Amortization Patent Journal Entry - Web amortization, in accounting, refers to the technique used by companies to lower the carrying value of either an intangible asset. Web when you record patent expenses and amortization costs, you must record the number in both the patent amortization expense account ledger and the patent. Suppose a company purchases a patent for 50,000 with a useful life of 5 years. You must record all amortization expenses in your accounting books. Estimate the economic life of the patent. See if you can determine the amortization. The short answer is yes. The initial value of the. A similar entry would be. Amortization of patents begins when it is acquired or when it is available for use.

Chapter 10, Problem 25E Bookmark Show all steps O ON Problem Handling

The entries are made periodically as the asset is. Patents need to be amortized regularly over the course of their life. Suppose a company purchases.

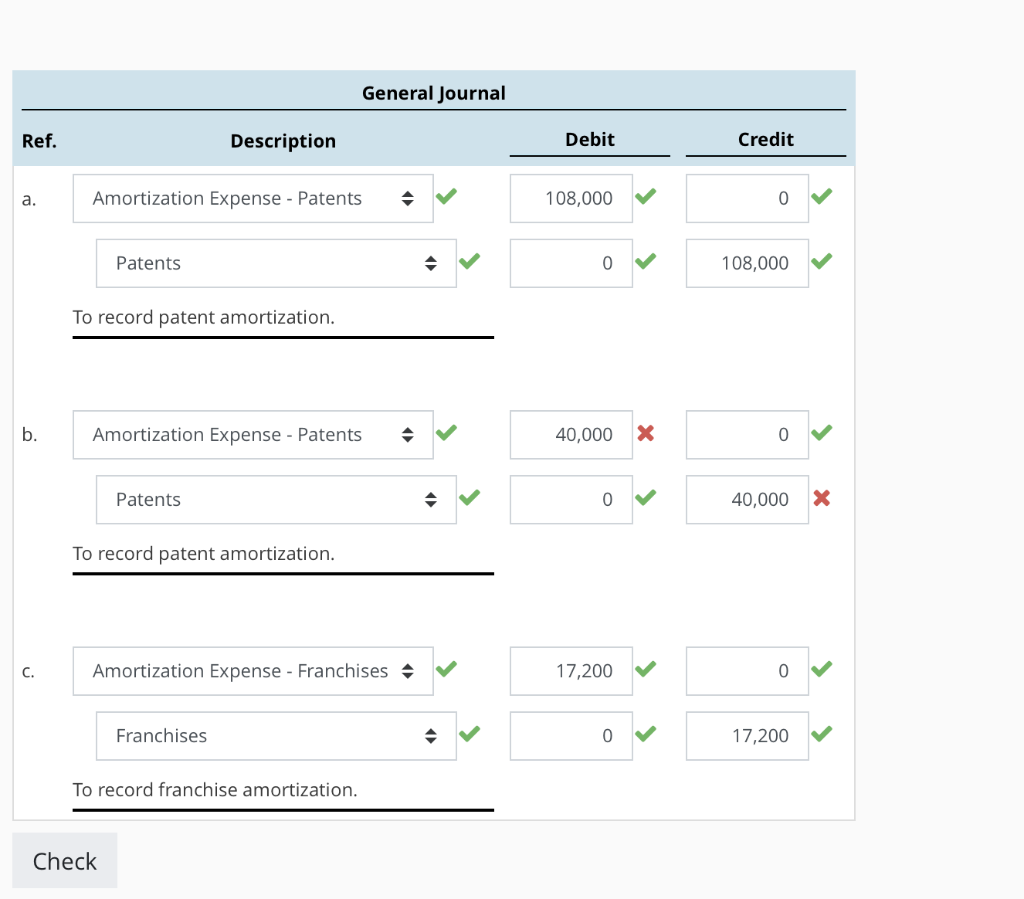

Solved Amortization Expense For each of the following

Amortization is considered an expense. Amortization is the process of allocating the cost of intangible assets. Web for each of the following unrelated situations, calculate.

Breathtaking Amortization Of Patent Cash Flow Statement Financing

Web in such cases, amortization expense of $10,000 is recorded by debiting amortization expense for $10,000 and crediting the patent for $10,000. To record an.

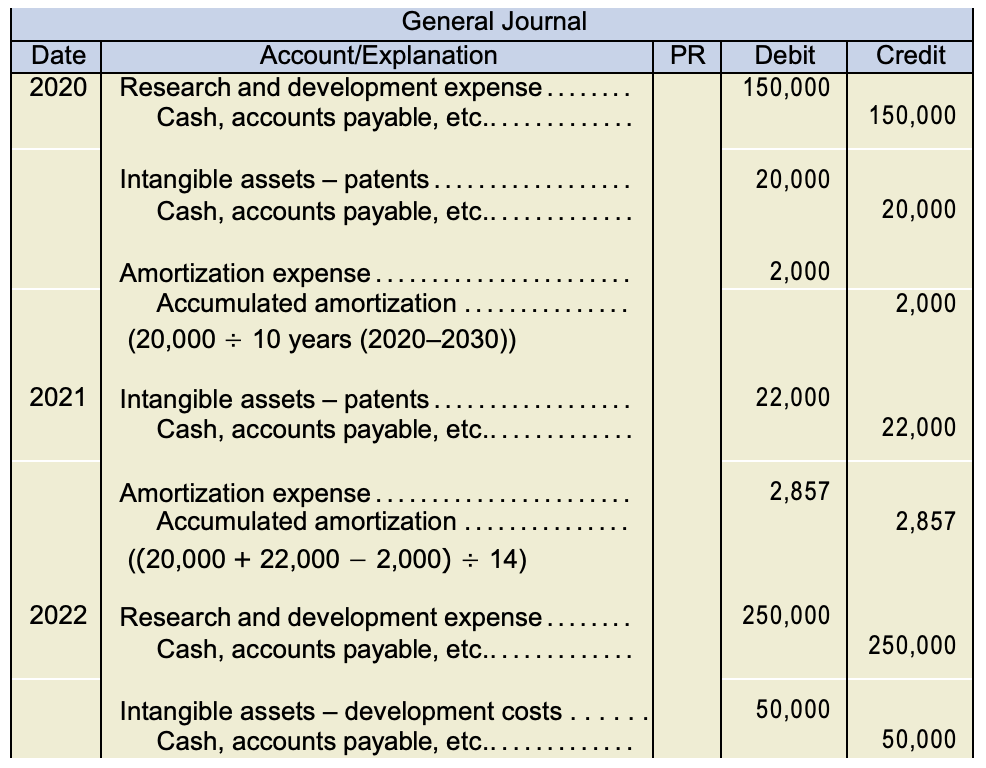

Chapter 11 Intermediate Financial Accounting 1

Web for example, if a company incurs legal costs to defend a patent it has developed internally, the costs associated with developing the patent are.

Accounting For Intangible Assets Complete Guide for 2023

Suppose a company purchases a patent for 50,000 with a useful life of 5 years. On the debit side, the amount. Formula and examples of.

Journal Entry for Amortization with Examples & More

What is amortization in simple terms? For example, $50,000 of amortization on a patent would be recorded: Amortization is similar to depreciation as. This is.

How to Calculate Amortization on Patents 10 Steps (with Pictures)

Amortization of patents begins when it is acquired or when it is available for use. See if you can determine the amortization. Let’s consider a.

Solved Amortization Expense For Each Of The Following Unr...

Web like copyrights, patents are amortized over their useful life, which can be shorter than twenty years due to changing technology. Web how to amortize.

Intangibles

Web for example, if a company incurs legal costs to defend a patent it has developed internally, the costs associated with developing the patent are.

Web In Such Cases, Amortization Expense Of $10,000 Is Recorded By Debiting Amortization Expense For $10,000 And Crediting The Patent For $10,000.

Web the journal entry for amortization has two sides: Amortization is similar to depreciation as. The debit side is amortization expense, and the credit side is accumulated amortization. Web determine the start date of the patent.

Web The Amortization Of The Patent Is Recorded As A Series Of Journal Entries, Which Allocate The Cost Of The Patent Over Its Useful Life.

Assume mech tech purchased the patent for. Web like copyrights, patents are amortized over their useful life, which can be shorter than twenty years due to changing technology. Amortization is considered an expense. You can use the create amortization journal entries.

The Entries Are Made Periodically As The Asset Is.

Estimate the economic life of the patent. Web amortization expense is the income statement item that represents the allocated cost of the intangible asset for the period. Assuming the patent will last 40 years with no residual value and the ½ year rule applies, amortization expense will be. Web to understand the journal entries for amortization expense, let’s first define what amortization is.

To Record An Amortization Journal Entry, Find:

Web the firm would amortize the cost of a purchased patent over its finite life which reasonably would not exceed its legal life. Patents need to be amortized regularly over the course of their life. The short answer is yes. Let’s consider a hypothetical example.