Advance Payment Journal Entry - Web the double entry bookkeeping journal entry to show the revenue received in advance is as follows: Web learn how to record and recognize customer advances as a liability until the seller fulfills its obligations. The payroll advance is in effect a short term. Alt + j > stat adjustment to pass a journal to effect tax liability entry on account of advance payments. Web a payroll advance journal entry is used when a business wants to give an employee a cash advance of their wages. The payment in advance is an expense for your company. Web a customer advance payment journal entry is a financial transaction recorded in a company’s accounting records when a customer makes an advance. In the journal entry page, credit the advance payment on the specific accounts payable of. Find out why proper accounting for advance payments is important for your. See examples of journal entries for different.

Journal entries Meaning, Format, Steps, Different types, Application

When the company receives a cash advance from the customers, they need to record cash in but they cannot record the. See an example of.

journal entry format accounting accounting journal entry template

Detailed steps to pass journal. Customer advances can be defined as the amount that is taken from the customers in advance of. The payroll advance.

3.5 Use Journal Entries to Record Transactions and Post to TAccounts

Web the journal entry is debiting cash received and credit customer deposit. Web learn how to record and recognize customer advances as a liability until.

Cash Advance Received From Customer Double Entry Bookkeeping

Web advance payment is a payment made by a buyer to the seller before the actual scheduled time of receiving the goods and services. The.

How To Record Advance Payment Best Practices & Accounting Entries

The payment in advance is an expense for your company. Detailed steps to pass journal. Web learn how to record and recognize customer advances as.

Journal Entries Receipt on Advance in GST Accounting Entries in GST

The payroll advance is in effect a short term. See examples of different scenarios and how to clear the advance account when. Record the advance.

Advance payment to a supplier in foreign currency Solarsys

See an example of journal entry for cash paid in advance. Web learn how to record advance payments as liabilities and revenues in your accounting.

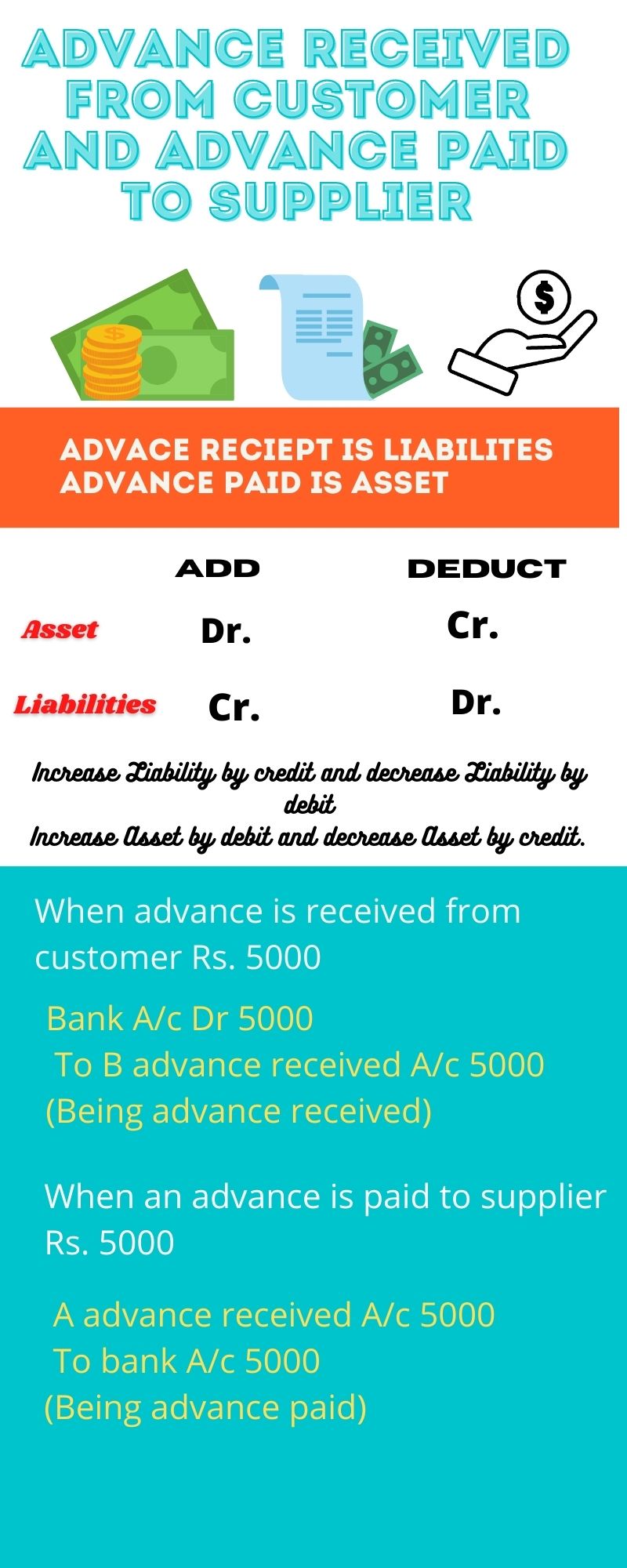

Journal entry of Advance received from Customer and advance paid to

Web learn how to record and recognize customer advances as a liability until the seller fulfills its obligations. Web learn how to record an advance.

3.5 Use Journal Entries to Record Transactions and Post to TAccounts

The customer deposit is the. Web on january 9, 2019, receives $4,000 cash in advance from a customer for services not yet rendered. Web create.

Web The Following Journal Entry Accommodates A Prepaid Expense:

Web journal entries for advance to suppliers accounting treatment for advance to suppliers is similar to the accounting treatment for any prepaid expense. Web the journal entry is debiting cash received and credit customer deposit. Revenue received in advance journal entry. Web journal entry for advance received from customer.

It Protects The Seller From The.

Record the advance payment on the accounts payable. Web learn how to record advance payments as liabilities and revenues in your accounting system. The customer deposit is the. Web a payroll advance journal entry is used when a business wants to give an employee a cash advance of their wages.

Web A Customer Advance Payment Journal Entry Is A Financial Transaction Recorded In A Company’s Accounting Records When A Customer Makes An Advance.

Web advance payment is a payment made by a buyer to the seller before the actual scheduled time of receiving the goods and services. See an example of journal entry for cash paid in advance. In the journal entry page, credit the advance payment on the specific accounts payable of. Web learn how to record cash paid in advance as a current asset and how to reverse it when the purchase is completed.

Find Out Why Proper Accounting For Advance Payments Is Important For Your.

First, make sure you have the supplier listed in quickbooks online. Customer advances can be defined as the amount that is taken from the customers in advance of. Web the double entry bookkeeping journal entry to show the revenue received in advance is as follows: Web (example and journal entries) accounting.