Adjusting Entries Journal Entry Examples - Web depreciation and allowance for doubtful accounts are two examples of common noncash transactions. For example, if the supplies account had a $300 balance at the beginning of the month and. There are following types of adjusting entries: One important accounting principle to remember is that. These include revenues not yet received nor recorded and expenses not yet paid nor recorded. Web read on to learn about: 5 types of adjusting journal entries (with examples) indeed editorial team. Wages earned by hourly paid employees, but not processed until the. The importance of adjusting entries. Why and when to book adjusting entries.

Adjusting Entries Examples Accountancy Knowledge

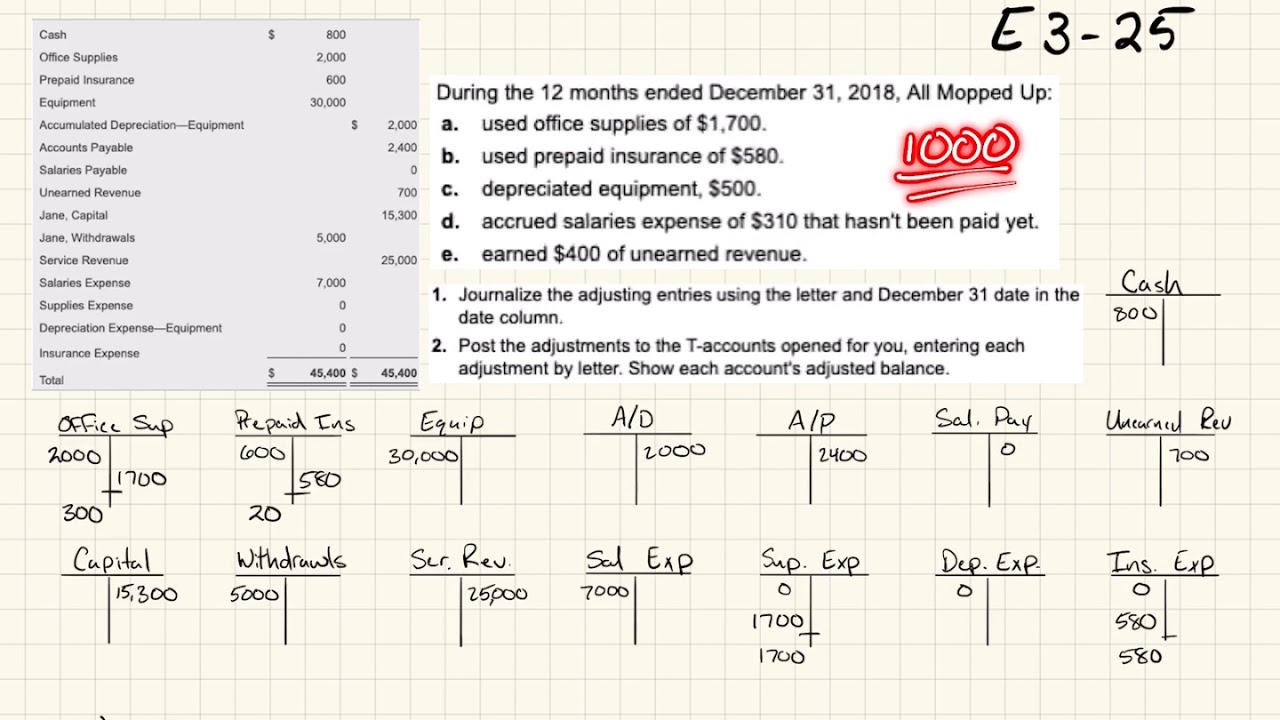

Web to illustrate the process of making adjusting journal entries from a trial balance and then preparing an adjusted trial balance, the kids learn online.

Adjusting Entries Example, Types, Why are Adjusting Entries Necessary?

One important accounting principle to remember is that. Web read on to learn about: Web an adjusting journal entry is a financial record you can.

E325 Basic Adjusting Journal Entry Example YouTube

Electricity and gas used by the company in june but not billed by the utility until july. Web an adjusting journal entry is a financial.

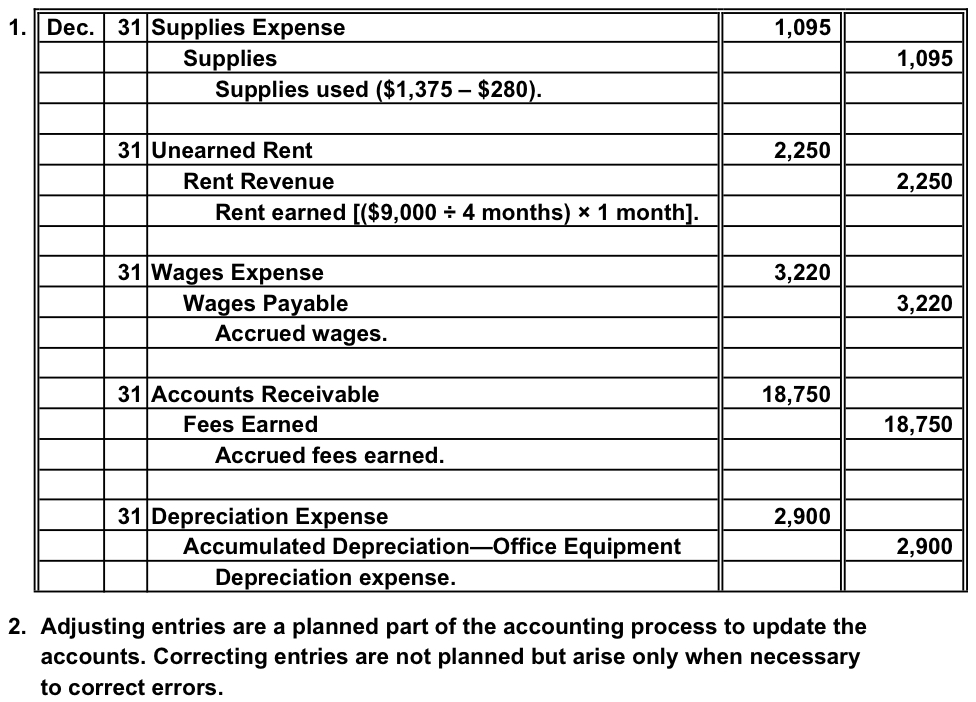

Solved Record the adjusting entries in the a General Journal

Web read on to learn about: Web adjusting entries are journal entries made at the end of an accounting period to update the accounts and.

Accounting Questions and Answers PR 31A Adjusting entries

A company’s insurance is $1800 for a year (paid on. What is an adjusting entry? Web what are adjusting journal entries (aje)? Web the three.

5.1 The Need for Adjusting Entries Financial Accounting

There are following types of adjusting entries: One important accounting principle to remember is that. Web below are some examples for each type of adjusting.

Adjusting Journal Entries Defined Accounting Play

Some common types of adjusting journal entries are accrued. Web adjusting entries are journal entries made at the end of an accounting period to update.

Adjusting Journal Entry Definition Purpose, Types, and Example

5 types of adjusting journal entries (with examples) indeed editorial team. Web an adjusting journal entry is a financial record you can use to track.

Adjusting Entries Adjusting Entries With Examples

Let’s briefly elaborate and exemplify each. Adjusted entry accounting is an important but potentially cumbersome part. Web read on to learn about: Web depreciation and.

A Type Of Journal Entry That Is Executed At The End Of The Accounting Period To Record Any.

Wages earned by hourly paid employees, but not processed until the. 5 types of adjusting journal entries (with examples) indeed editorial team. The importance of adjusting entries. Adjusting entries can be divided into four types.

Web Depreciation And Allowance For Doubtful Accounts Are Two Examples Of Common Noncash Transactions.

What is an adjusting entry? Web the three main types of adjusting entries are accruals, deferrals and estimates. Why and when to book adjusting entries. Web below are some examples for each type of adjusting journal entry used in accounting.

Web Adjusting Entries, Also Known As Adjusting Journal Entries (Aje), Are The Entries Made In A Business Firm’s Accounting Journals To Adapt Or Update The Revenues And Expenses Accounts According To The Accrual Principle And The Matching Concept Of.

Web an adjusting journal entry is a financial record you can use to track unrecorded transactions. 5+ examples for adjusting entries. Web with an adjusting entry, the amount of change occurring during the period is recorded. Web to illustrate the process of making adjusting journal entries from a trial balance and then preparing an adjusted trial balance, the kids learn online (klo) example from chapter.

There Are Following Types Of Adjusting Entries:

One important accounting principle to remember is that. What does an adjusting journal entry record? For example, if the supplies account had a $300 balance at the beginning of the month and. These include revenues not yet received nor recorded and expenses not yet paid nor recorded.

:max_bytes(150000):strip_icc()/AdjustingJournalEntry_V1-2dbdebbd05d74d808f539458dcfa2e2a.jpg)