Amortization Of Bond Premium Journal Entry - The amortization will cause the bond’s book value to increase from $96,149 on. At the end of first year if interest payable is $8,000,. Debit premium on bonds payable for $3,000. Calculating the present value of a 9% bond in a 10% market. How to record a bond receivable issued at a premium on the balance sheet and income. The premium paid for a bond represents part of. Web it equals coupon payment as adjusted for amortization of bond discount/premium as shown in the formula below: When a company issues bonds at a premium or discount, the amount of bond interest expense recorded each. Under the effective interest method, bond premium. Web the premium will disappear over time as it is amortized, but it will decrease the interest expense, which we will see in subsequent journal entries.

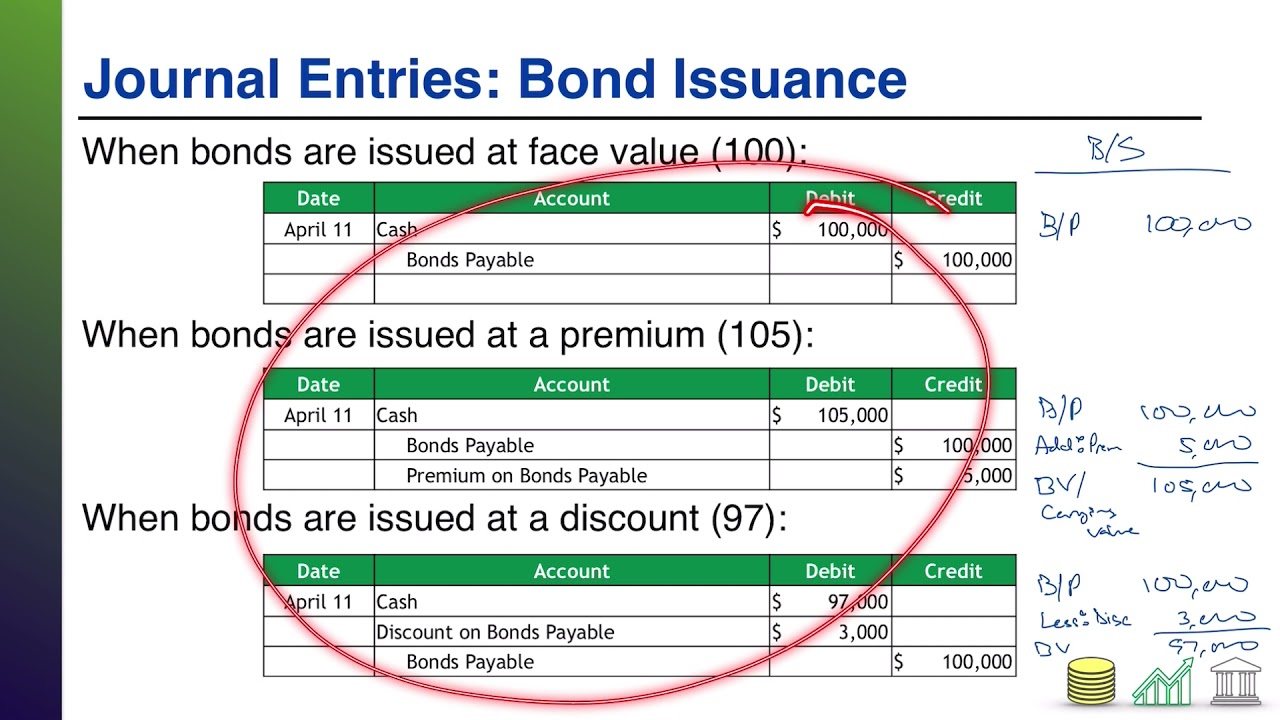

Bonds Payable Lecture 2 Journal Entries YouTube

Debit premium on bonds payable for $3,000. Web by obaidullah jan, aca, cfa and last modified on oct 31, 2020. Web a tax term, the.

Bonds Issued at a Premium Explanation, Examples & Journal Entries

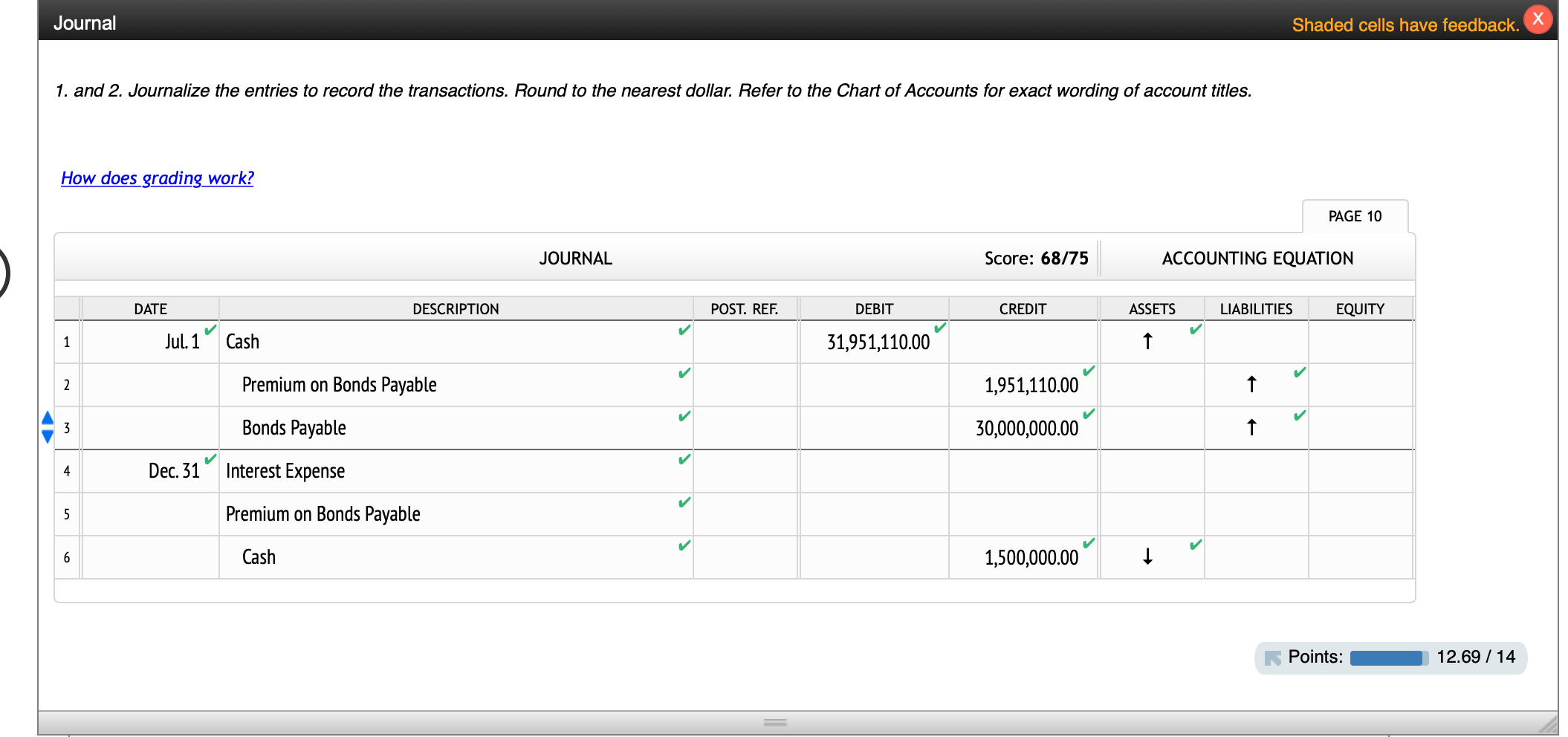

Issuing of bonds at a premium. The journal entries for 2025, 2026, and 2027 will also be. Web the premium will disappear over time as.

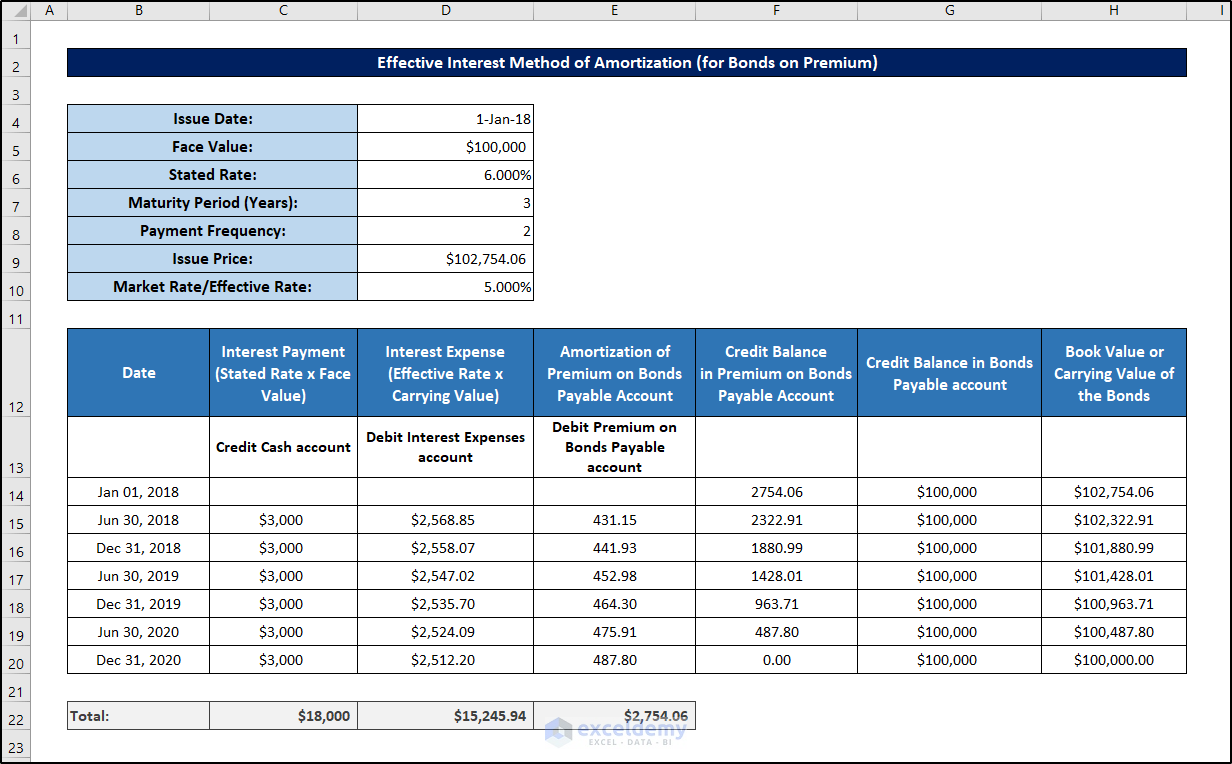

Bond Discount or Premium Amortization Business Accounting

The journal entries for 2025, 2026, and 2027 will also be. The amortization will cause the bond’s book value to increase from $96,149 on. Debit.

Premium On Bonds Payable Journal Entry / Bonds Issued At A Premium

Web there are five possible journal entries related to investing in bonds, as follows: Calculating the present value of a 9% bond in a 10%.

Bond Issuance Journal Entries and Financial Statement Presentation

Web the bond discount of $3,851 must be amortized to interest expense over the life of the bond. At the end of first year if.

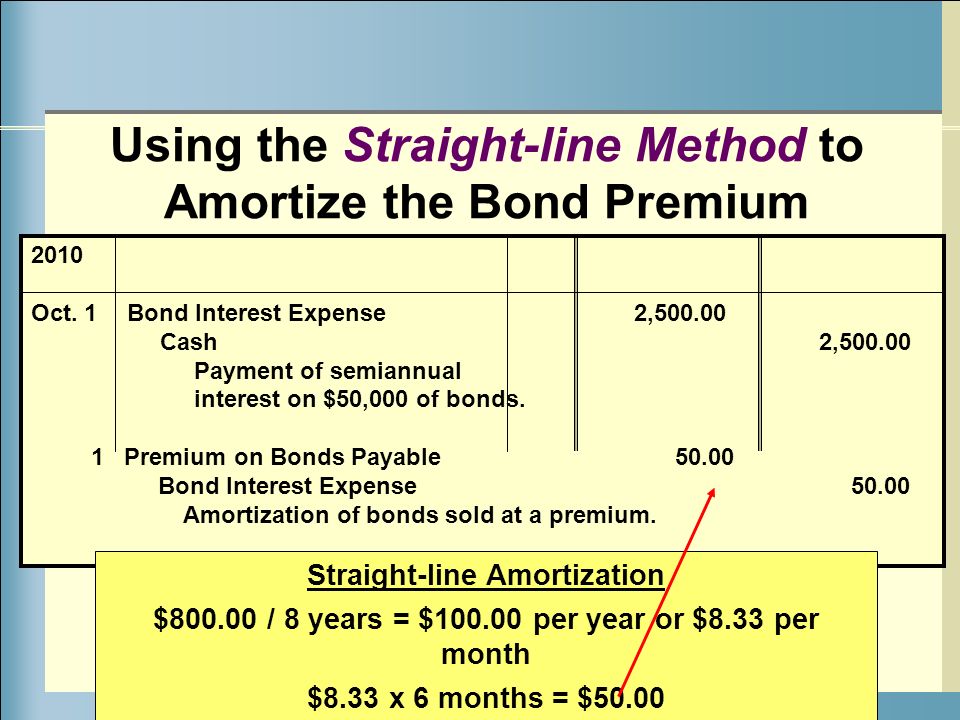

Bond Premium with StraightLine Amortization AccountingCoach

How to record a bond receivable issued at a premium on the balance sheet and income. Web the entry to record the issue of the.

Financial Accounting Lesson 10.18 Straight Line Method of Bond

Debit premium on bonds payable for $3,000. Web it equals coupon payment as adjusted for amortization of bond discount/premium as shown in the formula below:.

Bond Discount with StraightLine Amortization AccountingCoach

Reducing the balance in the. Debit premium on bonds payable for $3,000. Web the entries for 2023, including the entry to record the bond issuance,.

Solved Bond premium, entries for bonds payable transactions,

The premium paid for a bond represents part of. Web an amortizable bond premium refers to the excess amount paid for a bond over its.

Advantages And Limitations The Primary Advantage Of Premium Bond Amortization Is That It Is A Tax.

Debit premium on bonds payable for $3,000. Web the entries for 2023, including the entry to record the bond issuance, are: Under the effective interest method, bond premium. Web the premium will disappear over time as it is amortized, but it will decrease the interest expense, which we will see in subsequent journal entries.

How To Record A Bond Receivable Issued At A Premium On The Balance Sheet And Income.

Web it equals coupon payment as adjusted for amortization of bond discount/premium as shown in the formula below: The journal entries for 2025, 2026, and 2027 will also be. Reducing the balance in the. The amortization will cause the bond’s book value to increase from $96,149 on.

Web By Obaidullah Jan, Aca, Cfa And Last Modified On Oct 31, 2020.

Calculating the present value of a 9% bond in a 10% market. Web the journal entry for interest payment and bond premium amortized will be: Credit interest expense for $3,000. The premium on bonds payable account.

When A Company Issues Bonds At A Premium Or Discount, The Amount Of Bond Interest Expense Recorded Each.

Web the entry for the annual amortization will be the following: Issuing of bonds at a premium. Over time, the amount of premium is amortized until the bond. With the issuance of $300,000 bonds at a premium price of $312,000, the company abc can make the journal entry as below: