Bad Debt General Journal Entry - It is simply a loss because it is charged to the profit & loss account of the company in the name of provision. The provision for the bad debt is an expense for the business and a charge is made to the income statements through the bad debt expense. It differs from a bad debt expense, which anticipates future losses. Learn how to calculate and record the bad debt expense in this guide. The adjusting entry for bad debts looks like this: Web bad debt expense: Establishing a bad debt reserve. Web a bad debt, or doubtful debt, is a type of accounts receivable, which describes the amount of money a customer owes to a company. Web accounting and journal entry for bad debt expense involves two accounts, “bad debts account” & “debtor’s account (name)”. Web the journal entry is a debit to the bad debt expense account and a credit to the accounts receivable account.

Allowance For Bad Debts

Web a bad debt, or doubtful debt, is a type of accounts receivable, which describes the amount of money a customer owes to a company..

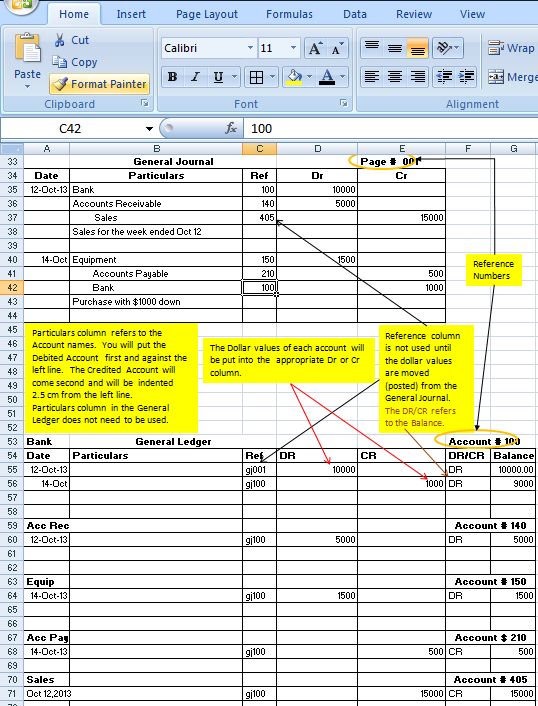

Bad Debt Write Off Journal Entry Double Entry Bookkeeping

Web the bad debt journal entry is a crucial accounting process that ensures accurate financial reporting and a strong financial position for a company. Web.

How to Calculate Bad Debt Expense? Get Business Strategy

Web a bad debt provision is a reserve made to show the estimated percentage of the total bad and doubtful debts that need to be.

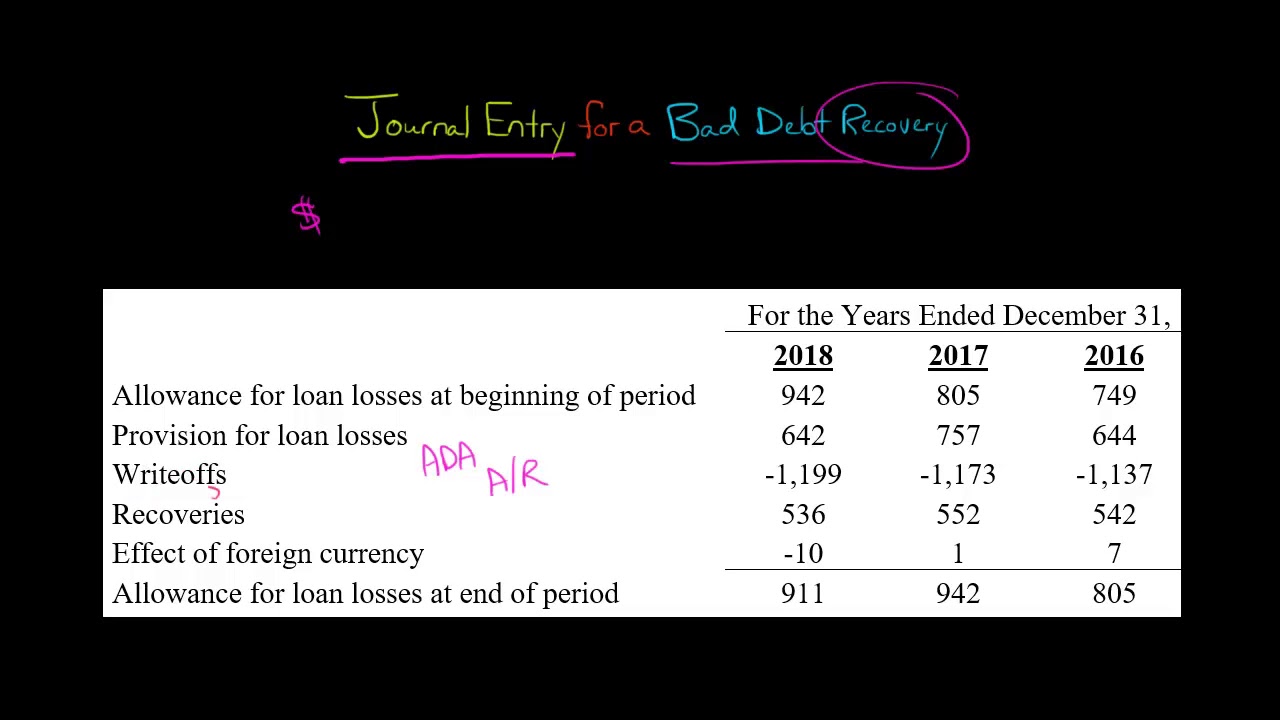

Journal Entry for a Bad Debt Recovery YouTube

Web the journal entry is a debit to the bad debt expense account and a credit to the accounts receivable account. Web written by andrew.

How to calculate and record the bad debt expense QuickBooks

A bad debt relates to amounts owed to us and for which we think there is a high chance we will not receive the money..

Journal Entries for Bad Debts and Bad Debts Recovered YouTube

The provision for the bad debt is an expense for the business and a charge is made to the income statements through the bad debt.

How Do I Write Off Bad Debt Expense Journal Entry

Establishing a bad debt reserve. A debit to allowance for doubtful accounts and a credit to accounts receivable. You only have to record bad debt.

Bad Debt Expense Is Debited When Accounting Methods

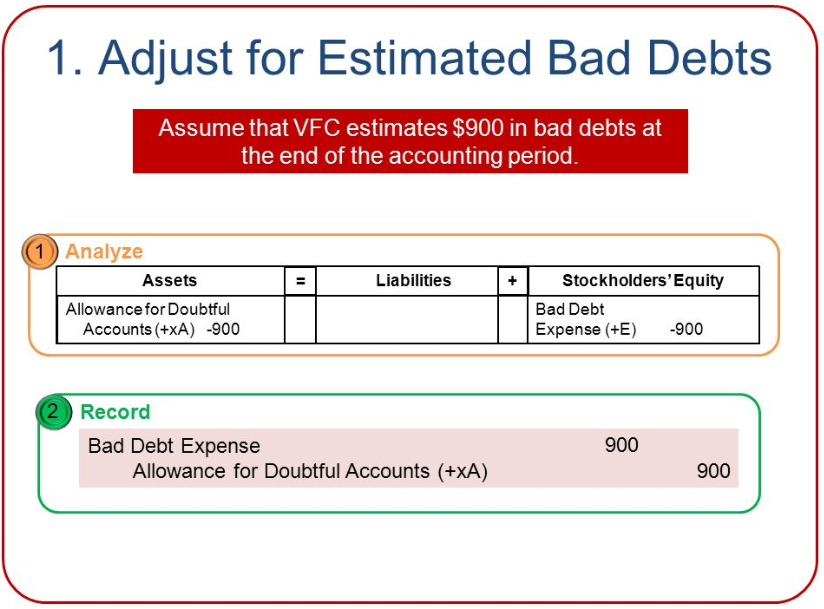

The adjusting entry for bad debts looks like this: Based on the company’s historical data and internal discussions, management estimates that 1.0% of its revenue.

How to write a general journal in accounting

It is simply a loss because it is charged to the profit & loss account of the company in the name of provision. The journal.

Web Journal Entry For The Bad Debt Write Off.

Bad debt provision bookkeeping entries explained. Web while journalizing for bad debts debtor’s personal account is credited and the bad debts account is debited because bad debts written off are treated as a loss to the business and now when they are recovered it is seen as a fresh gain. Web record the journal entry by debiting bad debt expense and crediting allowance for doubtful accounts. Amount due from gaurav ₹5,000 is irrecoverable as he became.

A Bad Debt Expense Is A Portion Of Accounts Receivable That Your Business Assumes You Won’t Ever Collect.

You only have to record bad debt expenses if you use accrual accounting principles. Hence, it is presented in the income statement. Web first, the company can make the journal entry for bad debt recovery by debiting the accounts receivable and crediting the allowance for doubtful accounts to reverse the entry that the company has previously made when writing off the customer’s account. The accounting records will show the following bookkeeping entries for the bad debt write off.

It Is Recorded In Accounts Receivable And Accounts Payable, Respectively.

The journal entry debits bad debt expense and credits allowance for bad debts. Web written by andrew in accounting tutorials. Web the bad debt journal entry is a crucial accounting process that ensures accurate financial reporting and a strong financial position for a company. It involves determining the amounts that cannot be collected from consumers and appropriately reflecting them on the balance sheet.

Web Journal Entry For The Bad Debt Provision.

Web how to record the bad debt expense journal entry. A debit to allowance for doubtful accounts and a credit to accounts receivable. This accounting entry allows a company to write off accounts receivable that are uncollectible. To recognize doubtful accounts or bad debts, an adjusting entry must be made at the end of the period.