Asc 842 Journal Entries Lessee - Effective date for private companies. Web under asc 842, journal entries for operating leases are concise calculations on the debits of your rou assets and the credits on your lease liabilities all recorded on your general. Web accounting for leases — lessees. What is a lease under asc 842? For finance leases, a lessee is. Web the fasb’s new standard on leases, asc 842, is effective for all entities. Richard stuart, partner, national professional standards group, rsm us llp. Web 5.3.1 lease remeasurement — lessee. Web asc 842 can be overwhelming; For additional information, refer to our.

Leases 101 New Accounting Standard Asc 842 Part 2 Finacco

For finance leases, a lessee is. Web a guide to lessee accounting under asc 842 prepared by: Web to help accounting teams at businesses and.

Asc 842 Lease Accounting Template

Since its introduction, all public and private entities. This article serves just that purpose. Web operating lease accounting example and journal entries. Web asc 842.

Lease Accounting Changes ASC 842 & IFRS 16 NetSuite

Web asc 842 can be overwhelming; Asc 842 guide to operating lease journal entries with netlessor. Richard stuart, partner, national professional standards group, rsm us.

ASC 842 Guide

Learn about operating and finance lease entries, equity impact, and cash flow requirements! We often just need a quick journal entry example to understand the.

How to Calculate the Journal Entries for an Operating Lease under ASC 842

Web accounting for leases — lessees. The first four chapters provide. Web asc 842 can be overwhelming; Effective date for public companies. 13, 2016, the.

Asc 842 Template

Asc 842 guide to operating lease journal entries with netlessor. 13, 2016, the iasb issued ifrs 16, leases, and on feb. Details on the example.

How to Calculate the Lease Liability and RightofUse (ROU) Asset for

13, 2016, the iasb issued ifrs 16, leases, and on feb. What is a lease under asc 842? Web operating lease accounting example and journal.

Q&A from ASC 842 Leases An Introduction to Lessee Accounting Webinar

Web on february 25, 2016, the fasb issued accounting standards update no. This guide discusses lessee and lessor accounting under asc 842. Web the fasb’s.

Asc 842 Lease Accounting Template

Asc 842 guide to operating lease journal entries with netlessor. We often just need a quick journal entry example to understand the concept or refresh.

Determine The Lease Term Under Asc 840.

Effective date for private companies. Web accounting for leases — lessees. Web 5.3.1 lease remeasurement — lessee. Details on the example lease agreement.

The First Four Chapters Provide.

Richard stuart, partner, national professional standards group, rsm us llp. Effective date for public companies. We often just need a quick journal entry example to understand the concept or refresh our memory. This article serves just that purpose.

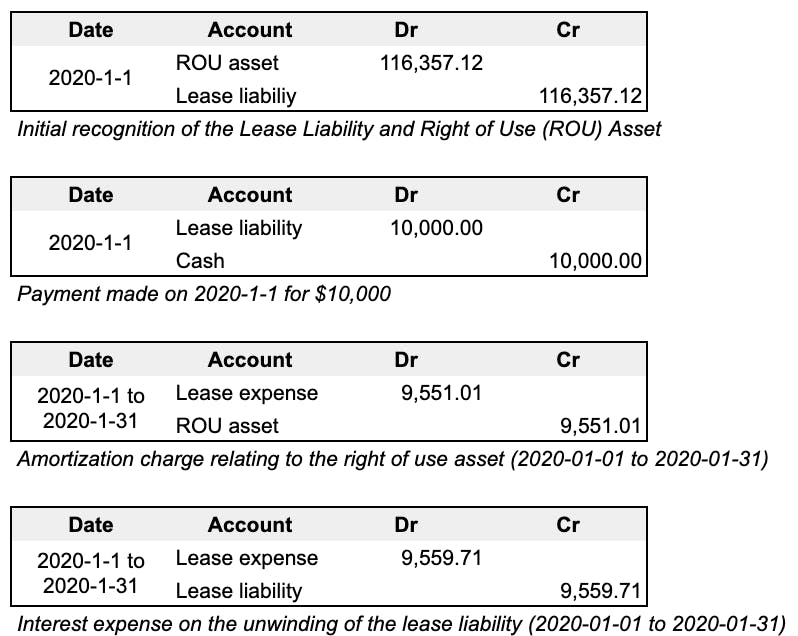

Web Under Asc 842, Journal Entries For Operating Leases Are Concise Calculations On The Debits Of Your Rou Assets And The Credits On Your Lease Liabilities All Recorded On Your General.

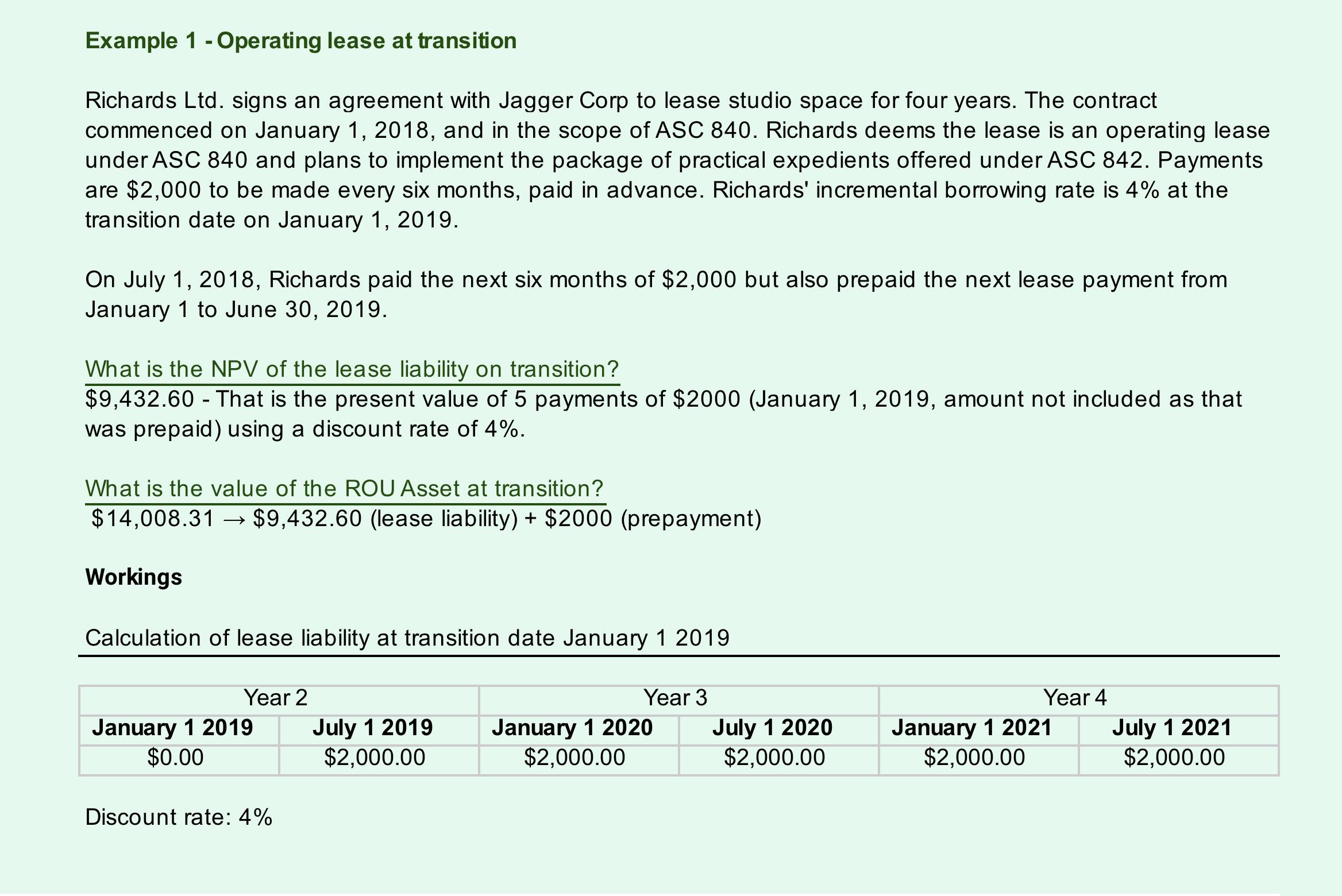

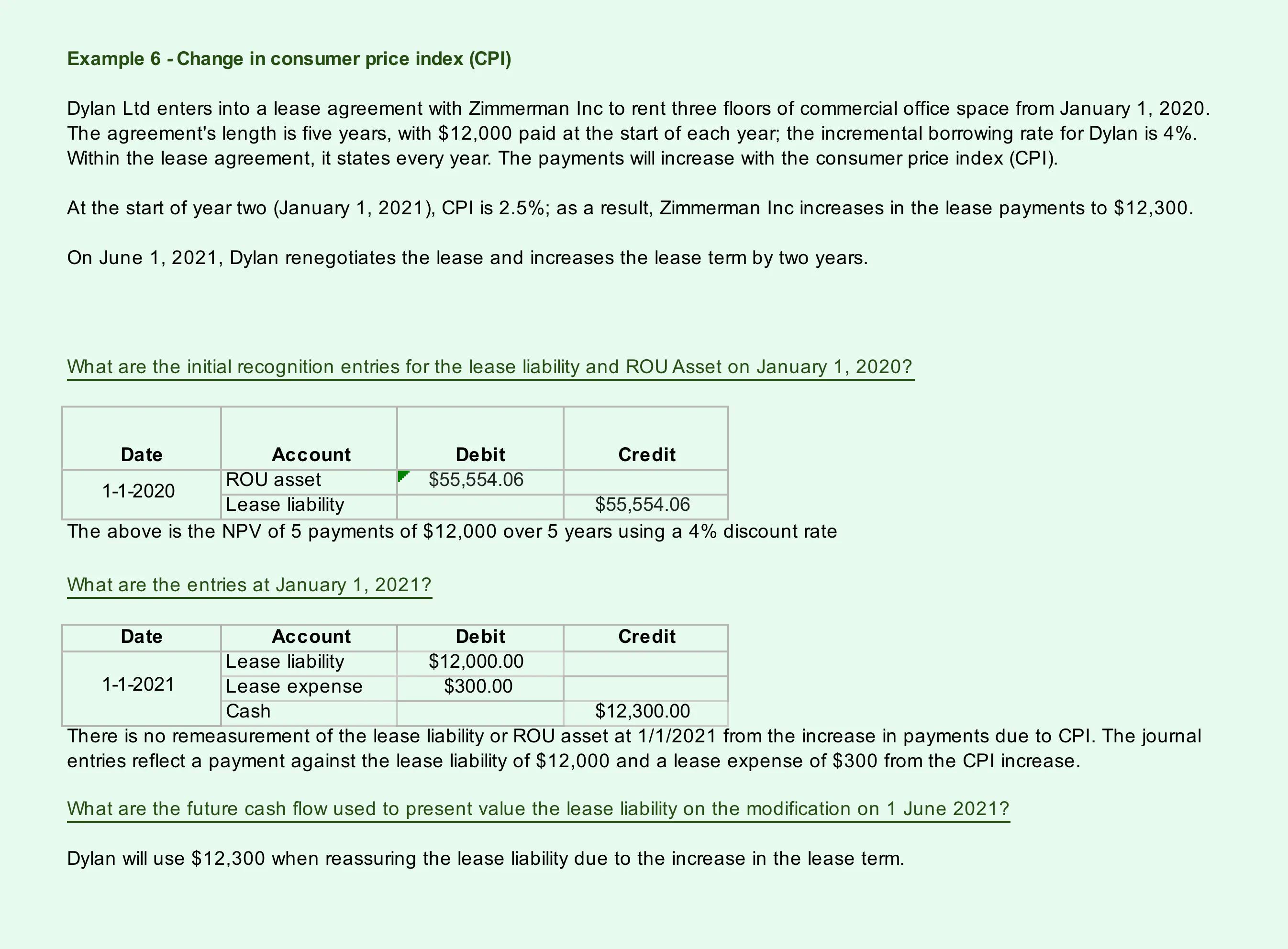

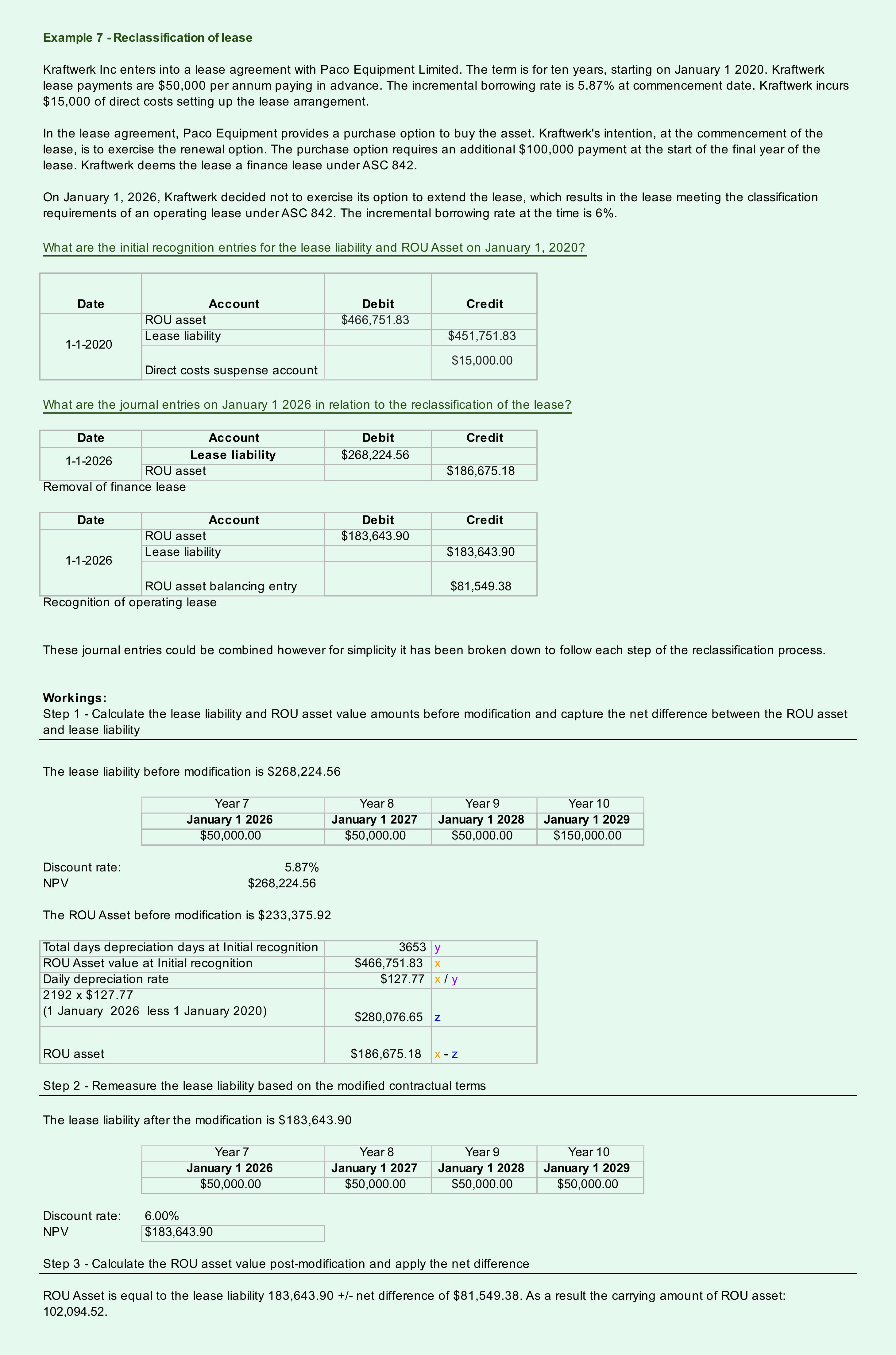

Web operating lease accounting example and journal entries. What is a lease under asc 842? Web a guide to lessee accounting under asc 842 prepared by: Web lease accounting has often been criticized for being too reliant on bright lines and subjective judgments, as lessees were not required to disclose assets and liabilities arising from.

# Audit Lease Accounting Financial Reporting.

Web to help accounting teams at businesses and nonprofits, here are some of the basic journal entries you’ll need to use to account for operating leases under the new lease standard. Web asc 842 is a new accounting standard that defines how businesses record the financial impact of their lease agreements. Web under asc 842, the lessee no longer recognizes a capital lease asset and capital lease obligation but a right of use asset and a lease liability. For finance leases, a lessee is.