Accrued Service Revenue Journal Entry - Web learn what accrued revenue is, how it is recorded in accrual accounting, and why it is important for service businesses. An accrued revenue is the revenue that has been earned (goods or services have been delivered), while the cash. Finally, once the payment comes through, record it in the revenue. Web the journal entry to record accounts receivable balance and the associated accrued revenues for the customer is as follows. Before recognizing the accrued revenue for a. This necessitates adjusting entries and the inclusion of items. Web this journal entry is to record the collection of receivables as the company receives the cash payment from the customer for the service it provides in october 2020. This type of revenue occurs when a company performs a service or delivers a. Web accrued expenses require adjusting entries. Web next, accrued revenues will appear on the balance sheet as an adjusting journal entry under current assets.

Lasicamping Blog

Before recognizing the accrued revenue for a. This type of revenue occurs when a company performs a service or delivers a. Web they often record.

Adjusting Journal Entries Defined Accounting Play

Business operations often result in accrual accounting when companies earn revenue or incur expenses for goods and services and wait to receive. Web they often.

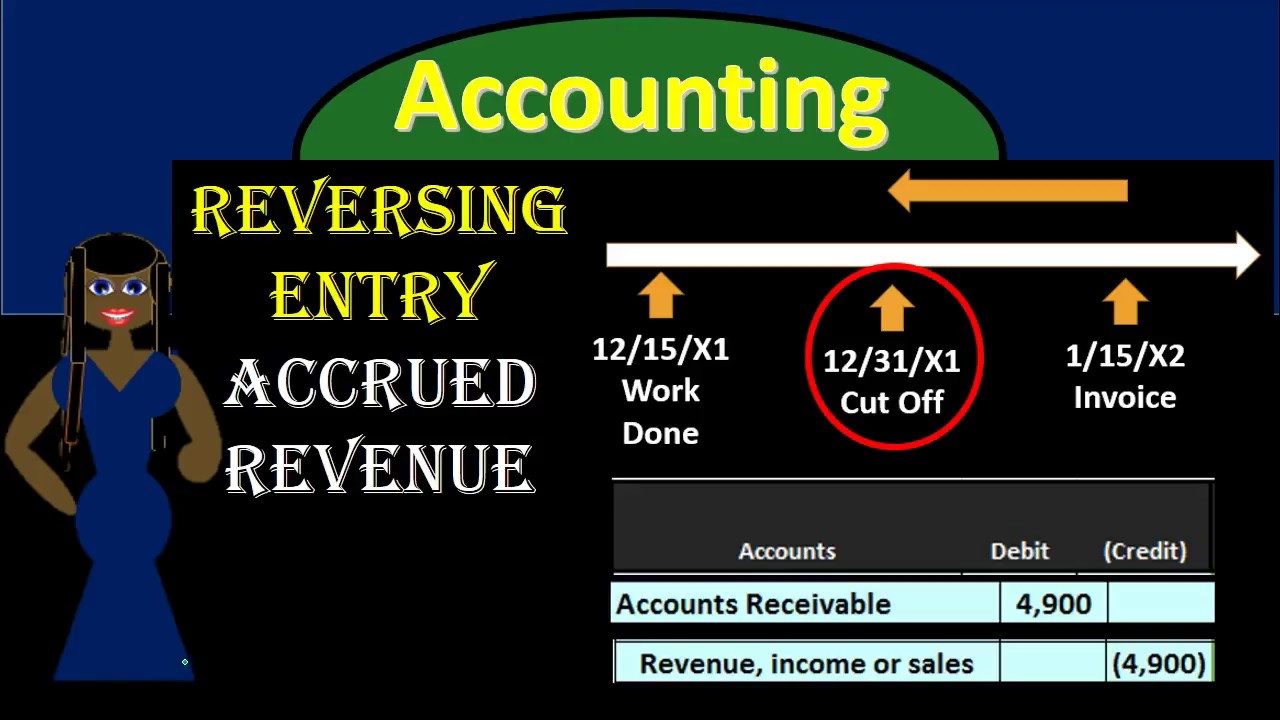

300 Reversing Journal Entries Accrued Revenue YouTube

Web the journal entry for accrued revenue is as below: Recording adjustments for accrued revenue. Web with cash basis accounting, you'll debit accrued income on.

Is accrued revenue a debit? Leia aqui What type of account is accrued

Business operations often result in accrual accounting when companies earn revenue or incur expenses for goods and services and wait to receive. An accrued revenue.

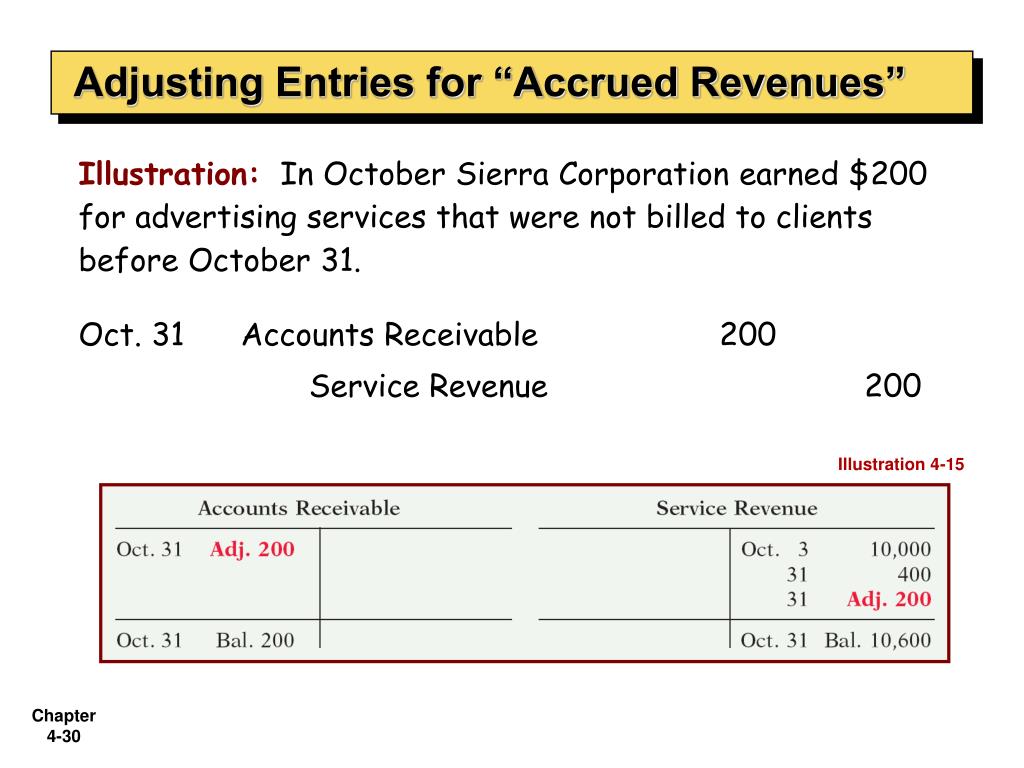

PPT Accrual Accounting Concepts PowerPoint Presentation, free

On the income statement, you'll record it. In this case someone is already performing a service for you but you have not paid them or.

Accrued revenue how to record it in 2023 QuickBooks

Web they often record accrued revenue as an adjusting journal entry, which is an entry that accounts for any unrecorded income or expenses within the.

PPT Accrual Accounting and the Financial Statements Chapter 3

This type of revenue occurs when a company performs a service or delivers a. On the income statement, you'll record it. Web on the financial.

Accrued Expenses Journal Entry How to Record Accrued Expenses With

Web with the journal entry, the asset (accrued revenue) is increased by 4,000 representing an amount owed by the customer for services provided during the.

Journal Entries and Trial Balance in Accounting Video & Lesson

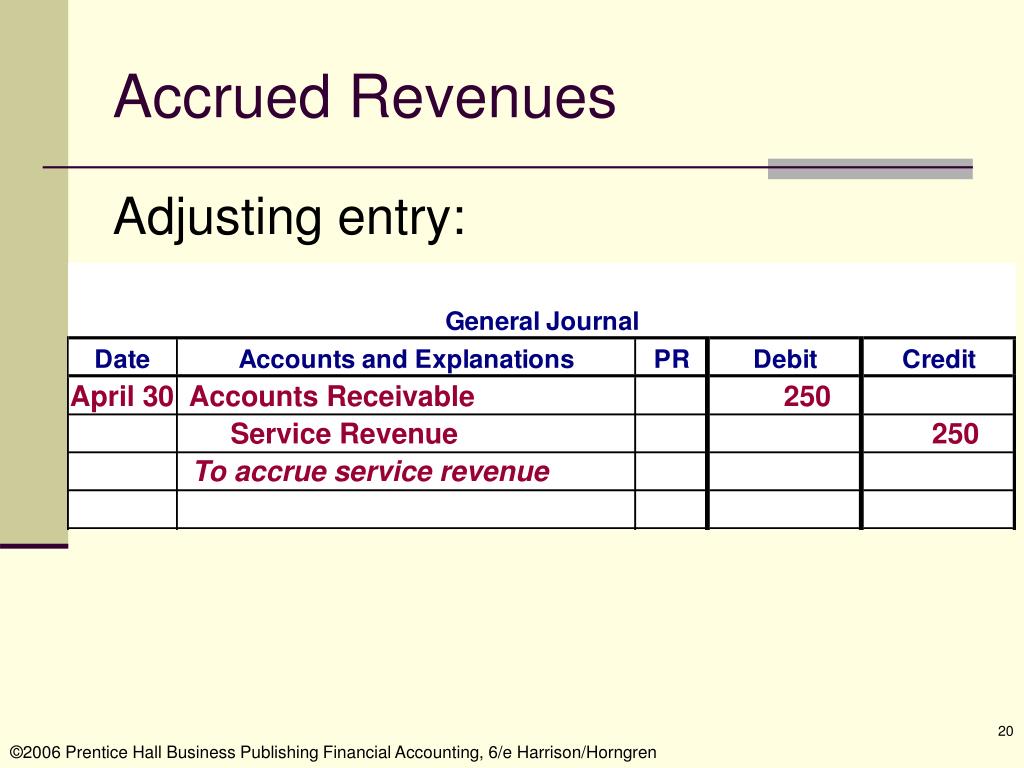

How accrual basis accounting differs from cash basis accounting. Web the adjusting entry to record an accrued revenue is: Deferred revenue how to calculate and.

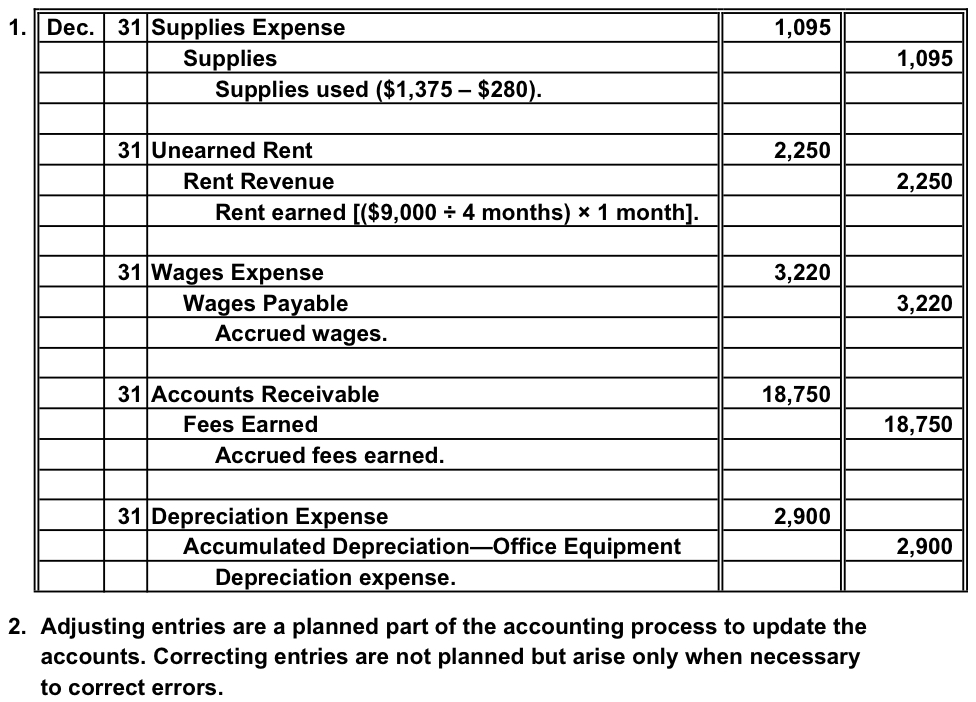

Web Accrued Expenses Require Adjusting Entries.

Web this journal entry is to record the collection of receivables as the company receives the cash payment from the customer for the service it provides in october 2020. Web they often record accrued revenue as an adjusting journal entry, which is an entry that accounts for any unrecorded income or expenses within the accounting period. Accrued revenue journal entries refer to the figures derived and entered by adjusting entries at the end of an accounting period to. Web updated february 3, 2023.

Web With The Journal Entry, The Asset (Accrued Revenue) Is Increased By 4,000 Representing An Amount Owed By The Customer For Services Provided During The Month.

The journal entry to settle payment for accrued revenue is as below: Web with cash basis accounting, you'll debit accrued income on the balance sheet under the current assets as an adjusting journal entry. Web accrued revenue is income that a company has earned but for which it has not yet received payment. Web the required journal entries are as follows:

Web The Journal Entry For Accrued Revenue Is As Below:

Web learn what accrued revenue is, how it is recorded in accrual accounting, and why it is important for service businesses. Web what are accrued revenue journal entries? An accrued revenue is the revenue that has been earned (goods or services have been delivered), while the cash. Deferred revenue how to calculate and record accrued (unbilled) revenue the role of accrued revenue in financial analysis.

Web Accrued Revenues Are Revenues Received For Services Completed Or Goods Delivered That Have Not Been Recorded.

Web the journal entry to record accounts receivable balance and the associated accrued revenues for the customer is as follows. The journal entry is made for accrued revenue as an asset and income. On the income statement, you'll record it. Finally, once the payment comes through, record it in the revenue.