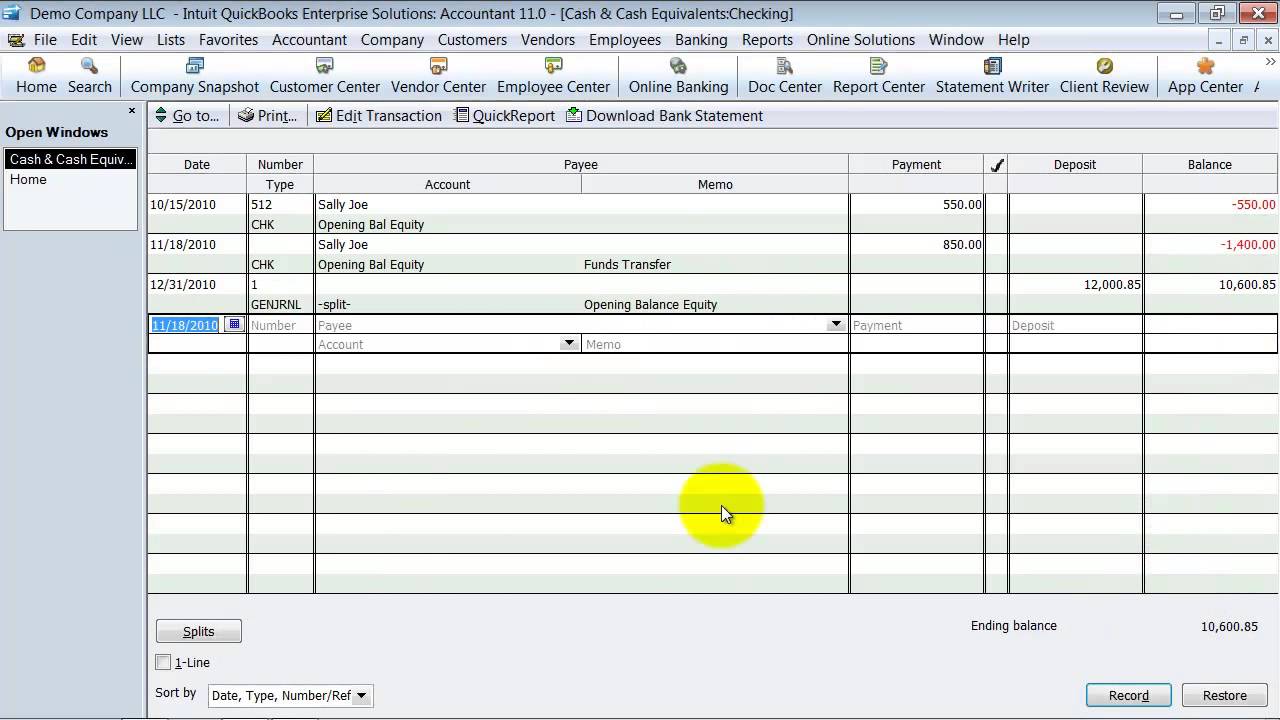

QuickBooks Training Enter Beginning Balances QuickBooks Enterprise

Select the account you want from. In the journal entry, unearned revenue has a debit of $600. Select opening balance equity in the first account.

It Should Be The Date You Pick For The Opening Balance.

With the reconciled balances from your old journal, you can record the opening entry in the new general ledger journal. It is only meant to be a temporary account. This will be the opening balance date. Web all opening entries should be recorded in the general ledger journal of the business and will represent the opening balance of accounts for the new period.

We Recommend You Use The Last Day Of Your Previous Reporting Period.

Web go to company, and then select make general journal entries. Subsequent transactions for the accounting period can now be. Web go to the company menu and select make general journal entries. Enter a date that comes before the oldest transaction in the account.

We Will Use The Following Preliminary Balance.

Web the adjusting journal entry for interest payable is: A journal entry records financial transactions that a business engages in throughout the accounting period. Select the account you want from. Web opening balance journal entry.

In The Journal Entry, Unearned Revenue Has A Debit Of $600.

On the first row of the account. Web choose a journal entry. In the future months the amounts will be different. Not closing out this account makes your balance.