Ap Accrual Journal Entry - Accrued expenses, also known as accrued liabilities, are expenses recognized when they are incurred but not yet paid in the accrual method of accounting. Accrued expenses are expenses that have been incurred (i.e., whose benefit or services have already been received) but which have not been paid for. By recording the expense in this manner, a business accelerates expense recognition into the current reporting period. Continue reading to understand the account payable journal entries and the accounts payable process. Web accruals are created by adjusting journal entries at the end of each accounting period. An accrual is a record of revenue or expenses that have been earned or incurred but. Web accounting experts share basic definitions and concepts, formulas, examples, sample journal entries, and advice to help best account for revenue. As such, ap is listed on the balance sheet as a. Web how journal entries are posted for accounts payable. These adjustments are called accruals.

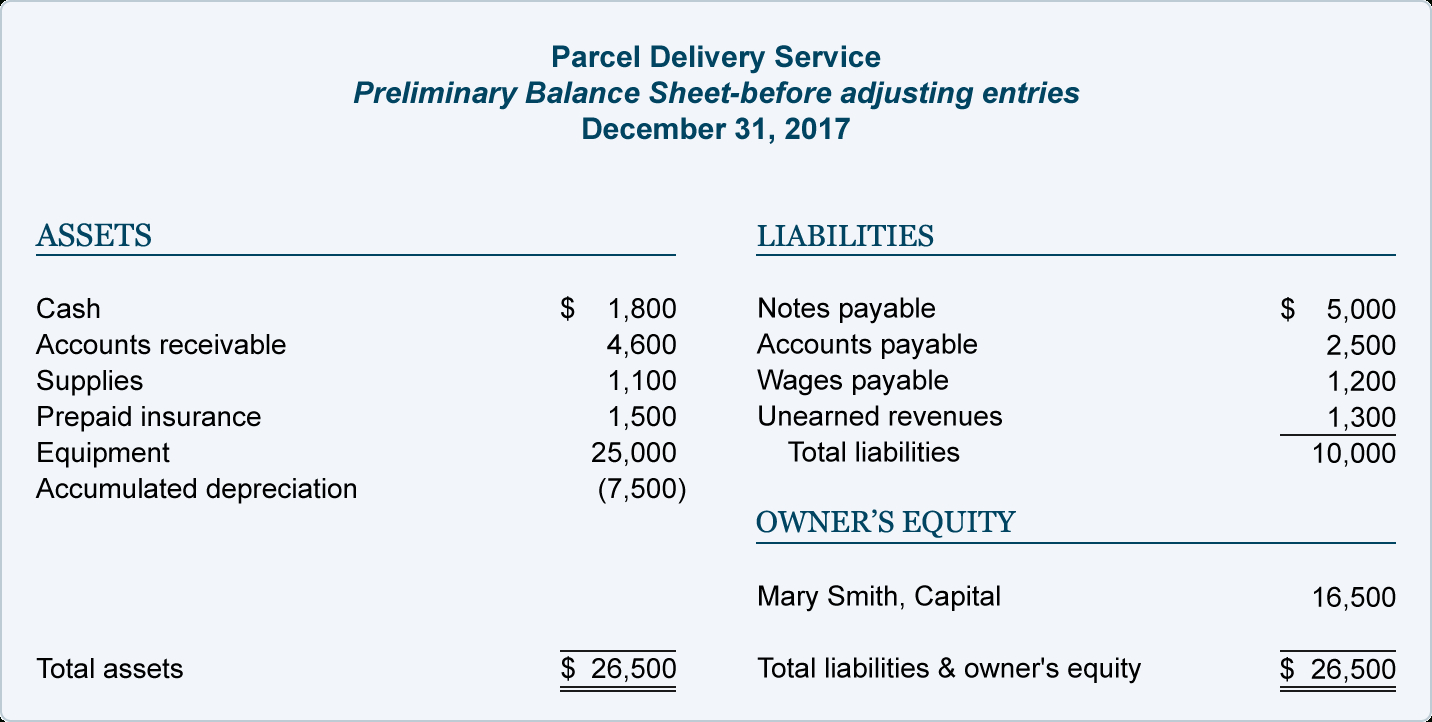

Adjusting Entries For Asset Accounts Accountingcoach with Examples Of

In the july 31 adjusting entry, the company abc ltd. Web the accounts payable journal entries below act as a quick reference, and set out.

Reversing Entries When, What, How and Why? YouTube

In each case the accounts payable journal entries show the debit and credit account together with a brief narrative. Ijournals specialist users with accrual responsibility.

Resolve AR or AP on the cash basis Balance Sheet w... QuickBooks

Adjusting journal entries are a feature of accrual accounting as a result of. Web reversing the accrual is particularly important if you have an automated.

Journal Entries Accounting

Ap liability is reduced when a bill is paid against cash or vendor’s bank accounts. Web the accounts payable journal entries below act as a.

Accruals and Prepayments Journal Entries HeathldDunn

Web create an accrual journal. Accrued expenses are expenses that have been incurred (i.e., whose benefit or services have already been received) but which have.

Accrued Expenses Journal Entry How to Record Accrued Expenses With

The expenditure account gets debited, and the accrued liabilities account gets credited. An accrual is a record of revenue or expenses that have been earned.

Accrual Accounting Examples Examples of Accrual Accounting

Web an accounts payable journal entry is used to record these transactions. Typical accrued expenses include utility, salaries,. After debiting it from the relevant purchase.

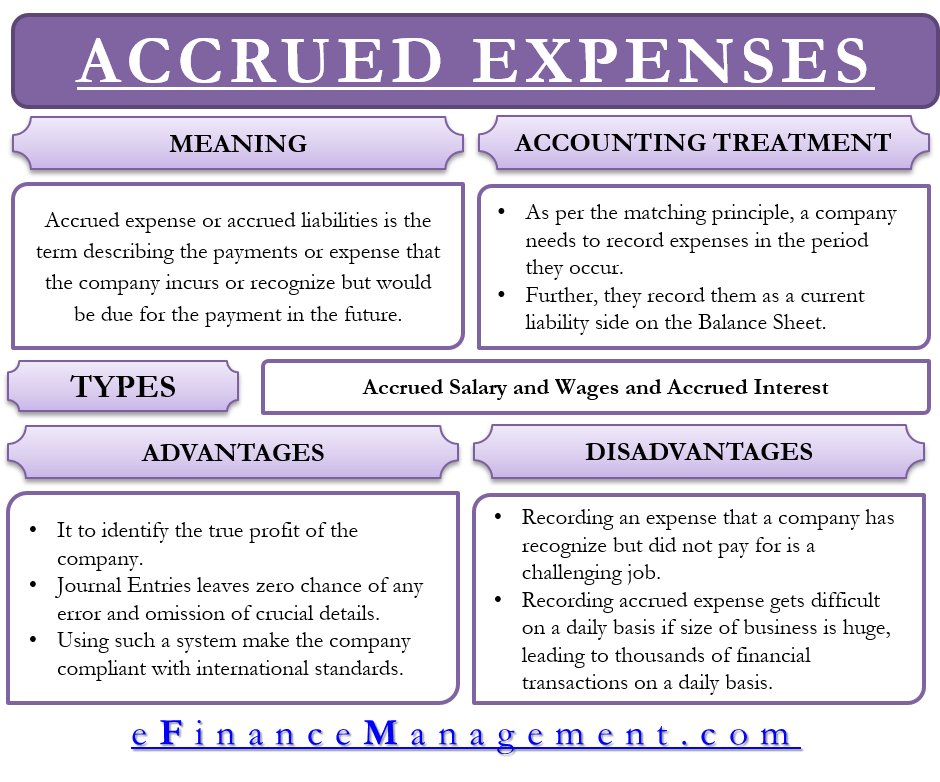

Accrued Expense Meaning, Accounting Treatment And More

These adjustments are called accruals. The credit side of this journal increases the accruals balance on the balance sheet. Accrued expenses, also known as accrued.

Basic Accounting for Business Your Questions, Answered

Web how journal entries are posted for accounts payable. Web the journal entry for accruals is as follows: Accounts payable refers to the outstanding amount.

Web An Accrual Is An Accounting Adjustment For Items (E.g., Revenues, Expenses) That Have Been Earned Or Incurred, But Not Yet Recorded.

Web businesses typically use an accrued expense journal entry to record expenses incurred throughout an accounting period that they haven't yet paid during that accounting period. Ap liability is reduced when a bill is paid against cash or vendor’s bank accounts. The expenditure account is debited here, and the accrued liabilities account is credited. Web create an accrual journal.

Web Accounts Payable (Ap) Refers To The Obligations Incurred By A Company During Its Operations That Remain Due And Must Be Paid In The Short Term.

How accrual basis accounting differs from cash basis accounting Explanation example journal entries to record accrued expenses accrued expenses faqs. Web an accounts payable journal entry is used to record these transactions. Web accruals are created by adjusting journal entries at the end of each accounting period.

In The July 31 Adjusting Entry, The Company Abc Ltd.

If you process payables for your client in accounting cs, you'll need to assign the appropriate gl accounts to the ap accounts to ensure that the journal entries are posted to the correct accounts. These adjustments are called accruals. An adjusting journal entry is usually made at the end of an accounting period to recognize an income or expense in the period that it is incurred. After debiting it from the relevant purchase or expense account, this is marked as a credit against the ap account.

However, If You’re Using A Manual System, Many Accountants May Opt To Skip The Traditional Reversal And Record The Payment By Completing The Following Journal Entry When The Invoice Has Been Paid.

Can make the accrued expense of journal entry for the five days of wages as below: Web an accrued expense payable is recorded with a reversing journal entry, which (as the name implies) automatically reverses in the following reporting period. Web the accounts payable journal entries below act as a quick reference, and set out the most commonly encountered situations when dealing with the double entry posting of accounts payable. Ijournals specialist users with accrual responsibility for accounts payable (ap) journals can generate accrual journals to recognize expenses that have been incurred in one reporting period but the invoice has not been fully matched in.

/accruals_definition_final_0804-b2460ee1b1a94e928a21a8f31b99c403.png)