Asc 842 Operating Lease Journal Entries - Web accounting under asc 842 third edition july 2022. This guide discusses lessee and lessor accounting under asc 842. See the balance sheet, income. Exhibit 2illustrates an operating lease, including the. What is a lease under asc 842? Operating leases under asc 842 involve the deferred rent, total lease, rou asset, and lease liability. Determine the lease term under asc 840. Both parties must evaluate the lease contract and determine whether the. Leases classifies all leases into two categories; Web exhibit 1 illustrates a finance lease, including the calculations, amortization table, and required journal entries.

How to Calculate the Journal Entries for an Operating Lease under ASC 842

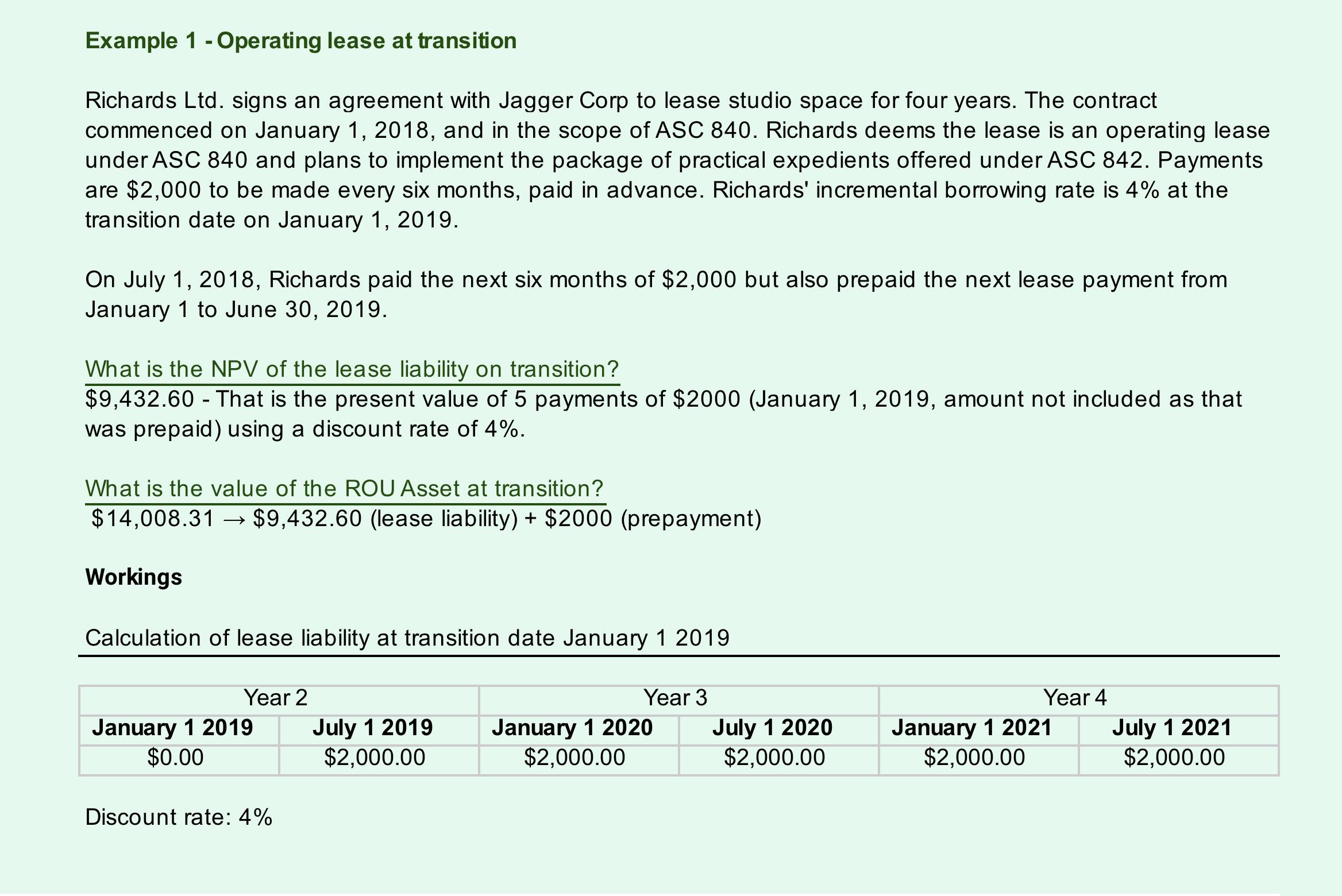

Under asc 842, this is no longer the matching. Suppose you have a 5 year lease beginning 7/1/23 through 6/30/28. Details on the example lease.

ASC 842 Guide

Leases classifies all leases into two categories; The lessee should record a lease liability on. A guide to lessee accounting under asc 842 prepared by:.

Leases 101 New Accounting Standard Asc 842 Part 2 Finacco

Determine the lease term under asc 840. This publication was created for general information purposes, and does not constitute professional advice on facts and circumstances.

ASC 842 Guide

Web according to asc 842, journal entries for operating leases are as follows: This guide discusses lessee and lessor accounting under asc 842. Web lease.

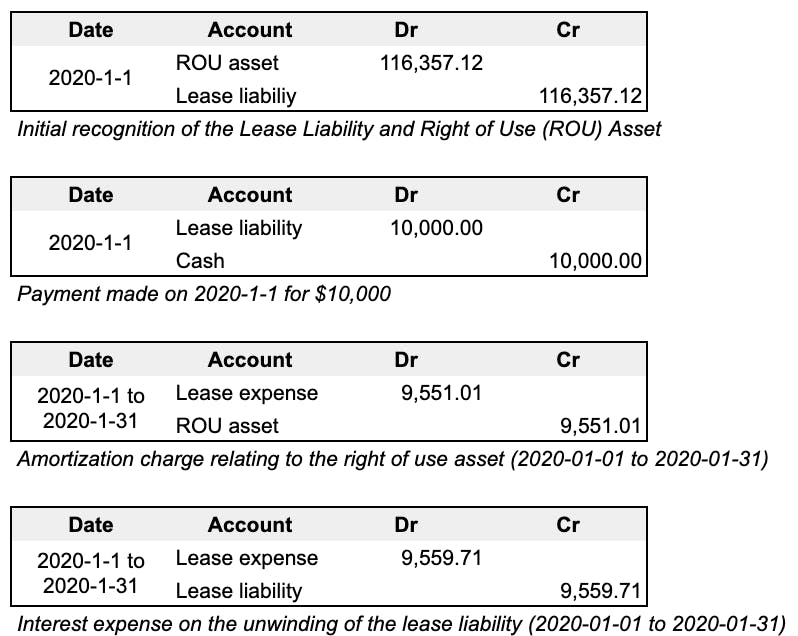

How to Calculate the Lease Liability and RightofUse (ROU) Asset for

A lessee should treat its. As stated above, the required journal entries at commencement and subsequent measurement will not change from a lessor’s. Initial recognition.

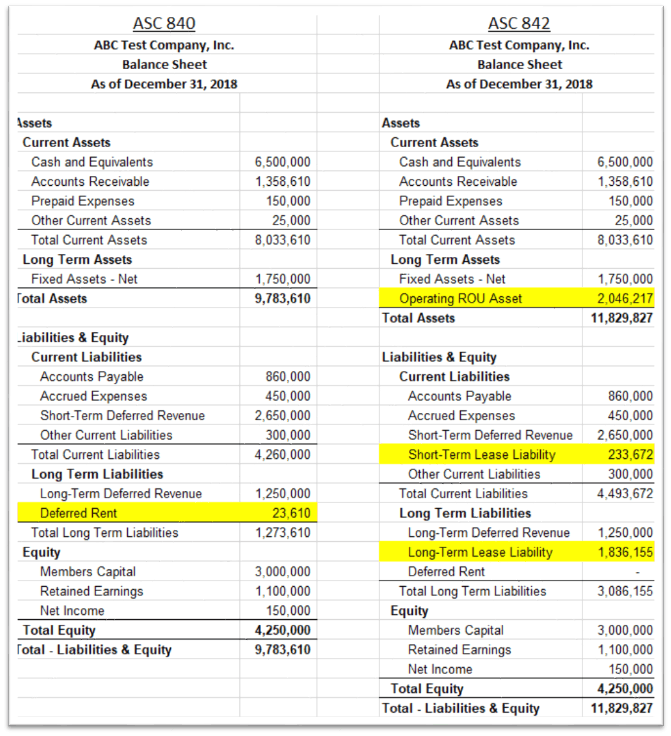

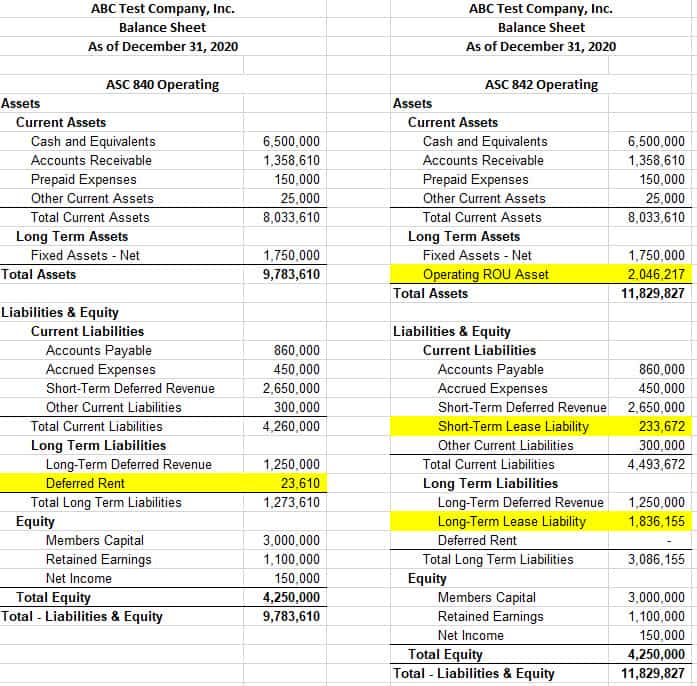

ASC 842 Summary of Balance Sheet Changes for 2020

A guide to lessee accounting under asc 842 prepared by: Web the fasb’s new standard on leases, asc 842, is effective for all entities. Operating.

Lease Liabilities in Journal Entries & Calculating ROU Visual Lease

A lessee should treat its. With asc 842 on the horizon, many entities are evaluating the. Web the fasb’s new standard on leases, asc 842,.

Asc 842 Lease Accounting Template

Suppose you have a 5 year lease beginning 7/1/23 through 6/30/28. Both parties must evaluate the lease contract and determine whether the. Web operating lease.

ASC 842 Journal Entries for Finance & Operating Leases Visual Lease

Web to show what asc 842 journal entries would look like for operating leases, we are going to give an example. Web lease accounting has.

Web Operating Leases Under Asc 842.

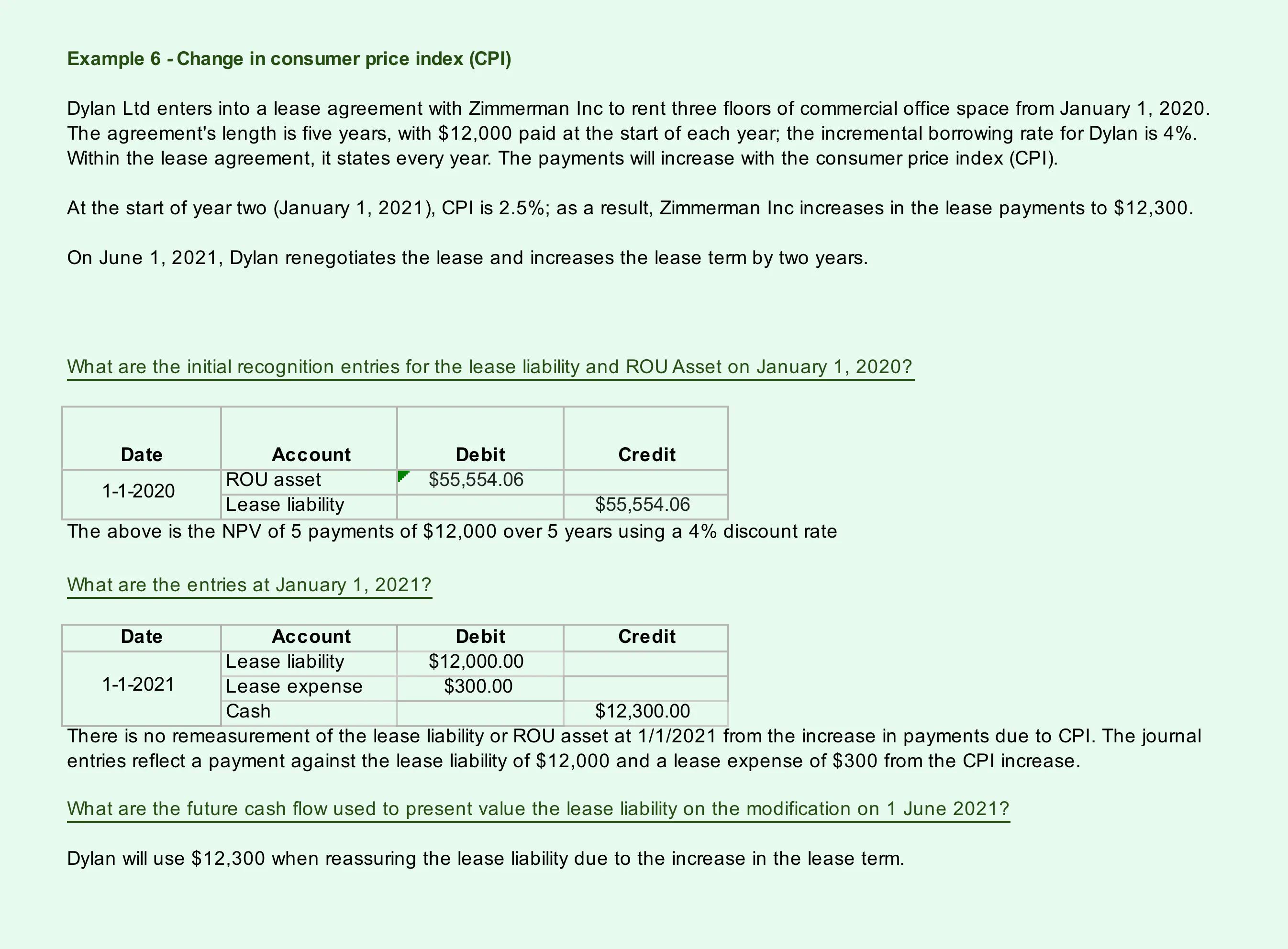

The first four chapters provide. Web learn how to record operating lease transactions for lessees and lessors under asc 842 with examples and calculations. This guide discusses lessee and lessor accounting under asc 842. What is a lease under asc 842?

Under Asc 842, An Operating Lease Is Accounted For As Follows:

Web to help accounting teams at businesses and nonprofits, here are some of the basic journal entries you’ll need to use to account for operating leases under the. Details on the example lease agreement. With asc 842 on the horizon, many entities are evaluating the. Suppose you have a 5 year lease beginning 7/1/23 through 6/30/28.

Web Operating Lease Journal Entries.

Web according to asc 842, journal entries for operating leases are as follows: A guide to lessee accounting under asc 842 prepared by: Web exhibit 1 illustrates a finance lease, including the calculations, amortization table, and required journal entries. Operating lease expense = total lease payments divided by rou asset useful life/lease term.

Web Operating Lease Accounting Example And Journal Entries.

This publication was created for general information purposes, and does not constitute professional advice on facts and circumstances specific to any person or. Both parties must evaluate the lease contract and determine whether the. See the balance sheet, income. The lessee should record a lease liability on.