Asc 842 Lease Accounting Journal Entries - Web under asc 842, a finance lease is accounted for as follows: Details on the example lease agreement. Web asc 842 can be overwhelming; Web asc 842, or accounting standards codification 842, is a set of rules created by the financial accounting standards board (fasb) to improve how companies report. Web deferred rent journal entries for year 1. Web we unpack hot topics in lease accounting under asc 842 and considerations for entities that haven’t yet adopted the new standard. Richard stuart, partner, national professional standards group, rsm us llp. Web under asc 842, regardless of the lease classification, the lease is coming on the balance sheet. Any lease payments made to the lessor at or before the commencement date, minus any lease incentives received. We’ll tackle accounting for operating leases under asc 842 much like the standard.

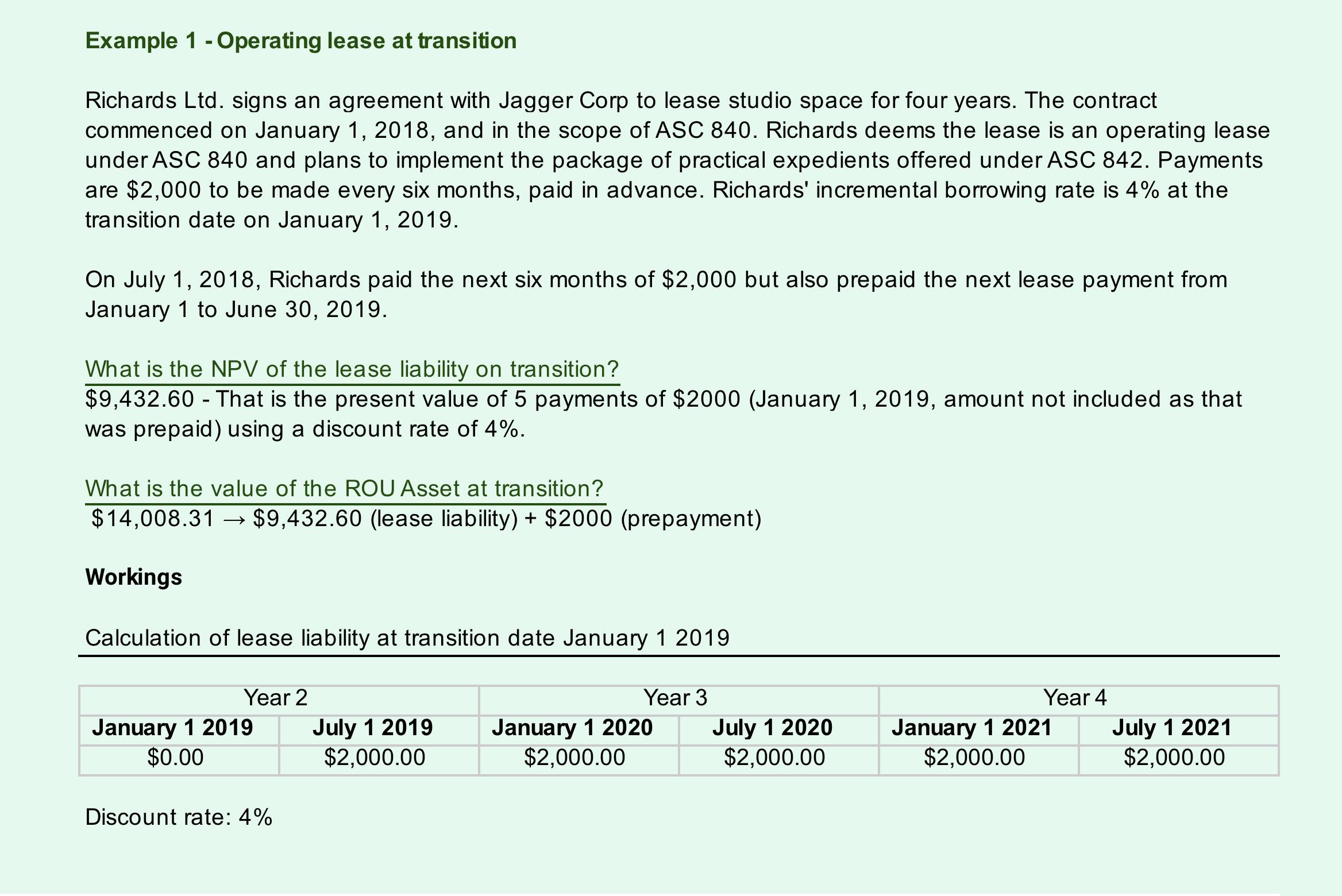

How to Calculate the Lease Liability and RightofUse (ROU) Asset for

Web to help accounting teams at businesses and nonprofits, here are some of the basic journal entries you’ll need to use to account for operating.

ASC 842 Journal Entries for Finance & Operating Leases Visual Lease

Web the fasb’s new standard on leases, asc 842, is effective for all entities. Web under asc 842, regardless of the lease classification, the lease.

ASC 842 Summary of Balance Sheet Changes for 2020

Web to help accounting teams at businesses and nonprofits, here are some of the basic journal entries you’ll need to use to account for operating.

ASC 842 Lease Accounting Software EZLease

This article serves just that. Web with the introduction of the new lease accounting standards (asc 842 and ifrs 16), managing leases has become an.

ASC 842 Guide

This article serves just that. Web we begin by describing what asc 842 requires for lease accounting, then we tackle the ins and outs of.

Lease Liabilities in Journal Entries & Calculating ROU Visual Lease

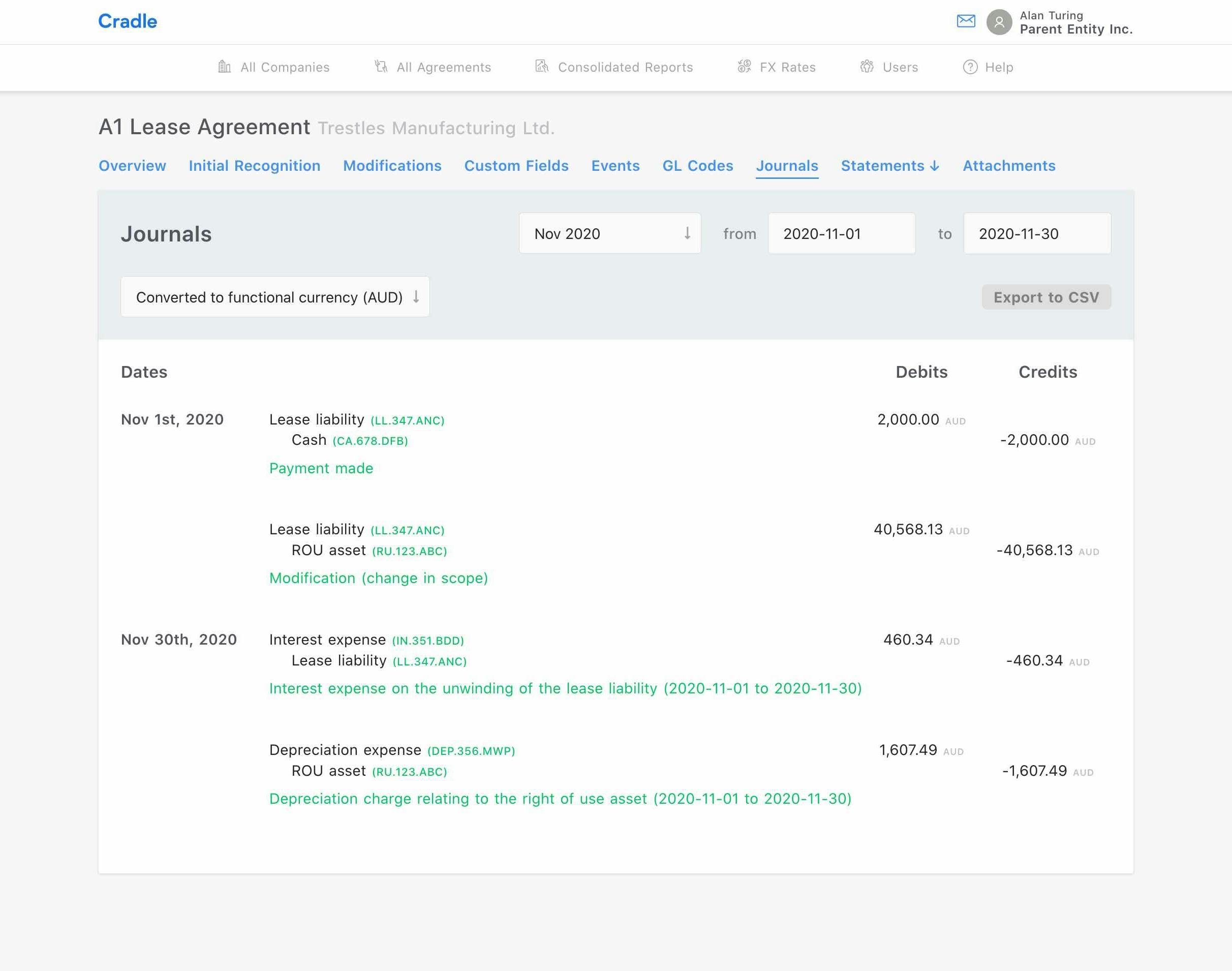

Understanding journal entries under the new accounting guidance (fasb asc842) the journal entry report at transition in. Web we begin by describing what asc 842.

Asc 842 Lease Accounting Template

Understanding journal entries under the new accounting guidance (fasb asc842) the journal entry report at transition in. Web we unpack hot topics in lease accounting.

How to Calculate the Journal Entries for an Operating Lease under ASC 842

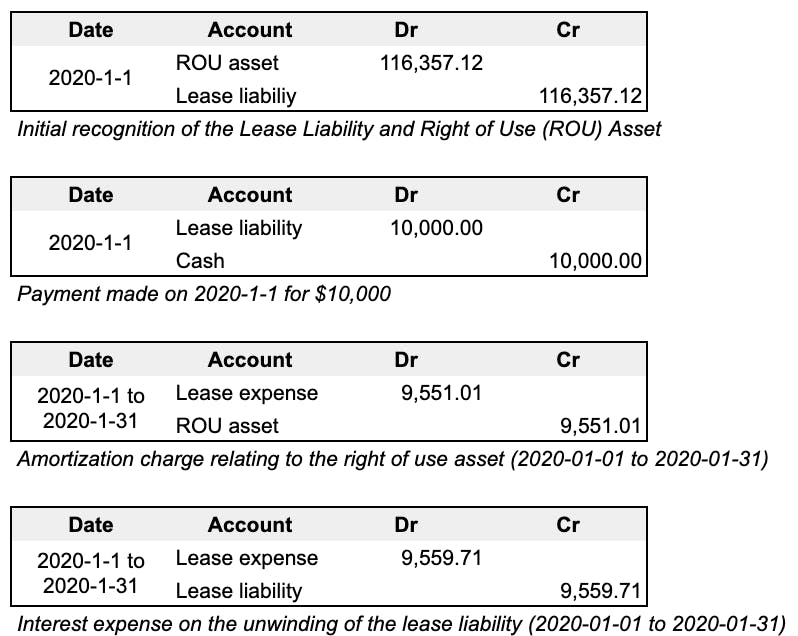

Web according to asc 842, journal entries for operating leases are as follows: Any lease payments made to the lessor at or before the commencement.

Asc 842 Lease Accounting Excel Template

Total lease payments of $1,146,388 + $10,000 initial direct costs divided by 10 years. This guide discusses lessee and lessor accounting under asc 842. The.

Web Portions Of Fasb Accounting Standards Codification® Material Included In This Work Are Copyrighted By The Financial Accounting Foundation, 401 Merritt 7, Norwalk, Ct 06856,.

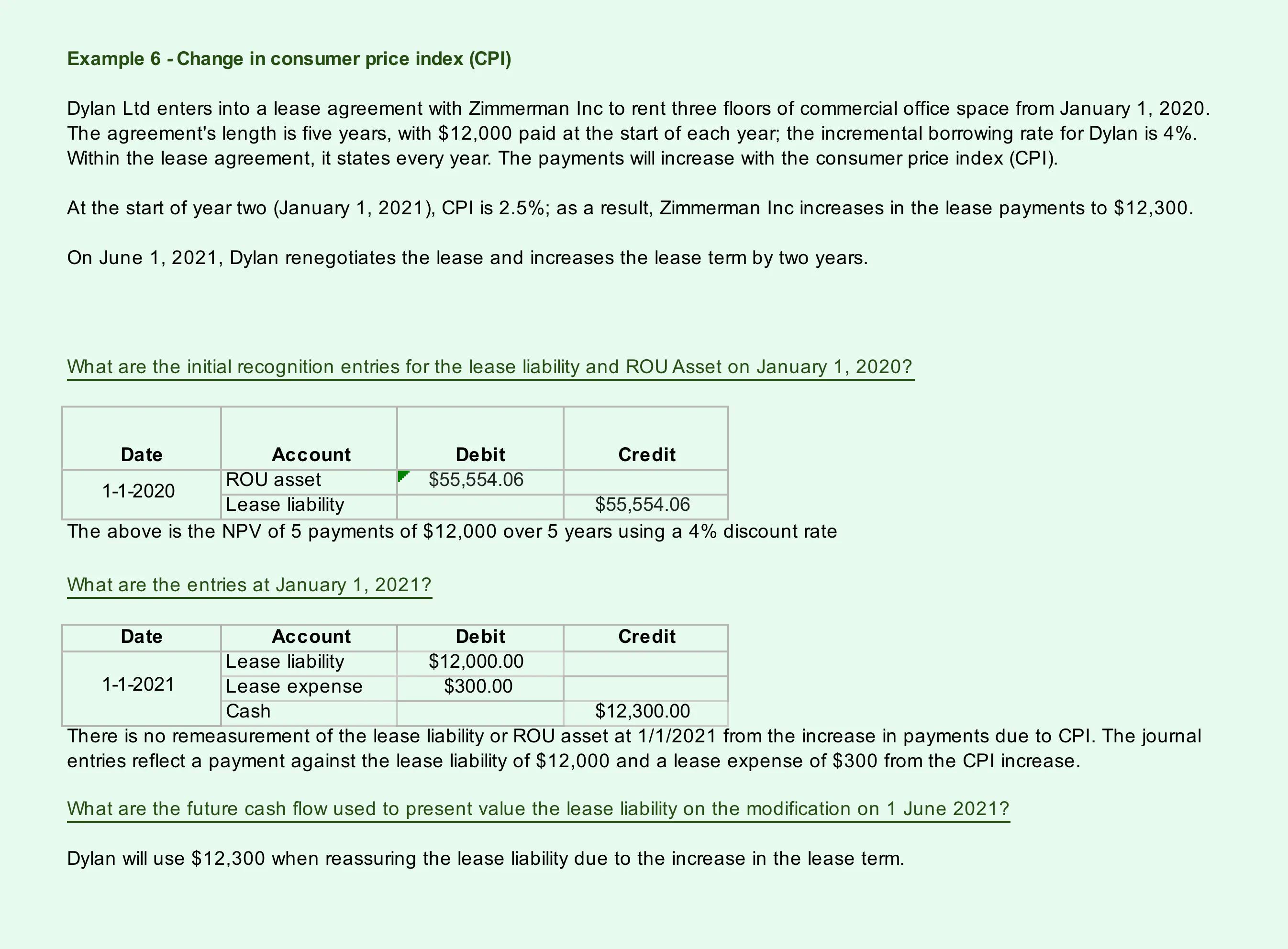

Web we begin by describing what asc 842 requires for lease accounting, then we tackle the ins and outs of journal entries themselves, along with special cases and frequently. We often just need a quick journal entry example to understand the concept or refresh our memory. Initial recognition of lease liability: Web asc 842 journal entries pertain to the new lease accounting standard introduced by the financial accounting standards board (fasb).

The First Four Chapters Provide.

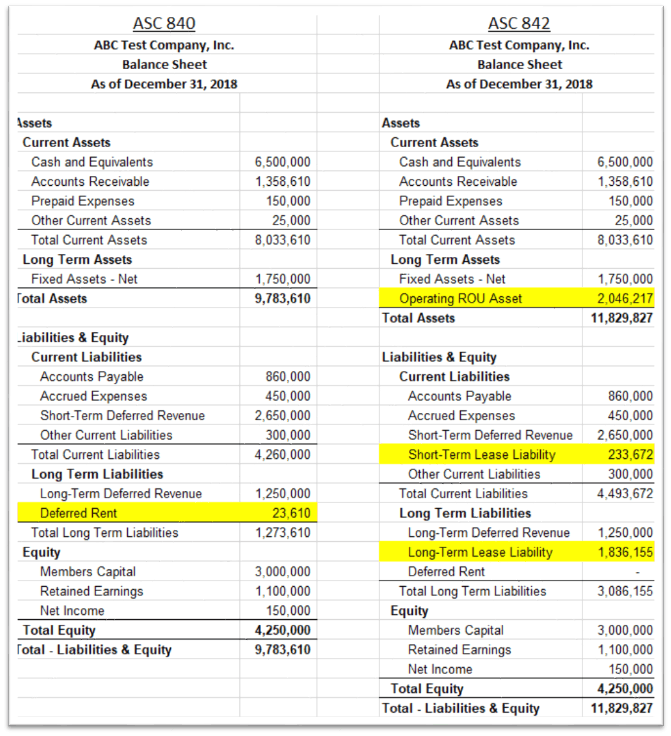

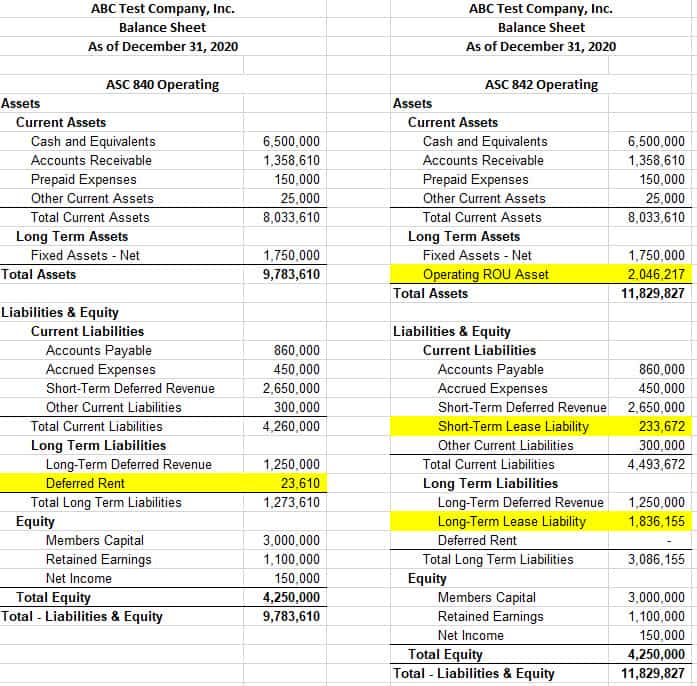

Web asc 842 can be overwhelming; Web operating lease accounting example and journal entries. Deloitte’s lease accounting guide examines. Web with the introduction of the new lease accounting standards (asc 842 and ifrs 16), managing leases has become an integral part of this process.

The Lessee Should Record A Lease Liability On Their Balance Sheet, Equal To The.

Web how to calculate the journal entries for an operating lease under asc 842. Web the fasb’s new standard on leases, asc 842, is effective for all entities. We’ll tackle accounting for operating leases under asc 842 much like the standard. Web under asc 842, a finance lease is accounted for as follows:

Web Asc 842, Or Accounting Standards Codification 842, Is A Set Of Rules Created By The Financial Accounting Standards Board (Fasb) To Improve How Companies Report.

Details on the example lease agreement. Web a guide to lessee accounting under asc 842 prepared by: This guide discusses lessee and lessor accounting under asc 842. Richard stuart, partner, national professional standards group, rsm us llp.