Adjusting Journal Entry For Depreciation - Web journalize adjusting entries for the recording of depreciation. And this process will be carried on till the life of the asset. Now there will be an. Web an accumulated depreciation journal entry is the journal entry passed by the company at the end of the year. Debit to the income statement account depreciation expense. It typically relates to the. Web the adjusting entry for depreciation refers to a journal entry made by a company to track the reduction in the value of a fixed asset over its useful lifespan. Web an adjusting journal entry involves an income statement account (revenue or expense) along with a balance sheet account (asset or liability). Web this article has been a guide to depreciation journal entry. Credit to the balance sheet account accumulated depreciation.

Adjusting Entries Examples Accountancy Knowledge

Web journalize adjusting entries for the recording of depreciation. Instead, depreciation is merely intended to gradually charge the cost of a fixed asset to expense.

Adjusting Entry for Depreciation Financial

The adjusting entry for a. It typically relates to the. Web jul 7, 2023 bookkeeping by adam hill. Web whether a company records its depreciation.

Adjusting Entries Journalizing Depreciation Adjusting Entries

Web this article has been a guide to depreciation journal entry. Instead, depreciation is merely intended to gradually charge the cost of a fixed asset.

Adjusting Journal Entries Defined Accounting Play

Now there will be an. In this case, we can make the journal entry of depreciation expenses in the june 30 adjusting entry as. An.

Accounting Entries for Depreciation, Accounting Lecture Sabaq.pk

It is done to adjust the book values of the different capital assets of. Web depreciation is recorded in the company’s accounting records through adjusting.

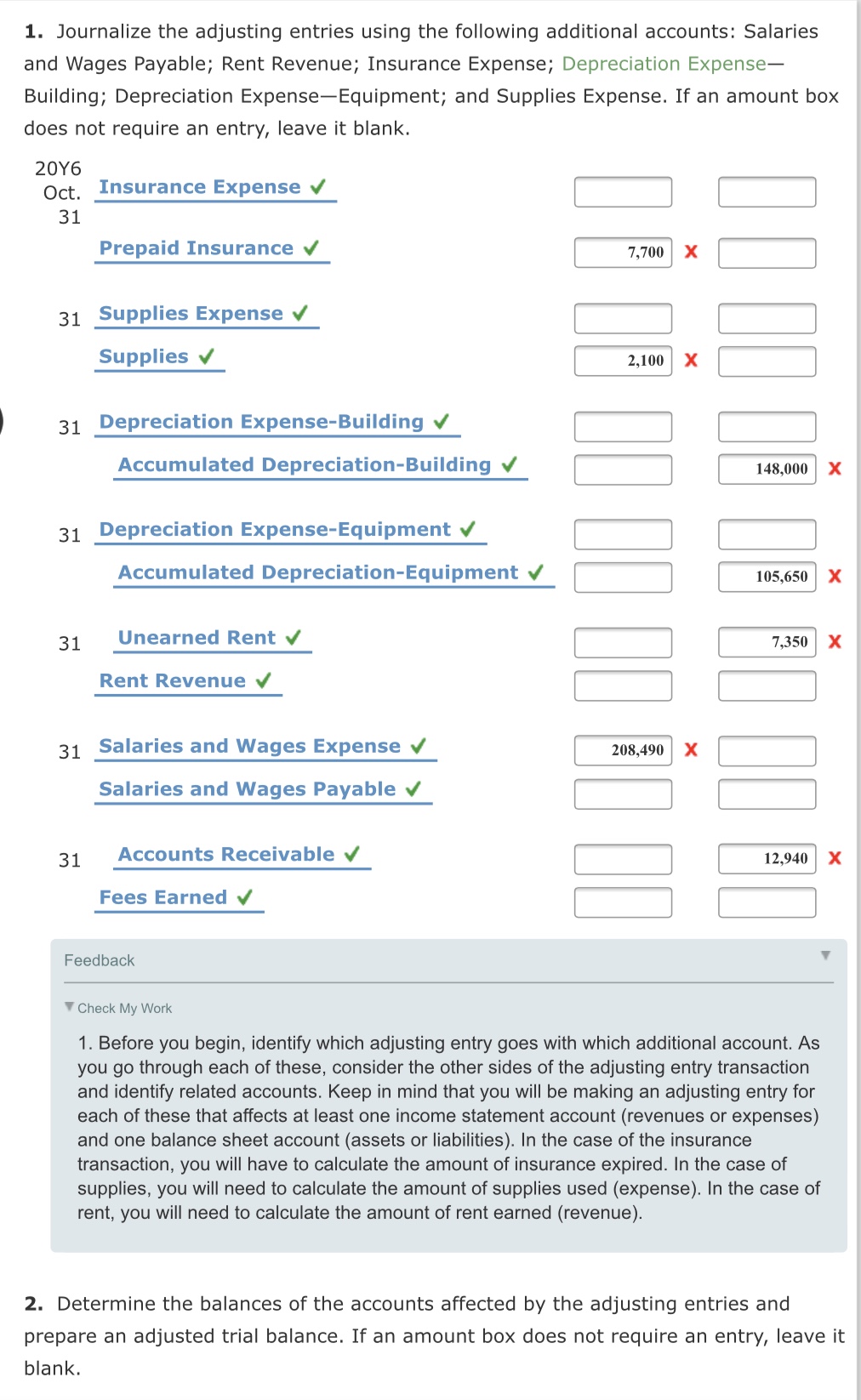

Answered 1. Journalize the adjusting entries… bartleby

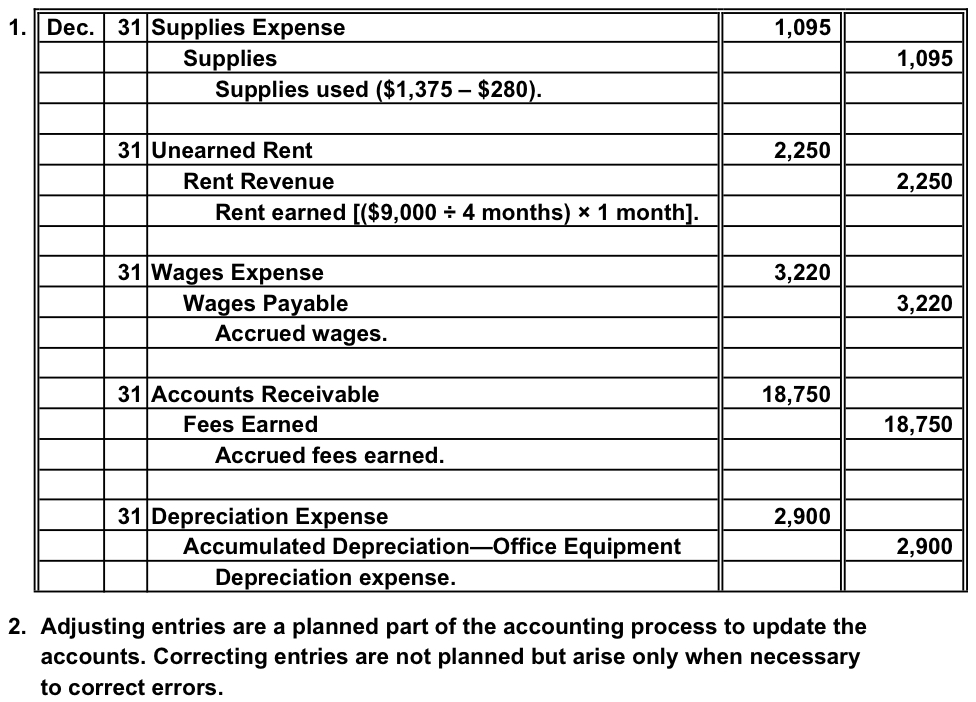

Each one of these entries adjusts income or expenses to. Adjusting entries are recorded in the general journal using the last day of the accounting..

Accounting Questions and Answers PR 31A Adjusting entries

Adjusting entries are recorded in the general journal using the last day of the accounting. Web this entry will add the current year’s depreciation expense.

Adjusting Entries Journalizing Depreciation Adjusting Entries

Debit to the income statement account depreciation expense. The adjusting entry for a. Here we discuss the journal entries on depreciation expense and the practical.

Journal Entry for Depreciation Example Quiz More..

Web journalize adjusting entries for the recording of depreciation. It is done to adjust the book values of the different capital assets of. Now there.

Web An Adjusting Entry For Depreciation Expense Is A Journal Entry Made At The End Of A Period To Reflect The Expense In The Income Statement And The Decrease In Value Of The Fixed.

The adjusting entry for a. Web journalize adjusting entries for the recording of depreciation. Web the journal entry for depreciation expense is: Web the basic journal entry for depreciation is to debit the depreciation expense account (which appears in the income statement) and credit the accumulated depreciation.

Web The Journal Entry For Depreciation Is:

Web depreciation is recorded in the company’s accounting records through adjusting entries. Credit to the balance sheet account accumulated depreciation. Now there will be an. Web this article has been a guide to depreciation journal entry.

Web An Accumulated Depreciation Journal Entry Is The Journal Entry Passed By The Company At The End Of The Year.

It is done to adjust the book values of the different capital assets of. An adjusting journal entry is usually made at the end of an accounting period to recognize an income or expense in the period that it is incurred. Web there are three different types of adjusting journal entries as follows: Accelerated depreciation methods, on the other.

Debit To The Income Statement Account Depreciation Expense.

The journal entry to record depreciation is fairly standard. Web whether a company records its depreciation monthly or yearly, an adjusting journal entry is made to adjust the balance of depreciation expense and to record the the loss of. Web the adjusting entry for depreciation refers to a journal entry made by a company to track the reduction in the value of a fixed asset over its useful lifespan. Instead, depreciation is merely intended to gradually charge the cost of a fixed asset to expense over its useful life.